As global manufacturers seek to diversify their supply chains beyond China, Southeast Asia has emerged as a prime alternative destination. Vietnam and Thailand stand at the forefront of this shift, each offering distinct advantages in their quest to become the next global manufacturing powerhouse. This comprehensive analysis examines the strengths, challenges, and future potential of both countries as they compete to attract international investment and establish themselves as dominant manufacturing hubs in the post-pandemic global economy.

Economic Background

Economic growth comparison between Vietnam and Thailand (2000-2023)

Vietnam’s economic journey began with the Đổi Mới (Renovation) reforms in 1986, which transformed the country from a centrally planned economy to a market-oriented one. This transition catalyzed remarkable growth, with Vietnam maintaining an average GDP growth rate of 6-7% annually over the past two decades. The country’s WTO accession in 2007 marked a pivotal moment, opening doors to increased foreign investment and trade opportunities.

Thailand, often referred to as the “Detroit of Asia,” has a longer history of industrialization dating back to the 1980s. Despite facing setbacks during the 1997 Asian Financial Crisis, Thailand successfully rebuilt its economy, focusing on high-value manufacturing sectors. With a GDP of approximately $500 billion, Thailand’s economy is more diversified and mature compared to Vietnam’s $340 billion economy.

Both countries have strategically positioned themselves within global supply chains, but through different paths. Thailand established itself as a manufacturing hub earlier, particularly in the automotive sector, while Vietnam has experienced more recent rapid growth, especially in electronics and textiles. These distinct trajectories have shaped their current manufacturing landscapes and continue to influence their competitive positions in the global market.

Manufacturing Strengths and Core Industries

Vietnam’s Industrial Profile

Vietnam has emerged as a powerhouse in electronics manufacturing, with Samsung alone investing over $20 billion in the country. This investment has transformed Vietnam into a major producer of smartphones and consumer electronics. The country’s garment and textile industry is equally significant, employing over 2.5 million workers and generating approximately $40 billion in annual exports.

Vietnam’s manufacturing strengths include:

- Electronics assembly (smartphones, components)

- Textiles and footwear production

- Furniture and wood products

- Seafood processing

The country is also making strides in automotive manufacturing with VinFast, Vietnam’s first domestic automaker, expanding internationally with electric vehicle production.

Thailand’s Industrial Profile

Thailand boasts a more mature and diversified manufacturing sector, with particular strength in automotive production. The country produces approximately 2 million vehicles annually, hosting facilities for Toyota, Honda, Ford, and other major manufacturers. Thailand is also a significant producer of hard disk drives and electronic components.

Thailand’s manufacturing strengths include:

- Automotive and auto parts production

- Electronics and electrical appliances

- Food processing and agricultural products

- Medical devices and pharmaceuticals

Thailand’s recent push into electric vehicle manufacturing, supported by substantial government incentives, demonstrates its commitment to maintaining leadership in automotive production.

Key manufacturing sectors: Electronics in Vietnam (left) vs. Automotive in Thailand (right)

Labor Market and Workforce

The composition, cost, and capabilities of the workforce represent critical factors in manufacturing competitiveness. Vietnam and Thailand present distinct labor market profiles that influence their manufacturing advantages.

| Factor | Vietnam | Thailand |

| Average Monthly Manufacturing Wage (2023) | $250-350 | $400-550 |

| Minimum Wage (2023) | $180-190 per month | $220-230 per month |

| Workforce Demographics | Young (70% under 35 years) | Aging (median age 40 years) |

| Technical Education | Developing rapidly | Well-established |

| English Proficiency | Moderate, improving | Moderate |

Vietnam’s primary labor advantage lies in its young, abundant workforce with competitive wages. With approximately 55 million workers and a median age of 32, Vietnam offers manufacturers access to a large labor pool at costs significantly lower than many regional competitors. However, the country faces challenges in skilled labor availability, particularly for advanced manufacturing processes.

Thailand’s workforce, while more expensive, brings higher productivity and technical expertise to the table. The country’s established vocational training system produces workers with specialized skills in automotive, electronics, and precision manufacturing. This advantage is particularly valuable for complex production processes requiring technical knowledge and quality control.

