The automotive industry stands at a historic crossroads as major manufacturers accelerate their transition from internal combustion engines to electric vehicles. This shift represents the most significant transformation in automotive manufacturing since the assembly line revolutionized production a century ago. Driven by environmental regulations, changing consumer preferences, and technological advancements, automotive giants are reimagining their business models, production facilities, and product lineups to secure their positions in an increasingly electrified future.

The Global EV Market: Current State of the Electric Vehicle Transition of Automotive Giants

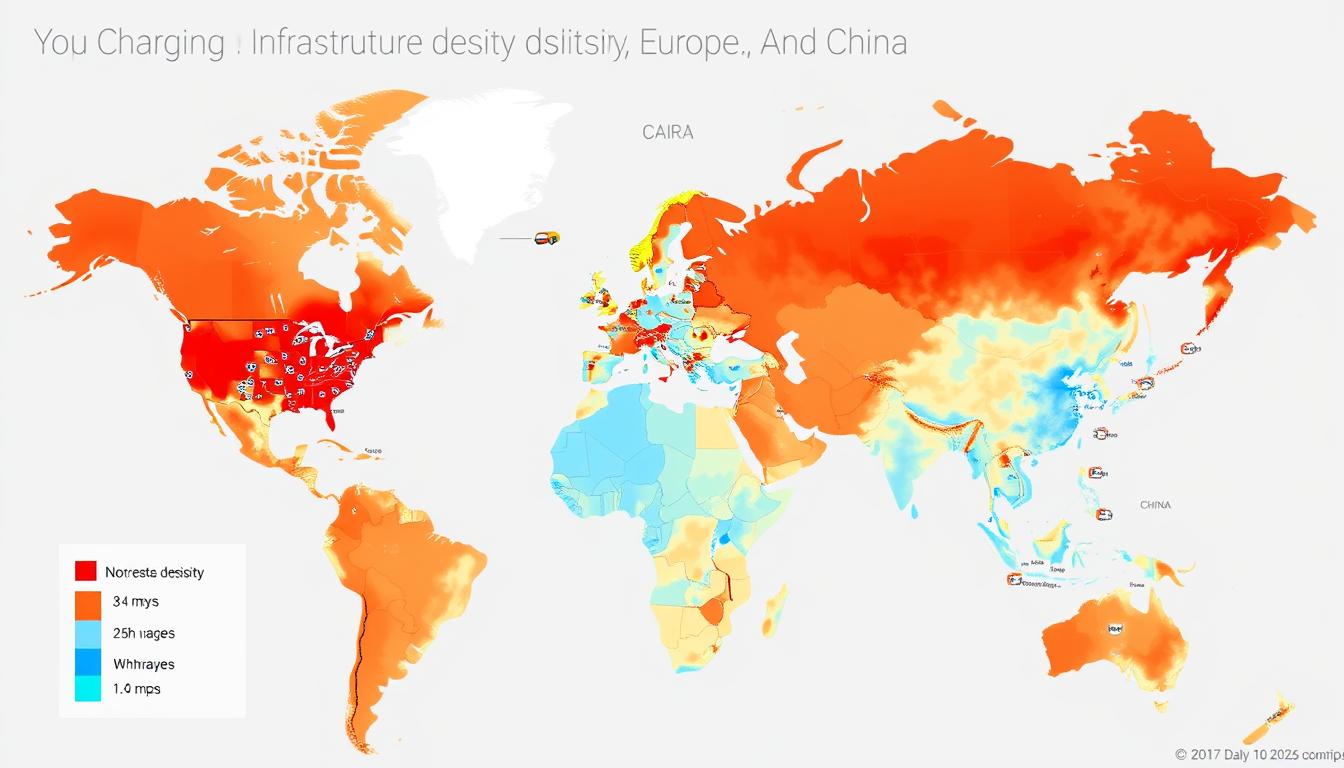

Global EV market share comparison across major automotive markets (2024)

The pace of EV adoption varies significantly across global markets. In China, electric vehicles now account for approximately 50% of new vehicle sales, with battery electric vehicles (BEVs) representing 28%, plug-in hybrid electric vehicles (PHEVs) at 15%, and extended-range electric vehicles (EREVs) at 6%. Europe follows with EVs making up 21% of new vehicle sales (14% BEV, 7% PHEV), while the United States lags at 10% (8% BEV, 2% PHEV).

