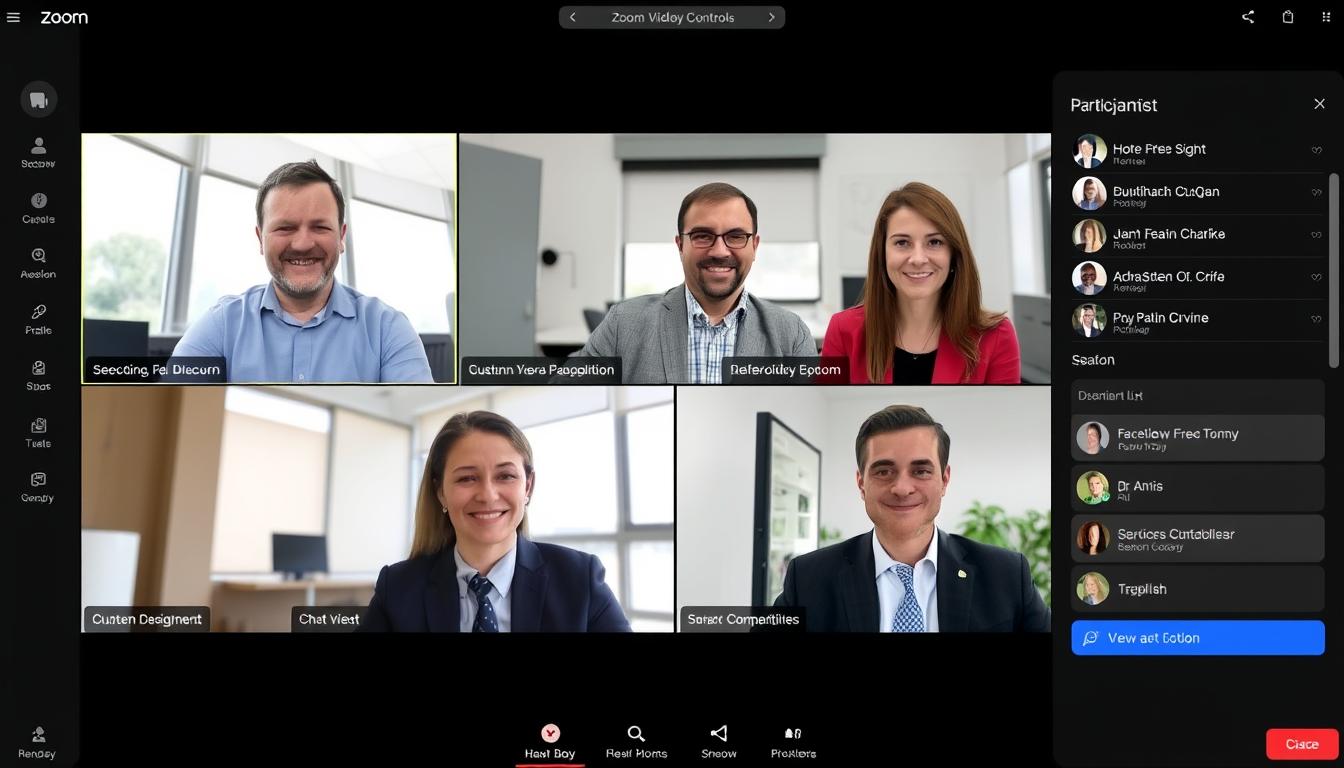

The landscape of remote work has transformed dramatically in recent years, with video conferencing tools and collaboration features becoming essential components of modern business operations. At the forefront of this digital transformation are two major players: Zoom and Microsoft Teams. Both platforms have seen explosive growth, but they approach remote collaboration from different angles, with distinct strengths and weaknesses. This comprehensive analysis examines how these platforms compare across multiple dimensions, from their founding principles to their future strategies, helping organizations make informed decisions about which solution best meets their unique needs, whether it’s Zoom’s paid plans or Microsoft Teams’ free plan, video meetings, team chat, screen sharing, or breakout rooms.

