The global energy landscape is dominated by titans that shape our world’s economic and geopolitical realities. Saudi Aramco and Chevron stand as two of the most influential forces in this arena, each with distinct histories, operational models, and visions for navigating the energy transition. As climate concerns intensify and market dynamics evolve, understanding how these oil giants compare provides crucial insights for investors, industry professionals, and policy makers. This comprehensive analysis examines their strengths, weaknesses, and strategic positioning to determine which company is better equipped to lead the future of oil and gas.

Company Background

Historical evolution of Saudi Aramco and Chevron as global energy leaders

Saudi Aramco’s story began in 1933 when the Saudi Arabian government granted Standard Oil of California (now Chevron) a concession to explore for oil. After the discovery of oil in 1938 at Well No. 7 in Dammam, the company expanded rapidly. Initially named the Arabian American Oil Company (Aramco), the Saudi government began acquiring ownership in 1973 and completed a full takeover by 1980, renaming it Saudi Arabian Oil Company (Saudi Aramco). The company remained fully state-owned until its historic IPO in December 2019, which valued it at $1.7 trillion—the world’s largest public offering.

Chevron’s roots trace back to 1879 when it was founded as the Pacific Coast Oil Company in California. It later became Standard Oil of California (Socal) and, through a series of mergers and acquisitions, evolved into the Chevron Corporation we know today. The 2001 acquisition of Texaco and the 2005 purchase of Unocal significantly expanded its global footprint. Throughout its history, Chevron has maintained its status as an American energy giant with operations spanning more than 180 countries.

While Aramco developed as a national oil company with government backing, Chevron evolved as a private enterprise navigating competitive markets. This fundamental difference has shaped their respective approaches to business, risk management, and strategic planning. Aramco’s close ties to the Saudi government have provided stability but also political complexities, while Chevron’s independent corporate structure has allowed for more flexible decision-making but with greater exposure to market pressures.

Core Business Focus

Business focus comparison: Aramco’s upstream strength vs. Chevron’s integrated approach

Saudi Aramco’s business model centers on its unparalleled upstream operations. As the custodian of the world’s second-largest proven oil reserves (approximately 259 billion barrels), Aramco’s primary strength lies in its ability to extract oil at exceptionally low costs—estimated at under $3 per barrel in some fields. This cost advantage stems from Saudi Arabia’s favorable geology, with massive conventional oil fields that are relatively easy to access. While Aramco has expanded its downstream operations through refineries and petrochemical facilities, its core identity remains tied to its role as the world’s largest crude oil producer.

Chevron, by contrast, operates as a fully integrated energy company with a more balanced portfolio across the value chain. Its upstream segment focuses on exploration and production in diverse geographies, including significant assets in the United States, Australia, Kazakhstan, and West Africa. Chevron’s downstream operations encompass refining, marketing, and chemical manufacturing, providing vertical integration that helps buffer against oil price volatility. This diversified approach allows Chevron to capture value at multiple points in the energy supply chain.

The fundamental difference in business focus creates distinct advantages and vulnerabilities for each company. Aramco’s concentrated strength in upstream production provides economies of scale and cost leadership but exposes it to greater risk from oil price fluctuations and energy transition pressures. Chevron’s integrated model offers more stability through market cycles but requires managing complex global operations across multiple business segments.

Strengths and Weaknesses

Aramco’s Strengths

- Unmatched production capacity (12 million barrels per day)

- World’s lowest production costs ($2.80-$3.50 per barrel)

- Massive proven reserves (259 billion barrels)

- Strong government backing and financial resources

- Dominant position in Asian markets

Aramco’s Weaknesses

- Heavy government influence in decision-making

- Geographic concentration of assets

- Limited international downstream presence

- Exposure to regional geopolitical risks

- Later start in renewable energy investments

Chevron’s Strengths

- Globally diversified asset portfolio

- Strong integrated business model

- Advanced technological capabilities

- Disciplined capital allocation approach

- Established international partnerships

Chevron’s Weaknesses

- Higher production costs than national oil companies

- Smaller reserve base (11.2 billion barrels)

- Exposure to stringent environmental regulations

- Lower production volume (2.4 million barrels per day)

- Aging assets in some regions

Aramco’s technological capabilities focus on maximizing recovery from existing fields, with significant investments in enhanced oil recovery techniques. Its research centers in Houston, Boston, Detroit, and Beijing develop technologies to improve extraction efficiency and reduce environmental impact. However, Aramco faces challenges in diversifying beyond its core oil business and adapting to a carbon-constrained future.