Workers at an electronics manufacturing facility in Vietnam

Both countries face distinct workforce challenges. Vietnam must address skill development to move up the value chain, while Thailand confronts an aging population that may constrain future labor supply. These demographic realities will influence each country’s manufacturing trajectory and competitiveness in the coming decades.

Infrastructure and Logistics

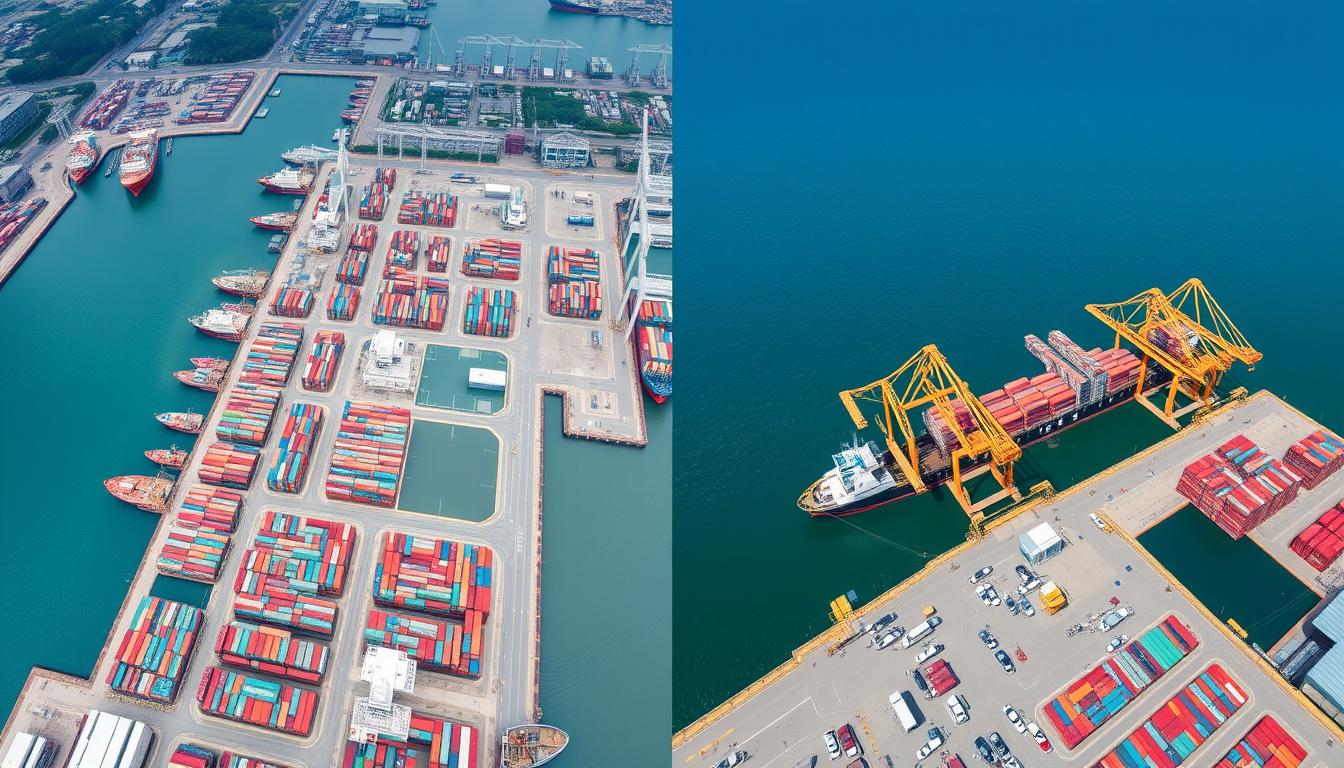

Port infrastructure comparison: Cai Mep Port, Vietnam (left) vs. Laem Chabang Port, Thailand (right)

Infrastructure quality directly impacts manufacturing efficiency, logistics costs, and supply chain reliability. Thailand currently maintains a significant advantage in this area, with more developed transportation networks and utilities.

