The battle for global manufacturing dominance has intensified in recent decades, with China’s meteoric rise challenging traditional industrial powerhouses. While China has emerged as a manufacturing giant with unprecedented scale, Germany maintains its reputation for precision engineering and high-quality production. This comprehensive analysis examines how these two manufacturing titans compare across ten critical dimensions, offering insights into their respective strengths, weaknesses, and future trajectories in the global industrial landscape.

Country Overview and Industrial Legacy

China’s manufacturing ascent represents one of the most remarkable economic transformations in modern history. Following Deng Xiaoping’s market reforms in 1978, China gradually opened its economy to foreign investment and global trade. The country leveraged its vast labor force and focused policy initiatives to transform from an agricultural society into the “world’s factory floor.” By 2008, China had surpassed the United States to become the global manufacturing leader, and by 2020, its manufacturing value-added reached approximately $4.66 trillion—29% of the global total.

Germany’s manufacturing prowess, by contrast, evolved over centuries through consistent innovation and specialization. The country’s industrial reputation was built on precision engineering, technical education, and a strong Mittelstand (small and medium-sized enterprises) tradition. Despite having a significantly smaller population and resource base than China, Germany has maintained its position as a manufacturing powerhouse through high-value production and export-oriented strategies. The “Made in Germany” label, originally imposed by Britain in 1887 to mark supposedly inferior goods, ironically evolved into a globally recognized symbol of quality.

Core Industrial Specialization

China’s Manufacturing Focus

Germany’s Manufacturing Focus

China has rapidly transformed its manufacturing base from low-value goods to more sophisticated products. In 1995, clothing and textiles accounted for 20% of China’s exports while electronics represented less than 9%. By 2020, electronics had surged to 24% of exports while textiles declined to 10%. This shift reflects China’s deliberate policy to climb the value chain through initiatives like “Made in China 2025,” which targets ten strategic sectors including advanced information technology, robotics, aerospace equipment, and new energy vehicles.

Germany maintains its competitive edge through specialization in high-value manufacturing sectors. The automotive industry remains Germany’s crown jewel, with companies like Volkswagen Group producing over 10 million vehicles annually. The country’s chemical sector, led by BASF and Bayer, is the largest in Europe. Germany’s manufacturing strategy emphasizes quality over quantity, with significant investments in research and development to maintain technological leadership in its core sectors.

Strengths and Weaknesses

China’s Manufacturing Strengths

- Unmatched production scale and capacity

- Comprehensive industrial supply chains

- Cost-competitive labor (though rising)

- Massive domestic market

- Strong government support and industrial policy

China’s Manufacturing Weaknesses

- Quality perception challenges

- Dependence on imported core technologies

- Environmental and labor standards concerns

- Geopolitical tensions affecting trade relations

- Intellectual property protection issues

Germany’s Manufacturing Strengths

- World-class quality and precision

- Highly skilled workforce

- Strong innovation ecosystem

- Robust intellectual property protection

- Strategic position within EU market

Germany’s Manufacturing Weaknesses

- High labor and production costs

- Aging workforce and demographic challenges

- Energy dependence and high costs

- Limited scale compared to China

- Regulatory complexity

China’s manufacturing strength lies primarily in its scale and comprehensive industrial ecosystem. The country has developed complete supply chains across numerous sectors, allowing for efficient production and rapid scaling. Government support through subsidies, preferential policies, and infrastructure development has further enhanced China’s manufacturing capabilities. However, China continues to face challenges in core technology development, particularly in semiconductors and aerospace, where it remains dependent on foreign inputs despite decades of investment.

Germany’s manufacturing excellence is built on its highly skilled workforce, supported by a dual education system that combines classroom learning with practical apprenticeships. This approach produces specialized workers capable of maintaining Germany’s quality standards. The country’s well-developed innovation ecosystem, featuring close collaboration between industry, universities, and research institutes, enables continuous technological advancement. However, Germany’s high labor costs and strict regulations create challenges in price competitiveness against emerging manufacturing powers.

