The e-commerce landscape is dominated by two titans that have transformed how the world shops: Amazon and Alibaba. These giants have revolutionized retail, created vast digital ecosystems, and continue to push the boundaries of what’s possible in commerce. While they share the common goal of connecting buyers and sellers, their approaches, business models, and regional strengths differ significantly. This comprehensive analysis examines how these e-commerce powerhouses compare across ten critical dimensions to provide a clear picture of their respective positions in the global marketplace.

Company Overviews and Founding Missions

Amazon was founded in 1994 by Jeff Bezos, initially as an online bookstore operating from his garage in Seattle. Bezos’s vision was encapsulated in the company’s mission: “to be Earth’s most customer-centric company.” This customer obsession has guided Amazon’s expansion from books to becoming “the everything store” and beyond. Bezos’s famous 1997 letter to shareholders established the company’s long-term thinking approach, emphasizing that “it’s all about the long term” – a philosophy that continues to drive Amazon’s strategy today.

Alibaba was established in 1999 by Jack Ma, a former English teacher, along with 17 co-founders in Hangzhou, China. Ma’s founding vision was “to make it easy to do business anywhere.” Unlike Amazon, Alibaba began as a B2B marketplace connecting Chinese manufacturers with overseas buyers. Ma’s vision was to create a platform that would empower small businesses, particularly in China, to reach global markets. This mission of empowerment remains central to Alibaba’s identity, even as it has expanded into consumer markets.

Both founders recognized the transformative potential of the internet for commerce, but their approaches reflected their different cultural contexts and personal philosophies. Bezos focused on operational excellence and customer experience, while Ma emphasized building trust in online transactions and creating opportunities for entrepreneurs.

