The global petrochemical industry represents one of the most critical sectors in the modern economy, providing essential building blocks for countless products that define contemporary life. At the heart of this industry stand two American giants: Dow, a historic chemical powerhouse with roots stretching back to the late 19th century, and Chevron Phillips Chemical, a more recent but formidable joint venture between two energy titans. This comprehensive analysis examines how these companies compare across multiple dimensions, from their core businesses and market shares to their innovation strategies and future outlooks.

As the petrochemical landscape continues to evolve amid sustainability pressures, feedstock volatility, and shifting global demand patterns, understanding the relative strengths and strategic positioning of these industry leaders provides valuable insights for stakeholders throughout the value chain. This comparison delves into the data behind their operations, financial performance, and strategic initiatives to determine which company holds the stronger position in today’s competitive marketplace.

Company Overview: Origins and Evolution

Dow’s history spans more than 125 years of chemical innovation and market development. Founded in 1897 by Herbert Henry Dow in Midland, Michigan, the company began by extracting bromine from brine deposits. This early venture laid the foundation for what would become one of the world’s largest chemical manufacturers. Through the 20th century, Dow expanded aggressively, developing breakthrough products across multiple chemical categories and establishing a global manufacturing footprint. The company underwent significant transformation in the 21st century, including a 2017 merger with DuPont followed by a 2019 restructuring that created the current Dow entity focused on materials science.

Chevron Phillips Chemical represents a different corporate evolution, emerging in 2000 as a joint venture between Chevron Corporation and Phillips Petroleum (now part of Phillips 66). The company combined the chemical operations and assets of its parent companies, creating an immediate major player in the petrochemical sector with significant olefins and polyolefins capacity. This evolution is crucial in the ongoing Dow vs Chevron Phillips Chemical petrochemical market comparison, particularly as market conditions fluctuate.

While younger as an organization, Chevron Phillips Chemical benefits from the deep industry expertise and resources of its parent companies, both of which have extensive histories in hydrocarbon processing and petrochemical production. As the business landscape evolves, with investments in plants reaching up to 1.2 billion dollars, the focus on operating units and cracker material efficiency becomes paramount. The balance of prices and profit recovery is essential in adapting to changes in market conditions, which ultimately impacts the entire industry.

Dow: A Century of Chemical Innovation

Dow has weathered multiple industry cycles and reinvented itself numerous times throughout its long history. The company’s current iteration emerged from the DowDuPont merger and subsequent three-way split that created separate entities focused on materials science (Dow), specialty products (DuPont), and agriculture (Corteva). Today’s Dow ranks third in the Global Top 50 chemical companies with approximately $55 billion in annual chemical sales, making it significantly larger than Chevron Phillips Chemical.

The company maintains headquarters in Midland, Michigan, and operates manufacturing sites across 31 countries. Dow’s extensive global footprint reflects its position as a truly multinational corporation with significant market presence across North America, Europe, Latin America, and Asia Pacific regions. This geographic diversity provides both market access advantages and a degree of insulation from regional economic fluctuations.

Chevron Phillips Chemical: Energy Giants Join Forces

Chevron Phillips Chemical emerged from the strategic decision by two energy majors to combine their chemical assets into a standalone operation. This 50-50 joint venture structure continues today, with both parent companies maintaining equal ownership. The company ranks 31st among global chemical producers with approximately $14.1 billion in annual chemical sales according to industry rankings.

Headquartered in The Woodlands, Texas, Chevron Phillips Chemical operates major manufacturing facilities primarily concentrated in the U.S. Gulf Coast region, with additional sites in Saudi Arabia, Qatar, Singapore, and Belgium. This geographic footprint reflects the company’s strategic focus on regions with advantaged feedstock positions, particularly for natural gas liquids that serve as key raw materials for its production processes.

Core Business and Product Lines

The product portfolios and business focus areas of Dow and Chevron Phillips Chemical reveal significant differences in their strategic approaches to the petrochemical market. While both companies maintain substantial positions in basic petrochemicals and plastics, their broader portfolios and downstream integration strategies diverge considerably.

Dow’s Diversified Portfolio

Dow operates through three primary business segments that encompass a broad range of chemical products and materials:

Packaging & Specialty Plastics: This segment represents Dow’s largest business unit, producing polyethylene and other materials critical to the packaging industry. The company maintains leading positions in flexible and rigid packaging applications, with products serving food packaging, industrial packaging, and consumer goods markets. This segment also includes Dow’s hydrocarbons operations that produce ethylene, propylene, and other basic petrochemical building blocks.

Industrial Intermediates & Infrastructure: This division focuses on chemicals used in industrial applications, construction, and consumer products. Key product lines include polyurethanes, industrial solutions, and construction chemicals. These materials serve diverse end markets including automotive, building and construction, consumer goods, and electronics.

Performance Materials & Coatings: This segment produces specialty materials including silicones, acrylics, and cellulosics that enhance performance in applications ranging from architectural paints to personal care products. The division leverages Dow’s significant intellectual property in specialty chemicals and formulation science.