These regional disparities reflect differences in government policies, charging infrastructure development, and consumer preferences. Chinese consumers have embraced EVs more rapidly due to strong government incentives, urban driving patterns, and competitive pricing from domestic manufacturers. European adoption is driven primarily by stringent emissions regulations, while the U.S. market shows significant geographic variation, with coastal states adopting EVs much faster than the interior.

For automotive giants, these regional differences necessitate market-specific strategies rather than one-size-fits-all approaches to electrification. Companies must balance their investments across markets with different adoption timelines while maintaining profitability during this transition period.

Strategic Approaches to EV Transition

Factory retooling represents a major investment for automotive manufacturers transitioning to EV production

Automotive manufacturers are pursuing diverse strategies to navigate the electric vehicle transition, with approaches varying based on their existing market position, technical capabilities, and regional focus. These strategies generally fall into three categories: aggressive all-in electrification, measured hybrid-first transition, and cautious parallel development.

R&D Investments in Battery Technology

Battery technology represents the most critical area of research and development for automotive manufacturers. Companies are investing billions to improve energy density, charging speeds, and production costs, recognizing that advancements in this field are essential for the successful transition to electric vehicles.

Tesla continues to lead with its 4680 cylindrical cells promising higher energy density and lower manufacturing costs, which are crucial for making EVs more accessible to the average consumer. The company’s focus on vertical integration allows it to control more of the supply chain, enhancing efficiency and reducing costs. Volkswagen Group has committed €52 billion to EV development, with a significant portion dedicated to battery research through partnerships with Northvolt and QuantumScape, aiming to establish a robust supply chain for battery production that can support its ambitious electrification goals. This commitment reflects a broader trend among manufacturers to prioritize battery technology as a cornerstone of their future strategies.

Toyota, initially hesitant about full electrification, has accelerated its battery development with a $13.6 billion investment in battery technology, including solid-state batteries that promise higher energy density and faster charging. General Motors has developed its Ultium platform with a focus on scalability across vehicle segments.

| Manufacturer | Battery Technology Focus | Key Partnerships | Investment Scale |

| Tesla | 4680 cylindrical cells, vertical integration | Panasonic, CATL, in-house production | $5+ billion |

| Volkswagen Group | Unified cell concept, solid-state research | Northvolt, QuantumScape, PowerCo | €30 billion (battery portion of €52B EV investment) |

| Toyota | Solid-state batteries, hybrid optimization | Panasonic, CATL, Prime Planet Energy | $13.6 billion |

| General Motors | Ultium platform, pouch cells | LG Energy Solution, Honda | $35 billion (total EV and AV investment) |

Strategic Partnerships and Collaborations

To share development costs and accelerate time-to-market, automotive giants are forming unprecedented partnerships. General Motors and Honda have partnered to develop affordable EVs using GM’s Ultium platform, which allows for a flexible architecture that can be adapted across various vehicle types. This collaboration not only aims to reduce production costs but also enhances the competitiveness of both companies in the rapidly evolving electric vehicle market.

Ford and Volkswagen have collaborated on EV technology sharing, pooling their resources and expertise to create more efficient and sustainable vehicles. This strategic alliance signifies a shift towards cooperation in an industry traditionally characterized by fierce competition. Meanwhile, Mercedes-Benz and Stellantis have joined with Total Energies to form Automotive Cells Company for European battery production, a move that underscores the importance of localizing battery supply chains in response to increasing demand for electric vehicles in Europe.

Chinese manufacturers are pursuing international partnerships to gain access to Western markets. BYD has established joint ventures with Toyota for EV development, while SAIC has expanded its MG brand internationally. These cross-border collaborations are reshaping traditional competitive boundaries in the automotive industry.

