The economic battleground of Africa has long been contested by former colonial powers, with France and the United Kingdom emerging as significant players with distinct approaches to maintaining influence. As Africa’s economic potential continues to grow, understanding the comparative advantages and strategies of these European powers becomes increasingly important for analysts, investors, and policymakers alike. This analysis examines the complex dynamics of French and British economic presence across the continent, evaluating their historical foundations, current footprints, and future trajectories.

Historical Legacy and Entry Points

Historical map showing French (blue) and British (red) colonial territories in Africa, which established the foundation for modern economic relationships

The colonial strategies employed by France and the UK have profoundly shaped their current economic relationships with African nations. France implemented a system of direct rule and cultural assimilation, creating deep linguistic and administrative ties particularly in West and Central Africa. This approach established the controversial CFA franc currency zone, which continues to bind 14 African nations to French monetary policy.

In contrast, Britain’s indirect rule through local authorities created more autonomous governance structures while maintaining economic ties through the Commonwealth. This difference in colonial administration has influenced how each country approaches trade relationships today, with France maintaining more centralized control in its former territories while British engagement tends to be more commercially driven and less politically entangled.

Primary Economic Sectors and Investment Areas

French Economic Focus

- Energy sector dominance through TotalEnergies operations across 40+ African countries

- Infrastructure development, particularly in transportation (Bolloré Africa Logistics)

- Telecommunications (Orange) with strong presence in Francophone markets

- Banking and financial services (Société Générale, BNP Paribas)

- Agricultural products and food processing industries

British Economic Focus

- Financial services and investment banking (Standard Chartered, Barclays Africa)

- Mining and resource extraction (Anglo American, Rio Tinto)

- Consumer goods and retail (Unilever, Diageo)

- Pharmaceutical and healthcare sectors

- Technology and telecommunications (Vodafone)

The sectoral focus reveals distinct approaches: France concentrates on infrastructure and energy in Francophone regions, while the UK leverages its financial expertise and focuses on consumer markets across Anglophone Africa. French investments tend to be more state-aligned, while British investments are typically driven by private sector interests with less direct government involvement.

Strengths and Weaknesses in Engagement Models

French Engagement Model

- Strengths: Strong linguistic advantage in Francophone countries; established currency integration through CFA franc; comprehensive diplomatic presence

- Opportunities: Leveraging historical ties to expand beyond traditional sectors; potential to modernize monetary relationships

French Engagement Challenges

- Weaknesses: Perception of neocolonialism; growing anti-French sentiment in some regions; restrictive monetary policies

- Threats: Rising competition from China and other powers; youth-led movements against French influence

British Engagement Model

- Strengths: Strong financial services expertise; Commonwealth network; English language advantage in business; flexible investment approach

- Opportunities: Post-Brexit trade agreements; growing tech sector investments; educational partnerships

British Engagement Challenges

- Weaknesses: Less coordinated government strategy; diminished diplomatic presence compared to colonial era; Brexit disruptions

- Threats: Loss of EU-backed investment guarantees; increasing competition from US, China, and emerging powers

The engagement models reflect fundamentally different approaches: France maintains stronger political control but faces growing resistance, while the UK adopts a more commercially-driven approach that sometimes lacks strategic coordination. Both nations are adapting their strategies in response to changing African priorities and increasing global competition.