Chevron Phillips Chemical’s Focused Approach

Chevron Phillips Chemical maintains a more concentrated portfolio centered on olefins and polyolefins production, with selective downstream integration:

Olefins & Polyolefins: The company’s core business revolves around the production of ethylene, propylene, and their derivative polyolefin products. Chevron Phillips Chemical operates world-scale ethylene crackers that convert natural gas liquids into these basic building blocks. Its polyethylene and polypropylene resins serve packaging, pipe, automotive, and consumer product applications.

Specialty Chemicals: This segment includes aromatics (benzene, styrene), alpha olefins, and specialty chemicals used in drilling applications, mining, and various industrial processes. The company has established particularly strong positions in normal alpha olefins and polyalphaolefins, which serve as important components in synthetic lubricants, drilling fluids, and other specialty applications.

Performance Pipe: This division manufactures high-density polyethylene pipe for water, gas, industrial, and mining applications. This downstream integration allows Chevron Phillips Chemical to capture additional value from its polyethylene production while serving critical infrastructure markets.

| Business Dimension | Dow | Chevron Phillips Chemical |

| Annual Chemical Sales | $55.0 billion | $14.1 billion |

| Primary Feedstocks | Mixed (ethane, propane, naphtha) | Natural gas liquids (primarily ethane) |

| Key Product Categories | Polyethylene, polyurethanes, silicones, acrylics, cellulosics | Polyethylene, normal alpha olefins, polyalphaolefins, HDPE pipe |

| Business Model | Diversified materials science portfolio with significant specialty chemicals | Focused petrochemical producer with selective downstream integration |

| End Markets | Packaging, infrastructure, consumer care, mobility, electronics | Packaging, pipe, automotive, lubricants, drilling |

Explore Detailed Product Portfolio Analysis

Download our comprehensive breakdown of Dow and Chevron Phillips Chemical’s product portfolios, including market share data for key product categories and competitive positioning analysis.

Strengths and Weaknesses Analysis

Both Dow and Chevron Phillips Chemical possess distinct competitive advantages and face specific challenges in the petrochemical marketplace. Understanding these strengths and weaknesses provides insight into their relative market positions and future prospects.

Dow’s Competitive Position

Strengths

Operational Scale: Dow’s position as the third-largest chemical company globally provides significant economies of scale in production, procurement, and logistics. The company operates some of the world’s largest integrated chemical manufacturing sites, enabling cost-efficient production and operational flexibility.

Product Diversification: Dow’s broad portfolio spanning commodity petrochemicals to specialty materials provides resilience against market cycles in any single product category. This diversification allows the company to capture value across multiple points in various value chains.

Innovation Capabilities: With R&D expenditures of approximately $857 million annually (1.6% of sales), Dow maintains robust research capabilities focused on developing higher-value materials. The company holds over 3,500 active U.S. patents and introduces numerous new products annually.

Global Manufacturing Network: Dow’s manufacturing footprint spans 31 countries with 106 production sites, providing proximity to key markets and supply chain flexibility. This global network enables the company to optimize production based on regional feedstock advantages and market demand patterns.

Weaknesses

Legacy Cost Structures: As a century-old company, Dow carries some older, less efficient assets that can impact overall cost position. While the company has undertaken significant rationalization efforts, some facilities still face cost disadvantages compared to newer competitors.

Environmental Liabilities: Dow’s long industrial history has created environmental remediation obligations at certain sites. These legacy issues require ongoing management attention and financial resources.

Capital Intensity: The company’s diverse portfolio requires substantial ongoing capital investment across multiple business lines, potentially limiting financial flexibility during industry downturns.

Chevron Phillips Chemical’s Competitive Position

Strengths

Feedstock Integration: The company benefits from parent company relationships that provide advantaged access to natural gas liquids feedstocks, particularly ethane from U.S. shale production. This integration supports cost-competitive ethylene production, especially during periods of favorable gas-to-oil price spreads.

Asset Quality: With most major assets built or significantly upgraded in the past two decades, Chevron Phillips Chemical operates a relatively modern production fleet. This includes world-scale facilities like the Cedar Bayou cracker and polyethylene units completed in recent years.

Financial Backing: The joint ownership structure provides access to capital and strategic support from two energy majors. This backing enables the company to undertake large-scale growth projects that might be challenging for a standalone entity of similar size.

Focused Strategy: By concentrating on core competencies in olefins and polyolefins, Chevron Phillips Chemical maintains strategic clarity and operational focus. This specialization supports excellence in its chosen market segments.

Weaknesses

Limited Product Diversification: The company’s concentrated portfolio creates greater exposure to market cycles in basic petrochemicals and polyolefins. This lack of diversification can lead to more pronounced earnings volatility.

Geographic Concentration: Despite some international operations, Chevron Phillips Chemical remains heavily concentrated in the U.S. Gulf Coast region, creating potential vulnerability to regional disruptions such as hurricanes.

Scale Disadvantage: At approximately one-quarter the size of Dow by revenue, Chevron Phillips Chemical faces scale disadvantages in certain operational areas and may have less market influence in some product categories.

