In the fiercely competitive streaming landscape, Roku has emerged as an unexpected success story, outpacing industry giants like Netflix and Amazon in certain key metrics. While Netflix focuses on subscription content and Amazon leverages its broader ecosystem, Roku has carved a unique position as the neutral platform connecting viewers to all streaming services. This analysis explores how a company that began as a simple hardware manufacturer transformed into a streaming powerhouse that outperforms established giants in critical areas of the connected TV market.

Company Introduction and Market Entry

Founded in 2002 by Anthony Wood, Roku began with a singular focus: creating devices that would make streaming accessible to everyday consumers. The company’s name, which means “six” in Japanese, signifies that Roku was Wood’s sixth company. The journey started when Netflix, seeking to expand beyond DVD-by-mail, approached Wood to develop a streaming player. This collaboration resulted in the “Netflix Player by Roku” in 2008, which later evolved into the independent Roku platform we know today.

Roku’s initial hardware-centric approach quickly evolved. After launching its first streaming device, the company recognized the potential of creating an entire ecosystem rather than just selling boxes. This pivotal shift transformed Roku from a hardware manufacturer into a sophisticated platform company that could monetize user engagement through advertising and content partnerships.

Business Model Differentiation

Unlike Netflix and Amazon, which invest billions in original content, Roku has pursued a fundamentally different business model. Roku positions itself as a neutral platform that aggregates content from all streaming services rather than competing with them. This platform-agnostic approach has proven remarkably effective in several ways:

Roku’s Platform Approach

- Operates as a content-neutral aggregator

- Generates revenue primarily through advertising

- Collects valuable user data across all streaming services

- Monetizes through The Roku Channel (free, ad-supported content)

- Licenses Roku OS to smart TV manufacturers

Content Giants’ Approach

- Heavy investment in original content production

- Subscription-based revenue models

- Walled garden ecosystems

- Limited cross-platform data collection

- Higher customer acquisition costs

This strategic difference has allowed Roku to benefit from the streaming wars without bearing the enormous content costs that burden Netflix and Amazon. While these giants spend billions creating shows and movies, Roku profits by providing access to all services through a unified interface, collecting valuable user data, and selling targeted advertising.

Strengths and Weaknesses

Roku’s Key Strengths

- Hardware affordability (devices starting at $29.99)

- User-friendly interface preferred by consumers

- Strong smart TV OS licensing partnerships

- The Roku Channel’s growing ad-supported content library

- Data-driven advertising platform with precise targeting

- Lower operating costs than content-producing competitors

- Neutral position in the streaming ecosystem

Roku’s Limitations

- Limited original content compared to Netflix/Amazon

- Slower international expansion than competitors

- Dependence on advertising market fluctuations

- Potential vulnerability to smart TV manufacturers developing competing platforms

- Less diversified revenue streams than Amazon

- Limited ecosystem lock-in compared to Apple or Amazon

Roku’s greatest strength lies in its position as the “Switzerland of streaming” – a neutral platform that doesn’t compete with the content providers it hosts. This neutrality has allowed Roku to partner with virtually all streaming services while collecting valuable cross-platform user data that individual services cannot access.