Chevron has built its reputation on technological innovation, particularly in deep-water drilling, liquefied natural gas (LNG) production, and digital technologies for operational efficiency. As one of the largest oil companies in the world, its Chevron Technology Ventures division actively invests in emerging energy technologies, including carbon capture and hydrogen, to enhance its integrated oil and gas portfolio. This forward-looking approach positions Chevron, a key player in the United States market, to potentially adapt more quickly to energy transition demands, ensuring it remains competitive among the world’s largest integrated oil companies.

Innovation and Energy Transition

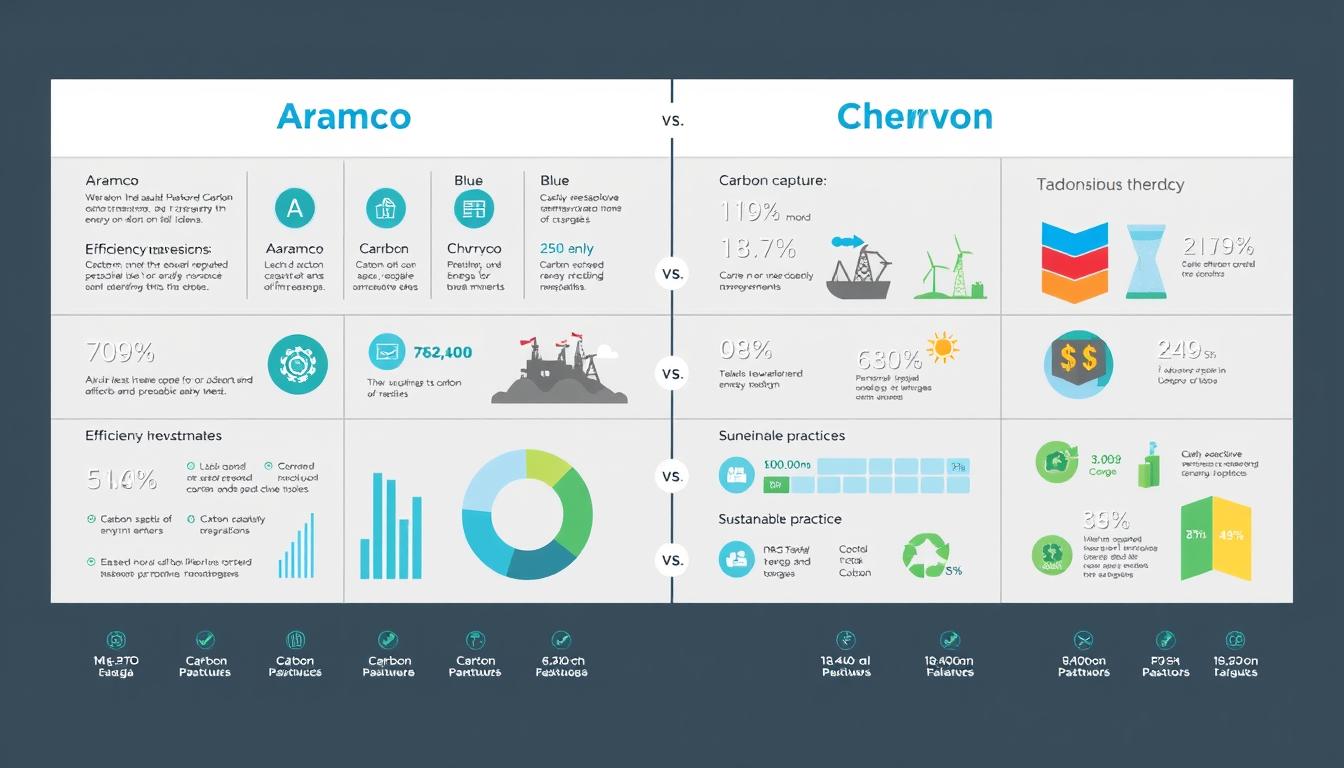

Energy transition strategies: Aramco’s efficiency focus vs. Chevron’s diversified approach

As the energy landscape evolves, both companies are navigating the transition differently. Aramco’s approach to innovation centers on making its core oil and gas operations more efficient and less carbon-intensive. The company has invested in carbon capture and storage (CCS) technologies, with a particular focus on “blue hydrogen” produced from natural gas with carbon capture. Aramco’s research centers are developing technologies to reduce the carbon intensity of its operations, including direct air capture and advanced materials for more efficient refineries.