Thailand’s Laem Chabang deep-sea port ranks among Southeast Asia’s most efficient, handling over 8 million TEUs annually with direct connections to industrial zones via well-maintained highways. The country’s Eastern Economic Corridor (EEC) development project has further enhanced infrastructure in key manufacturing regions, with over $45 billion in planned investments for high-speed rail, expanded airports, and improved highways.

Vietnam has made substantial infrastructure progress but still faces challenges. The country’s major ports, including Hai Phong in the north and Cai Mep-Thi Vai in the south, have expanded capacity but experience higher congestion rates than Thai facilities. Vietnam’s ambitious North-South Expressway project aims to improve connectivity, but road and rail networks remain less developed than Thailand’s, particularly outside major industrial zones.

Vietnam’s Infrastructure Outlook

- Rapid development with $120 billion planned investment by 2030

- Improving port capacity but facing congestion challenges

- Electricity supply reliability improving but occasional disruptions

- Industrial zones concentrated around Hanoi and Ho Chi Minh City

Thailand’s Infrastructure Advantage

- Well-established transportation network with high reliability

- Superior port efficiency and capacity

- Stable electricity supply with 99.4% reliability

- Geographically strategic location within ASEAN

Energy infrastructure represents another critical consideration. Thailand offers more reliable power supply with fewer outages, while Vietnam has faced periodic electricity shortages during peak demand periods. However, Vietnam is investing heavily in power generation capacity, which may narrow this gap in coming years.

Foreign Direct Investment and Trade Policies

Both Vietnam and Thailand have implemented policies to attract foreign investment, but with different approaches and results. Recent FDI trends reveal shifting investor preferences that influence each country’s manufacturing growth trajectory.

FDI inflows to Vietnam and Thailand (2013-2023)

Vietnam has experienced remarkable FDI growth, attracting approximately $22.4 billion in 2023. The country’s success stems from competitive investment incentives, including corporate income tax exemptions for up to four years and reduced rates for up to nine years for qualifying projects. Vietnam’s participation in 15 free trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement, has enhanced its attractiveness to export-oriented manufacturers.

Thailand’s Board of Investment (BOI) offers targeted incentives focused on higher-value industries, including up to eight years of corporate income tax exemptions and import duty reductions for machinery and raw materials. The country received approximately $16 billion in FDI in 2023, with significant investments in automotive, electronics, and medical devices. Thailand’s participation in the Regional Comprehensive Economic Partnership (RCEP) strengthens its position within Asian supply chains.

| Investment Factor | Vietnam | Thailand |

| FDI Inflow (2023) | $22.4 billion | $16 billion |

| Ease of Doing Business Rank (World Bank) | 70th | 21st |

| Key Investors | South Korea, Japan, Singapore | Japan, China, United States |

| Tax Incentives | Up to 4 years exemption, 9 years reduction | Up to 8 years exemption, import duty reductions |

A notable difference emerges in the ease of doing business. Thailand ranks 21st globally according to the World Bank’s Ease of Doing Business index, significantly ahead of Vietnam at 70th. This gap reflects Thailand’s more transparent regulatory environment, streamlined procedures, and established legal frameworks that reduce operational complexity for foreign investors.

Innovation and Technology Adoption

Advanced automation in Thailand’s automotive manufacturing sector

The ability to adopt and integrate advanced manufacturing technologies increasingly determines competitiveness in global production. Thailand and Vietnam demonstrate different levels of technological readiness that shape their manufacturing capabilities.

Thailand has made significant progress in industrial automation, with a robot density of 55 units per 10,000 workers in manufacturing—nearly three times Vietnam’s rate of 19 units. This automation advantage is particularly evident in Thailand’s automotive and electronics sectors, where precision and consistency requirements drive technology adoption. The country’s Thailand 4.0 initiative aims to further accelerate digital transformation across industries.

