The global 5G technology landscape is rapidly evolving, with Chinese tech giants Huawei and ZTE emerging as key players in this transformative race. Both companies have made significant strides in 5G development, but their approaches, strengths, and challenges differ substantially. This comprehensive analysis examines how these telecommunications powerhouses compare across critical dimensions, from technological innovation to market deployment, helping industry professionals understand who truly leads in the 5G revolution.

Company Overview and Strategic Vision

Founded in 1987, Huawei has grown from a small private company into a global telecommunications giant with operations in over 170 countries. Initially focused on manufacturing phone switches, Huawei has expanded into a comprehensive technology provider spanning telecommunications equipment, consumer electronics, and enterprise solutions. Its 5G strategy centers on delivering end-to-end solutions across the entire network architecture.

ZTE, established in 1985, began as a state-owned enterprise with strong government connections. While also operating globally, ZTE maintains a stronger focus on telecommunications infrastructure and has a more concentrated presence in developing markets. Its 5G vision emphasizes cost-effective solutions and technological accessibility for emerging economies.

Huawei’s Strategic Approach

- Vertically integrated ecosystem spanning devices to cloud

- Heavy investment in proprietary chipsets and software

- Focus on premium, high-performance solutions

- Emphasis on technological leadership and innovation

ZTE’s Strategic Approach

- Specialized focus on telecommunications infrastructure

- Strategic partnerships for component development

- Value-oriented pricing strategies

- Emphasis on accessibility and practical deployment

Core Specialization and Business Focus

Huawei has developed a more diversified business model, with significant investments across three main segments: carrier networks, consumer devices, and enterprise solutions. This integrated approach allows Huawei to leverage synergies between hardware and software development, creating a comprehensive ecosystem that spans from devices to infrastructure.

ZTE maintains a more concentrated focus on telecommunications infrastructure and carrier networks, with less emphasis on consumer products. This specialization has allowed ZTE to develop deep expertise in specific network technologies and optimize its solutions for telecommunications providers.

| Business Segment | Huawei | ZTE |

| Carrier Networks | Primary focus (35% of revenue) | Dominant focus (70% of revenue) |

| Consumer Devices | Major segment (34% of revenue) | Minor segment (15% of revenue) |

| Enterprise Solutions | Growing segment (31% of revenue) | Emerging segment (15% of revenue) |

Strengths and Weaknesses Analysis

Huawei Strengths

- Extensive R&D capabilities with over 80,000 researchers

- Proprietary chipset development (Kirin series)

