Does Unemployment Reflect Economic Weakness or Policy Failures?

Does Unemployment Reflect Economic Weakness or Policy Failures? Analyze the impact of economic policies on…

Does inflation affect demand for luxury goods

Does inflation affect demand for luxury goods? Past trends reveal the complex relationship between economic…

Can an unemployment crisis lead to mass migration

Can an unemployment crisis lead to mass migration? Our trend analysis examines the historical context…

How credit ratings help shape government spending policies

Discover How credit ratings help shape government spending policies in the US, influencing budget decisions…

Does remote work affect unemployment rates

Does remote work affect unemployment rates? Analyze past trends to understand the correlation between remote…

China’s real estate crisis and the looming challenges ahead

Explore the future implications of China's real estate crisis and the looming challenges ahead as…

How does credit rating affect a country’s imports and exports

Understand the impact of credit rating on a country's imports and exports, shaping international trade…

How do banking systems regulate the currency market

Learn how banking systems regulate the currency market with our comprehensive guide, covering current regulations…

How do central bank decisions impact gold prices

Understand the impact of central bank decisions on gold prices with our comprehensive Ultimate Guide.…

What are the consequences of raising income taxes

Analyze the future consequences of raising income taxes and their potential economic implications

What Makes the Pound Sterling Strong Amid Global Crises?

How does a currency retain its dominance while economies worldwide face turbulence? The British pound…

Can London Keep Its Status as a Global Financial Hub?

Can London Keep Its Status as a Global Financial Hub? Get the latest analysis on…

Why Credit Ratings Matter in Emerging Markets

Understand Why Credit Ratings Matter in Emerging Markets to make better investment decisions now.

Is Inflation a Threat to Retirement Income?

Is Inflation a Threat to Retirement Income? Understand the risks and find out how to…

Is Crypto a Quick Escape from Inflation?

As everyday costs climb, your paycheck buys less each month. Groceries, gas, and housing drain…

How Can Taxes Help Fund National Defense?

Learn 'How Can Taxes Help Fund National Defense?' with our in-depth Ultimate Guide. Uncover the…

What Is the Central Bank’s Role in the Real Estate Market?

Learn about What Is the Central Bank's Role in the Real Estate Market? and its…

What Are the Fundamental Principles of Banking Systems?

Discover the key principles that shape modern banking systems. Learn 'What Are the Fundamental Principles…

Credit Ratings and Foreign Direct Investment

Credit Ratings and Foreign Direct Investment: Analyzing the impact on global investment flows and economic…

Japan’s Debt Crisis and Its Struggles

Explore Japan’s Debt Crisis and Its Struggles in our latest industry report, analyzing the country's…

Key Factors Driving Price Inflation

Learn about the Key Factors Driving Price Inflation in the present economy with our comprehensive…

Wage Policies and Their Impact on Unemployment

Analyze the trend of Wage Policies and Their Impact on Unemployment, understanding its implications on…

What Causes Sudden Credit Rating Drops?

What Causes Sudden Credit Rating Drops? Explore the common factors that lead to a sudden…

Iceland’s Banking Crisis and Economic Collapse Explained

Explore the causes and consequences of Iceland’s Banking Crisis and Economic Collapse in this in-depth…

Does Inflation Increase Income Inequality

"Does Inflation Increase Income Inequality? Examine the link between inflation rates and income distribution, and…

How Innovative Companies Create New Jobs

Learn How Innovative Companies Create New Jobs and drive future growth. Read our trend analysis…

How Taxes Impact the Real Estate Market

Discover How Taxes Impact the Real Estate Market in our Ultimate Guide. Learn the effects…

How Central Banks Build Trust in the Financial System

Learn How Central Banks Build Trust in the Financial System, ensuring stability and confidence in…

What is the Role of the Central Bank in Price Stability?

One often overlooked aspect of daily life is the quiet but constant effort to keep…

What are the Lessons Learned from the 2008 Financial Crisis?

The year 2008 marked a period of intense global economic turmoil. Did you know that…

How the Banking System Manages 24/7 Payments

Understand the intricacies of How the Banking System Manages 24/7 Payments through our comprehensive Ultimate…

Traditional Banks vs Digital Banks – Who Wins Customer Trust?

Learn which wins in Traditional Banks vs Digital Banks – Who Wins Customer Trust? by…

What Is a Credit Rating and How Does It Impact a Country’s Competitiveness?

