In the rapidly evolving landscape of enterprise technology, IBM and Oracle stand as two titans with rich legacies and competing visions for the future. Both companies have transformed themselves multiple times over decades, from hardware pioneers to software giants and now to cloud and AI innovators. For enterprise decision-makers, choosing between these tech behemoths means aligning with fundamentally different approaches to solving tomorrow’s business challenges. This comprehensive IBM vs Oracle enterprise computing comparison examines how these legacy players are positioning themselves for the next era of digital transformation.

Company Overview: Legacy Giants in Transition

IBM (International Business Machines) was founded in 1911 in New York, beginning as a manufacturer of tabulating machines before evolving through multiple technology eras. From mainframes to personal computers to services, IBM has repeatedly reinvented itself, now focusing on hybrid cloud and artificial intelligence solutions under its “IBM Cloud” umbrella.

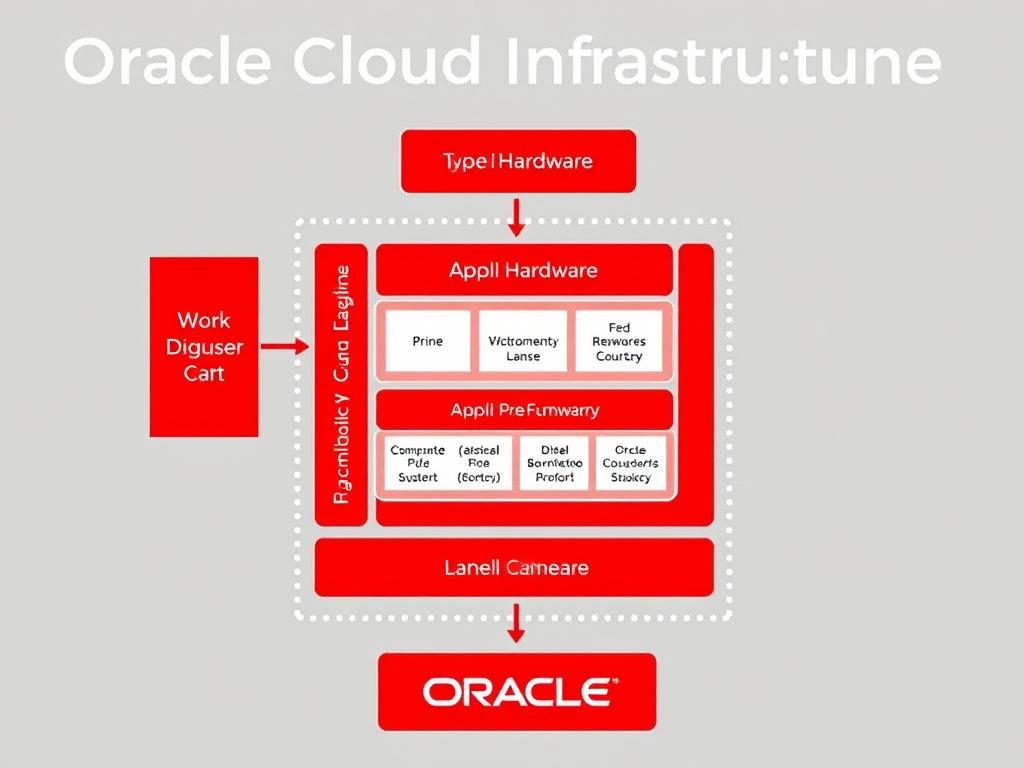

Oracle Corporation, founded in 1977 in California, began with Larry Ellison’s vision of a relational database management system. Over decades, Oracle expanded its database dominance into enterprise applications, hardware systems (following the Sun Microsystems acquisition), and now cloud infrastructure with Oracle Cloud Infrastructure (OCI).

IBM has pivoted toward hybrid cloud solutions and AI services, leveraging its Watson platform and Red Hat acquisition to position itself as an enterprise transformation partner.

Oracle has built its strategy around its database technology foundation, expanding into integrated cloud applications and infrastructure services with a focus on performance and security.

Core Business Focus: Divergent Paths to Enterprise Value

| Business Area | IBM | Oracle |

| Primary Focus | Hybrid Cloud & AI Solutions | Database & Integrated Cloud Applications |

| Cloud Strategy | Multi-cloud management with Red Hat OpenShift | Integrated cloud infrastructure (OCI) and applications |

| AI Approach | Watson AI platform for enterprise applications | Autonomous database and embedded AI in applications |

| Services | Extensive consulting and implementation services | Application-focused implementation and support |

| Hardware | Power Systems, Z mainframes, storage | Engineered systems, Exadata, SPARC servers |

IBM has strategically pivoted toward becoming a hybrid cloud platform company, with its acquisition of Red Hat for $34 billion in 2019 serving as the cornerstone of this strategy. The company has organized its business around the cloud platform, AI applications, and consulting services that help enterprises modernize their operations.