Innovation and Advanced Technology

China’s Innovation Approach

China has dramatically increased its R&D spending, with manufacturing R&D nearly tripling in the past decade. The government’s strategic focus on technological self-sufficiency has accelerated innovation in selected sectors. China now leads globally in areas like 5G technology, electric vehicles, and renewable energy equipment manufacturing. Chinese manufacturers filed over 1.5 million patents in 2022, though quality and originality remain variable.

Germany’s Innovation Approach

Germany pioneered the Industry 4.0 concept, integrating cyber-physical systems, IoT, and cloud computing into manufacturing processes. The country invests approximately 3.1% of GDP in R&D, with strong private sector participation. German manufacturers excel in developing specialized production technologies and continuously improving existing products. The Fraunhofer network of 76 institutes creates effective knowledge transfer between research and industry.

China’s approach to manufacturing innovation combines massive state investment with market-driven entrepreneurship. The country has made remarkable progress in areas like artificial intelligence, where it now publishes more research papers than any other nation. Chinese manufacturers have rapidly adopted automation, deploying more industrial robots annually than any other country since 2016. However, China continues to lag in some critical technologies, particularly advanced semiconductor design and manufacturing, where it remains dependent on foreign suppliers despite substantial investment.

Germany’s innovation ecosystem emphasizes incremental improvement and practical application of new technologies. The country’s manufacturers excel at integrating digital technologies into traditional industrial processes—the essence of Industry 4.0. German companies maintain global leadership in specialized machinery, with firms like Siemens and Bosch developing advanced manufacturing solutions that are exported worldwide. Germany’s innovation approach is characterized by close collaboration between industry, academia, and government, creating effective pathways for commercializing research.

Sustainability and Green Manufacturing

China’s Green Manufacturing

Germany’s Green Manufacturing

China presents a paradox in green manufacturing—simultaneously being the world’s largest producer of clean energy equipment and its biggest industrial carbon emitter. The country manufactures approximately 80% of the world’s solar panels, dominates global battery production, and leads in electric vehicle manufacturing. However, China’s industrial base remains heavily dependent on coal power, contributing significantly to its carbon footprint. The government has set ambitious targets, including peak carbon emissions by 2030 and carbon neutrality by 2060, driving increased investment in cleaner production technologies.

Germany has established itself as a leader in sustainable manufacturing practices, with stringent environmental regulations driving innovation in cleaner production processes. The country’s Energiewende (energy transition) policy has encouraged manufacturers to adopt renewable energy and improve energy efficiency. German companies have pioneered technologies for reducing industrial waste, water usage, and emissions. The country’s circular economy approach emphasizes product design for durability, repairability, and recyclability—principles increasingly embedded in German manufacturing standards.

Economic Performance and Industrial Output

| Economic Indicator | China | Germany |

| Manufacturing Value Added (2022) | $4.9 trillion | $806 billion |

| Manufacturing Growth Rate (2013-2023 avg.) | 6.2% annually | 1.3% annually |

| Manufacturing Employment | 112 million workers | 7.6 million workers |

| Manufacturing FDI Inflow (2022) | $112 billion | $38 billion |

China’s manufacturing sector has experienced extraordinary growth over the past two decades, with value-added expanding at an average annual rate of 6.2% between 2013 and 2023. This growth has been driven by both export demand and increasing domestic consumption. China’s manufacturing employment remains massive at approximately 112 million workers, though this number has stabilized in recent years as automation increases. Foreign direct investment in Chinese manufacturing continues to flow despite geopolitical tensions, with $112 billion invested in 2022, though this represents a decline from previous peaks.

Germany’s manufacturing sector has shown more modest but stable growth, averaging 1.3% annually over the past decade. The sector employs approximately 7.6 million workers, representing about 19% of the country’s workforce—a significantly higher proportion than most advanced economies. German manufacturing productivity (output per worker) remains among the world’s highest, reflecting the sector’s focus on high-value production and automation. The country continues to attract substantial manufacturing FDI, particularly in advanced technology sectors.