Production Facility Transformation

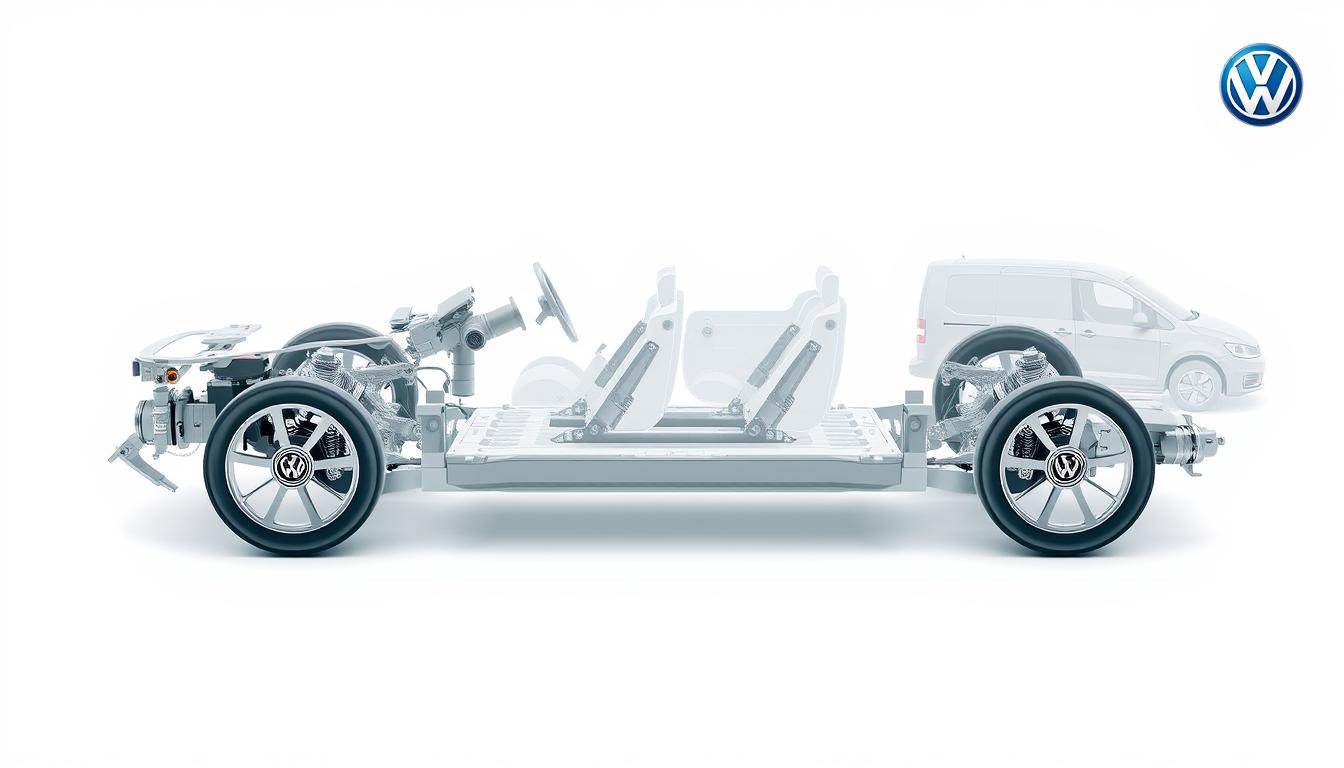

Key component differences between internal combustion and electric vehicles driving manufacturing changes

Converting existing manufacturing facilities represents one of the most capital-intensive aspects of the EV transition. Volkswagen has transformed its Zwickau plant in Germany from producing internal combustion vehicles to exclusively manufacturing EVs, investing €1.2 billion in the conversion. Ford is developing dedicated EV manufacturing campuses in Tennessee and Kentucky with a $11.4 billion investment.

General Motors has converted its Detroit-Hamtramck facility into “Factory ZERO,” dedicated to EV production. These transformations require not only new equipment but also workforce retraining and supply chain reorganization. The Biden Administration has announced $15.5 billion in investments dedicated to retooling manufacturing facilities in the United States, emphasizing job creation in traditional automotive manufacturing communities.