Innovation and Sustainability Initiatives

As the petrochemical industry faces increasing pressure to address environmental concerns and develop more sustainable materials, both Dow and Chevron Phillips Chemical have established significant innovation programs and sustainability commitments. Their approaches to research and development, circular economy initiatives, and carbon reduction targets reveal important strategic priorities.

Research and Development Investments

Dow maintains one of the industry’s most substantial research and development operations, with annual R&D expenditures of approximately $857 million, representing 1.6% of total sales. The company operates global innovation centers in Midland, Michigan; Collegeville, Pennsylvania; and Shanghai, China, employing over 3,600 technical professionals. Dow’s research efforts span fundamental chemistry, materials science, process technology, and application development.

Chevron Phillips Chemical invests approximately $124 million annually in R&D, representing about 0.9% of sales. While smaller in absolute terms, this investment supports focused research programs at the company’s technology centers in Bartlesville, Oklahoma, and Kingwood, Texas. The company’s research priorities include catalyst development, polyolefin product innovation, and process technology improvements.

Circular Economy Initiatives

Both companies have established significant programs to address plastic waste and develop circular economy solutions, though with different approaches and emphasis:

Dow’s Circular Economy Strategy

Dow has positioned itself as an industry leader in plastic circularity through several major initiatives:

Recycling Partnerships: The company has established collaborations with waste management companies and recyclers to increase plastic collection and processing. Notable examples include Dow’s partnership with Mura Technology to deploy advanced recycling technology and its investment in Mr. Green Africa to develop recycling infrastructure in Kenya.

Design for Recyclability: Dow has developed numerous packaging innovations designed to improve recyclability, including all-polyethylene barrier packaging that eliminates the need for multi-material structures that are difficult to recycle.

Advanced Recycling: The company has invested in multiple advanced recycling technologies, including partnerships to deploy pyrolysis and gasification processes that convert plastic waste back into feedstocks for new plastic production.

Circular Economy Targets: Dow has committed to enabling 1 million metric tons of plastic to be collected, reused, or recycled by 2030 and to have 100% of its products sold into packaging applications be reusable or recyclable by 2035.

Chevron Phillips Chemical’s Sustainability Approach

Chevron Phillips Chemical has developed its own circular economy program with several key elements:

Advanced Recycling: The company has launched its Marlex Anew Circular Polyethylene, produced using pyrolysis oil from plastic waste. This program aims to scale to approximately 450,000 metric tons of circular polyethylene annually by 2030.

Technology Investments: Chevron Phillips Chemical has made strategic investments in recycling technology companies, including Nexus Circular and Mura Technology, to secure access to advanced recycling capabilities.

Industry Collaborations: The company participates in multiple industry initiatives addressing plastic waste, including Operation Clean Sweep and the Alliance to End Plastic Waste, where it works with value chain partners on waste management solutions.

Sustainability Targets: Chevron Phillips Chemical has established goals to eliminate plastic waste in the environment and to further reduce its operational environmental footprint, though its public targets are generally less specific than Dow’s quantitative commitments.

Carbon Reduction and Climate Initiatives

Both companies have established carbon reduction targets and climate strategies, though with different levels of ambition and scope:

| Climate Initiative | Dow | Chevron Phillips Chemical |

| Carbon Neutrality Target | Net carbon neutral by 2050 | No specific carbon neutrality date announced |

| Interim Emissions Targets | Reduce net carbon emissions 15% by 2030 (vs. 2020 baseline) | Reduce greenhouse gas intensity 25% by 2030 (vs. 2018 baseline) |

| Renewable Energy Commitments | Procure 750 MW of renewable power capacity by 2025 | No specific renewable energy target announced |

| Low-Carbon Technology Investments | $1 billion/year allocated to decarbonization projects | Focused investments in energy efficiency and process improvements |

| Climate Disclosure | Comprehensive reporting aligned with TCFD recommendations | Annual sustainability reporting with selected climate metrics |

Patent Activity and Innovation Output

Patent filings provide another window into the innovation priorities and capabilities of both companies. Dow consistently ranks among the top U.S. patent recipients in the chemical industry, averaging over 500 patent grants annually across diverse technology areas including catalysis, polymer science, formulation chemistry, and application development. The company’s innovation output reflects its broader portfolio and larger R&D investment.

Chevron Phillips Chemical maintains a more focused patent portfolio primarily concentrated in polyolefin catalysts, process technology, and specialty applications for its core products. The company typically receives 50-75 patents annually, with particular strength in metallocene catalyst technology and polyethylene resin development for specialized applications.

“Innovation in sustainability isn’t optional for the petrochemical industry – it’s existential. The companies that develop truly circular solutions for plastics and dramatically reduce carbon intensity will define the industry’s future.”

Financial Performance

The financial profiles of Dow and Chevron Phillips Chemical reflect their different scales, portfolio compositions, and corporate structures. Analyzing their revenue trends, profitability metrics, and capital allocation priorities provides insight into their relative financial strength and strategic priorities.