Trade Volume and Economic Footprint

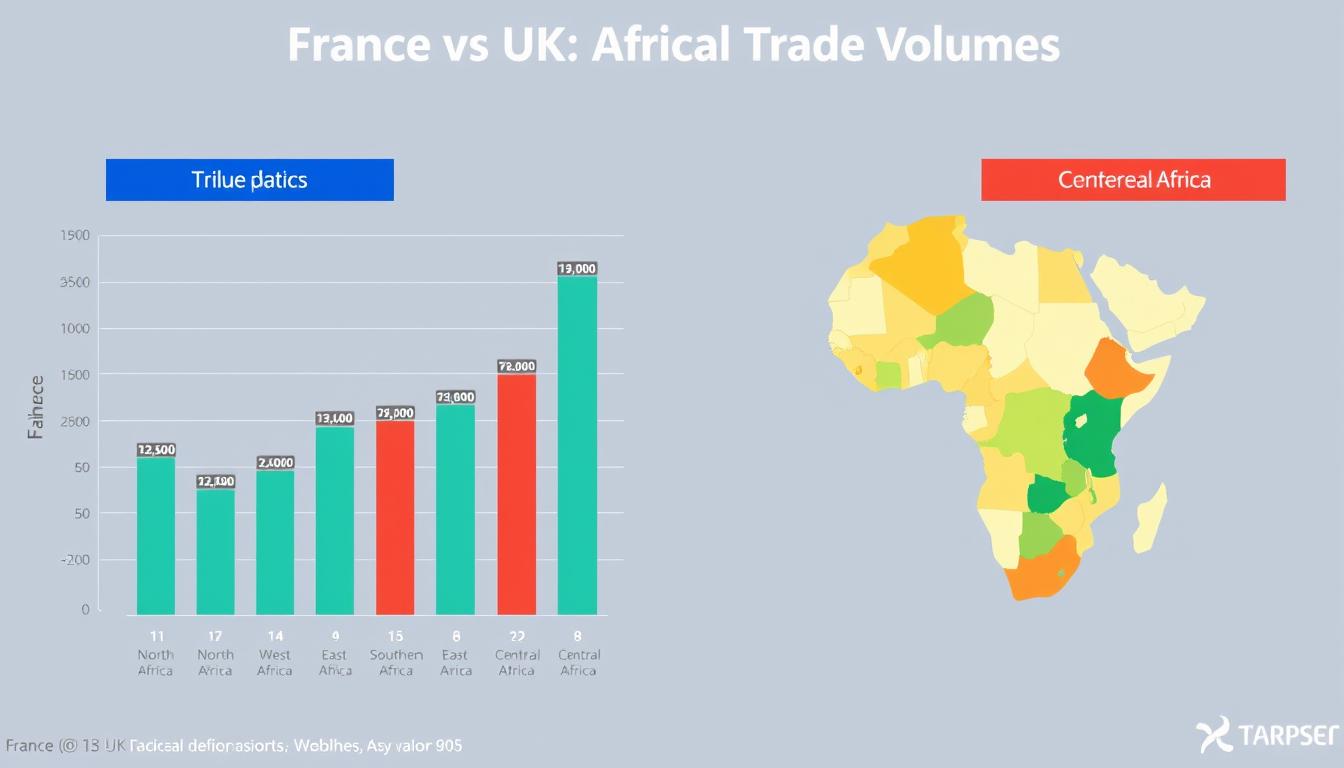

Comparative analysis of French and British trade volumes with African regions (2022 data)

| Metric | France | United Kingdom |

| Total Trade Volume (2022) | €27.5 billion | £18.9 billion |

| Primary Export Markets | Morocco, Algeria, Tunisia, Senegal, Ivory Coast | South Africa, Nigeria, Egypt, Kenya, Ghana |

| Main Exports | Machinery, pharmaceuticals, agricultural products, refined petroleum | Vehicles, machinery, pharmaceuticals, technology, financial services |

| Main Imports | Hydrocarbons, agricultural products, textiles, minerals | Crude oil, precious metals, fruits, coffee, tea |

| Trade Agreements | EU Economic Partnership Agreements, bilateral investment treaties | Post-Brexit continuity agreements, Developing Countries Trading Scheme |

France maintains higher overall trade volumes with Africa, particularly with North and West African nations, while the UK shows stronger commercial relationships with South Africa and Nigeria. The composition of trade also differs significantly, with France more focused on infrastructure and energy projects while the UK emphasizes consumer goods and services.

