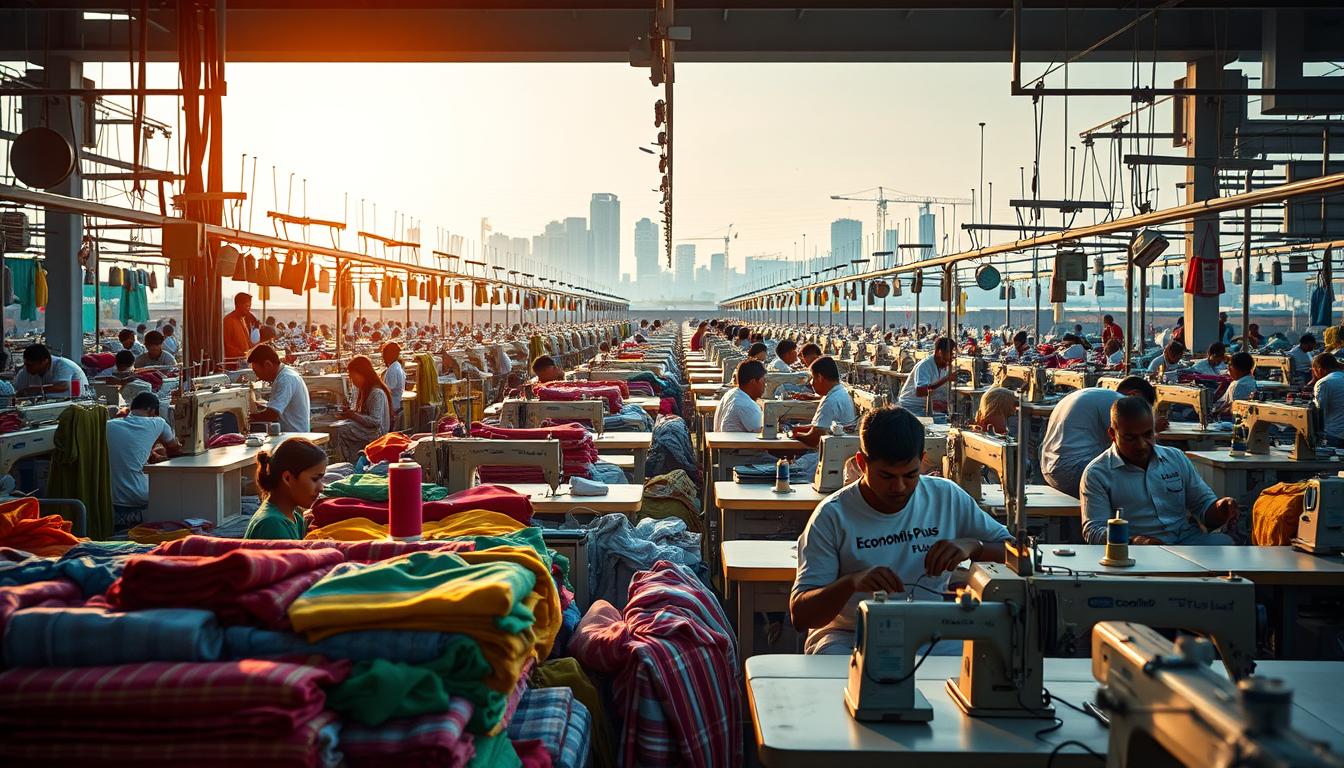

Could a nation once synonymous with poverty reshape its destiny through clothing? Bangladesh’s journey from agrarian roots to becoming the world’s second-largest apparel exporter defies expectations. Between 2011 and 2019, overseas sales of textiles surged from $14.6 billion to $33.1 billion, fueling unprecedented economic shifts.

This sector now employs over 4 million workers, primarily women, and accounts for 84% of the country’s total exports. International brands like H&M and Walmart rely heavily on Bangladeshi factories. Yet this success followed dark chapters—the 2013 Rana Plaza collapse killed 1,134 workers, triggering global outrage and safety reforms.