Chevron has adopted a more diversified approach to the energy transition. Through its Chevron Technology Ventures, the company has invested in renewable energy technologies, including geothermal, wind, and solar. Chevron has also made significant commitments to renewable fuels, carbon capture, and hydrogen production. Its New Energies division, established in 2021, focuses specifically on commercializing lower-carbon technologies, with an initial commitment of $10 billion through 2028.

| Energy Transition Initiative | Aramco’s Approach | Chevron’s Approach |

| Carbon Reduction Targets | Net-zero operational emissions by 2050 | Net-zero upstream emissions by 2050 |

| Renewable Energy | Limited investments, primarily solar | Investments in solar, wind, geothermal |

| Carbon Capture | Focus on industrial-scale CCS | Multiple CCS projects globally |

| Hydrogen | Blue hydrogen from natural gas | Both blue and green hydrogen |

The contrast in approaches reflects their different starting points and strategic visions. Aramco, with its massive oil reserves and low production costs, is focusing on extending the viability of its core business in a carbon-constrained world. Chevron, facing higher production costs and stricter regulatory environments, is more actively diversifying beyond traditional oil and gas. Both strategies have merits, but their success will ultimately depend on the pace and nature of the global energy transition.

Financial Performance

Financial comparison: Aramco’s massive scale vs. Chevron’s efficient operations

The financial profiles of these energy giants reveal stark differences in scale and profitability. Aramco stands as the more profitable entity, generating $590.3 billion in revenue and $156.5 billion in net income (2022 figures). This extraordinary profitability stems from its unmatched production volume and industry-leading low costs. With a market capitalization of approximately $1.9 trillion, Aramco ranks among the world’s most valuable companies, though its public float represents only about 2% of total shares.

Chevron, while smaller in absolute terms, demonstrates strong financial discipline and shareholder returns. The company reported $227.1 billion in revenue and $34.2 billion in net income for 2022. With a market capitalization around $288 billion, Chevron maintains a strong position among Western oil majors. The company is known for its disciplined capital allocation, maintaining a strong balance sheet with relatively low debt compared to peers.

| Financial Metric | Saudi Aramco | Chevron |

| Revenue (2022) | $590.3 billion | $227.1 billion |

| Net Income (2022) | $156.5 billion | $34.2 billion |

| Market Cap | $1.9 trillion | $288 billion |

| Return on Capital Employed | 30.2% | 14.8% |

| Dividend Yield | 4.1% | 3.9% |

Investment strategies also differ significantly. Aramco’s capital expenditure is heavily weighted toward maintaining and expanding its production capacity, with significant investments in downstream integration. The company’s investment decisions are influenced by Saudi national interests, including economic diversification goals. Chevron has maintained a more conservative capital program, focusing on high-return projects and returning excess cash to shareholders through dividends and share repurchases.

Brand Reputation and Stakeholder Relations

Stakeholder relations: Government ties, environmental records, and corporate responsibility

Aramco’s brand identity is inextricably linked to Saudi Arabia itself, with the company serving as both a commercial entity and an instrument of national policy. This dual role creates unique stakeholder dynamics, with the Saudi government as the dominant shareholder influencing major decisions. Aramco has worked to build its international reputation through strategic partnerships, sponsorships, and corporate social responsibility initiatives. However, it continues to face scrutiny regarding environmental practices, transparency, and governance standards.

Chevron has cultivated a brand identity centered on operational excellence, technological innovation, and shareholder returns. As a publicly traded company accountable to diverse shareholders, Chevron faces intense scrutiny from investors, regulators, and environmental groups. The company has invested significantly in community engagement programs and sustainability initiatives to address stakeholder concerns, though it continues to face criticism from environmental activists regarding its climate impact.

Both companies navigate complex stakeholder landscapes, but with different primary constituencies. Aramco must balance commercial objectives with national development goals, while Chevron must satisfy shareholders while addressing growing environmental and social expectations. Their approaches to corporate social responsibility reflect these different contexts, with Aramco focusing on national development projects and Chevron emphasizing global best practices in sustainability and community engagement.