Core Business Models and Specializations

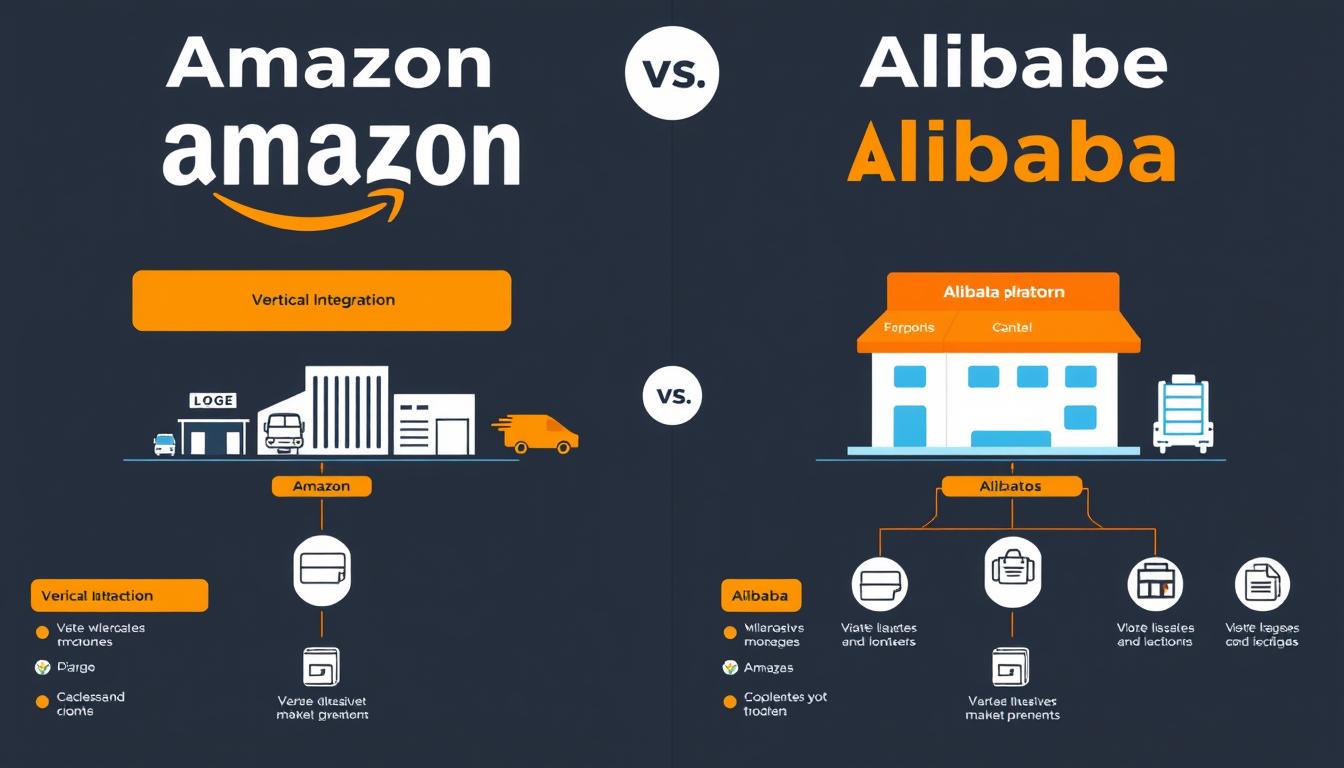

Amazon operates primarily as a hybrid model that combines direct retail operations with a third-party marketplace. The company purchases products wholesale and sells them directly to consumers while also allowing other businesses to sell through its platform. Amazon’s approach is characterized by vertical integration, with the company controlling much of the supply chain from warehousing to last-mile delivery through its extensive logistics network.

Alibaba, by contrast, functions almost exclusively as a platform connecting buyers and sellers without holding inventory. Its ecosystem includes several distinct marketplaces: Alibaba.com (B2B), Taobao (C2C), Tmall (B2C), and AliExpress (cross-border retail). Unlike Amazon, Alibaba doesn’t compete with the merchants on its platform by selling products directly, focusing instead on providing the infrastructure for commerce.

| Feature | Amazon | Alibaba |

| Primary Model | Hybrid (Direct retail + Marketplace) | Pure marketplace platform |

| Inventory Approach | Holds inventory + FBA for sellers | No inventory (connects buyers & sellers) |

| Main Revenue Source | Product sales, marketplace fees, subscriptions | Advertising, commissions, membership fees |

| Loyalty Program | Amazon Prime | 88VIP |

| Target Market | Primarily B2C with B2B segment | B2B, B2C, and C2C segments |

Amazon’s Prime membership program has been transformative for its business model, creating a loyal customer base that shops more frequently and spends more. For $139 annually in the US, Prime members receive benefits including free shipping, streaming services, and exclusive deals. Alibaba’s 88VIP program, while less known globally, offers similar benefits to high-spending customers on its platforms, including discounts across the Alibaba ecosystem.

Strengths and Weaknesses

Amazon’s Strengths

- Unmatched logistics infrastructure in Western markets

- AWS dominance in cloud computing (32% market share)

- Strong customer loyalty through Prime membership

- Vertical integration across the supply chain

- Robust presence in North America and Europe

Amazon’s Weaknesses

- Limited success in penetrating Asian markets

- Increasing regulatory scrutiny in multiple regions

- Tensions with third-party sellers who compete with Amazon’s own products

- Labor practices controversies affecting brand image

- High capital expenditure requirements for logistics expansion

Alibaba’s Strengths

- Dominant position in China’s massive e-commerce market

- Asset-light business model with higher profit margins

- Strong fintech integration through Ant Group

- Cultural advantage in Asian markets

- Diversified revenue streams across multiple platforms

Alibaba’s Weaknesses

- Heavy reliance on Chinese domestic market (78% of revenue)

- Vulnerability to Chinese regulatory changes

- Limited brand recognition in Western markets

- Perception issues regarding counterfeit products

- Geopolitical tensions affecting global expansion

Amazon’s greatest strength lies in its logistics infrastructure, which enables fast delivery and customer satisfaction in Western markets. However, this capital-intensive approach also represents a vulnerability, requiring massive ongoing investment. Alibaba’s platform model offers higher margins and scalability but makes the company more dependent on the health of the Chinese economy and regulatory environment.

Both companies face regional limitations. Amazon has struggled to gain traction in China and Southeast Asia, while Alibaba has found it challenging to expand significantly beyond its Asian stronghold into Western markets where Amazon dominates.

Innovation and Technology Leadership

Both Amazon and Alibaba have established themselves as technology innovators, extending far beyond their e-commerce origins. Amazon Web Services (AWS) has transformed the company into a cloud computing leader, generating $80.5 billion in revenue in 2023 and maintaining approximately 32% market share in the global cloud infrastructure services market. AWS powers not only Amazon’s operations but also those of millions of businesses worldwide, from startups to enterprises.

Alibaba Cloud, while less dominant globally, is the market leader in Asia Pacific with about 9.5% of the global market share. The company has made significant investments in cloud infrastructure across 27 regions worldwide and has been particularly focused on serving the needs of Chinese companies expanding internationally.

In logistics innovation, Amazon has pioneered warehouse automation with over 520,000 robotic drive units working alongside human employees. The company continues to invest in delivery innovations, including drone delivery through Amazon Prime Air and autonomous delivery vehicles. Alibaba’s logistics arm, Cainiao, has similarly embraced automation with smart warehouses and delivery robots, while also developing a global logistics network that can support cross-border e-commerce.