Company Background

Zoom Video Communications

Founded in 2011 by former Cisco Webex executive Eric Yuan, Zoom emerged from Yuan’s vision to create a video conferencing solution that prioritized user experience. The company began as Saasbee, Inc. before rebranding to Zoom in 2012. Initially, Zoom operated in relative obscurity, steadily building its platform and user base while competing against established players like Skype and Webex.

Zoom’s trajectory changed dramatically in 2020 when the COVID-19 pandemic forced organizations worldwide to adopt remote work solutions. The platform’s daily meeting participants skyrocketed from 10 million in December 2019 to over 300 million by April 2020. This unprecedented growth catapulted Zoom into the mainstream, transforming it from a specialized business tool to a household name.

Microsoft Teams

Microsoft Teams launched in 2017 as part of the Microsoft 365 ecosystem (formerly Office 365). Unlike Zoom, which began as a standalone product, Teams was conceived as an integrated component of Microsoft’s broader productivity suite. The platform emerged as Microsoft’s response to the growing popularity of team collaboration tools like Slack.

Teams benefited significantly from Microsoft’s established enterprise presence and its integration with familiar tools like Word, Excel, and Outlook. While its growth was initially more measured than Zoom’s, Teams has seen consistent expansion, particularly among organizations already invested in the Microsoft ecosystem. By 2023, Microsoft reported that Teams had surpassed 280 million monthly active users, cementing its position as a leading collaboration platform.

Core Purpose and Business Focus

Zoom: Video-First Approach

Zoom was built with a singular focus: to deliver high-quality, reliable video conferencing. This specialized approach is evident in Zoom’s design philosophy, which prioritizes simplicity and performance. The platform was engineered to maintain video quality even in low-bandwidth environments, making it accessible to users regardless of their internet connection quality.

While Zoom has expanded its offerings to include features like team chat, phone services, and whiteboarding, its core identity remains rooted in video conferencing excellence. This focus has allowed Zoom to optimize the meeting experience, with features like virtual backgrounds, breakout rooms, and advanced audio processing receiving significant development attention.

Microsoft Teams: Integrated Collaboration Hub

Microsoft Teams was designed as a comprehensive collaboration hub that unifies various communication and productivity tools. Rather than focusing exclusively on video conferencing, Teams integrates chat, meetings, file sharing, and application collaboration into a single platform. This approach reflects Microsoft’s broader strategy of creating an interconnected ecosystem of productivity tools.

Teams’ integration with Microsoft 365 applications represents a key differentiator. Users can seamlessly transition between collaborating on documents, scheduling meetings, and communicating with colleagues without leaving the Teams environment. This integration extends to Microsoft’s broader enterprise offerings, including SharePoint, OneDrive, and Power Platform, positioning Teams as a central component of Microsoft’s business productivity strategy.

Strengths and Weaknesses

Zoom Strengths

- Superior video quality and reliability, especially in low-bandwidth environments

- Intuitive user interface with minimal learning curve

- Excellent performance scaling from small meetings to large webinars (up to 1,000 participants)

- Platform-agnostic approach with consistent experience across devices

- Robust free tier offering generous functionality

Zoom Weaknesses

- Limited integration with productivity tools compared to Teams

- Less comprehensive document collaboration capabilities

- Historical security concerns (though significantly addressed)

- Additional costs for advanced features and larger participant capacity

- Less robust asynchronous collaboration tools

Microsoft Teams Strengths

- Seamless integration with Microsoft 365 applications

- Comprehensive collaboration features beyond video meetings

- Strong enterprise security and compliance capabilities

- Included in existing Microsoft 365 subscriptions for many organizations

- Robust file sharing and document co-authoring

Microsoft Teams Weaknesses

- More complex interface with steeper learning curve

- Video quality can degrade more quickly in bandwidth-constrained environments

- Resource-intensive application that can impact system performance

- Less intuitive for external participants not familiar with the platform

- Feature overload can overwhelm casual users

Innovation and Technology

AI Capabilities

Both platforms have made significant investments in artificial intelligence to enhance the meeting experience. Zoom’s AI Companion (included in paid plans) offers meeting summaries, chapter highlights, and AI-composed messages. Microsoft counters with Copilot for Microsoft 365, which provides similar functionality but requires an additional license ($30/user/month).