Oracle maintains its stronghold in database technology while aggressively expanding its cloud applications portfolio, particularly in storage and management software. The company has invested heavily in its Oracle Cloud Infrastructure to compete directly with public cloud providers, emphasizing performance advantages for running Oracle workloads. This includes features for data access and monitoring, making it a strong contender in the systems management software space. Users can compare Oracle’s capabilities with IBM Power Systems to evaluate their organization’s functionality and capacity needs.

Strengths and Weaknesses: Competitive Positioning

IBM Strengths

- Strong hybrid cloud strategy with Red Hat OpenShift

- Deep enterprise relationships spanning decades

- Advanced AI capabilities through Watson platform

- Extensive global consulting services

- Strong research capabilities (quantum computing)

IBM Challenges

- Revenue decline in traditional segments

- Complex legacy systems integration

- Slower cloud market share growth vs competitors

- Perception as traditional rather than innovative

- Complex product portfolio can confuse customers

Oracle Strengths

- Dominant database market position

- Integrated applications and infrastructure

- Strong enterprise application suite (ERP, HCM)

- Performance-optimized cloud infrastructure

- Autonomous database capabilities

Oracle Challenges

- Late entry to cloud infrastructure market

- Reputation for aggressive licensing practices

- Limited third-party ecosystem compared to competitors

- Less diverse revenue streams

- Perception of vendor lock-in

Both companies face the challenge of transitioning their traditional enterprise customers to new cloud-based models while defending against cloud-native competitors like AWS, Microsoft Azure, and Google Cloud.

Cloud Strategy and Infrastructure: Different Approaches to Enterprise Cloud

IBM’s cloud strategy centers on hybrid cloud flexibility through Red Hat OpenShift, allowing customers to build and run applications across any cloud environment. This approach acknowledges that most enterprises will maintain a mix of on-premises, private cloud, and multiple public cloud environments.

Oracle’s cloud strategy focuses on providing a complete, integrated stack from infrastructure to applications. Oracle Cloud Infrastructure (OCI) is designed specifically to run Oracle workloads with superior performance, often claiming significant advantages for running Oracle databases compared to other cloud providers.

Need Help Evaluating Cloud Options?

Our enterprise cloud specialists can provide a detailed analysis of how IBM and Oracle cloud solutions would perform with your specific workloads and requirements.

AI, Data & Innovation: Competing Visions for Intelligent Enterprise

IBM has positioned Watson as its flagship AI platform, offering pre-built AI services and tools for enterprises to develop custom AI solutions. The company has also made significant investments in quantum computing research, positioning itself for the next computing paradigm shift.