Key Challenges in the Electric Vehicle Transition

EV charging infrastructure density varies significantly between urban and rural areas

Battery Limitations and Supply Chain Constraints

Despite significant advances, battery technology continues to present challenges. Current lithium-ion batteries face limitations in energy density, charging speed, and performance in extreme temperatures, which can affect their efficiency and reliability in various conditions. As electric vehicles (EVs) become more prevalent, the demand for batteries with higher energy densities and faster charging capabilities is growing.

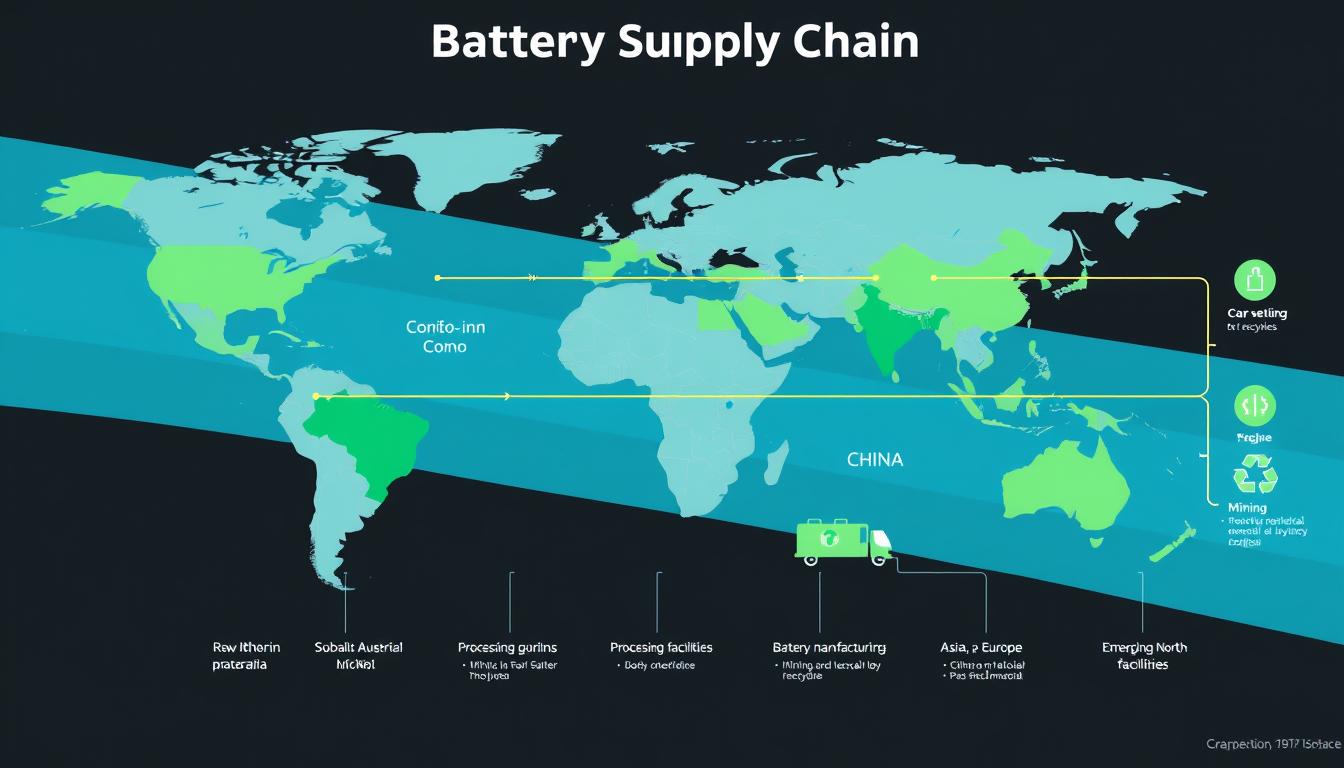

Additionally, raw material supply chains for critical minerals like lithium, cobalt, and nickel face potential bottlenecks as demand increases exponentially. These materials are essential for producing high-performance batteries, and their extraction and processing are often constrained by geopolitical factors, environmental concerns, and regulatory challenges. This creates a complex landscape where manufacturers must navigate not only the technical limitations of current battery technologies but also the logistical hurdles associated with sourcing these critical materials.