In transcription accuracy, both platforms perform comparably for standard English, though Microsoft’s solution currently supports more languages. Zoom’s noise suppression technology has maintained a slight edge in real-world testing, particularly in challenging acoustic environments.

Meeting Experience

Virtual background technology has become a standard feature, with both platforms offering comparable quality. Microsoft’s Together Mode represents a unique innovation, placing participants in shared virtual spaces to reduce meeting fatigue. Zoom counters with Immersive View, though it has seen less widespread adoption.

For engagement tools, Zoom offers more extensive options for polls, Q&A, and interactive whiteboarding in its base packages. Teams integrates more deeply with Microsoft Whiteboard and offers superior persistent collaboration spaces that extend beyond the meeting itself.

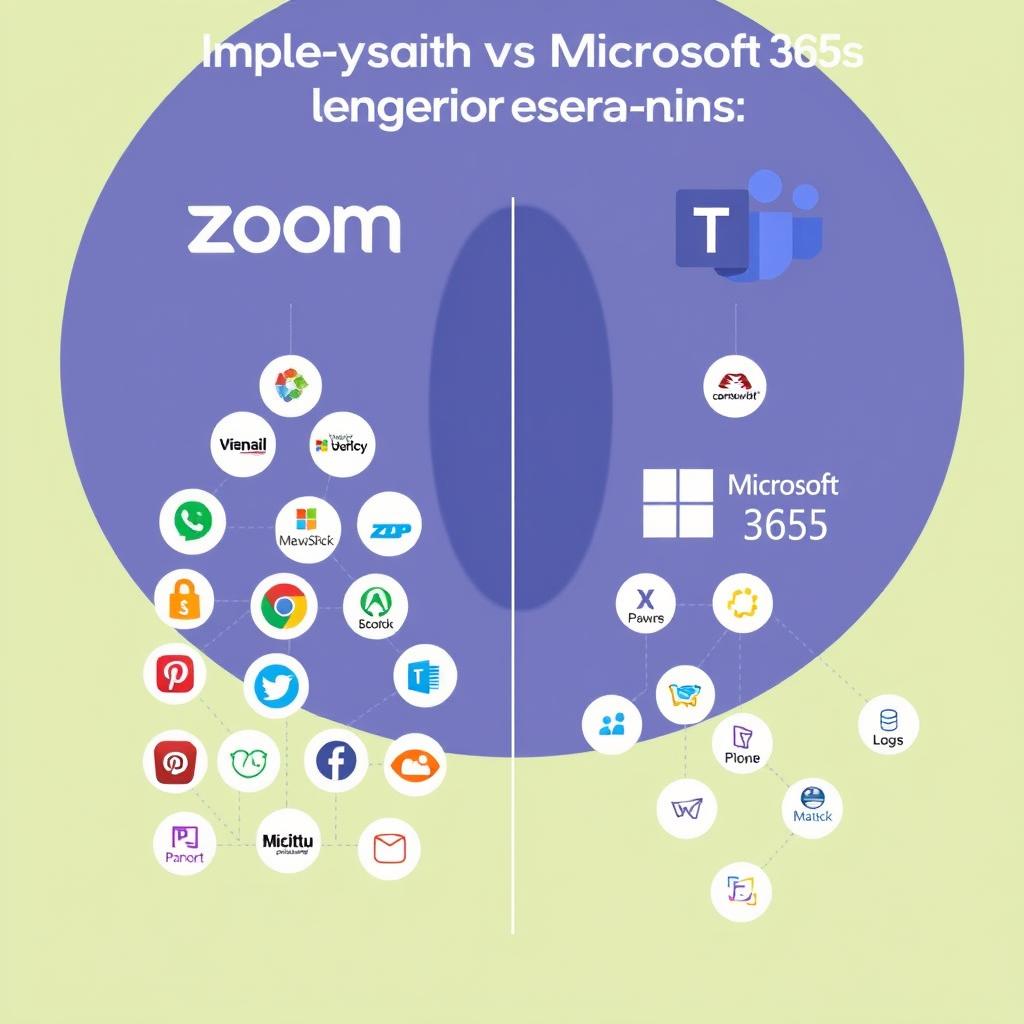

Integration Ecosystem

Zoom’s marketplace features nearly 3,000 third-party integrations, reflecting its open platform approach. These integrations span productivity tools, CRM systems, and specialized industry applications. Microsoft Teams offers fewer third-party integrations (approximately 2,500) but provides deeper integration with Microsoft’s own productivity suite.

For developers, both platforms offer robust APIs and SDKs, though Zoom’s documentation and implementation are generally considered more accessible for rapid development. Microsoft’s Power Platform integration gives Teams an advantage for organizations looking to build custom workflows without extensive coding.

Security and Privacy

| Security Feature | Zoom | Microsoft Teams |

| End-to-End Encryption | Available for all meetings when enabled | Available for 1:1 calls; standard TLS encryption for group meetings |

| Meeting Access Controls | Waiting rooms, passcodes, authenticated users only | Lobby, tenant restrictions, private channels |

