In the high-stakes world of energy drinks, two giants have been battling for supremacy for decades: Red Bull and Monster Energy. This rivalry extends far beyond caffeine content and flavor profiles—it represents a fascinating case study in contrasting business strategies, brand positioning, and market dominance. This comprehensive analysis examines how these beverage titans have shaped the global energy drink landscape and which company truly holds the competitive edge in this multi-billion dollar industry.

Company Background and Brand Story

Red Bull emerged in 1987 when Austrian entrepreneur Dietrich Mateschitz discovered a Thai energy drink called Krating Daeng during his travels. Recognizing its potential in Western markets, Mateschitz adapted the formula and launched Red Bull with the now-iconic slogan “Red Bull gives you wings.” The company pioneered the premium energy drink category with its distinctive slim blue and silver can, establishing itself as a lifestyle brand rather than just a beverage.

Monster Energy entered the scene much later, launching in 2002 as a product of Hansen Natural Corporation (now Monster Beverage Corporation). The American company took a decidedly different approach with its edgy black and neon green branding, larger 16-ounce cans, and aggressive marketing targeting extreme sports enthusiasts and counterculture communities. Monster’s strategy was clear from the beginning: don’t try to be Red Bull; instead, create an entirely different energy drink identity.

While Red Bull built its foundation on a single flagship product with minimal variations, Monster rapidly expanded its flavor portfolio and sub-brands. This fundamental difference in approach—focused premium positioning versus diversified product range—has defined their competition for over two decades.

Core Specialization and Product Range

Red Bull’s Focused Approach

Red Bull has maintained remarkable consistency in its product strategy, focusing primarily on its original formula in the signature 8.4-ounce (250ml) can. The company has introduced limited variations, including sugar-free and total zero options, along with seasonal editions like the Winter Edition and Summer Edition. This deliberate restraint has helped Red Bull maintain its premium positioning and brand recognition.

The company’s product innovation has been cautious and strategic, introducing new flavors and formulations only after extensive market research. This approach has allowed Red Bull to maintain consistent brand messaging and avoid market saturation or consumer confusion.

Monster’s Diversification Strategy

In stark contrast, Monster has aggressively pursued product diversification, offering more than 34 different flavors and variants across multiple sub-brands. The Monster portfolio includes the original green line, the zero-sugar Ultra series, the coffee-based Java Monster, the recovery-focused Rehab line, and the juice-infused Monster Juice, among others.

This expansive approach allows Monster to target different consumer segments, usage occasions, and flavor preferences. By occupying significant shelf space with its varied offerings, Monster effectively crowds out competitors and provides retailers with a comprehensive energy drink solution from a single brand family.

Strengths and Weaknesses

Red Bull Strengths

- Premium brand positioning allows for higher profit margins

- Consistent global marketing message and brand identity

- Pioneering status in the category creates authenticity

- Extensive sports and cultural event ownership

- Strong direct distribution network in key markets

Red Bull Weaknesses

- Limited product diversification restricts market coverage

- Premium pricing creates vulnerability to lower-priced competitors

- Slower adaptation to changing consumer preferences

- Relatively static flavor innovation compared to competitors

- Smaller serving size may deter value-seeking consumers

Monster Strengths

- Extensive product range appeals to diverse consumer segments

- Strategic partnership with Coca-Cola provides global distribution power

- Larger serving size offers perceived value advantage

- Aggressive flavor innovation captures trend-seeking consumers

- Strong presence in motorsports and action sports communities

Monster Weaknesses

- Lower price points may reduce profit margins

- Extensive product range risks brand dilution

- Less consistent global brand recognition than Red Bull

- Edgy branding may limit appeal in some professional contexts

- Reliance on Coca-Cola’s distribution system reduces direct market control

Innovation and Product Development

Red Bull’s Innovation Approach

Red Bull’s innovation strategy has been characterized by careful, measured releases of new products. The company introduced its sugar-free variant in 2003, followed by Red Bull Total Zero in 2012. The Red Bull Editions line, featuring flavors like cranberry, lime, and blueberry, represented the brand’s most significant product expansion.