The concentration of battery manufacturing in Asia, particularly China, creates geopolitical vulnerabilities for Western automakers. In response, manufacturers are investing in regional battery production facilities and exploring alternative battery chemistries that reduce dependence on scarce materials. Recycling infrastructure for EV batteries remains underdeveloped, though companies like Redwood Materials are scaling up operations to create closed-loop supply chains.

Charging Infrastructure Gaps

Inadequate charging infrastructure remains a significant barrier to EV adoption, particularly in rural areas and for consumers without access to home charging. The disparity between urban and rural charging networks creates “charging deserts” that limit EV practicality for many potential buyers.

Cross-border standardization issues persist, with different charging standards and payment systems complicating long-distance travel. Public-private partnerships are emerging to address these gaps, with automotive manufacturers increasingly investing in charging networks. Tesla’s Supercharger network remains the gold standard for integration and reliability, prompting other manufacturers to pursue similar vertically integrated approaches.

EV Adoption Accelerators

- Declining battery costs (90% reduction since 2010)

- Expanding model variety across vehicle segments

- Government incentives and regulations

- Lower operating costs compared to ICE vehicles

- Improving charging infrastructure in urban areas

EV Adoption Barriers

- Higher upfront purchase costs

- Range anxiety and charging time concerns

- Insufficient charging infrastructure in rural areas

- Limited battery raw material supply chains

- Workforce transition challenges

Regulatory Pressures and Policy Uncertainty

Automotive manufacturers face a complex patchwork of regulations across global markets. The European Union’s plan to ban new internal combustion engine vehicles by 2035 creates a clear timeline for manufacturers operating in that market, compelling them to pivot toward electric vehicle (EV) production and invest in new technologies. This regulation not only sets a definitive deadline but also influences consumer expectations and encourages manufacturers to innovate rapidly in order to remain competitive.

In the United States, the regulatory landscape is more fragmented, with California and states following its lead pursuing more aggressive electrification timelines than federal standards. This variation in regulations can create confusion and challenges for manufacturers trying to comply with differing state requirements while also navigating federal guidelines, leading to increased costs and potential delays in product rollout.

The U.S. Inflation Reduction Act has significantly impacted manufacturing strategies through its domestic content requirements for EV tax credits. This has accelerated investments in North American battery production and mineral processing. Policy uncertainty remains a challenge, as changes in political leadership can lead to regulatory shifts that complicate long-term planning for automotive manufacturers.

Case Studies: Contrasting Approaches to Electrification

Tesla’s vertically integrated manufacturing approach at its Gigafactories

Tesla: Vertical Integration and Software-First Approach

Tesla’s approach to electrification has centered on vertical integration and a software-first mindset. By controlling everything from battery cell design to vehicle software, Tesla has achieved technological advantages and supply chain resilience. The company’s direct-to-consumer sales model has disrupted traditional automotive retail channels.

Despite recent challenges including a 5% decline in vehicle deliveries in Q2 2024 and reduced profit margins, Tesla maintains significant advantages in manufacturing efficiency and battery technology. The company’s expansion into energy storage and solar products creates synergies with its automotive business, though its ambitious robotaxi plans have faced delays.

Volkswagen Group: Platform Strategy and Massive Investment

Volkswagen’s MEB platform enables efficient production of multiple EV models

Volkswagen Group has pursued an aggressive electrification strategy centered on its modular electric drive matrix (MEB) platform. This standardized architecture enables efficient production of multiple models across the group’s brands. The company has committed €52 billion to electrification, including converting entire factories to EV production.

Volkswagen’s ID series has achieved moderate success, though the company has faced software development challenges. The group’s multiple brands (Volkswagen, Audi, Porsche, Skoda) allow it to target different market segments with specialized EV offerings. Recent partnerships with Chinese manufacturers aim to strengthen Volkswagen’s position in the world’s largest EV market.