| Compliance Certifications | GDPR, HIPAA, SOC 2, FedRAMP | GDPR, HIPAA, SOC 1/2, FedRAMP, ISO 27001 |

| Data Residency Options | Available in select regions with paid plans | Extensive global data center options |

| Admin Controls | Centralized management, role-based access | Integrated with Microsoft 365 admin center |

Security Evolution

Zoom faced significant security scrutiny in early 2020 with issues like “Zoom-bombing” and encryption concerns. The company responded with a 90-day security plan that substantially improved its security posture, including implementing true end-to-end encryption and enhancing default security settings. These improvements have largely restored confidence in the platform’s security capabilities.

Microsoft Teams has benefited from Microsoft’s decades of enterprise security experience, with robust protections integrated from the outset. Its security architecture leverages Microsoft’s broader cloud security infrastructure, though its encryption approach differs from Zoom’s with end-to-end encryption limited to specific scenarios.

Compliance and Governance

For regulated industries, both platforms offer comprehensive compliance capabilities, though their implementations differ. Microsoft Teams integrates with Microsoft’s established compliance framework, including retention policies, eDiscovery, and information barriers. This integration provides a familiar experience for organizations already using Microsoft’s compliance tools.

Zoom has developed its own compliance features, with capabilities that match or exceed Teams in certain areas. Zoom’s approach to data sovereignty has also evolved, with more options for organizations to control where their data is stored and processed, addressing concerns from multinational organizations and those in highly regulated industries.