Modern factories now meet strict international standards, with over 3,900 facilities upgraded through initiatives like the Accord on Fire and Building Safety. These changes helped exports nearly double in eight years while improving working conditions. The government’s strategic policies, including tax incentives and export processing zones, further accelerated growth.

This analysis explores how textile trade reshaped national infrastructure, reduced poverty rates by 50% since 2000, and positioned Bangladesh as a development model. While challenges like wage disputes persist, the industry’s evolution offers lessons in economic transformation through targeted industrialization.

Key Takeaways

- Textile exports skyrocketed 127% between 2011-2019, reaching $33.1 billion

- Post-Rana Plaza safety programs upgraded 3,900+ factories

- Apparel sales generate 84% of Bangladesh’s total export income

- Industry employs 4 million+ workers, mostly women from rural areas

- Poverty rates halved since 2000 due to manufacturing growth

Historical Evolution of Bangladesh’s Garment Industry

The foundation of Bangladesh’s apparel dominance traces back to modest tailoring shops in the 1970s. Following independence in 1971, entrepreneurs began stitching basic garments for local markets. By 1978, a breakthrough occurred when a Dhaka-based firm shipped 10,000 woven shirts to France—the nation’s first major international order.

Post-Independence Beginnings

Early operations relied on manual sewing machines and limited infrastructure. These small-scale workshops often struggled with inconsistent quality and production delays, which hindered their ability to compete in the burgeoning global market. Government reforms in 1980 removed export taxes for textile firms, sparking initial growth and encouraging more entrepreneurs to enter the industry.

This pivotal change provided a much-needed financial incentive for manufacturers, allowing them to invest in better equipment and training. The Multi-Fiber Arrangement (MFA) system later granted quota-free access to Western markets, enabling rapid scaling of production. This access not only facilitated an influx of foreign investment but also led to the establishment of more structured supply chains, further solidifying Bangladesh’s position as a competitive player in the global apparel sector.

Milestones in Industry Growth

Three pivotal developments shaped the sector:

- 1985: Ready-made garments surpassed jute as the top export

- 1990s: Factories adopted automated cutting machines

- 2005: WTO’s quota-free regime boosted annual export growth to 16%

Strategic partnerships with global buyers transformed small workshops into vertically integrated factories. By 2010, over 5,000 manufacturing units operated nationwide, employing 3.2 million workers. These structural changes positioned the country as a key player in global apparel trade.

Impact on National Economic Growth

The textile sector’s rise reshaped financial landscapes across South Asia. Ready-made garments now generate 84% of export earnings, creating an economic engine that lifted GDP growth from 6% to 7% annually over the past decade. This expansion turned the nation into the world’s second-largest apparel supplier after China.

Foreign exchange reserves surged from $19 billion to $42 billion between 2013-2023, stabilizing currency values. “This sector became our economic lifeblood,” notes a Dhaka-based trade analyst. Export revenues funded critical infrastructure projects, including new highways and power plants serving industrial zones.

Three key growth drivers emerged:

- Annual textile shipments exceeding $45 billion since 2022

- Direct employment for 4 million workers

- Secondary job creation in logistics and raw material supply chains

Rural communities saw particular transformation. Wages from factory jobs increased household incomes by 300% in manufacturing hubs since 2010. These earnings helped reduce national poverty rates from 31% to 18% over two decades.

The industry’s success attracted major global retailers. Over 60% of European fast fashion brands now source products from Bangladeshi exporters. This market dominance ensures continued economic momentum as companies invest in automation and sustainable practices.

The Role of Trade Policies and Export Strategies

Strategic reforms in international commerce frameworks propelled Bangladesh’s textile sector to global prominence. Central to this success were calculated adjustments to trade regulations and targeted support systems for manufacturers. These reforms not only streamlined the export process but also fostered a more competitive environment, allowing local producers to enhance their capabilities and meet international standards.