Toyota: Hybrid-First Transition Strategy

Toyota initially pursued a more cautious approach to full electrification, focusing on hybrid technology while developing hydrogen fuel cells as a parallel path. This strategy reflected the company’s global market presence, including regions with limited charging infrastructure, where hybrid vehicles serve as a more practical solution for consumers. By leveraging its extensive experience in hybrid powertrains, Toyota has been able to maintain a competitive edge in markets where electric vehicle adoption is still in its infancy. However, Toyota has recently accelerated its EV plans with a $70 billion electrification investment through 2030, signaling a shift in its long-term strategy to embrace fully electric vehicles alongside its hybrid offerings.

Additionally, the company is enhancing its research and development efforts to innovate in battery technology, aiming to improve the efficiency and range of its electric models. This proactive approach is evident in Toyota’s collaborations with various technology firms to explore solid-state batteries, which promise to overcome many limitations of current lithium-ion technology. These advancements not only reflect Toyota’s commitment to sustainability but also its intention to lead in the rapidly evolving EV market.

The company’s expertise in hybrid powertrains provides a transitional advantage as markets gradually shift to full electrification. Toyota’s partnership with BYD for the Chinese market demonstrates its pragmatic approach to regional differences in EV adoption. The company’s solid-state battery research represents a potential technological leap that could address current battery limitations.

General Motors: Ultium Platform and Carbon-Neutral Pledge

GM’s Ultium platform enables scalable battery configurations across vehicle segments

General Motors has committed to carbon neutrality by 2035 and developed its proprietary Ultium platform to support this transition. The scalable battery architecture enables efficient production of vehicles ranging from compact cars to full-size trucks. GM’s partnership with Honda demonstrates its willingness to collaborate to accelerate electrification.

Despite these ambitious plans, GM has recently scaled back some EV targets due to slower-than-expected consumer demand. The company delayed the opening of an EV truck factory in Michigan to mid-2026 and paused plans for Buick’s first EV model. This recalibration reflects the challenges of matching production capacity with evolving market demand.

Economic and Workforce Impacts

Workforce retraining is essential for successful transition to EV manufacturing

Manufacturing Job Transformation

The transition to EVs is reshaping automotive manufacturing employment. Nearly 900,000 workers in the United States are employed in manufacturing internal combustion engine vehicles and components. Of these, approximately 58,000 workers focused on gasoline engines and engine parts manufacturing face the highest risk of displacement as EV production increases. This shift not only threatens jobs directly linked to traditional automotive manufacturing but also has broader implications for the entire supply chain, including suppliers and ancillary services.

As the industry pivots towards electric vehicles, many of these workers may need to acquire new skills to adapt to changing technologies and processes, emphasizing the importance of targeted retraining programs to facilitate this transition and minimize unemployment.

However, new opportunities are emerging in battery production, power electronics, and software development. The U.S. Bureau of Labor Statistics projects 17% growth in vehicle electrical equipment manufacturing employment between 2021 and 2031. These new positions often require different skill sets, emphasizing the need for comprehensive workforce development programs.

The geography of automotive manufacturing is evolving with the EV transition. Traditional automotive manufacturing centers are competing with emerging “Battery Belt” regions for new investments. Between 2001 and 2022, Michigan saw a 43% drop in motor vehicle and parts manufacturing employment, while states like Alabama experienced significant growth. This shift reflects not only the relocation of manufacturing facilities but also the changing dynamics of labor markets, as companies seek to capitalize on lower operational costs and incentives offered by states eager to attract EV production. The implications of this transformation extend beyond mere job displacement; they encompass broader economic revitalization efforts in regions that are becoming new hubs for electric vehicle components and technologies. Additionally, as these new regions develop, they may attract a workforce that is more skilled in modern manufacturing techniques, potentially leaving traditional centers to grapple with the challenges of retraining their existing workforce.

Approximately 50% ($85.6 billion) of announced private EV investments in the United States have been directed to five Southern states—Georgia, Tennessee, South Carolina, North Carolina, and Kentucky. These regional shifts have significant implications for local economies and workforce development strategies.