More recently, Red Bull has ventured into functional beverages with the Organics by Red Bull line, featuring natural sodas, and Red Bull Winter Edition with seasonal flavors. Despite these innovations, Red Bull maintains strict control over new releases, ensuring each product aligns with its premium positioning and brand identity.

Monster’s Innovation Approach

Monster has pursued a much more aggressive innovation strategy, regularly introducing new flavors, formulations, and sub-brands. The company has been particularly responsive to emerging consumer trends, quickly developing products to address demand for sugar-free options (Monster Ultra), coffee-energy hybrids (Java Monster), recovery drinks (Monster Rehab), and juice-based energy drinks (Monster Juice).

This rapid innovation cycle allows Monster to capture emerging market segments and respond quickly to changing consumer preferences. The company typically launches multiple new products each year, compared to Red Bull’s more measured approach of one or two releases annually.

Sustainability and Corporate Responsibility

Red Bull’s Sustainability Efforts

Red Bull has implemented several sustainability initiatives, including its “Red Bull Recycling” program, which focuses on aluminum can recycling. The company has committed to reducing its carbon footprint by 50% by 2030 and achieving carbon neutrality by 2050. Red Bull’s production facilities in Austria have achieved ISO 14001 environmental management certification.

The company has also invested in renewable energy projects, with solar panels installed at its headquarters and manufacturing facilities. However, critics note that Red Bull could be more transparent about its supply chain sustainability and ingredient sourcing practices.

Monster’s Sustainability Efforts

Monster Beverage Corporation has been less vocal about its sustainability initiatives compared to Red Bull. The company has committed to reducing packaging waste and improving energy efficiency in its production facilities. Through its partnership with Coca-Cola, Monster benefits from Coca-Cola’s “World Without Waste” initiative, which aims to collect and recycle the equivalent of every bottle or can it sells globally by 2030.

Monster has made progress in reducing the aluminum content in its cans and improving water usage efficiency. However, the company has faced criticism for lagging behind industry peers in publishing comprehensive sustainability reports and setting specific environmental targets.