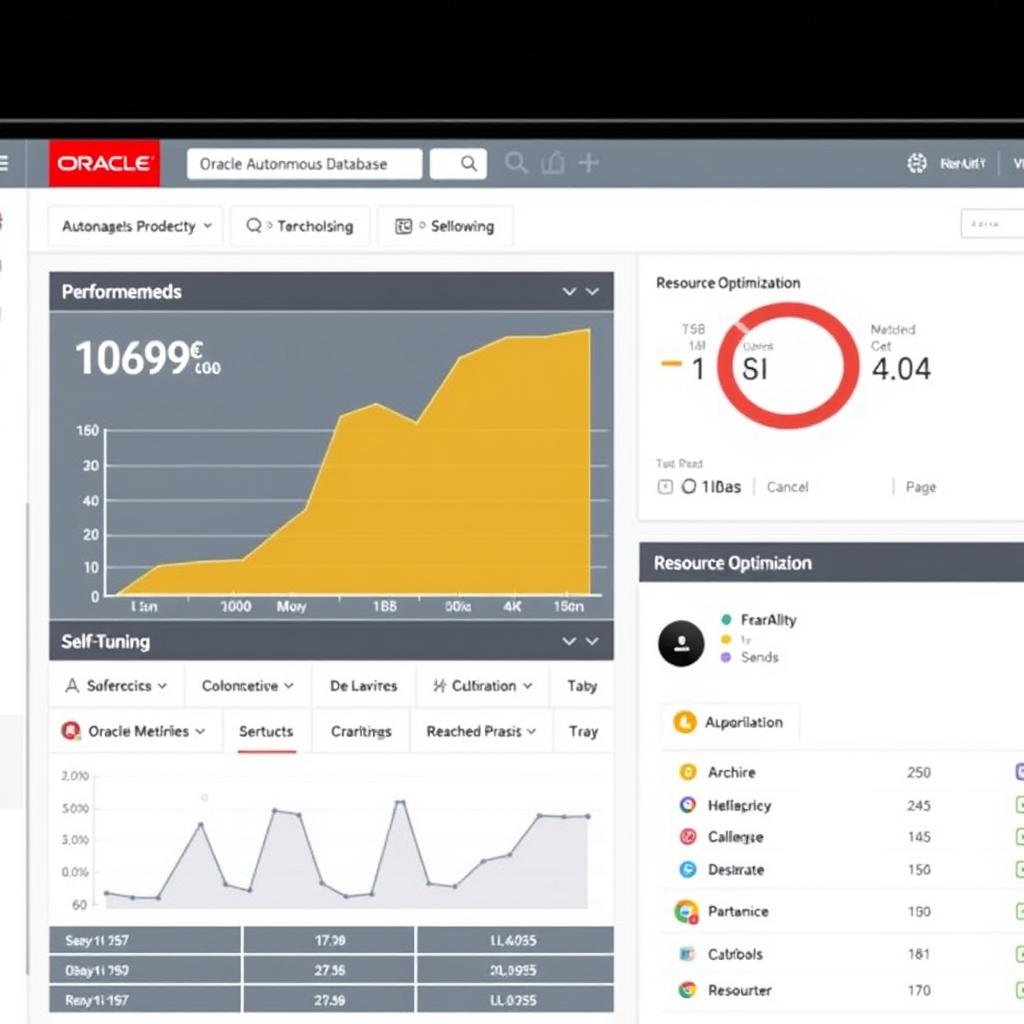

Oracle has focused on embedding AI capabilities directly into its applications and autonomous database offerings, which can self-tune, self-patch, and self-secure without human intervention. This approach emphasizes practical AI that improves existing workflows and features, rather than creating entirely new AI platforms. By leveraging performance management tools, Oracle’s enterprise manager enhances data access and monitoring, making it a competitive choice when compared to IBM Power systems in the realm of systems management software.

IBM’s Watson platform provides AI services ranging from natural language processing to visual recognition, with industry-specific solutions for healthcare, financial services, and more.

Oracle’s Autonomous Database automatically handles routine database management tasks, allowing enterprises to focus on using data rather than managing infrastructure.

“While IBM focuses on building a comprehensive AI platform with Watson, Oracle embeds AI capabilities directly into its applications and database offerings. These different approaches reflect each company’s core strengths and vision for how AI will transform enterprise computing.”

Financial Performance: Investment and Growth Indicators

| Financial Metric | IBM | Oracle |

| Annual Revenue (2022) | $60.5 billion | $42.4 billion |

| Cloud Revenue Growth | +16% year-over-year | +24% year-over-year |

| R&D Investment | $6.5 billion (10.7% of revenue) | $7.2 billion (17.0% of revenue) |

| Profit Margin | 13.4% | 21.5% |

IBM has been focusing on revenue quality over quantity, divesting lower-margin businesses while investing in higher-growth areas like hybrid cloud and AI. This strategy has temporarily impacted overall revenue but improved profit margins.

Oracle has shown stronger cloud revenue growth in recent years, albeit from a smaller base compared to cloud leaders. Its higher profit margins reflect the company’s efficient operations and the high-margin nature of its software and cloud services.

Future Challenges and Strategic Direction

Both IBM and Oracle face significant challenges in the rapidly evolving enterprise technology landscape. Cloud hyperscalers like AWS, Microsoft Azure, and Google Cloud continue to gain market share, while specialized AI companies threaten to capture the high-growth AI market.

IBM’s strategic direction focuses on becoming the leading hybrid cloud platform company, leveraging Red Hat OpenShift to help enterprises modernize applications and deploy workloads across multiple environments. The company is also betting heavily on quantum computing as the next major computing paradigm.

Oracle is positioning itself as providing the most complete and integrated cloud solution, from infrastructure to applications. Its strategy emphasizes the performance and cost advantages of running Oracle workloads on Oracle Cloud Infrastructure, while expanding its application portfolio through acquisitions.

Conclusion: Choosing Your Enterprise Computing Partner

The IBM vs Oracle enterprise computing comparison reveals two technology giants with different approaches to solving enterprise challenges. IBM offers a more open, hybrid approach with strong consulting capabilities and broad AI platform, while Oracle provides a more integrated, performance-optimized stack with industry-leading database technology.

For enterprises evaluating these solutions, the choice depends largely on existing investments, specific workload requirements, and strategic technology direction. Organizations with diverse, multi-vendor environments may find IBM’s hybrid approach more aligned with their needs, while those heavily invested in Oracle technologies may benefit from Oracle’s integrated stack.

As both companies continue to evolve their offerings and compete with cloud-native providers, enterprise customers should regularly reassess their technology partnerships to ensure alignment with business objectives and emerging capabilities.