Supply Chain Restructuring

The global EV battery supply chain is driving new manufacturing investments

The EV transition is fundamentally restructuring automotive supply chains. Traditional tier-one suppliers focused on internal combustion components must diversify or risk obsolescence. New entrants specializing in battery technology, power electronics, and software are gaining prominence in the supply chain.

Concerns about supply chain resilience, highlighted by pandemic-related disruptions, are driving increased vertical integration. Tesla’s approach of sourcing raw materials directly and manufacturing its own batteries is being emulated by other manufacturers seeking greater control over critical components. This trend represents a significant departure from decades of increasing specialization and outsourcing in the automotive industry.

Environmental Considerations and Sustainability

Lifecycle carbon emissions comparison between internal combustion and electric vehicles

While EVs offer significant environmental benefits through zero tailpipe emissions, their overall environmental impact depends on multiple factors. The carbon intensity of electricity generation significantly affects the lifecycle emissions of EVs. In regions with coal-dominated electricity production, the emissions advantage of EVs is reduced, though still generally positive compared to internal combustion vehicles.

Battery production remains energy and resource-intensive, with mining of materials like lithium, cobalt, and nickel raising environmental and human rights concerns. The industry is responding with increased focus on responsible sourcing, battery recycling, and development of less resource-intensive battery chemistries.

Automotive manufacturers are increasingly adopting circular economy principles, designing vehicles for recyclability and establishing battery recycling programs. Companies like Redwood Materials and Li-Cycle are scaling up operations to recover valuable materials from end-of-life batteries, potentially reducing the need for new mining operations as the EV fleet grows.