Vietnam is working to close this technology gap through its National Digital Transformation Program, which targets modernizing manufacturing processes by 2025. The country has seen increasing technology transfer through partnerships with multinational corporations, particularly in electronics manufacturing. Companies like Intel and Samsung have established R&D centers in Vietnam, contributing to technological capability development.

Vietnam’s Technology Trajectory

Vietnam is pursuing a technology leapfrogging strategy, leveraging partnerships with global technology leaders to accelerate innovation. The government has established high-tech parks in Hanoi, Ho Chi Minh City, and Da Nang to foster technology clusters. While still developing, Vietnam’s digital infrastructure is expanding rapidly, with 5G networks being deployed in industrial zones to support smart manufacturing initiatives.

Thailand’s Innovation Ecosystem

Thailand benefits from a more established innovation ecosystem, with stronger university-industry collaboration and greater R&D investment. The country’s Eastern Economic Corridor of Innovation (EECi) focuses on developing advanced technologies in targeted industries, including next-generation automotive, smart electronics, and biotechnology. Thailand’s technical universities produce more specialized engineering graduates, supporting higher-value manufacturing activities.

Both countries face the challenge of balancing automation with employment considerations in the context of Southeast Asia’s evolving logistics and supply chain landscape. Thailand’s higher labor costs create stronger incentives for automation, while Vietnam’s competitive wage advantage may temporarily reduce pressure for technological investment in some sectors. However, as both countries seek to move up the value chain, technology adoption will become increasingly critical for companies aiming to maintain competitiveness in their product and services offerings.

Sustainability and Environmental Impact

Solar farm installation supporting manufacturing in Vietnam

Environmental considerations are increasingly influencing manufacturing decisions, with sustainability becoming a strategic priority for global companies. Vietnam and Thailand have adopted different approaches to balancing industrial growth with environmental protection.

Thailand has implemented its Bio-Circular-Green (BCG) Economy model, which promotes sustainable manufacturing practices across industries. The country has set ambitious targets for renewable energy, aiming to increase its share in the energy mix to 30% by 2037. Thailand’s automotive industry is transitioning toward electric vehicle production, supported by government incentives that promote cleaner manufacturing technologies.

Vietnam has made a bold commitment to achieve net-zero carbon emissions by 2050, announced at the COP26 climate summit. The country is rapidly expanding renewable energy capacity, particularly in solar power, which grew from virtually zero to over 16,500 MW between 2018 and 2023. Vietnam’s National Green Growth Strategy provides a framework for more sustainable industrial development, though implementation challenges remain.

Environmental Challenges in Vietnam

- Rapid industrialization has increased pollution levels

- Water treatment infrastructure lags behind industrial growth

- Coal remains a significant energy source despite renewable growth

- Environmental enforcement varies across regions

Thailand’s Environmental Initiatives

- More established environmental regulations and enforcement

- Advanced industrial waste management systems

- Growing focus on circular economy principles

- Certification programs for eco-friendly manufacturing

Both countries face the challenge of managing environmental impacts while maintaining manufacturing competitiveness in Southeast Asia. Thailand’s more developed regulatory framework provides greater clarity for companies and investors regarding environmental compliance, while Vietnam offers opportunities to implement newer, cleaner technologies in developing industrial zones. As global supply chains increasingly prioritize sustainability, the level of environmental performance will become a more significant factor in logistics and manufacturing location decisions for companies seeking to enhance their product and services.

Economic Challenges

Transportation congestion affecting supply chain efficiency in Vietnam

Despite their manufacturing strengths, both Vietnam and Thailand face significant economic challenges that could impact their future competitiveness as production hubs.

Vietnam’s political stability under its single-party system provides policy continuity that appeals to long-term investors. However, the country faces challenges in bureaucratic efficiency, with complex administrative procedures that can delay project implementation. Corruption remains a concern, with Vietnam ranking 87th on Transparency International’s Corruption Perceptions Index compared to Thailand’s 110th position.

Thailand has experienced political volatility in recent years, with transitions between military and civilian governments creating policy uncertainty. This instability has occasionally affected investor confidence, though the country’s strong institutions have maintained economic continuity. Thailand’s regulatory environment is generally more transparent and predictable than Vietnam’s, but political tensions remain a risk factor.