Financial Performance and Growth

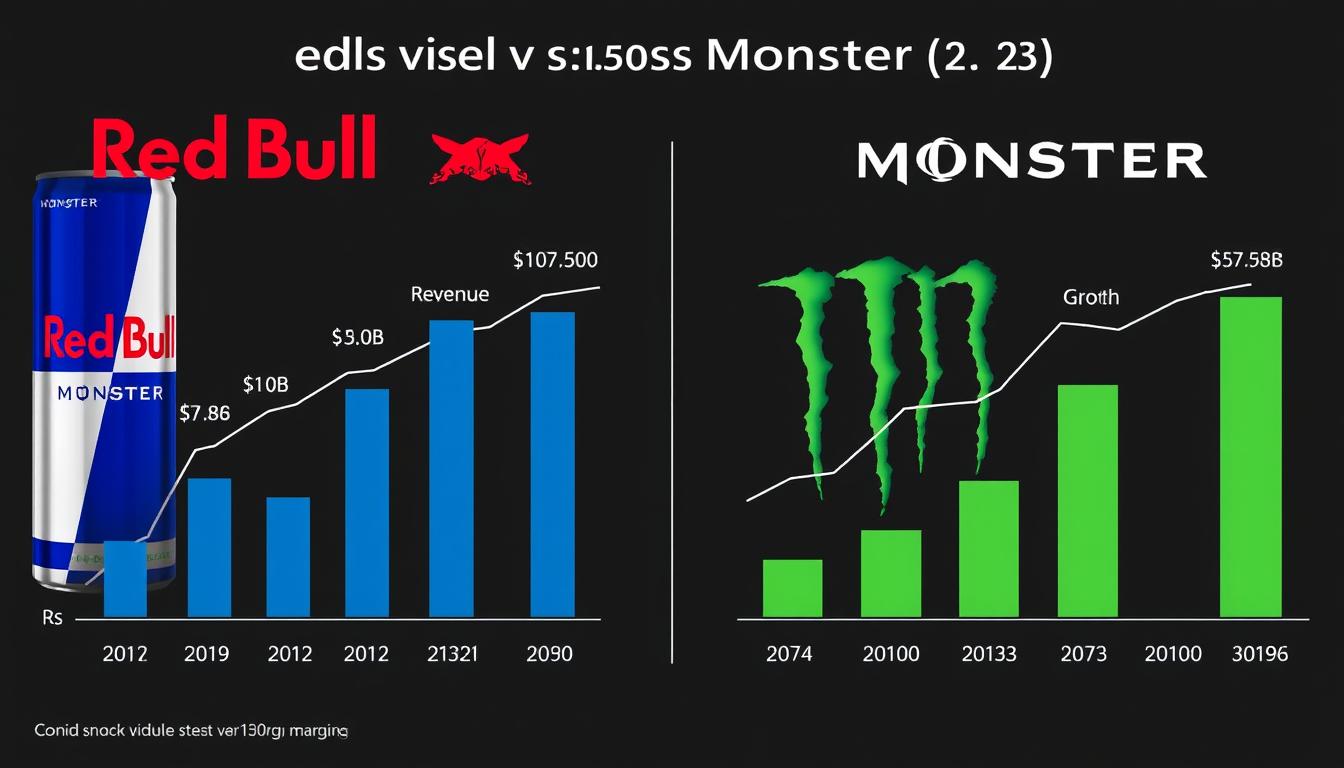

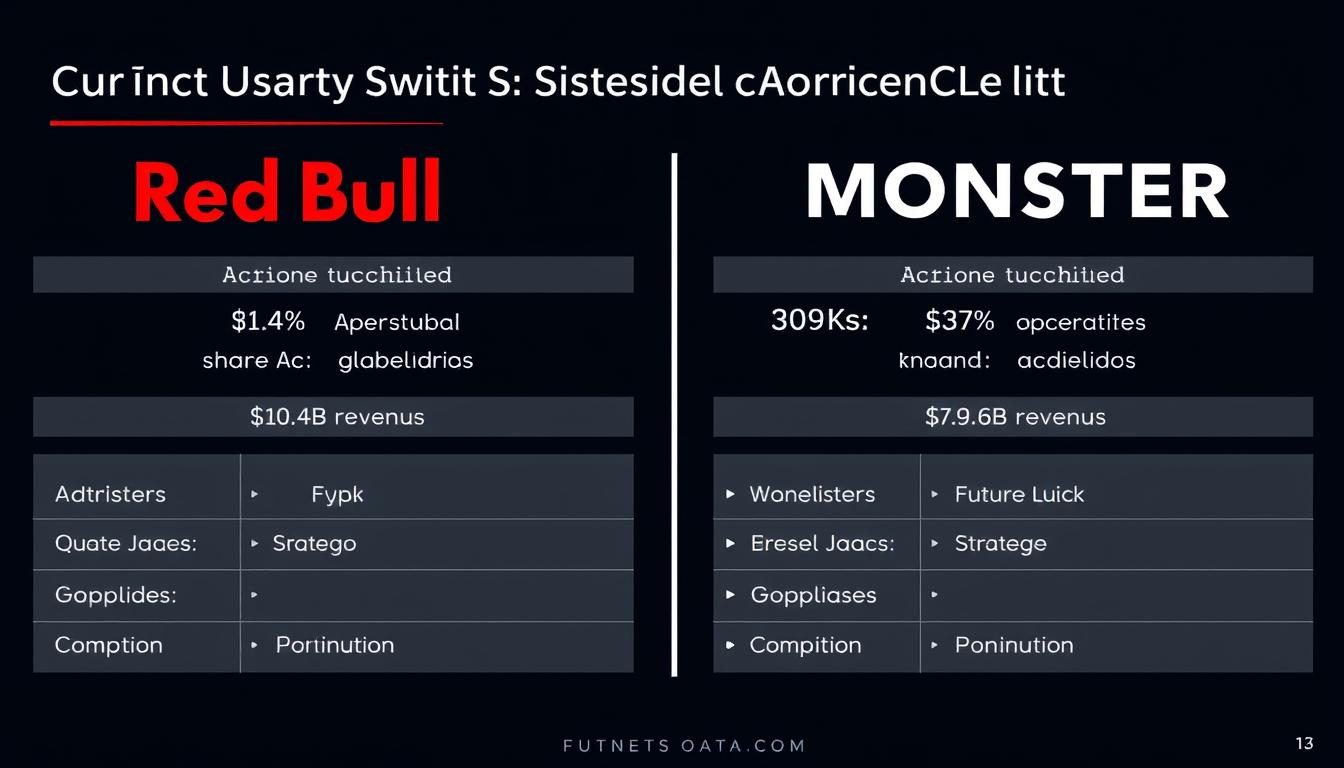

| Financial Metric | Red Bull (2023) | Monster (2023) |

| Annual Revenue | $10.4 billion | $6.3 billion |

| Revenue Growth (YoY) | 8.3% | 10.2% |

| Estimated Profit Margin | 30-35% | 25-30% |

| Global Can Volume | 11.6 billion cans | 7.2 billion cans |

| Market Capitalization | Private company | $52.7 billion |

Red Bull remains the revenue leader with approximately $10.4 billion in annual sales for 2023, compared to Monster’s $6.3 billion. However, Monster has consistently demonstrated stronger year-over-year growth rates, with 10.2% growth in 2023 compared to Red Bull’s 8.3%.

Red Bull’s higher profit margins (estimated at 30-35% compared to Monster’s 25-30%) reflect its premium pricing strategy and efficient operations. As a privately held company, Red Bull does not disclose detailed financial information, but industry analysts estimate its profitability based on sales volumes and pricing.

Monster’s financial performance has been bolstered by its strategic partnership with Coca-Cola, which has reduced distribution costs and improved operational efficiency. The company’s stock has been a remarkable performer, delivering over 70,000% returns since its public listing, making it one of the best-performing stocks of the past two decades.

Public Image and Marketing Strategy

Red Bull’s Marketing Approach

Red Bull has pioneered the concept of “marketing as media,” creating owned events and content that transcend traditional advertising. The company owns multiple sports teams, including Red Bull Racing (Formula 1), FC Red Bull Salzburg (soccer), and the New York Red Bulls (MLS). Its signature events, like the Red Bull Air Race and Red Bull Cliff Diving World Series, generate content while reinforcing the brand’s association with extreme performance.

The company’s most famous marketing stunt, the Red Bull Stratos space jump featuring Felix Baumgartner, generated unprecedented global media coverage and exemplified the brand’s commitment to pushing boundaries. Red Bull Media House produces high-quality content across multiple platforms, effectively functioning as a media company that happens to sell energy drinks.

Monster’s Marketing Approach

Monster has taken a different approach, focusing on sponsorships rather than owned events. The company maintains a massive roster of sponsored athletes across motorsports, action sports, and combat sports. Monster is particularly dominant in motocross, supercross, and UFC, where its distinctive claw logo is ubiquitous.

Rather than creating its own events, Monster embeds itself within existing cultural touchpoints that resonate with its target audience. The brand’s marketing emphasizes authenticity and subcultural credibility, with a focus on grassroots engagement. Monster’s social media strategy leverages its sponsored athletes and events to create content that feels organic rather than promotional.