Revenue and Earnings Trends

As a publicly traded company, Dow provides comprehensive financial disclosure through quarterly and annual reports. The company reported chemical sales of approximately $55 billion in 2021, a significant increase from the previous year driven by both higher volumes and prices. Dow’s earnings before interest and taxes (EBIT) for its chemical operations reached approximately $7.5 billion, representing an EBIT margin of about 13.6%.

Chevron Phillips Chemical, as a private joint venture, provides more limited financial disclosure. Industry analysts estimate the company’s 2021 chemical sales at approximately $14.1 billion, also reflecting substantial growth from 2020 levels. While specific earnings figures are not publicly disclosed, industry sources suggest operating margins in the 12-15% range, broadly comparable to Dow’s profitability metrics during the same period.

Capital Expenditure and Investment Patterns

Dow’s capital expenditures totaled approximately $1.5 billion in 2021, representing about 2.7% of sales. This investment level reflects the company’s disciplined approach to capital allocation following its separation from DowDuPont. Major recent investments include:

Incremental Capacity Expansions: Dow has focused on debottlenecking and incremental expansions at existing facilities rather than greenfield projects. Examples include polyethylene capacity expansions in the U.S. Gulf Coast and Europe.

Sustainability Investments: The company has allocated significant capital to projects supporting its carbon reduction goals, including investments in circular economy infrastructure and energy efficiency improvements.

Digital Transformation: Dow has invested in manufacturing digitalization initiatives to improve operational efficiency and reliability across its global production network.

Chevron Phillips Chemical’s capital expenditures have fluctuated significantly in recent years as the company completed a major investment cycle. After spending approximately $6 billion on its U.S. Gulf Coast Petrochemicals Project (completed in 2018), the company has moderated its capital spending to approximately $600-700 million annually, representing about 4-5% of sales. Recent investment priorities include:

Specialty Chemicals Expansion: The company has invested in expanding its normal alpha olefins capacity at Cedar Bayou, Texas, strengthening its position in this high-margin product category.

International Joint Ventures: Chevron Phillips Chemical continues to invest in its Middle Eastern joint ventures, leveraging advantaged ethane feedstocks in Saudi Arabia and Qatar.

Sustainability Projects: The company has directed capital toward advanced recycling capabilities and other sustainability initiatives, though at a smaller absolute scale than Dow’s investments in these areas.

Financial Metrics Comparison

| Financial Metric | Dow | Chevron Phillips Chemical | Industry Average |

| Annual Revenue (2021) | $55.0 billion | $14.1 billion | N/A |

| Revenue Growth (2020-2021) | +43% | ~+40% (estimated) | +38% |

| EBITDA Margin (2021) | ~20% | ~18-20% (estimated) | ~17% |

| Capital Expenditure (2021) | $1.5 billion | ~$650 million (estimated) | N/A |

| Capex as % of Sales | 2.7% | ~4.6% (estimated) | 4-5% |

| R&D Spending (2021) | $857 million | ~$124 million (estimated) | 1-2% of sales |

| R&D as % of Sales | 1.6% | ~0.9% (estimated) | 1-2% |

Financial Structure and Flexibility

As a publicly traded company, Dow maintains a capital structure balanced between equity and debt financing. The company has prioritized debt reduction in recent years, improving its financial flexibility. Dow’s investment-grade credit rating supports access to capital markets at favorable terms, while its dividend policy (yielding approximately 4-5%) reflects its commitment to shareholder returns.

Chevron Phillips Chemical, as a joint venture, operates with a different financial structure. The company is not publicly traded and does not issue its own debt; instead, it relies on a combination of operating cash flow and capital contributions from its parent companies when needed for major investments. This structure provides certain advantages, including the ability to take a longer-term view on investments without quarterly earnings pressure, but may also create constraints on capital availability for large-scale growth initiatives.

Brand Reputation and Industry Standing

Beyond quantitative metrics like market share and financial performance, the reputations and industry standing of Dow and Chevron Phillips Chemical provide important context for understanding their competitive positions. Their brand perceptions, industry partnerships, regulatory compliance records, and corporate social responsibility initiatives all contribute to their overall market influence.

Brand Recognition and Perception

Dow has established one of the chemical industry’s most recognized global brands, consistently ranking among the world’s most valuable chemical company brands in annual evaluations. The company’s red diamond logo and “Seek Together” tagline reflect its positioning as a collaborative innovation partner. Dow’s brand architecture emphasizes both its corporate identity and specific product brands like DOWLEX™ polyethylene resins and DOWSIL™ silicone technologies that maintain strong recognition in their respective markets.

Chevron Phillips Chemical, while less recognized among general consumers, maintains strong brand equity within the petrochemical industry and among direct customers. The company’s branding leverages the heritage and recognition of its parent companies while establishing its own identity in specific product categories. Chevron Phillips Chemical’s product brands like Marlex® polyethylene and Soltex® drilling chemicals have established strong positions in their respective market segments.

Industry Partnerships and Collaborations

Both companies maintain extensive networks of industry partnerships, though with different emphasis and scope:

Dow’s Collaborative Ecosystem

Dow has established a broad collaborative network spanning customers, suppliers, academic institutions, and even competitors in certain areas. Notable examples include:

Customer Innovation Centers: Dow operates dedicated innovation centers with major customers in packaging, infrastructure, and consumer goods, enabling collaborative development of new applications and solutions.