By implementing measures such as reducing tariffs on imported machinery and raw materials, the government significantly lowered production costs. This enabled manufacturers to invest in better technology and training for their workforce, thereby improving product quality and increasing production efficiency.

Furthermore, the establishment of trade partnerships and participation in global supply chains facilitated access to larger markets, ensuring that Bangladeshi textiles could compete effectively on the world stage.

Government Initiatives and Reforms

The bonded warehouse system revolutionized production costs by letting factories import raw materials duty-free. Eight specialized export processing zones emerged between 2000-2015, offering tax holidays and streamlined customs procedures. These zones now handle 32% of total textile shipments.

Key policy changes included:

- 15% cash incentives for non-traditional product lines

- Duty exemptions on machinery imports

- Simplified export documentation processes

Trade Liberalization and Preferential Access

Preferential trade agreements with the EU and USA proved transformative. The EU’s Everything But Arms initiative granted tariff-free access for 60% of Bangladesh’s textile products. This advantage helped capture 12% of Europe’s apparel imports by 2022.

“Our competitiveness stems from smart policy alignment with global market demands,” observes a Dhaka-based trade economist. Automation investments and upgraded management systems further enhanced efficiency, with 68% of factories adopting ERP software by 2023.

These strategic moves solidified Bangladesh’s position as a preferred sourcing hub. The country now supplies 7% of America’s clothing imports, leveraging cost advantages amplified by thoughtful trade governance.

Global Market Penetration and Competitiveness

Strategic market expansion and adaptive production capabilities have propelled Bangladesh into new international commerce territories. This proactive approach has not only diversified the country’s export portfolio but also strengthened its resilience against global economic fluctuations. While Europe and North America remain critical buyers, exporters now ship apparel to 167 countries, including emerging markets like Japan and South Africa.

This expansion into diverse markets has allowed Bangladeshi manufacturers to tap into new consumer bases, increasing their competitiveness on a global scale and reducing their dependency on traditional markets.

Diversification of Export Markets

Non-traditional destinations now account for 18% of textile shipments, up from 9% in 2015. This shift reduced reliance on Western markets, which previously represented 82% of total exports. Firms increasingly target Middle Eastern and Australian buyers, with shipments to Saudi Arabia growing 47% annually since 2020.

Shifting Global Sourcing Trends

Competitors like Vietnam gained ground in technical fabrics, but Bangladeshi manufacturers countered by expanding into high-value categories. Activewear exports surged 210% over five years, capturing 11% of the global market for yoga apparel. Leading firms adopted digital design tools to meet fast-fashion turnaround demands from brands like Zara and Target.

Industry analysts note a “strategic pivot toward diversified product lines and regional buyers.” This approach helped maintain 6.4% annual export growth despite Vietnam’s 14% surge in electronics-integrated garments. With 73% of factories now serving at least three geographic regions, the sector demonstrates resilience through market agility.

Challenges in the Journey of Transformation

Bangladesh’s path to becoming a textile powerhouse faced critical roadblocks that tested its industrial resolve. While production capacities expanded rapidly to meet increasing global demand, systemic weaknesses in logistics and workplace safety emerged as significant barriers that threatened to undermine this progress.

Inefficient transportation networks hampered the timely delivery of raw materials and finished products, while inadequate safety measures in factories led to concerns about worker welfare and compliance with international standards. These hurdles demanded urgent reforms to maintain global competitiveness and to ensure that the country could sustain its growth trajectory in the highly competitive textile market.