Future Trends and Industry Outlook

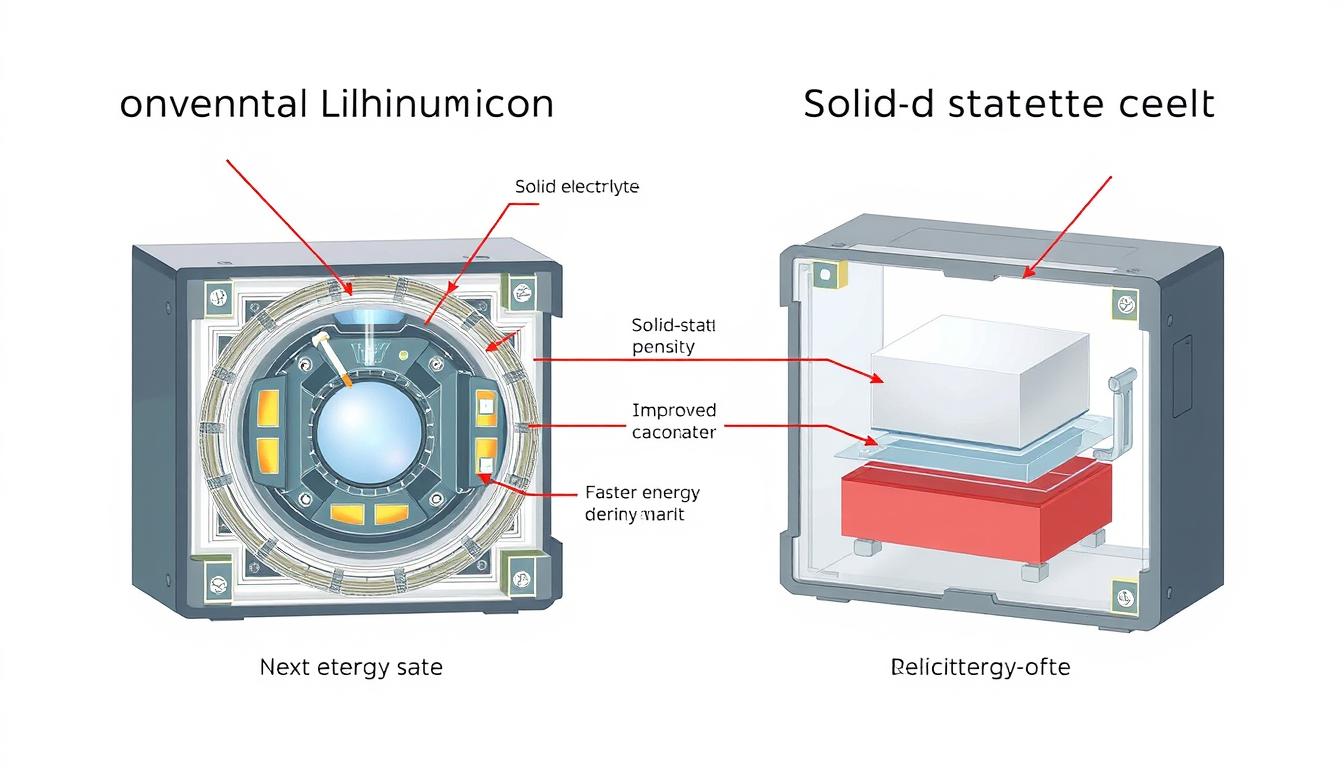

Solid-state battery technology promises higher energy density and improved safety

Technological Innovations on the Horizon

Solid-state batteries represent the most anticipated technological breakthrough in the EV sector. These batteries promise higher energy density, faster charging, improved safety, and longer lifespans compared to current lithium-ion technology. Toyota, Volkswagen (through QuantumScape), and BMW are among the manufacturers investing heavily in this technology, with commercial applications expected by 2025-2027.

Artificial intelligence is increasingly integrated throughout the automotive value chain, from design and manufacturing to vehicle operation. AI-powered battery management systems can optimize charging and extend battery life, while predictive maintenance reduces downtime. Advanced driver assistance systems are evolving toward full autonomy, potentially reshaping vehicle usage patterns and ownership models.

Market Consolidation and New Entrants

The capital-intensive nature of the EV transition is likely to drive industry consolidation. Smaller manufacturers without sufficient resources for electrification may be acquired or form strategic partnerships. Chinese manufacturers like BYD and SAIC are expanding internationally, challenging established Western and Japanese brands.

New entrants focused exclusively on EVs continue to emerge, though with mixed success. Companies like Rivian and Lucid have brought innovative products to market but face significant challenges in scaling production and achieving profitability. Traditional automotive giants retain advantages in manufacturing expertise, supply chain management, and brand recognition.

Revised Timelines and Realistic Expectations

Major automotive manufacturers have revised their EV adoption timelines in response to market realities

Recent months have seen several major manufacturers revise their electrification timelines. Volvo has backed away from its goal of selling only EVs by 2030, now targeting 90% electrified vehicles (including hybrids) by that date. General Motors has delayed EV production expansions, while Ford has reduced its capital spending on EVs from 40% to 30% of its budget.

These adjustments reflect the reality that EV adoption is proceeding at different rates across markets and vehicle segments. Rather than a linear transition, the industry is experiencing a more complex evolution with regional variations and technological uncertainties. Manufacturers are increasingly adopting flexible strategies that can adapt to evolving market conditions while maintaining progress toward long-term electrification goals.

Stay Updated on EV Industry Developments

Subscribe to our newsletter for quarterly insights on automotive electrification strategies, technology breakthroughs, and market trends.

Conclusion: Navigating the Complex Road Ahead

The electric vehicle transition of automotive giants represents a fundamental reshaping of a century-old industry. While the direction toward electrification is clear, the pace and path of this transition continue to evolve in response to technological developments, market conditions, and regulatory frameworks.

Successful navigation of this transition requires strategic flexibility, technological innovation, and workforce adaptation. Manufacturers must balance aggressive electrification targets with realistic market assessments, investing in future technologies while maintaining profitability during the transition period. The most successful companies will likely be those that can adapt their strategies to regional differences while maintaining a clear long-term vision for an electric future.

For industry stakeholders, policymakers, and investors, understanding the complex dynamics of this transition is essential for making informed decisions. The transformation of automotive manufacturing represents not just a technological shift but a comprehensive economic and social transition with far-reaching implications for global industry, employment patterns, and environmental sustainability.