Reputation and Industrial Branding

The “Made in China” label has undergone significant evolution over the past two decades. Historically associated with low-cost, variable-quality products, Chinese manufacturers have worked diligently to improve quality standards and brand perception. In certain sectors like consumer electronics, Chinese brands such as Huawei, Xiaomi, and Lenovo have achieved global recognition for innovation and value. However, perception challenges persist, particularly in high-end markets where Chinese products often face skepticism regarding durability, safety standards, and intellectual property concerns.

The “Made in Germany” label continues to command premium status globally, particularly in industries requiring precision, reliability, and engineering excellence. German products consistently rank at the top of global quality perception surveys, with consumers willing to pay premium prices for German-made goods in sectors like automotive, machinery, and household appliances. This reputation provides German manufacturers with pricing power and market resilience even in competitive environments. The country’s industrial brand has been carefully cultivated through consistent quality standards, technical innovation, and effective industry associations.

Industrial Infrastructure and Global Supply Chains

China’s Industrial Infrastructure

Germany’s Industrial Infrastructure

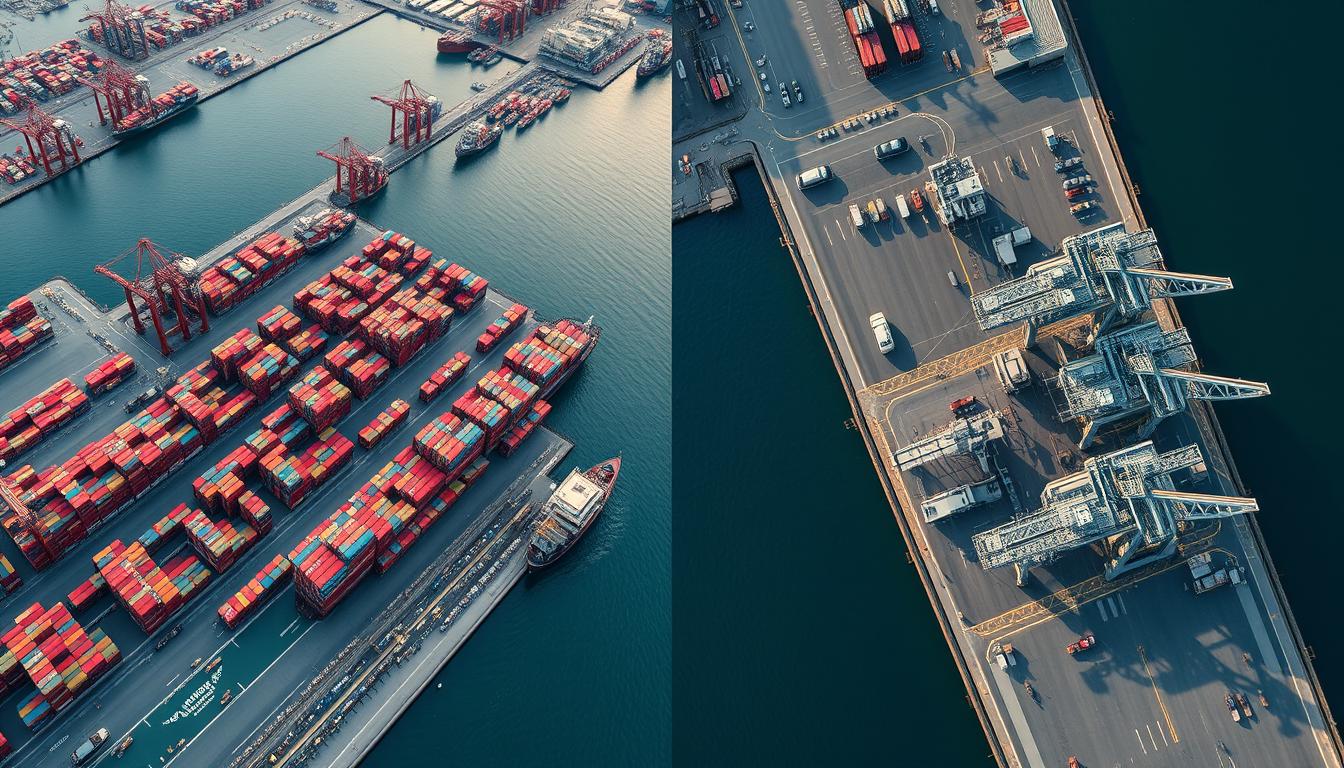

China has invested massively in industrial infrastructure, creating a manufacturing ecosystem of unprecedented scale. The country hosts seven of the world’s ten busiest container ports, handling over 242 million TEUs (twenty-foot equivalent units) annually. China’s strategic development of industrial clusters has created comprehensive supply chains where components, assembly, and distribution can occur within close proximity. This infrastructure advantage allows Chinese manufacturers to achieve production efficiencies difficult to replicate elsewhere. The country’s Belt and Road Initiative further extends these logistics advantages by developing transportation links across Asia, Africa, and Europe.

Germany’s industrial infrastructure emphasizes efficiency and integration rather than scale. The country’s central European location provides strategic advantages for regional distribution, supported by excellent transportation networks. German industrial clusters, such as the automotive concentration in Baden-Württemberg or the chemical industry in North Rhine-Westphalia, create specialized ecosystems that support innovation and production efficiency. The country’s infrastructure excellence extends to digital systems, with advanced implementation of smart factory technologies and industrial internet applications. Germany’s position within the EU single market provides seamless access to a sophisticated regional supply chain.

Challenges and Future Outlook

China’s Manufacturing Challenges

Germany’s Manufacturing Challenges