Academic Partnerships: The company maintains research collaborations with leading universities globally, including substantial programs with institutions like MIT, the University of Michigan, and several European and Asian universities.

Industry Consortia: Dow participates in numerous industry collaborations addressing shared challenges, including the Alliance to End Plastic Waste, the World Business Council for Sustainable Development, and various industry standards organizations.

Chevron Phillips Chemical’s Partnership Approach

Chevron Phillips Chemical’s partnership strategy reflects its more focused business model and joint venture heritage:

Joint Ventures: The company has established successful manufacturing joint ventures in strategic regions, particularly in the Middle East with partners including Saudi Industrial Investment Group (SIIG) and Qatar Petroleum.

Technology Licensing: Chevron Phillips Chemical licenses its proprietary technologies, particularly in polyethylene production, to other producers globally, creating strategic relationships throughout the industry.

Industry Associations: The company maintains active participation in industry organizations including the American Chemistry Council, the Plastics Industry Association, and the Alliance to End Plastic Waste, collaborating on shared industry challenges.

Regulatory Compliance and ESG Performance

Environmental, social, and governance (ESG) performance has become increasingly important for chemical industry reputation and stakeholder relationships. Both companies have established comprehensive ESG programs, though with different emphasis and external recognition:

| ESG Dimension | Dow | Chevron Phillips Chemical |

| Environmental Compliance | Strong overall compliance record with some legacy issues; transparent disclosure of environmental incidents | Strong compliance record with comprehensive environmental management systems; limited public disclosure of specific metrics |

| Sustainability Reporting | Comprehensive annual ESG report aligned with GRI, SASB, and TCFD frameworks; third-party verified data | Annual sustainability report with selected metrics; less comprehensive than Dow’s disclosure |

| External ESG Ratings | Strong ratings from major ESG rating agencies; included in Dow Jones Sustainability Index | Limited participation in external ESG rating programs; fewer public ratings available |

| Diversity & Inclusion | Industry-leading D&I programs; transparent disclosure of workforce demographics and goals | Established D&I initiatives with less public disclosure of specific metrics |

| Community Engagement | Global citizenship program with significant philanthropic activities across operating regions | Strong community presence near major operating sites; focused on education and safety initiatives |

Industry Leadership and Influence

Both companies maintain significant industry influence, though expressed through different channels and priorities:

Dow has established itself as a thought leader on industry-wide challenges including sustainability, circular economy, and climate action. The company’s executives frequently serve in leadership positions in major industry associations and speak at high-profile global forums including the World Economic Forum. Dow’s scale and diverse portfolio give it substantial influence across multiple chemical industry segments and value chains.

Chevron Phillips Chemical exercises more focused industry leadership in its core areas of expertise, particularly in polyethylene technology and olefins production. The company’s technical expertise in these areas is widely respected, and it has influenced industry standards and practices through its technology licensing activities. Its joint ownership by two energy majors also provides unique perspective and influence at the intersection of the energy and petrochemical sectors.

“While both companies maintain strong industry reputations, Dow has leveraged its scale and history to establish broader influence across multiple stakeholder groups, while Chevron Phillips Chemical has built deep credibility in specific market segments where it maintains leadership positions.”