Financial Performance and Growth

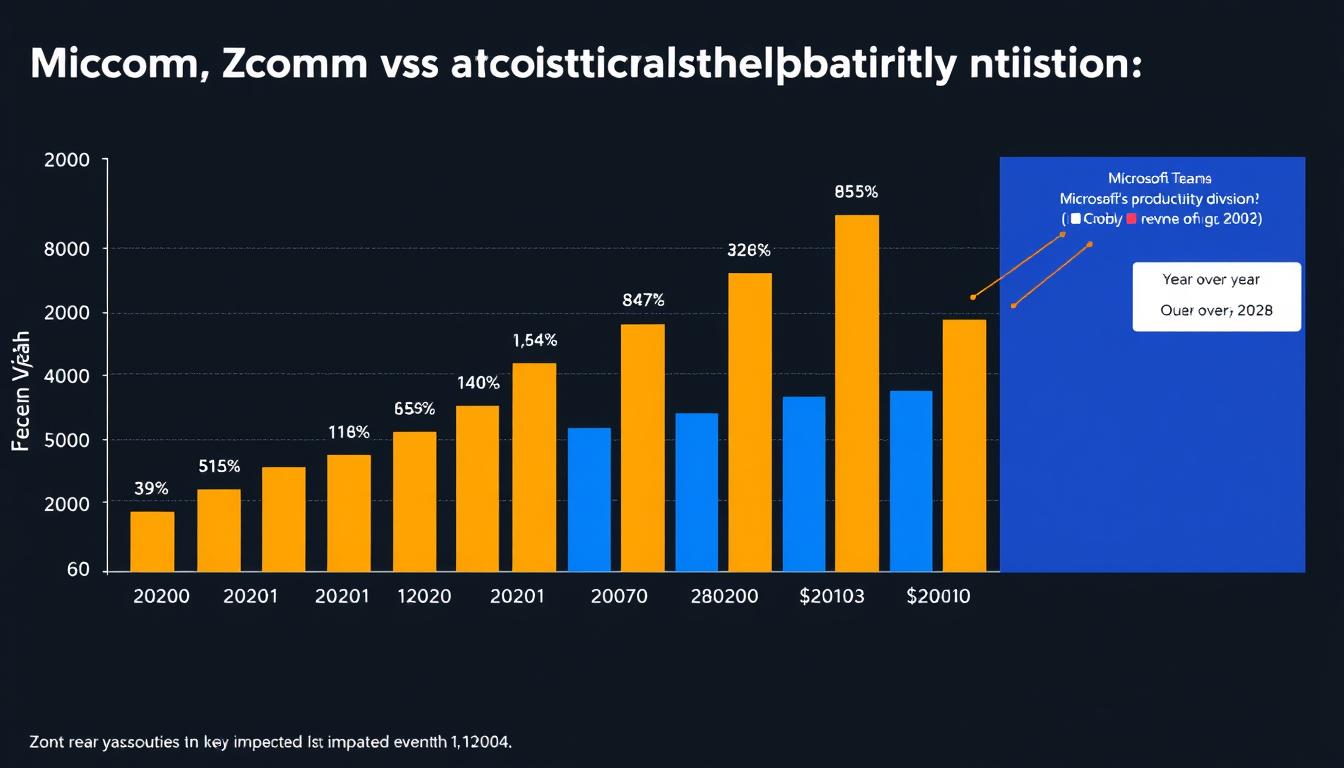

Zoom Financial Trajectory

Zoom’s financial performance reflects its dramatic rise during the pandemic and subsequent normalization. The company’s revenue grew from $623 million in fiscal year 2020 to $4.1 billion in fiscal year 2022—a staggering 558% increase in two years. Growth has moderated since then, with fiscal year 2023 showing a more modest 7% increase to $4.39 billion.

Profitability has followed a similar pattern, with net income peaking during the height of the pandemic before facing pressure from increased competition and investment in new features. Zoom’s enterprise customer base (customers generating >$100,000 in annual revenue) has continued to grow, increasing 12% year-over-year in the most recent fiscal quarter, indicating strength in its core business market.

Microsoft Teams as Part of Microsoft 365

Assessing Teams’ financial performance is more challenging as Microsoft does not report Teams revenue separately. Instead, Teams is bundled within Microsoft 365 subscriptions, which have shown consistent growth. Microsoft’s Productivity and Business Processes segment, which includes Microsoft 365, generated $63.4 billion in fiscal year 2023, representing 13% year-over-year growth.

Microsoft’s strategy of integrating Teams into its broader ecosystem has proven effective for driving adoption and retention. The company has secured numerous large enterprise contracts, with over 60% of Fortune 500 companies using Microsoft Teams. This enterprise penetration provides Microsoft with a stable revenue base and opportunities for upselling additional services.