- Comprehensive end-to-end 5G solutions

- Strong financial resources for continued innovation

- Established presence in premium markets

Huawei Challenges

- Intense regulatory scrutiny in Western markets

- Supply chain vulnerabilities due to US restrictions

- Higher cost structure compared to competitors

- Perception issues related to security concerns

- Limited access to certain global markets

ZTE Strengths

- Cost-effective infrastructure solutions

- Strong positioning in developing markets

- Agile adaptation to market conditions

- Specialized expertise in telecommunications

- Recovering from previous regulatory challenges

ZTE Challenges

- Smaller R&D budget compared to Huawei

- Less diversified business portfolio

- Limited brand recognition in consumer markets

- Previous compliance issues affecting reputation

- Dependency on third-party chipsets

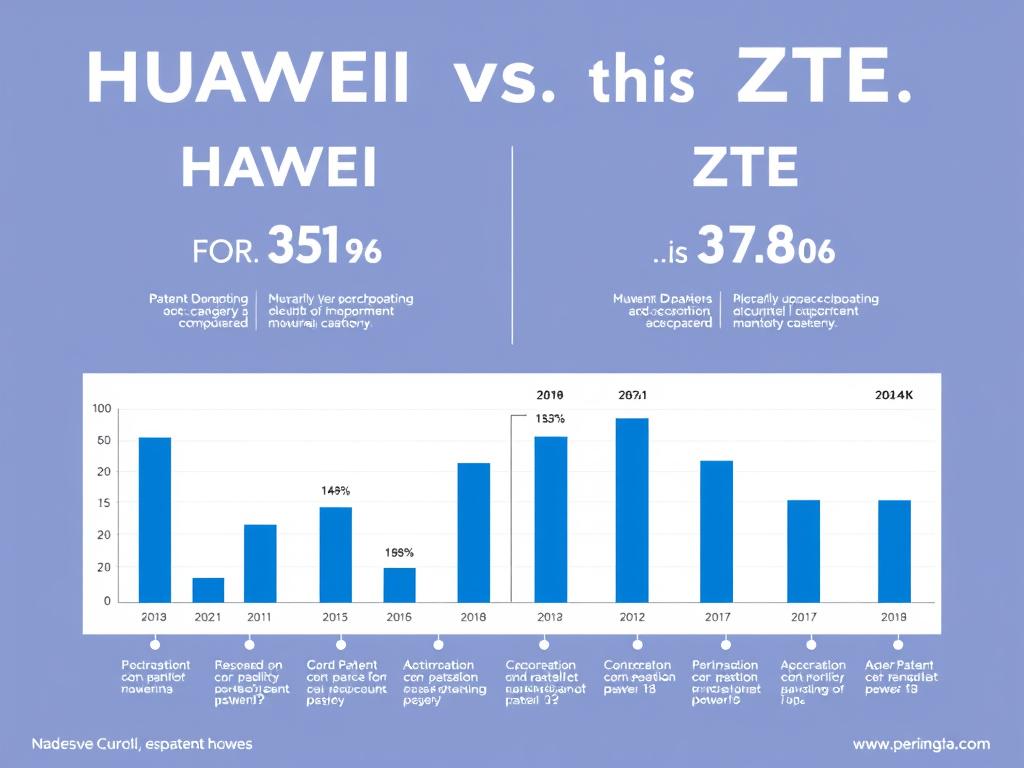

Technological Innovation and Patents

Both companies have made significant investments in 5G research and development, resulting in substantial patent portfolios. According to IPlytics, Huawei leads in declared 5G Standard Essential Patents (SEPs) with approximately 15% of global 5G patents, while ZTE holds around 7-8%.

Key Technology Differentiators

| Technology Area | Huawei Approach | ZTE Approach |

| Chipset Development | Proprietary Kirin series, facing challenges from US restrictions | Partnerships with chipmakers, some in-house development |

| Network Architecture | Emphasis on cloud-native, AI-driven networks | Focus on simplified architecture and cost optimization |

| Spectrum Efficiency | Advanced Massive MIMO solutions | Competitive MIMO implementations at lower cost points |

| Energy Efficiency | PowerStar solution with AI-based power management | PowerPilot solution optimizing for operational efficiency |

Huawei’s innovation strategy has focused on vertical integration and proprietary technology development, allowing it to maintain control over its supply chain and ensure high-quality standards across its products. This approach has enabled Huawei to rapidly develop and deploy advanced technologies, resulting in a robust portfolio of patents and innovations.

On the other hand, ZTE has pursued a more collaborative approach with strategic partnerships, working closely with various stakeholders, including governments and industry players, to foster innovation and share knowledge. This strategy has allowed ZTE to adapt quickly to market changes and customer needs.

Both companies have contributed significantly to 5G standards development through participation in 3GPP and other standards bodies, where they have advocated for their technological advancements and helped shape the future of mobile communication. Their active involvement has not only solidified their positions as leaders in the industry but has also driven the global adoption of 5G technology, paving the way for new applications and services that rely on high-speed connectivity.

Sustainability and Compliance

As environmental concerns become increasingly important in technology deployment, both companies have developed sustainability initiatives focused on reducing the environmental impact of 5G networks.

Huawei’s Sustainability Approach

- Digital Power solutions reducing energy consumption by up to 15%

- Commitment to carbon neutrality in operations by 2030

- Circular economy initiatives for equipment recycling

- Green 5G networks reducing power consumption per bit

ZTE’s Sustainability Approach

- PowerPilot energy efficiency solutions

- Green 5G innovations reducing base station energy use

- Sustainable supply chain certification programs

- Digital inclusion initiatives in developing markets

Compliance and Regulatory Challenges

Both companies have faced regulatory scrutiny, though with different outcomes. Huawei continues to navigate significant restrictions in Western markets, particularly the US, UK, and parts of Europe, based on security concerns that have raised alarms regarding data privacy and potential espionage.

These challenges have not only limited Huawei’s ability to expand its market presence but have also compelled the company to invest heavily in compliance measures and legal defenses to address these allegations. In contrast, ZTE previously faced severe penalties from the US Department of Commerce in 2018 due to violations of trade sanctions, which resulted in a temporary ban on its ability to conduct business with American suppliers.

However, ZTE has since worked diligently to rebuild compliance systems and regain market access, implementing rigorous internal controls and fostering relationships with regulatory bodies to ensure adherence to international standards.