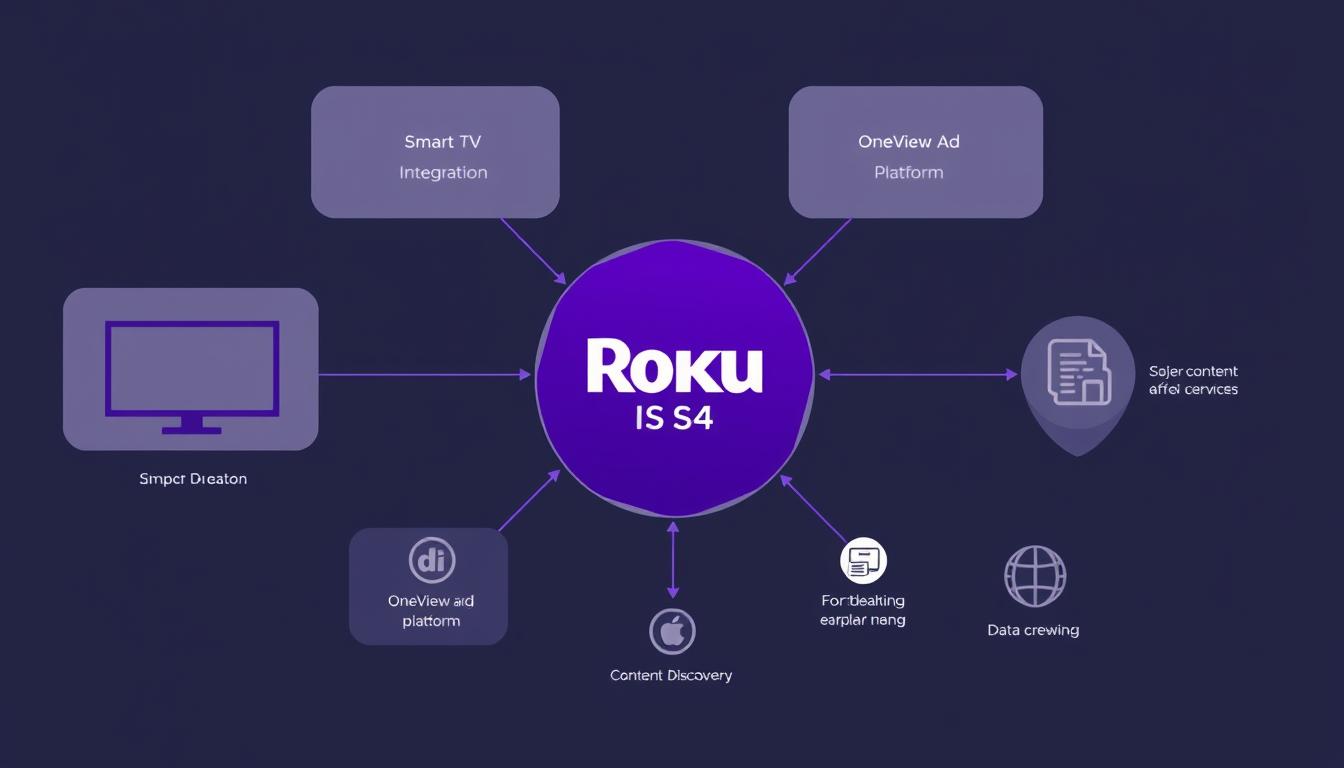

Technology and Innovation

Roku’s technological approach differs significantly from its competitors. While Netflix invests heavily in content delivery infrastructure and recommendation algorithms, and Amazon leverages its vast AWS capabilities, Roku has focused on creating an intuitive operating system and powerful advertising technology.

Roku OS

Roku’s operating system prioritizes simplicity and universal search capabilities. Unlike competitor interfaces that often prioritize their own content, Roku’s neutral platform makes finding content across services straightforward. This user-friendly approach has made Roku OS attractive to TV manufacturers seeking a pre-built smart TV solution.

OneView Ad Platform

Roku’s acquisition of dataxu (rebranded as OneView) created a sophisticated advertising platform that leverages cross-service viewing data. This allows advertisers to target audiences with precision unavailable on individual streaming services, creating a significant competitive advantage in the growing connected TV ad market.

Smart TV Integration

Rather than just making streaming devices, Roku has successfully licensed its operating system to TV manufacturers like TCL, Hisense, and Sharp. This strategy has dramatically expanded Roku’s footprint, with Roku-powered smart TVs accounting for more than one-third of all smart TVs sold in the U.S.

Roku’s technological innovation extends to its content discovery capabilities. The company has developed sophisticated algorithms that help users find content across multiple streaming services, creating a unified experience that individual platforms cannot match. This cross-platform approach gives Roku a unique advantage in understanding viewer preferences across the entire streaming ecosystem.

Advertising Dominance and Revenue Streams

Roku’s advertising-based revenue model has proven remarkably effective, especially as the streaming market has matured. While Netflix only recently introduced an ad-supported tier and Amazon shows ads primarily within its own content ecosystem, Roku has built its entire business model around advertising from the start.

Key Components of Roku’s Advertising Advantage:

- The Roku Channel: This free, ad-supported channel has become one of the top streaming channels on the Roku platform, providing the company with valuable ad inventory.

- Cross-platform data: Roku collects viewing data across all streaming services on its platform, creating uniquely valuable audience insights.

- Programmatic advertising: The OneView platform allows for automated, targeted ad buying across the Roku ecosystem.

- Ad revenue sharing: Roku negotiates revenue-sharing agreements with many streaming services on its platform.

- Higher margins: Advertising revenue typically carries higher profit margins than hardware sales or content production.

In 2023, platform revenue (primarily advertising) accounted for over 80% of Roku’s total revenue, demonstrating the company’s successful transition from a hardware-focused business to an advertising powerhouse. This shift has been crucial to Roku’s ability to outperform expectations in the competitive streaming market.

Financial Performance

Roku’s financial performance reveals how its unique business model has translated into impressive results, particularly in comparison to the content-heavy approaches of Netflix and Amazon. While total revenue figures differ significantly due to company size, Roku’s growth rates and margin improvements tell a compelling story.

| Financial Metric | Roku | Netflix | Amazon Prime Video |

| Annual Revenue (2023) | $3.5+ billion | $33.7 billion | Est. $15 billion (not reported separately) |

| Revenue Growth YoY | ~13% | ~6% | Not disclosed separately |

| Gross Margin | ~43% (platform segment) | ~38% | Not disclosed separately |

| Content Spend (2023) | ~$100 million | ~$17 billion | ~$7 billion |

Roku’s financial strategy demonstrates how the company has outperformed expectations by focusing on high-margin platform revenue while minimizing the enormous content costs that burden Netflix and Amazon. The company’s advertising-first approach has created a more sustainable financial model in many ways, though it lacks the scale of its larger competitors.