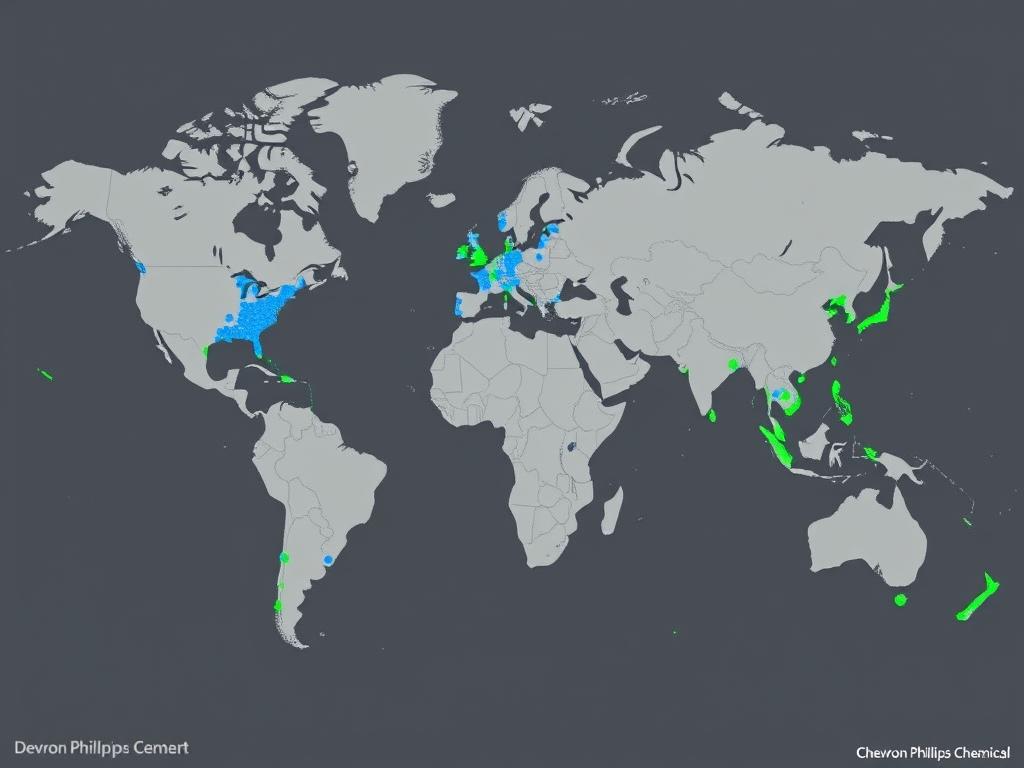

Global Footprint and Supply Chain

The manufacturing networks and supply chain capabilities of Dow and Chevron Phillips Chemical represent critical competitive assets that influence their market access, cost positions, and operational resilience. Their different approaches to global footprint development reflect their strategic priorities and historical evolution.

Manufacturing Footprint Comparison

Dow’s Global Manufacturing Network

Dow operates one of the chemical industry’s most extensive global manufacturing networks, with 106 production sites across 31 countries. This footprint includes:

Integrated Production Hubs: Dow’s manufacturing strategy centers on large, integrated production complexes that enable operational synergies and logistics efficiencies. Major integrated sites include:

- Freeport, Texas: Dow’s largest global manufacturing site, producing over 100 different products

- Terneuzen, Netherlands: The company’s largest European complex, recently expanded with additional ethylene capacity

- Map Ta Phut, Thailand: A major integrated site serving Asian markets

- Bahia Blanca, Argentina: Dow’s largest Latin American manufacturing complex

Regional Manufacturing: Beyond these major hubs, Dow maintains numerous smaller manufacturing sites producing specialty products closer to regional customers. This distributed manufacturing approach supports the company’s customer-centric strategy in higher-value segments.

Joint Ventures: Dow has established strategic manufacturing joint ventures in certain regions, including significant operations in Kuwait (with PIC), Thailand (with SCG), and South Korea (with SKC).

Chevron Phillips Chemical’s Focused Production Base

Chevron Phillips Chemical operates a more concentrated manufacturing footprint, with approximately 30 production facilities globally, primarily in the United States and Middle East:

U.S. Gulf Coast Concentration: The company’s manufacturing strategy emphasizes large-scale, efficient production in regions with advantaged feedstocks. Major U.S. Gulf Coast sites include:

- Sweeny/Old Ocean, Texas: Major ethylene and polyethylene complex

- Cedar Bayou, Texas: Integrated site producing ethylene, polyethylene, and alpha olefins

- Port Arthur, Texas: Joint venture ethylene facility with Total

Middle Eastern Joint Ventures: Chevron Phillips Chemical has established strategic joint ventures in Saudi Arabia and Qatar to leverage low-cost ethane feedstocks:

- Saudi Polymers Company (SPCo): Joint venture with Saudi Industrial Investment Group

- Qatar Chemical Company (Q-Chem): Joint venture with Qatar Petroleum

Specialty Manufacturing: The company maintains several specialized production facilities focused on performance products, including its Borger, Texas, plant (specialty chemicals) and Beringen, Belgium, facility (polyalphaolefins).

Supply Chain Capabilities

The logistics networks and supply chain capabilities of both companies reflect their different manufacturing footprints and go-to-market strategies:

| Supply Chain Dimension | Dow | Chevron Phillips Chemical |

| Logistics Infrastructure | Extensive proprietary logistics assets including marine terminals, rail facilities, and storage terminals across global markets | Focused logistics infrastructure primarily in North America and Middle East, with strategic export terminals for global distribution |

| Distribution Model | Hybrid approach combining direct sales to large customers with extensive distributor network for broader market access | Primarily direct sales model for major products, with selective use of distributors for specialty offerings and smaller markets |

| Digital Capabilities | Advanced digital supply chain capabilities including AI-powered demand forecasting and integrated customer portals | Growing digital capabilities focused on operational efficiency and customer service improvements |

| Supply Chain Resilience | High resilience through geographic diversification, multiple production sites for key products, and extensive backup capabilities | More concentrated production creates some vulnerability, partially offset by strategic inventory positioning |

Raw Material Sourcing Strategies

The approaches to feedstock sourcing represent another important difference between the two companies:

Dow’s Feedstock Flexibility

Dow has developed significant feedstock flexibility across its global operations, allowing it to optimize raw material selection based on regional economics:

North America: The company’s U.S. Gulf Coast operations can process multiple feedstocks, from ethane to heavier liquids, allowing optimization based on relative prices. Dow has invested in capabilities to increase ethane cracking capacity to leverage advantaged shale gas economics.

Europe: Dow’s European crackers primarily use naphtha and other liquid feedstocks derived from crude oil, reflecting the regional feedstock availability. The company has invested in furnace flexibility to process lighter feeds when economically advantageous.