In payment technology, Alibaba has a clear advantage through its association with Ant Group (formerly Ant Financial), which operates Alipay. With over 1.3 billion users worldwide, Alipay has revolutionized digital payments in China and is expanding globally. Amazon’s payment solutions, including Amazon Pay, have gained traction but lack the same scale and integration across daily life that Alipay has achieved in China.

Both companies are heavily invested in artificial intelligence and machine learning, using these technologies to enhance customer experiences through personalized recommendations, improve operational efficiency, and develop new products and services. Amazon’s Alexa voice assistant has become a household name in Western markets, while Alibaba’s AI technologies power everything from smart cities to healthcare applications in China.

Sustainability and Social Responsibility

Both Amazon and Alibaba have made significant commitments to sustainability and social responsibility, though their approaches and areas of focus differ somewhat. Amazon launched The Climate Pledge in 2019, committing to reach net-zero carbon emissions by 2040, ten years ahead of the Paris Agreement. As part of this initiative, Amazon has become the world’s largest corporate purchaser of renewable energy and has ordered over 100,000 electric delivery vehicles.

Alibaba announced its Carbon Neutrality Action Plan in 2021, pledging to achieve carbon neutrality in its operations by 2030 and to reduce carbon emissions across its ecosystem by 1.5 gigatons by 2035. The company has invested in green logistics, energy-efficient cloud computing centers, and sustainable packaging initiatives.

“Amazon is committed to building a sustainable business for our customers and the planet. We have a responsibility to conduct our business in a way that protects the environment and provides our employees, partners, and communities the resources they need to thrive.”

In terms of labor practices, both companies have faced scrutiny. Amazon has been criticized for working conditions in its fulfillment centers, with concerns about productivity quotas, workplace injuries, and anti-unionization efforts. The company has responded by raising its minimum wage to $15 per hour in the US and implementing safety programs, but continues to face challenges in this area.

Alibaba has focused much of its social responsibility efforts on poverty alleviation and rural development in China. Through initiatives like Rural Taobao, the company has helped connect rural communities to the digital economy, creating new economic opportunities. However, Alibaba has also faced criticism for the working conditions in the broader ecosystem of manufacturers and logistics providers that support its platforms.

Both companies have established charitable foundations: the Bezos Earth Fund (with a $10 billion commitment from Jeff Bezos) focuses on climate change, while the Jack Ma Foundation focuses on education, entrepreneurship, women’s leadership, and environmental protection.

In terms of governance, both companies have faced increasing regulatory scrutiny. Amazon has been the subject of antitrust investigations in the US and EU regarding its dual role as platform operator and seller. Alibaba faced a major regulatory crackdown in China in 2020-2021, resulting in a record $2.8 billion antitrust fine and the suspension of Ant Group’s planned IPO.

Financial Performance and Investment Strategy

Amazon and Alibaba present contrasting financial profiles that reflect their different business models and market approaches. Amazon reported $574.8 billion in revenue for 2023, representing a 12% year-over-year increase. The company’s net income was $30.4 billion, yielding a net profit margin of approximately 5.3%. While Amazon’s retail operations operate on thin margins, AWS contributes disproportionately to profitability, generating operating income of $26.5 billion on $80.5 billion in revenue (33% operating margin).

Alibaba generated revenue of $126.7 billion for its fiscal year ending March 2023, with a net income of $21.8 billion, resulting in a net profit margin of 17.2%. This higher margin reflects Alibaba’s asset-light platform business model, which doesn’t require the same level of investment in physical infrastructure as Amazon’s direct retail operations.

| Financial Metric | Amazon (2023) | Alibaba (FY 2023) |

| Revenue | $574.8 billion | $126.7 billion |

| Net Income | $30.4 billion | $21.8 billion |

| Profit Margin | 5.3% | 17.2% |

| R&D Spending | $73.3 billion | $8.1 billion |

| Market Cap (Aug 2024) | $1.85 trillion | $190 billion |

In terms of investment strategy, Amazon is known for its willingness to invest heavily in long-term growth opportunities, often at the expense of short-term profitability. The company spent $73.3 billion on technology and content in 2023, which includes its R&D expenditures. Major recent investments include the $8.45 billion acquisition of MGM Studios to bolster Amazon Prime Video content and continued expansion of its logistics network.

Alibaba has pursued a more diversified investment approach, making strategic investments across various sectors including entertainment (Youku Tudou), social media (Weibo), and physical retail (Sun Art Retail Group). The company has also invested heavily in international expansion, particularly in Southeast Asia through its $4 billion investment in Lazada. However, following regulatory pressure in China, Alibaba has shifted toward more conservative capital allocation, including a $25 billion share repurchase program announced in 2023.