Brand Perception and User Loyalty

Roku has cultivated a distinct brand identity that differs significantly from Netflix and Amazon. While Netflix is known for its vast content library and Amazon leverages its broader ecosystem, Roku has positioned itself as the user-friendly, neutral gateway to all streaming content.

According to J.D. Power’s streaming device satisfaction surveys, Roku consistently ranks at or near the top for user satisfaction. The company’s straightforward interface and content-neutral approach have created strong brand loyalty, with Roku users reporting high satisfaction with the platform’s ease of use and content discovery capabilities.

Unlike Netflix, which faces subscription cancellations when popular shows end, or Amazon, which ties Prime Video to its broader Prime membership, Roku benefits from being a persistent gateway to all content. This position has helped Roku maintain lower churn rates and establish itself as an essential component of the streaming ecosystem rather than just another service competing for monthly subscription dollars.

Strategic Partnerships and Global Expansion

Roku’s partnership strategy has been fundamental to its ability to outperform larger competitors in key markets. Rather than trying to build everything internally, Roku has created an extensive network of partnerships that expand its reach and capabilities.

Key Strategic Partnerships:

TV Manufacturers

Roku has secured partnerships with major TV brands including TCL, Hisense, Sharp, and Philips to integrate Roku OS directly into smart TVs. These relationships have dramatically expanded Roku’s footprint without requiring consumers to purchase separate streaming devices.

Content Providers

Unlike Netflix and Amazon who often compete with other content providers, Roku maintains positive relationships with virtually all streaming services. This neutral position has allowed Roku to negotiate favorable terms for content distribution and revenue sharing.

Retailers

Partnerships with major retailers like Walmart (which sells Roku-powered Onn TVs) have helped Roku reach price-sensitive consumers. These relationships extend Roku’s market penetration beyond what it could achieve through direct sales alone.

Roku’s global expansion has been more measured than Netflix’s aggressive international push or Amazon’s leveraging of its global e-commerce platform. The company has focused on establishing strong positions in North America while making strategic moves into markets like the UK, Brazil, and Mexico. This focused approach has allowed Roku to build dominant positions in key markets rather than spreading resources too thinly.

Challenges and Future Outlook

Despite Roku’s impressive performance, the company faces significant challenges as the streaming landscape continues to evolve. Understanding these challenges is crucial for assessing Roku’s ability to maintain its competitive advantage against Netflix, Amazon, and emerging competitors.

Key Challenges:

- Increasing competition: Google (Android TV/Google TV), Samsung (Tizen), and Amazon (Fire TV) continue to improve their competing platforms.

- International expansion hurdles: Roku faces different competitive landscapes and content licensing requirements in international markets.

- Advertising market fluctuations: As an ad-dependent business, Roku is vulnerable to economic downturns that impact advertising budgets.

- Content negotiation leverage: Major streaming services may seek more favorable terms as they gain market power.

- Smart TV manufacturer independence: TV makers could develop their own operating systems rather than licensing Roku OS.

Looking ahead, Roku’s future success will likely depend on its ability to maintain its position as the neutral, user-friendly gateway to streaming content while expanding its advertising capabilities. The company’s continued investment in The Roku Channel and strategic content acquisitions suggests a balanced approach that leverages its platform strengths without trying to compete directly with content giants like Netflix and Amazon.

“Roku’s success demonstrates that in the streaming wars, sometimes the most valuable position isn’t creating content but controlling the gateway to all content. By focusing on the platform rather than competing in the expensive content arms race, Roku has created a uniquely sustainable position in the streaming ecosystem.”

Conclusion

Roku’s ability to outperform streaming giants like Netflix and Amazon in key metrics stems from its fundamentally different approach to the streaming market. While content-focused companies engage in expensive production battles, Roku has built a platform business that benefits from the entire streaming ecosystem without bearing the enormous costs of content creation.

The company’s strategic focus on user experience, advertising technology, and smart TV integration has created a powerful position in the connected TV market, particularly in North America. By serving as the neutral gateway to all streaming content, Roku has established itself as an essential component of the streaming landscape rather than just another service competing for subscription dollars.

As the streaming market continues to evolve, Roku’s platform-based model appears well-positioned to benefit from increasing fragmentation in the content landscape. While Netflix and Amazon must continuously invest billions in new content to retain subscribers, Roku benefits regardless of which services consumers choose to watch – a uniquely advantageous position that explains how this once-small hardware company has outperformed some of the biggest names in technology and entertainment.