Asia: Dow’s Asian operations utilize diverse feedstocks depending on local availability, including naphtha in Korea and mixed feeds in Thailand.

This feedstock flexibility provides Dow with a degree of insulation from volatility in any single raw material market, though it also requires more complex manufacturing capabilities and higher capital investment.

Chevron Phillips Chemical’s Feedstock Focus

Chevron Phillips Chemical has pursued a more focused feedstock strategy centered on advantaged natural gas liquids:

North America: The company’s U.S. Gulf Coast ethylene crackers are primarily configured to process ethane derived from natural gas, reflecting its strategic emphasis on leveraging the U.S. shale gas advantage. This focus has supported competitive production costs during periods of favorable gas-to-oil price spreads.

Middle East: Chevron Phillips Chemical’s joint ventures in Saudi Arabia and Qatar utilize ethane feedstocks available at advantaged pricing through its partnerships with national oil companies. These operations consistently maintain some of the lowest production costs globally.

This concentrated focus on ethane cracking in advantaged regions has generally supported strong cost positions, though with less flexibility during periods when heavier feedstocks become relatively more economical.

Operational Excellence and Manufacturing Efficiency

Both companies have established comprehensive operational excellence programs to maximize manufacturing efficiency and reliability:

Dow has implemented its Operations Management System globally, driving consistent manufacturing practices across its diverse production network. The company has reported significant improvements in key operational metrics, including a 40% reduction in process safety incidents over the past decade. Dow’s manufacturing digitalization initiative represents a major focus area, with investments in advanced process control, predictive maintenance, and manufacturing analytics to further improve efficiency.

Chevron Phillips Chemical leverages operational excellence methodologies derived from its parent companies’ energy sector heritage. The company’s “Our Journey to Zero” initiative focuses on eliminating safety incidents, environmental releases, and process safety events. Chevron Phillips Chemical has reported industry-leading performance in several operational metrics, including employee safety rates consistently below industry averages.

Challenges and Future Outlook

The petrochemical industry faces transformative challenges in the coming decade, from sustainability pressures and feedstock volatility to shifting demand patterns and competitive dynamics. How Dow and Chevron Phillips Chemical navigate these challenges, including changes in cracker plant operations and material prices, will significantly influence their future market positions and financial performance, with projections of 1.2 billion in profit recovery each year.

Industry Challenges and Disruptions

Sustainability Transformation

Both companies face increasing pressure to address the environmental impact of plastic products and petrochemical production:

Circular Economy: Growing regulatory and consumer pressure to develop circular solutions for plastic waste represents both a challenge and opportunity. Extended producer responsibility regulations in Europe and emerging policies in other regions will require significant business model adaptation.

Carbon Reduction: Decarbonizing petrochemical production, which is both energy-intensive and generates process emissions, presents substantial technical and economic challenges. Carbon pricing mechanisms and customer demands for lower-carbon products are accelerating the need for transformation.

Chemical Regulation: Increasing regulatory scrutiny of chemical substances globally requires ongoing product stewardship investments and may threaten certain product categories over time.

Market and Competitive Dynamics

The competitive landscape continues to evolve with several important trends:

Middle East Expansion: Continued capacity growth in the Middle East, leveraging advantaged feedstocks, will maintain pressure on global markets. Saudi Aramco’s petrochemical growth strategy and expansion plans from other regional players will add significant new capacity.

China’s Self-Sufficiency: China’s drive toward petrochemical self-sufficiency through massive domestic investments threatens traditional export opportunities to the world’s largest chemical market.

Industry Consolidation: Ongoing consolidation in mature markets may create both competitive threats and potential acquisition opportunities for established players.

Feedstock and Energy Volatility

The petrochemical industry faces continued uncertainty in energy markets:

Natural Gas Dynamics: Volatility in natural gas markets, influenced by geopolitical factors and energy transition policies, creates uncertainty for ethane-based producers.

Energy Transition: The broader energy transition toward renewables and electrification will reshape traditional relationships between refining and petrochemicals, potentially disrupting feedstock availability patterns.

Technology Disruption

Emerging technologies present both opportunities and threats:

Bio-based Alternatives: Continued development of bio-based and renewable chemicals could disrupt traditional petrochemical markets, particularly in specialty applications.

Digital Transformation: Advanced analytics, artificial intelligence, and process automation are reshaping manufacturing operations and customer engagement models, requiring significant capability development.