User Experience and UI Design

Zoom: Simplicity as a Virtue

Zoom’s interface design philosophy emphasizes simplicity and accessibility. The platform’s controls are intuitive, with core functions prominently displayed and advanced features accessible without overwhelming the user. This approach has contributed significantly to Zoom’s rapid adoption, particularly among users with varying levels of technical proficiency.

The meeting experience prioritizes video quality, with participant thumbnails automatically adjusting based on who is speaking. Zoom maintains remarkable consistency across platforms, with mobile, desktop, and web experiences offering nearly identical functionality. This consistency reduces friction when switching between devices, an important consideration for remote workers.

Microsoft Teams: Comprehensive but Complex

Microsoft Teams employs a more feature-rich interface that reflects its broader collaboration ambitions. The platform organizes content into teams, channels, tabs, and chats, providing a structured environment for ongoing collaboration. This approach offers greater versatility but introduces a steeper learning curve, particularly for new users.

Teams’ integration with Microsoft 365 applications is evident throughout the interface, with seamless transitions to Word, Excel, and other tools. While this integration enhances productivity for users familiar with the Microsoft ecosystem, it can create complexity for those primarily seeking video conferencing functionality. Mobile experiences, while improving, still lag behind desktop in terms of feature parity.

Brand Perception and Public Image

Zoom: From Verb to Scrutiny to Stability

Zoom achieved the rare distinction of becoming a verb (“Let’s Zoom”), reflecting its cultural impact during the pandemic. This rapid ascent brought unprecedented visibility but also intense scrutiny. Early security concerns and “Zoom fatigue” narratives presented challenges to the brand, though the company’s transparent response to security issues helped rebuild trust.

In education, Zoom became the default platform for many institutions during remote learning, creating strong brand recognition among younger users. The platform’s accessibility and free tier made it popular for personal use cases beyond business, from family gatherings to community events, broadening its brand reach beyond the corporate world.

Microsoft Teams: Enterprise Reliability

Microsoft Teams benefits from association with the broader Microsoft brand, inheriting perceptions of enterprise reliability and security. The platform is widely viewed as a professional tool rather than a consumer application, with stronger brand equity among IT decision-makers than end users. This positioning aligns with Microsoft’s enterprise-first strategy but limits Teams’ cultural impact compared to Zoom.

In media coverage, Teams is typically framed within the context of workplace productivity and digital transformation rather than as a standalone phenomenon. This association with Microsoft’s ecosystem is both a strength and limitation for the Teams brand, providing credibility while sometimes overshadowing its distinct identity.

Challenges and Future Strategy

Adapting to Hybrid Work

Both platforms face the challenge of evolving from emergency remote work solutions to supporting sustainable hybrid work models. Zoom is developing enhanced room solutions and hardware integrations to better connect in-office and remote participants. Its Zoom Rooms Smart Gallery feature uses AI to create individual video feeds of in-room participants, addressing the inequality between remote and in-person attendees.

Microsoft’s approach leverages its hardware ecosystem, including Surface Hub and Teams Rooms devices. The company has introduced features specifically designed for hybrid scenarios, such as front row layouts and intelligent cameras that can track and frame in-room speakers. Both companies recognize that hybrid work represents a fundamental shift rather than a temporary adjustment.