Both companies have seen significant changes in their market valuations in recent years. Amazon’s market capitalization stands at approximately $1.85 trillion as of August 2024, making it one of the world’s most valuable companies. Alibaba’s market cap has declined significantly from its peak, currently standing at around $190 billion, reflecting both regulatory challenges in China and increased competition in its home market.

Brand Image and Consumer Perception

Amazon has built one of the world’s most recognizable brands, consistently ranking among the top global brands in various indices. According to Kantar’s BrandZ 2023 report, Amazon ranks as the third most valuable brand globally, with a brand value of $299.3 billion. The company’s brand is strongly associated with convenience, vast selection, and reliable delivery – encapsulated in its customer-centric approach.

Alibaba, while less well-known globally, is a household name in China and increasingly recognized across Asia. The company ranks 9th in BrandZ’s most valuable Chinese brands, with a brand value of $30.7 billion – a significant decline from previous years due to regulatory challenges and increased competition. In its home market, Alibaba is associated with innovation, entrepreneurship, and creating opportunities for small businesses.

Consumer trust is a critical factor for both companies. Amazon has built trust through its customer service, reliable fulfillment, and A-to-z Guarantee that protects purchases. However, the company has faced criticism over issues including counterfeit products, treatment of third-party sellers, and data privacy concerns. Alibaba has worked to address historical perceptions of counterfeit goods on its platforms through initiatives like its Intellectual Property Protection Platform, though this remains a challenge particularly for international perception.

How do loyalty programs impact consumer perception?

▶

Amazon Prime has transformed consumer expectations for e-commerce, with over 200 million members worldwide. Prime members spend approximately 2.3 times more annually than non-Prime customers, demonstrating the program’s effectiveness in building loyalty. The bundling of fast shipping with streaming services, photo storage, and other benefits has created a comprehensive value proposition that keeps customers within the Amazon ecosystem.

Alibaba’s 88VIP program, while less known globally, offers similar benefits to high-spending customers on its platforms. Members receive discounts across the Alibaba ecosystem, including Tmall, Taobao, food delivery service Ele.me, and video platform Youku. The program has been effective in China at increasing customer retention and spending.

Cultural resonance also plays a significant role in brand perception. Alibaba’s Singles’ Day (November 11) shopping festival has become a cultural phenomenon in China, generating $84.5 billion in gross merchandise volume in 2023. Amazon has created similar shopping events with Prime Day, which generated an estimated $12.7 billion in sales in 2023, though it lacks the same cultural significance as Singles’ Day in China.

Both companies have faced public relations challenges. Amazon has been criticized for its environmental impact, treatment of warehouse workers, and market dominance. Alibaba faced a major reputational challenge when founder Jack Ma criticized Chinese financial regulators in 2020, leading to increased government scrutiny of the company and its affiliates. The company has since worked to realign its messaging with Chinese government priorities, emphasizing contributions to common prosperity.

Global Footprint and Infrastructure

Amazon’s global infrastructure is built around its fulfillment network, which includes over 185 fulfillment centers globally, covering more than 220 million square feet. The majority of these facilities are located in North America and Europe, reflecting the company’s market focus. Amazon’s logistics capabilities have expanded to include approximately 70 cargo planes in Amazon Air’s fleet, thousands of delivery stations, and a growing fleet of delivery vehicles including electric vans.

Alibaba’s logistics arm, Cainiao Network, takes a different approach, operating as a data-driven platform that coordinates a network of logistics partners rather than owning most of the physical infrastructure itself. Cainiao has established six global logistics hubs in cities including Kuala Lumpur, Dubai, Moscow, and Liège (Belgium) to facilitate cross-border e-commerce. The network can deliver to more than 200 countries and regions, with guaranteed delivery times of 5-10 days to major markets.

| Infrastructure Element | Amazon | Alibaba |

| Fulfillment Centers | 185+ owned facilities | Primarily partner network |

| Global Logistics Hubs | 30+ major hubs | 6 global hubs (Cainiao) |

| Data Centers | AWS: 32 regions, 102 availability zones | Alibaba Cloud: 27 regions, 84 availability zones |

| Air Fleet | 70+ cargo planes | Partnerships with cargo carriers |

| Last-Mile Delivery | Owned fleet + delivery partners | Primarily partner network |

In cloud infrastructure, Amazon Web Services operates 32 regions globally with 102 availability zones, providing comprehensive coverage across North America, Europe, Asia, South America, and Australia. Alibaba Cloud has established a presence in 27 regions worldwide with 84 availability zones, with particular strength in Asia Pacific but growing coverage in other regions.