Supply Chain and Infrastructure

Supply chain comparison: Aramco’s regional integration vs. Chevron’s global network

Aramco possesses one of the world’s most integrated oil and gas supply chains within Saudi Arabia, with a vast network of pipelines connecting production facilities to processing plants, refineries, and export terminals. The company’s East-West Pipeline allows flexible export options to both European and Asian markets. Aramco’s supply chain advantages include geographic concentration, state-of-the-art facilities, and direct access to shipping lanes. However, this concentration also creates vulnerability to regional disruptions, as demonstrated by the 2019 drone attacks on its Abqaiq facility.

Chevron operates a more geographically diverse but less integrated supply chain spanning multiple continents. The company’s global logistics network connects upstream production to refineries and marketing operations across different regions. This diversification provides resilience against localized disruptions but creates greater complexity in supply chain management. Chevron has invested heavily in digital technologies to optimize its supply chain, implementing advanced analytics and automation to improve efficiency and reduce costs.

Both companies have demonstrated supply chain resilience during recent market disruptions, including the COVID-19 pandemic and geopolitical conflicts. Aramco’s vertical integration allowed it to maintain production and exports despite volatile market conditions, while Chevron’s geographical diversification helped mitigate regional impacts. As energy markets continue to evolve, supply chain flexibility and adaptability will remain critical competitive factors.

Challenges and Strategic Outlook

Strategic outlook: Navigating energy transition, market volatility, and regulatory pressures

Both companies face significant challenges in navigating the energy transition, though with different risk profiles and strategic responses. Aramco’s primary challenges include its heavy dependence on oil revenues, potential long-term demand decline, and increasing global climate regulations. The company’s strategic response focuses on maintaining its position as the lowest-cost producer while gradually diversifying into petrochemicals and selected low-carbon technologies. Aramco’s close alignment with Saudi Arabia’s Vision 2030 economic diversification plan shapes its long-term strategy.

Chevron confronts challenges including higher production costs, stricter environmental regulations in key markets, and pressure from investors to address climate concerns. The company’s strategic outlook emphasizes capital discipline, high-grading its portfolio toward lower-carbon intensity assets, and measured investments in new energy technologies. Chevron has articulated a “higher returns, lower carbon” strategy that aims to maintain profitability while gradually reducing emissions intensity.

How are Aramco and Chevron addressing climate change regulations?▶

Aramco is focusing on reducing the carbon intensity of its operations while maintaining its core oil business, investing in carbon capture and methane reduction technologies. Chevron has adopted more explicit emissions reduction targets and is diversifying into renewable fuels and hydrogen while advocating for market-based climate policies rather than prescriptive regulations.

Which company is better positioned for oil price volatility?▶

Aramco’s extremely low production costs (under $3 per barrel in some fields) provide significant buffer against low oil prices, though its national budget obligations create pressure for higher prices. Chevron’s integrated business model and financial discipline help it weather price cycles, but its higher cost structure makes it more vulnerable to prolonged price downturns.

How do their long-term growth strategies differ?▶

Aramco’s growth strategy centers on maintaining its dominant position in oil production while expanding downstream integration and selective diversification. Chevron is pursuing a more balanced approach, focusing on high-return conventional energy projects while gradually building capabilities in lower-carbon businesses that leverage its existing strengths.

Conclusion: Who Leads the Future?

Future positioning: Scale and resources vs. adaptability and innovation

The question of who leads the future of oil and gas has no simple answer, as Aramco and Chevron represent different models with distinct advantages. Aramco’s unmatched scale, lowest-cost position, and massive reserves provide significant competitive advantages in a scenario where oil demand remains robust. Its financial resources and national backing enable long-term strategic planning beyond quarterly results. However, Aramco faces greater transition risks if global oil demand peaks earlier than expected.

Chevron’s strengths lie in its operational flexibility, technological capabilities, and experience navigating complex regulatory environments. Its more diversified approach to the energy transition, combined with disciplined financial management, positions it well for an evolving energy landscape. Yet Chevron lacks the scale and cost advantages that make Aramco so formidable in the traditional oil business.

The leader of tomorrow’s energy world will likely be the company that best balances maintaining profitability in traditional operations while successfully adapting to changing energy demands. Both giants have demonstrated resilience and strategic vision, but their paths forward diverge based on their different starting points, capabilities, and constraints. For investors, policymakers, and industry observers, understanding these nuanced differences is essential for navigating the complex future of global energy.