Understand the impact of credit ratings on a country's competitiveness. Our Ultimate Guide explains What…

The 2008 U.S. Housing Bubble Crisis: How the Global Economy Collapsed

"Learn about The2008 U.S. Housing Bubble Crisis: How the Global Economy Collapsed, a critical analysis…

How Do Companies Adapt to Inflation and Protect Their Profits?

Discover How Do Companies Adapt to Inflation and Protect Their Profits? Learn effective strategies to…

Can Vocational Education Be a Weapon Against Unemployment?

Can Vocational Education Be a Weapon Against Unemployment? Future trends analysis and insights reveal its…

Direct vs Indirect Taxes: Who Actually Pays and What Do Prices Bear?

Direct vs Indirect Taxes: Who Actually Pays and What Do Prices Bear? Get insights into…

Central Banks vs Commercial Banks – Who Shapes Policy and Who Serves People?

Explore the distinct functions of Central Banks vs Commercial Banks – Who Shapes Policy and…

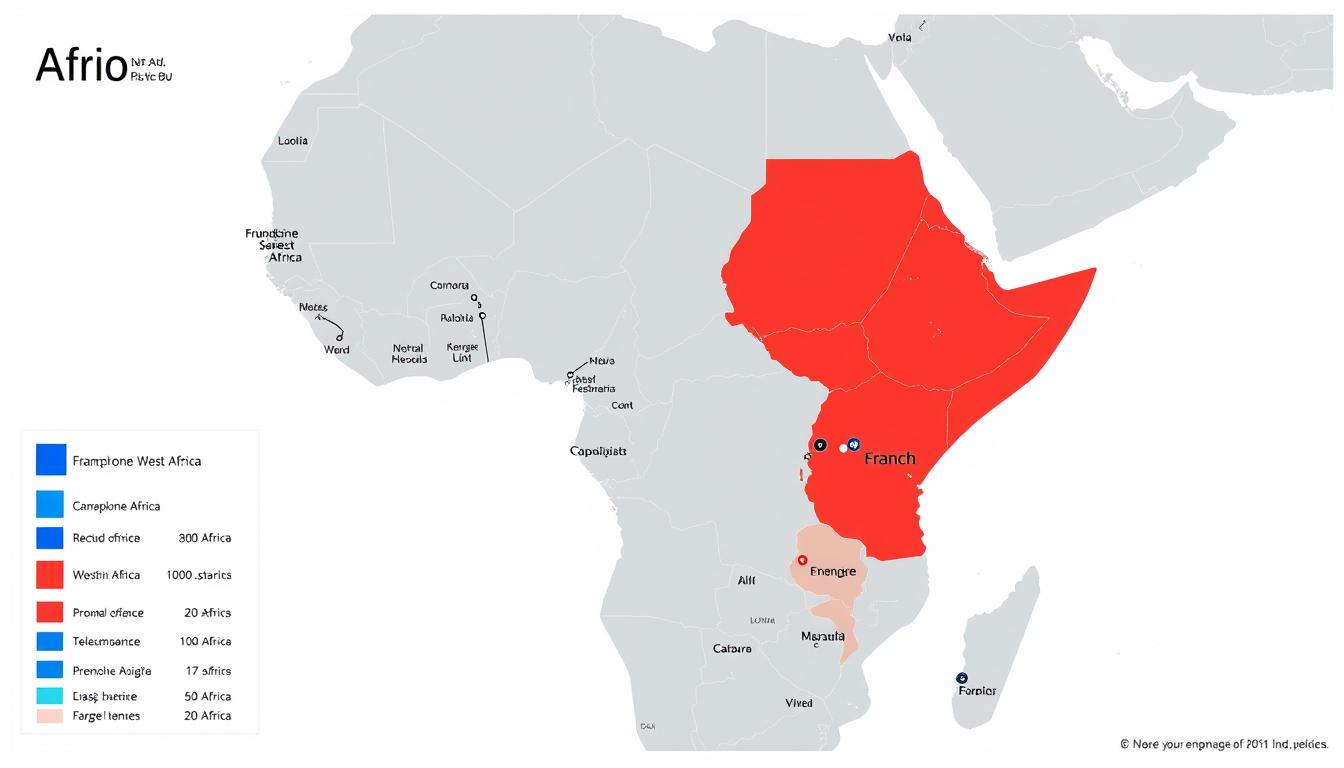

France vs UK: Who Dominates African Markets?

Comprehensive analysis comparing France vs UK African markets influence through trade volumes, investment sectors, diplomatic…

Japan vs Singapore: Who Offers a Smarter Model of Development?

Explore a comprehensive analysis of the Japan vs Singapore development model across economic strategies, innovation,…