Vietnam’s Advantages

- Strong economic growth trajectory

- Competitive labor costs

- Young, abundant workforce

- Increasing integration in global trade

Vietnam’s Challenges

- Infrastructure gaps

- Skilled labor shortages

- Administrative complexity

- High dependence on imported inputs

Thailand’s Advantages

- Superior infrastructure

- Established industrial ecosystem

- Technical workforce capabilities

- Strategic location in ASEAN

Thailand’s Challenges

- Political instability

- Aging population

- Higher production costs

- Natural disaster vulnerability

Supply chain vulnerabilities represent another challenge for both countries in Southeast Asia. Vietnam’s manufacturing sector relies heavily on imported components and goods, particularly from China, creating exposure to supply disruptions that affect logistics and export processes. Thailand’s geographic location makes it vulnerable to flooding, as demonstrated by the 2011 floods that severely impacted industrial areas and global supply chains, particularly in the automotive and electronics sectors, posing risks for companies and their operations.

Future Outlook and Growth Potential

Vision of future manufacturing capabilities in Southeast Asia

As global supply chains continue to evolve, both Vietnam and Thailand are positioning themselves for the next phase of manufacturing growth. Their distinct strategies and inherent advantages suggest different but potentially successful paths forward.

Vietnam’s future manufacturing growth will likely build on its momentum in electronics and expand into higher-value segments. The country’s semiconductor ambitions are supported by increasing investment in technical education and infrastructure development. Vietnam’s participation in multiple free trade agreements provides preferential access to major markets, enhancing its attractiveness for export-oriented manufacturing.

Thailand is focusing on next-generation industries aligned with its Thailand 4.0 vision, including medical devices, biopharmaceuticals, and advanced automotive technologies. The country’s well-developed ecosystem for complex manufacturing positions it favorably for industries requiring technical precision and established supply chains.

In the context of Vietnam vs Thailand manufacturing hub dynamics, Thailand’s push to become an electric vehicle production hub demonstrates its commitment to evolving with global industry trends. This evolution is supported by government investments and a skilled workforce, creating numerous opportunities for companies in Southeast Asia to enhance their product and export capabilities across various areas of trade and logistics.

Strategic positioning of Vietnam and Thailand within ASEAN and global supply chains

ASEAN economic integration offers benefits to both countries, facilitating regional supply chains and market access. The ASEAN Economic Community (AEC) creates opportunities for complementary specialization, with Thailand potentially focusing on higher-value components and Vietnam on assembly and labor-intensive processes within integrated production networks.

Industry experts suggest that rather than a single “winner” emerging, Vietnam and Thailand may establish complementary roles in regional manufacturing. Thailand’s mature industrial base and technical capabilities make it well-suited for complex, high-precision manufacturing, while Vietnam’s cost advantages and growing capabilities position it strongly for large-scale production and assembly operations.

Conclusion

Potential for complementary manufacturing relationship between Vietnam and Thailand

The question of whether Vietnam or Thailand will become the next “factory of the world” may ultimately be reframed. Rather than direct competition, these two Southeast Asian nations appear to be carving out distinct but complementary manufacturing niches based on their respective strengths.

Thailand’s advantages in infrastructure, technical workforce, and established industrial ecosystems make it the preferred destination for complex, high-value manufacturing requiring precision and reliability. Vietnam’s competitive labor costs, improving infrastructure, and strategic trade agreements position it strongly for large-scale production and assembly operations, particularly in electronics and consumer goods.

For global manufacturers, the optimal strategy may involve leveraging both countries within their supply chain networks. Thailand’s technical capabilities and Vietnam’s scale and cost advantages can be combined to create resilient, efficient production systems that maximize the strengths of each location.

As both countries continue to evolve their manufacturing capabilities and address their respective challenges, they will likely reinforce Southeast Asia’s growing importance as a global production hub. Rather than a single “next factory of the world,” we may be witnessing the emergence of a more distributed, specialized, and resilient manufacturing network across the region.