Financial Health and Investment Strategy

The financial capabilities of both companies significantly influence their ability to invest in 5G innovation and global expansion. Huawei maintains a stronger financial position, despite recent challenges, while ZTE has shown resilience in recovering from previous regulatory issues.

| Financial Indicator | Huawei | ZTE |

| Annual Revenue (2022) | $92.5 billion | $17.8 billion |

| R&D Investment | $22.1 billion (23.9% of revenue) | $2.4 billion (13.5% of revenue) |

| Net Profit Margin | 9.8% | 7.4% |

| 5G-Related Revenue | Approximately 35% of total | Approximately 42% of total |

Huawei’s larger scale provides advantages in R&D investment capacity, allowing it to allocate substantial resources toward innovative technologies and cutting-edge research initiatives. This has enabled Huawei to develop a more diverse range of 5G applications and solutions that cater to various sectors, including smart cities and IoT. In contrast, ZTE has focused its resources more narrowly on telecommunications infrastructure, honing in on specific areas of expertise and building robust systems that support 5G deployment.

Both companies have maintained significant investment in 5G development despite market challenges, with Huawei’s aggressive expansion strategies and partnerships leading to a broader global footprint. However, Huawei’s absolute investment levels substantially exceed ZTE’s, reflecting its ambition to dominate the market and secure a leading position in the global telecommunications landscape.

Reputation and Public Relations

The global perception of both companies has been significantly influenced by geopolitical factors, particularly concerns raised by the United States and some allies regarding potential security risks. These perceptions vary substantially by region.