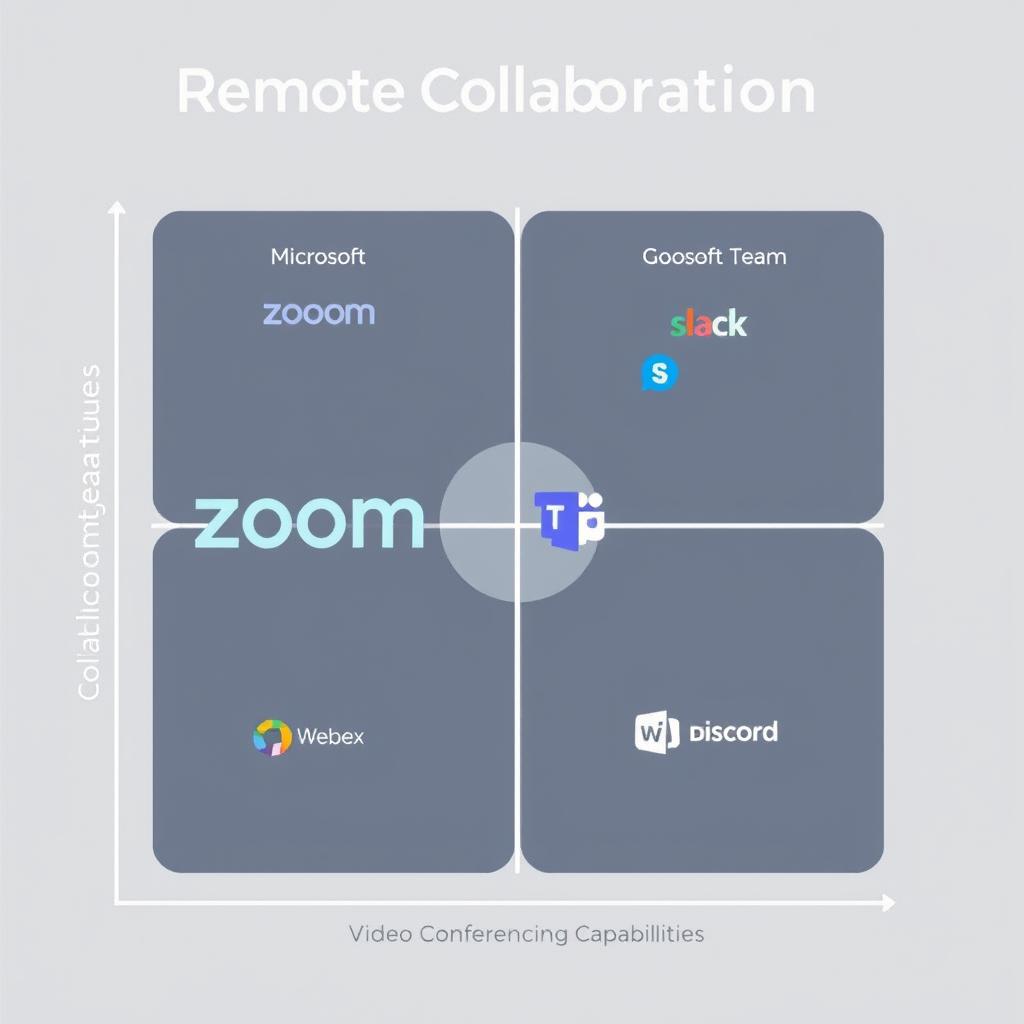

Competitive Pressures

The collaboration space continues to consolidate, with Google Meet, Cisco Webex, and Slack (now part of Salesforce) presenting significant competition. Zoom’s strategy involves expanding beyond meetings into a comprehensive communication platform with Zoom Phone, Contact Center, and Zoom Rooms. This expansion aims to increase customer retention and average revenue per user but places Zoom in direct competition with established unified communications providers.

Microsoft’s competitive advantage stems from its integrated ecosystem and established enterprise relationships. The company continues to leverage these advantages while addressing Teams’ performance and usability challenges. Both platforms must also contend with emerging specialized competitors targeting specific verticals or use cases with tailored solutions.

Innovation Roadmaps

Artificial intelligence represents a central focus for both platforms’ future development. Zoom’s AI Companion and Microsoft’s Copilot reflect initial steps toward AI-enhanced collaboration, with features like meeting summarization, action item extraction, and real-time assistance. These capabilities will likely expand to include more sophisticated real-time coaching, content generation, and predictive analytics.