Technological Collaboration and Innovation Transfer

French-backed technology innovation hub in Dakar, Senegal, representing growing tech collaboration

French Tech Initiatives

- Digital Africa initiative supporting startups across Francophone countries

- Orange Digital Centers providing coding and entrepreneurship training

- AFD Digital Challenge funding innovative solutions to development challenges

- Strong focus on mobile banking solutions through Orange Money

British Tech Initiatives

- UK-Africa Tech Hub program operating in Kenya, Nigeria, and South Africa

- CDC Group (now British International Investment) funding for African tech ventures

- London Stock Exchange ELITE program for African scale-ups

- Fintech partnerships through the City of London’s financial expertise

Both countries are increasingly focusing on technology transfer and digital innovation, recognizing Africa’s potential as a growth market for tech solutions. France leverages its telecom presence through Orange to deploy mobile solutions, while the UK capitalizes on London’s status as a global fintech hub to foster partnerships with African financial technology companies.

Sustainability and Development Assistance

Comparative approaches to sustainable development: French solar energy project (left) and British agricultural initiative (right)

How does French development assistance compare to British aid in Africa?

France provides approximately €4.5 billion annually in official development assistance to Africa, with a significant portion directed through the French Development Agency (AFD). This assistance focuses heavily on climate adaptation, infrastructure, and education in Francophone countries. The UK, through its Foreign, Commonwealth & Development Office (FCDO), allocates around £2.7 billion to African development, with emphasis on governance, economic development, and health systems primarily in Anglophone nations.

What are the key differences in sustainability approaches?

France’s sustainability initiatives tend to be more state-directed and integrated with its broader strategic interests, particularly in energy security and climate policy. French companies like TotalEnergies are major investors in African renewable energy. The UK takes a more market-based approach, using public-private partnerships and focusing on creating enabling environments for sustainable business. British initiatives like the Climate Finance Accelerator exemplify this approach by mobilizing private capital for climate projects.

Both nations have committed to shifting development assistance toward sustainability goals, though their implementation approaches differ significantly. France maintains stronger governmental direction of sustainability initiatives, while the UK emphasizes private sector leadership with government support.

Financial Institutions and Market Influence

Société Générale branch in Dakar, representing French banking dominance in Francophone Africa

The financial sector reveals one of the starkest contrasts between French and British approaches. French banks like BNP Paribas and Société Générale maintain extensive branch networks across Francophone Africa, particularly within the CFA franc zone, while British influence is exercised more through investment banking, private equity, and London’s role as a capital-raising hub for African businesses. The CFA franc system gives French financial institutions structural advantages in West African states and Central Africa, ensuring they can effectively manage foreign exchange reserves and prices, while British firms leverage London’s global financial expertise to navigate the complexities of foreign exchange and guarantee resources. This dynamic reflects the historical context of colonial ties and the ongoing influence of former colonial powers in the region.

Diplomatic Reputation and Soft Power

Cultural influence comparison: Alliance Française (left) and British Council (right) facilities in African capitals

Cultural Institutions

France maintains 131 Alliance Française centers across Africa compared to the UK’s 85 British Council locations. French cultural promotion receives approximately €120 million in annual funding specifically for African initiatives, while British Council operations in Africa operate on a budget of approximately £95 million.

Educational Influence

France hosts over 150,000 African students annually in its universities, with specialized scholarship programs for Francophone countries. The UK attracts approximately 35,000 African students yearly, with the Chevening Scholarship as its flagship program, though British universities maintain numerous satellite campuses across Anglophone Africa.

Military Presence

France maintains permanent military bases in Djibouti, Ivory Coast, Gabon, and Senegal, with approximately 5,000 troops deployed across the Sahel region. The UK has a permanent training base in Kenya and smaller military cooperation agreements with Nigeria, Sierra Leone, and other Commonwealth nations.

France invests more heavily in cultural and linguistic promotion, maintaining a larger network of cultural centers and educational exchanges in the context of France vs UK African markets. The UK’s soft power approach emphasizes educational partnerships and governance support rather than direct cultural promotion, reflecting the dynamics of foreign exchange reserves and the colonial currency legacy in African states. Both nations leverage their permanent UN Security Council seats to advocate for their African allies in international forums, influencing the CFA franc zone and the economic landscape of West African states.