China faces significant challenges in maintaining its manufacturing dominance. Rising labor costs have eroded traditional competitive advantages, pushing manufacturers to automate or relocate to lower-cost countries. Geopolitical tensions have resulted in trade restrictions and supply chain “decoupling” efforts by Western nations, particularly in sensitive technology sectors. Environmental pressures, both domestic and international, require substantial investments in cleaner production methods. Despite these challenges, China’s manufacturing future looks robust, supported by its massive domestic market, continued infrastructure investment, and strategic focus on advanced manufacturing sectors.

Germany confronts structural challenges that threaten its manufacturing model. The country’s demographic decline creates persistent skills shortages, with approximately 400,000 skilled positions unfilled in manufacturing. High energy costs, exacerbated by the transition away from Russian gas supplies, impact production economics. German manufacturers also face intensifying global competition, including from Chinese companies moving up the value chain into traditional German strength areas. Despite these headwinds, Germany’s manufacturing outlook remains positive, supported by its innovation ecosystem, quality reputation, and leadership in sustainability—attributes likely to remain valuable in future manufacturing paradigms.

Conclusion: Complementary Giants

The comparison between China and Germany reveals two manufacturing giants with fundamentally different but equally impressive approaches to industrial development. China’s manufacturing dominance is built on unmatched scale, comprehensive supply chains, and strategic government support. Germany’s strength derives from specialized expertise, quality excellence, and continuous innovation in high-value sectors. Rather than declaring a single “winner” in global manufacturing dominance, this analysis suggests that both nations have established leadership positions aligned with their respective advantages.

Looking ahead, both countries face the challenge of adapting their manufacturing models to a changing global landscape. China must continue its transition toward innovation-driven growth while addressing environmental impacts and geopolitical headwinds. Germany must navigate demographic challenges, energy transitions, and intensifying global competition. The future of global manufacturing will likely be shaped by how successfully each country leverages its strengths while addressing its vulnerabilities in an increasingly complex industrial environment.

What remains clear is that both China and Germany will continue to play pivotal roles in global manufacturing, with their complementary approaches contributing to industrial advancement worldwide. The true measure of manufacturing dominance may ultimately lie not in market share alone, but in the ability to develop sustainable, innovative production systems that create lasting economic and social value.