Strategic Responses and Future Positioning

Dow and Chevron Phillips Chemical have articulated different strategic priorities to address these industry challenges:

| Strategic Priority | Dow’s Approach | Chevron Phillips Chemical’s Approach |

| Portfolio Evolution | Continued shift toward higher-value materials and solutions; potential further pruning of commodity businesses | Maintaining core focus on olefins and polyolefins while selectively expanding specialty offerings |

| Sustainability Strategy | Comprehensive transformation program with specific targets for carbon reduction, circular economy, and safer materials | Focused initiatives in advanced recycling and operational footprint reduction; leveraging parent company capabilities |

| Geographic Priorities | Balanced global approach with continued investment across regions; selective growth in high-growth markets | Continued emphasis on advantaged production regions (U.S. Gulf Coast, Middle East) with export-oriented strategy |

| Innovation Focus | Broad innovation portfolio spanning multiple technology platforms; emphasis on sustainability-enabling materials | Focused innovation in core polyolefin technologies and applications; targeted development in circular solutions |

| Digital Transformation | Comprehensive digital strategy spanning manufacturing, supply chain, and customer engagement | Targeted digital investments focused on operational excellence and efficiency improvements |

Growth Initiatives and Investment Plans

Dow’s Strategic Priorities

Dow has outlined several key growth initiatives for the coming years:

Circular Economy Leadership: The company has committed to enabling 1 million metric tons of plastic to be collected, reused, or recycled by 2030 and to have 100% of its products sold into packaging applications be reusable or recyclable by 2035.

Low-Carbon Manufacturing: Dow plans to allocate approximately $1 billion annually to decarbonization projects, with a goal of achieving carbon neutrality by 2050. The company is pursuing multiple pathways including renewable energy procurement, process electrification, and carbon capture.

Higher-Value Portfolio: Dow continues to emphasize growth in higher-margin applications and specialty materials, particularly in packaging, infrastructure, consumer care, and mobility markets.

Digital Acceleration: The company is investing in digital capabilities across its value chain, from manufacturing operations to customer engagement platforms, to drive efficiency and enhance service delivery.

Chevron Phillips Chemical’s Strategic Priorities

Chevron Phillips Chemical has identified several strategic focus areas:

Advanced Recycling Scale-Up: The company aims to produce 450,000 metric tons of circular polyethylene annually by 2030 through its Marlex Anew Circular Polyethylene program, leveraging pyrolysis oil derived from plastic waste.

Normal Alpha Olefins Leadership: Chevron Phillips Chemical continues to strengthen its position in the high-value normal alpha olefins market, where it maintains global leadership and attractive margins.

Operational Excellence: The company emphasizes continuous improvement in manufacturing efficiency and reliability across its asset base, with particular focus on digitalization of operations.

Selective Growth Projects: While not pursuing the scale of expansion seen in the previous decade, Chevron Phillips Chemical continues to evaluate targeted growth opportunities, particularly in advantaged feedstock regions and specialty applications.

Competitive Outlook: Who Will Lead?

The relative competitive positions of Dow and Chevron Phillips Chemical will likely evolve in response to industry trends and their strategic execution:

Scale and Diversification Advantage: Dow’s larger scale and more diverse portfolio provide certain advantages in navigating industry volatility and investing in transformation. The company’s broader technology base and customer relationships support multiple pathways for growth and adaptation.

Focused Execution Opportunity: Chevron Phillips Chemical’s more concentrated business model allows for focused execution in its core markets. The company’s advantaged feedstock position and joint venture structure provide resilience in certain market scenarios, particularly those favoring low-cost producers.

Sustainability Transformation: Both companies face the imperative to transform their business models for a more circular, lower-carbon future. Dow’s broader research capabilities and customer relationships may provide advantages in developing comprehensive solutions, while Chevron Phillips Chemical’s focused approach allows for targeted initiatives in its core markets.

Digital Capabilities: The development of digital capabilities across manufacturing, supply chain, and customer engagement will increasingly influence competitive positioning. Dow’s larger scale supports more substantial digital investments, though focused applications may allow Chevron Phillips Chemical to achieve similar benefits in specific areas.

“The petrochemical industry stands at an inflection point where traditional competitive advantages based solely on scale and feedstock position are being complemented—and in some cases superseded—by capabilities in sustainability, digitalization, and customer-centric innovation. How companies navigate this transition will determine the industry leaders of tomorrow.”

Conclusion: The Balance of Power in Petrochemicals

The comparison between Dow and Chevron Phillips Chemical reveals two companies with fundamentally different approaches to the petrochemical market. Dow leverages its scale, diversification, and innovation capabilities to maintain leadership across multiple product categories and regions. Its comprehensive sustainability strategy and digital transformation initiatives position it to navigate the industry’s evolving landscape, though legacy assets and broad portfolio management create certain challenges.

Chevron Phillips Chemical, with its more focused business model and advantaged feedstock position, maintains strong competitiveness in its core markets despite its smaller overall scale. The company’s strategic clarity and operational discipline support consistent performance in its chosen segments, though its more concentrated portfolio and geographic footprint create different risk exposures.

Rather than declaring a single “winner” in this comparison, the analysis suggests that both companies are positioned to succeed in their respective strategic approaches. Dow’s broader capabilities and diverse portfolio provide resilience across multiple market scenarios, while Chevron Phillips Chemical’s focused strategy and parent company relationships support excellence in its core businesses.

As the petrochemical industry navigates transformative challenges in sustainability, digitalization, and shifting market dynamics, the relative competitive positions of these companies will continue to evolve. Their success will depend not only on strategic choices but on execution excellence in an increasingly complex and demanding business environment.