Strategic partnerships play an important role in both companies’ global footprints. Amazon has partnered with local retailers in markets where it doesn’t have a direct presence, such as its partnership with Future Retail in India (though this has faced legal challenges). Alibaba has pursued joint ventures and investments, such as its partnership with SingPost in Singapore and investment in Turkey’s Trendyol, to expand its global reach.

Physical retail presence represents another dimension of infrastructure. Amazon has expanded into brick-and-mortar retail through Amazon Fresh grocery stores, Amazon Go cashierless convenience stores, and its acquisition of Whole Foods Market, which added over 500 physical locations. Alibaba has similarly invested in physical retail through its New Retail strategy, including Freshippo (Hema) supermarkets and Sun Art Retail Group, one of China’s largest hypermarket chains.

Current Challenges and Strategic Outlook

Both Amazon and Alibaba face significant challenges as they navigate an evolving global landscape. Regulatory pressure represents perhaps the most immediate concern for both companies. Amazon faces antitrust scrutiny in the United States and European Union regarding its dual role as platform operator and seller, with potential remedies ranging from fines to structural separation of businesses. Alibaba continues to adapt to China’s regulatory environment following the government’s crackdown on the technology sector, which has required adjustments to business practices and greater alignment with national strategic priorities.

Geopolitical tensions, particularly between the United States and China, create additional complexity for both companies’ global strategies. Amazon faces challenges entering and operating in China, while Alibaba must navigate increasing skepticism toward Chinese technology companies in Western markets, particularly in sensitive areas like cloud services and data management.

Both companies are investing heavily in emerging technologies that could reshape commerce, including artificial intelligence, augmented reality shopping experiences, autonomous delivery, and blockchain-based supply chain solutions.

Competitive pressures are intensifying for both giants. Amazon faces growing competition from traditional retailers that have enhanced their omnichannel capabilities, such as Walmart and Target, as well as specialized e-commerce players like Shopify that empower merchants to sell directly to consumers. Alibaba contends with domestic competitors including JD.com and Pinduoduo, which has rapidly gained market share with its social commerce model targeting lower-tier cities and rural areas in China.

Looking ahead, both companies are pursuing strategies that leverage their core strengths while addressing vulnerabilities. Amazon continues to invest in vertical integration, expanding its logistics capabilities and diversifying into healthcare, financial services, and other sectors. The company’s focus on AI through initiatives like Amazon Bedrock (a service that makes foundation models available through an API) indicates its commitment to maintaining technological leadership.

Alibaba is pursuing a “domestic consumption, global cross-border, cloud computing” strategy, focusing on strengthening its position in China while selectively expanding international operations. The company is investing in its cloud business and digital infrastructure while exploring opportunities in areas like healthcare technology and sustainability solutions.

Both companies must balance growth ambitions with increasing expectations regarding environmental sustainability, labor practices, and social responsibility. Their ability to address these concerns while maintaining innovation and competitiveness will be crucial to long-term success.

The future competitive landscape will likely be shaped by how effectively each company can adapt to regional market conditions while leveraging their respective strengths. Amazon’s integrated model provides control and consistency but requires massive capital investment. Alibaba’s platform approach offers flexibility and capital efficiency but depends on ecosystem partners for execution. As commerce continues to evolve globally, these different approaches will be tested across diverse markets and regulatory environments.

Conclusion

The question of which company “reigns supreme” in global e-commerce defies a simple answer. Amazon and Alibaba have developed distinct approaches to digital commerce that reflect their origins, cultural contexts, and strategic visions. Amazon’s vertically integrated model has created unparalleled convenience for consumers in Western markets, while Alibaba’s platform ecosystem has empowered millions of merchants in China and increasingly across Asia.

Rather than a single global winner, we see regional dominance with Amazon controlling North America and much of Europe, while Alibaba leads in China and parts of Southeast Asia. Both companies continue to evolve beyond their e-commerce origins, expanding into cloud computing, digital media, financial services, and physical retail. Their future success will depend on how effectively they can navigate regulatory challenges, adapt to regional market conditions, and continue to innovate in an increasingly competitive landscape.

For businesses and consumers, the competition between these giants drives innovation and improvements in service quality. Understanding the strengths, weaknesses, and strategic directions of both Amazon and Alibaba provides valuable insights for anyone participating in the global digital economy, whether as a merchant, partner, competitor, or customer. As e-commerce continues to evolve, these two companies will undoubtedly remain at the forefront, shaping the future of how the world shops and does business.