Huawei’s Reputation Management

- Established transparency centers in multiple countries

- Increased focus on cybersecurity assurance programs

- Engaged with independent security audits

- Maintained strong brand loyalty in home market

- Faced persistent challenges in Western markets

ZTE’s Reputation Management

- Rebuilt compliance systems after 2018 US penalties

- Lower public profile compared to Huawei

- Focus on technical reliability rather than brand building

- Gradual recovery of operator trust

- Less prominent in security debates than Huawei

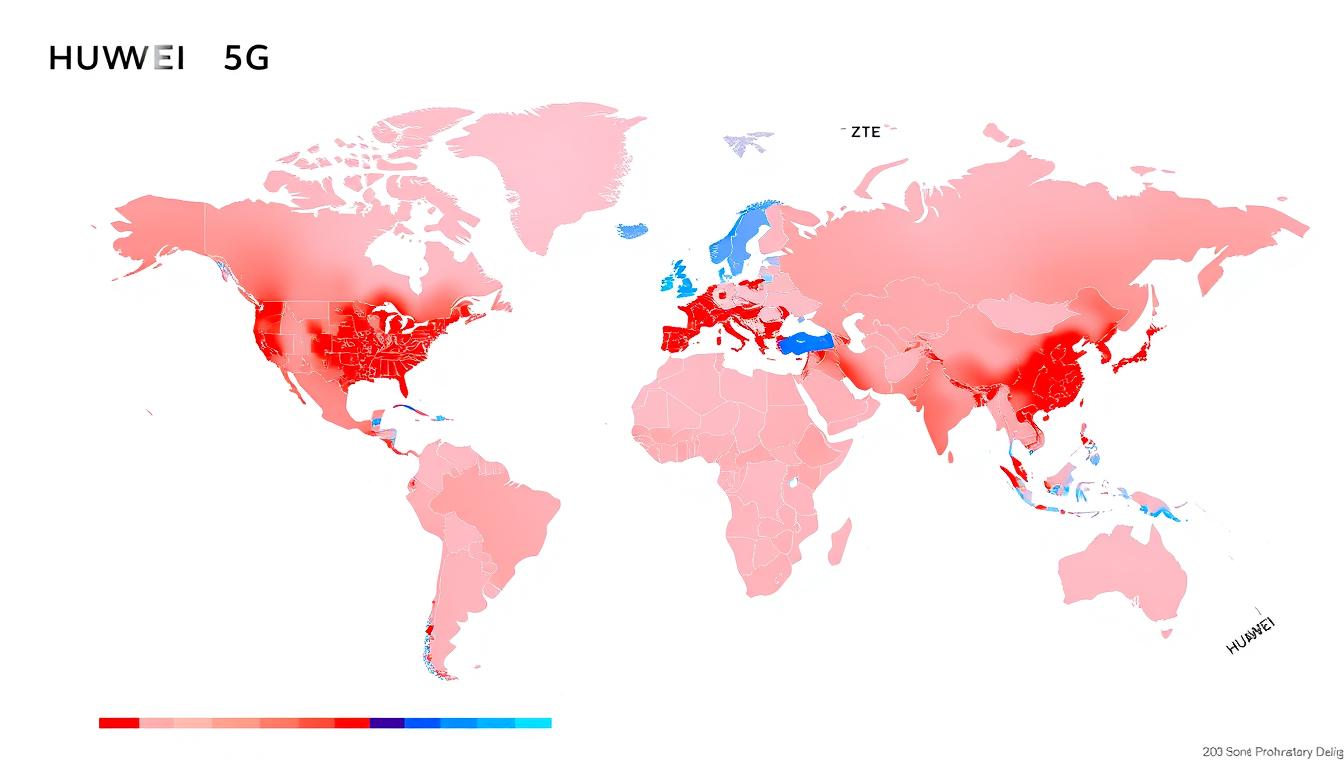

International Presence and Partnerships

Both companies have developed extensive networks of partnerships with telecom operators, though their geographic distribution and partnership models differ significantly.

Key Operator Partnerships

| Region | Huawei Key Partners | ZTE Key Partners |

| Europe | Deutsche Telekom, Telefonica, Orange (partial) | Wind Tre, MTS, select Eastern European operators |

| Asia-Pacific | China Mobile, Telkomsel, Axiata Group | China Telecom, China Unicom, BSNL |

| Middle East & Africa | Etisalat, MTN Group, Safaricom | Ooredoo, Ethio Telecom, Airtel Africa |

| Latin America | America Movil, Telefonica subsidiaries | TIM Brasil, Claro, select regional operators |

Huawei has generally secured more partnerships with tier-one operators in developed markets, though this has shifted somewhat due to regulatory pressures. ZTE has found success with cost-conscious operators and in markets where price sensitivity is a primary consideration.

Challenges and Future Outlook

Both companies face significant challenges in the evolving 5G landscape, though the nature and severity of these challenges differ substantially.

Key Challenges for Huawei

- US Export Restrictions: Continued limitations on access to advanced semiconductors and technologies

- Market Access: Exclusion from 5G deployments in key markets including US, UK, Australia

- Supply Chain Resilience: Need to develop alternative component sources

- Diversification: Pivoting toward enterprise, cloud, and automotive to offset carrier network challenges

Key Challenges for ZTE

- Scale and Resources: Competing with larger rivals with greater R&D capacity

- Technology Gap: Maintaining technological competitiveness in advanced 5G features

- Market Perception: Overcoming historical compliance issues and security concerns

- Differentiation: Establishing unique value proposition beyond cost advantages

Future Outlook

The 5G technology race between Huawei and ZTE will continue to evolve in response to market conditions, regulatory environments, and technological developments. Huawei’s scale and technological depth provide advantages in innovation, while ZTE’s focused approach and cost efficiency offer competitive strengths in specific market segments.

Conclusion: Who Leads the 5G Race?

The question of leadership in the 5G race between Huawei and ZTE depends significantly on the metrics used for evaluation. Huawei maintains clear advantages in scale, R&D investment, technological breadth, and global market share. ZTE offers strengths in cost efficiency, focused expertise, and resilience in navigating regulatory challenges.

For telecommunications operators and national authorities evaluating these companies, the choice between Huawei and ZTE involves balancing considerations of technological capability, cost, security requirements, and long-term partnership potential. As the 5G landscape continues to evolve, both companies will need to adapt their strategies to address changing market conditions and prepare for the eventual transition to 6G technologies.

Frequently Asked Questions

How do Huawei and ZTE compare in terms of 5G patents?

Huawei leads with approximately 15% of declared 5G Standard Essential Patents (SEPs), while ZTE holds around 7-8%. Huawei’s larger R&D investment has contributed to its more extensive patent portfolio, though both companies rank among the top contributors to 5G standards development.

What are the main differences in Huawei and ZTE’s approach to 5G technology?

Huawei emphasizes vertical integration with proprietary chipsets and end-to-end solutions, focusing on technological leadership and premium offerings. ZTE takes a more specialized approach centered on telecommunications infrastructure, with greater emphasis on cost efficiency and strategic partnerships for component development.

How have security concerns affected Huawei and ZTE in global markets?

Both companies have faced security scrutiny, though with different impacts. Huawei has been excluded from 5G networks in several Western countries including the US, UK, and Australia. ZTE faced severe penalties from the US in 2018 but has since implemented compliance reforms and faces somewhat less resistance in certain markets compared to Huawei.