Immersive collaboration represents another frontier, with both companies exploring virtual and mixed reality experiences. Microsoft has already introduced Mesh for Teams, enabling shared holographic experiences, while Zoom has partnered with Meta on virtual reality meeting spaces. These initiatives reflect a shared vision of collaboration that transcends traditional video conferencing limitations.

Pricing and Value Comparison

| Plan Type | Zoom | Microsoft Teams | Key Differentiators |

| Free Tier | Basic: 40-minute limit on group meetings, 100 participants | Free: 60-minute limit on meetings, 100 participants | Teams offers longer meeting duration; Zoom provides more features in free tier |

| Entry Business | Pro: $13.32/user/month, 30-hour meetings, 100 participants | Teams Essentials: $4/user/month, 30-hour meetings, 300 participants | Teams offers higher participant limit at lower cost |

| Mid-tier Business | Business: $18.32/user/month, 300 participants, managed domains | Microsoft 365 Business Basic: $6/user/month, includes email and Office web apps | Teams bundled with Microsoft 365 provides broader productivity tools |

| Enterprise | Enterprise: Custom pricing, 500-1000 participants, unlimited cloud storage | Microsoft 365 E3/E5: $36-57/user/month, includes full Office suite and advanced security | Zoom offers more flexible enterprise options; Microsoft provides comprehensive enterprise suite |

| Add-ons | Large Meetings ($50/month), Webinars, Zoom Phone, Events | Microsoft Copilot ($30/user/month), Audio Conferencing, Phone System | Zoom offers more granular add-ons; Teams AI features require significant additional investment |

Total Cost Considerations

When evaluating total cost of ownership, organizations must consider several factors beyond base subscription prices. For companies already invested in Microsoft 365, Teams represents an included value that may make standalone Zoom licenses appear redundant. Conversely, organizations with minimal Microsoft investment may find Zoom’s pricing more straightforward and potentially more cost-effective.

Implementation and training costs also factor into the equation. Zoom’s simpler interface typically requires less training investment, while Teams’ broader functionality may demand more extensive onboarding but deliver greater long-term productivity benefits. Hardware compatibility, network requirements, and integration costs should also be evaluated when calculating total cost of ownership.

Value Proposition Analysis

Zoom’s value proposition centers on providing a best-in-class video conferencing experience with straightforward pricing and minimal complexity. The platform’s consistent performance and reliability justify its premium pricing for organizations that prioritize these attributes. Zoom’s expanding platform capabilities aim to increase its value proposition beyond meetings.

Microsoft Teams delivers value through its integration with the broader Microsoft ecosystem, offering a unified environment for collaboration, communication, and productivity. For organizations already invested in Microsoft 365, Teams represents an integrated value rather than an additional cost center. This bundled approach can deliver significant value but may include features that some organizations don’t fully utilize.

Conclusion: Who’s Winning the Remote Collaboration Battle?

The question of which platform is “winning” depends largely on how success is measured and the specific needs of the organization. Zoom excels in providing a focused, high-quality video conferencing experience with minimal friction. Its intuitive interface, reliable performance, and specialized meeting features make it the preferred choice for organizations prioritizing simplicity and meeting quality above all else.

Microsoft Teams delivers a more comprehensive collaboration environment that extends well beyond video meetings. Its integration with Microsoft 365, robust document collaboration, and unified communication capabilities make it ideal for organizations seeking a centralized workspace rather than standalone meeting tools. Teams’ strength lies in its ability to reduce context switching and create a persistent collaboration environment.

Rather than declaring a definitive winner, forward-thinking organizations are increasingly adopting a hybrid approach. Many companies maintain both platforms, using Teams for internal collaboration and Zoom for external meetings or specialized use cases. This strategy leverages the strengths of each platform while mitigating their respective limitations.

Ultimately, the remote collaboration battle continues to evolve as both platforms respond to changing work patterns and emerging technologies. Organizations should evaluate these tools based on their specific collaboration needs, existing technology investments, user preferences, and long-term digital workplace strategy rather than market share or popularity metrics alone.