Geographic Reach and Regional Focus

Geographic distribution of French (blue) and British (red) economic influence across African regions

| Region | French Presence | British Presence | Dominant Power |

| North Africa | Strong (Morocco, Algeria, Tunisia) | Moderate (Egypt) | France |

| West Africa | Very Strong (Senegal, Ivory Coast, Mali) | Moderate (Ghana, Nigeria) | France |

| Central Africa | Strong (Cameroon, Gabon, Congo) | Limited | France |

| East Africa | Limited (Djibouti) | Strong (Kenya, Uganda, Tanzania) | UK |

| Southern Africa | Moderate (Madagascar) | Very Strong (South Africa, Botswana, Zimbabwe) | UK |

The geographic distribution of influence largely follows colonial boundaries, with France dominant in Francophone West and Central Africa and the Maghreb region, while the UK maintains stronger positions in Anglophone East and Southern Africa. This distribution is a direct result of historical colonial practices that established entrenched economic and political ties, which continue to shape relationships today. Both powers are attempting to expand beyond their traditional spheres, with France making significant inroads in East Africa through various infrastructure projects, such as roads and energy initiatives, aimed at enhancing connectivity and trade. Meanwhile, the UK is seeking greater engagement in West Africa, particularly Nigeria, where it has invested in technology and education sectors to strengthen its influence. This strategic maneuvering reflects a broader trend of both nations adapting to the evolving geopolitical landscape in Africa, where new players, including China, are also vying for influence and investment opportunities.

Challenges and Future Trajectory

Chinese-built railway in Kenya, representing the growing competition to traditional European influence in Africa

Key Challenges to European Dominance in Africa

- China’s Belt and Road Initiative has committed over $150 billion to African infrastructure, dwarfing European investments

- Growing Russian influence in security sectors, particularly in the Sahel and Central Africa

- Turkey, India, and Gulf states rapidly expanding commercial footprints

- Rising pan-African sentiment and resistance to perceived neocolonial relationships

- African Continental Free Trade Area creating new intra-African trade opportunities

Both France and the UK face significant challenges to their traditional dominance in African markets. Rising competition from China, which has become Africa’s largest trading partner, threatens European commercial positions. This shift is evident in the numerous infrastructure projects funded by Chinese investments across the continent, which not only bolster economic ties but also enhance China’s geopolitical influence.

Meanwhile, growing anti-French sentiment in the Sahel region, fueled by perceptions of neocolonialism and past military interventions, complicates France’s efforts to maintain its historical relationships. Additionally, post-Brexit trade disruptions for the UK create additional hurdles, as the nation seeks to redefine its role in Africa amidst a backdrop of shifting alliances and economic partnerships.

France is responding with initiatives like “Choose Africa” to support entrepreneurship and attempts to reform the controversial CFA franc system. This initiative aims to empower African entrepreneurs by providing access to financing, training, and mentorship, thereby fostering local innovation and economic growth. The program also seeks to enhance cooperation between French and African businesses, creating a more balanced economic partnership.

The UK’s post-Brexit “Global Britain” strategy emphasizes new bilateral trade agreements and increased development finance through British International Investment. This strategy is designed to open up new markets for British companies while promoting sustainable development projects across the continent. Both nations are adapting their approaches to emphasize partnership rather than historical dominance, though with varying degrees of success. As they navigate these complex relationships, they are increasingly focusing on mutual benefits and respect for African agency, recognizing that a collaborative approach is essential for long-term success.

Conclusion: Comparative Advantages in a Changing Landscape

Modern business district in Nairobi, representing Africa’s evolving economic landscape and changing relationship with European powers

The competition between France and the UK for economic influence in Africa reveals distinct approaches shaped by colonial legacies and contemporary strategic priorities. France maintains stronger political and monetary control in its traditional spheres of influence but faces growing resistance to perceived neocolonial relationships. The UK adopts a more commercially-driven approach with less direct political entanglement but sometimes lacks strategic coordination.

While France currently maintains larger overall trade volumes and more extensive banking networks across Africa, the UK demonstrates advantages in financial services innovation and educational partnerships. Both nations are being forced to adapt their strategies in response to growing competition from China and other emerging powers, as well as increasing African agency in determining economic partnerships.