Distribution and Retail Power

Red Bull’s distribution strategy centers on its proprietary direct store delivery (DSD) system in key markets. The company owns and operates its distribution network in many countries, giving it greater control over product placement, merchandising, and retailer relationships. This approach has allowed Red Bull to ensure premium positioning in retail environments and maintain consistent brand presentation.

Monster initially partnered with Anheuser-Busch for distribution before forming its strategic alliance with Coca-Cola in 2015. This partnership gave Monster access to Coca-Cola’s unparalleled global distribution network, dramatically expanding its international reach. While this arrangement has accelerated Monster’s global growth, it also means the company has less direct control over its distribution compared to Red Bull.

Both companies have achieved near-ubiquitous retail presence in their core markets, with products available in convenience stores, supermarkets, gas stations, bars, and vending machines. Red Bull typically secures premium eye-level shelf placement, while Monster leverages its extensive product range to dominate shelf space through sheer volume of SKUs.

Current Challenges and Strategic Direction

Emerging Competitive Threats

Both Red Bull and Monster face increasing competition from new entrants in the energy drink space. Brands like Celsius, Bang, and Prime have gained significant market share, particularly among younger consumers. These challengers often position themselves around specific functional benefits or cleaner ingredient profiles that appeal to health-conscious consumers.

Traditional beverage companies have also entered the category, with PepsiCo launching Mtn Dew Rise Energy and Coca-Cola (despite its Monster partnership) introducing Coca-Cola Energy. These established players bring massive distribution networks and marketing budgets to an already competitive landscape.

Regulatory and Health Concerns

The energy drink category faces ongoing regulatory scrutiny regarding caffeine content, marketing to minors, and health claims. Several countries have implemented or proposed restrictions on energy drink sales and marketing, particularly to younger consumers. Both Red Bull and Monster must navigate this evolving regulatory landscape while defending their core products.

Consumer concerns about artificial ingredients, sugar content, and overall wellness have also impacted the category. Both companies have responded with sugar-free and “natural” variants, but must continue to innovate as consumer preferences shift toward cleaner labels and functional benefits beyond caffeine.

Red Bull’s Strategic Direction

Red Bull appears focused on maintaining its premium positioning while carefully expanding into adjacent categories. The company has ventured into organic sodas and is exploring functional beverages beyond energy. Red Bull continues to invest heavily in its media properties and sponsored events, reinforcing its lifestyle brand status.

The company’s ownership structure, following founder Dietrich Mateschitz’s death in 2022, may influence its future strategic direction. Red Bull has historically prioritized controlled growth and brand integrity over rapid expansion, a philosophy that may continue under new leadership.

Monster’s Strategic Direction

Monster continues to pursue aggressive product innovation and international expansion. The company has entered the alcoholic beverage market with The Beast Unleashed and acquired craft beer and hard seltzer brands. Monster is also exploring non-alcoholic functional beverages beyond the energy category.

The company’s relationship with Coca-Cola remains central to its strategy, with speculation about a potential full acquisition by Coca-Cola periodically emerging. Monster’s growth-oriented approach suggests it will continue to diversify its portfolio and target new consumer segments and occasions.

The Bottom Line

The rivalry between Red Bull and Monster represents a fascinating study in contrasting business strategies within the same category. Red Bull maintains its position as the global revenue leader with approximately 43% market share, leveraging its premium positioning, controlled innovation, and powerful marketing machine. Monster follows closely with 39% global market share, driven by its diverse product portfolio, aggressive innovation, and strategic partnership with Coca-Cola.

Rather than declaring a definitive “winner” in this competition, it’s more accurate to recognize that both companies have executed their distinct strategies remarkably well. Red Bull’s focused, premium approach and Monster’s diversified, value-oriented strategy have both proven successful, with each company carving out its own space within the energy drink landscape.

As the energy drink market continues to evolve, both companies face similar challenges from emerging competitors, changing consumer preferences, and potential regulatory constraints. Their ability to adapt to these challenges while maintaining their core brand identities will determine their continued success in the global beverage industry.