Infrastructure Limitations

Chronic transport bottlenecks created delays in raw material deliveries and finished goods shipments. Chittagong Port—handling 90% of exports—faced 11-day average turnaround times in 2018, three times longer than Singapore’s port. Road networks near manufacturing hubs struggled with:

- 40% of highways needing major repairs

- Daily traffic jams adding 30% to delivery costs

- Limited cold storage facilities causing fabric spoilage

| Infrastructure Challenge | Impact | Remediation Progress |

|---|---|---|

| Port congestion | 25% shipment delays | New deep-sea port construction (2023) |

| Power shortages | 8% production loss annually | 1,200MW solar plants operational by 2022 |

| Factory zoning issues | Limited expansion capacity | 12 new industrial parks established |

Safety and Regulatory Hurdles

The 2013 Rana Plaza disaster exposed dangerous working conditions, triggering a 22% drop in orders from European buyers. Over 1,100 factories failed initial safety inspections, revealing:

- Faulty electrical systems in 68% of facilities

- Inadequate fire exits in 54% of buildings

- Structural weaknesses in 31% of production units

These findings accelerated the Accord on Fire and Building Safety, with $280 million invested in upgrades by 2020. International brands mandated stricter compliance checks, pushing 89% of suppliers to achieve safety certifications within five years.

Safety and Compliance Improvements Post-Tragedies

What transformed factories from death traps into models of workplace safety? The 2013 Rana Plaza collapse and 2012 Tazreen Fashions fire became catalysts for sweeping reforms that reshaped the garment industry in Bangladesh. In response to these tragedies, over 200 global brands joined forces with the Bangladeshi government and labor groups to overhaul safety protocols, recognizing the urgent need for comprehensive change.

This collaboration led to the establishment of rigorous safety standards, extensive training programs for workers, and the implementation of regular safety audits to ensure compliance. Furthermore, the initiative aimed not only to prevent future disasters but also to create a sustainable and safe working environment for millions of employees in the sector.

Response to Factory Incidents

Two landmark programs emerged: the Accord on Fire and Building Safety (signed by 220 companies) and the Alliance for Bangladesh Worker Safety (41 North American retailers). These initiatives conducted 38,000 inspections across 3,900 facilities, identifying critical risks:

| Safety Aspect | Pre-2013 Status | 2023 Status | Improvement |

|---|---|---|---|

| Fire Exits | 54% inadequate | 92% compliant | +70% |

| Electrical Systems | 68% faulty | 89% certified | +31% |

| Structural Integrity | 31% unsafe | 84% reinforced | +53% |

The government strengthened labor laws, mandating worker committees in every factory. Over $280 million funded upgrades like fire-resistant doors and emergency alarms. “We rebuilt trust through transparency,” states a Dhaka factory manager whose facility achieved ISO 45001 certification.

Worker training programs reduced accident rates by 65% since 2015. Injury reports now get resolved 80% faster through digital grievance systems. These changes helped Bangladesh regain its position as a reliable sourcing hub, with 73% of European buyers reporting improved factory performance.

Advancements in Production and Technology Adoption

Innovative manufacturing techniques are revolutionizing textile operations across South Asia. Leading factories now deploy 3D prototyping software to slash design timelines from weeks to hours. Automated fabric cutting systems achieve 99% material accuracy, reducing waste by 40% compared to manual methods.

Digitization drives operational efficiency through real-time tracking systems. Over 72% of major manufacturers adopted RFID chips to monitor workflow from stitching to packaging. This technology cut production errors by 65% and improved order fulfillment speeds by 28% since 2020.

| Technology | Pre-2020 Adoption | 2023 Adoption | Impact |

|---|---|---|---|

| Automated Sewing | 12% | 47% | 300% output increase |

| AI Quality Control | 3% | 39% | Defects reduced by 82% |

| Cloud ERP Systems | 18% | 74% | Lead times halved |

Resource management transformed through predictive analytics tools. Factories using smart inventory systems reduced raw material shortages by 91%. “Our production cycles now match European efficiency standards,” notes a Dhaka-based plant manager.

These developments fueled 14% annual export expansion since 2018. Advanced knitting machines enable complex designs previously outsourced to Chinese factories. With 68% of facilities upgrading equipment since 2020, the sector demonstrates how strategic technology adoption drives industrial progress.

Sustainability and Environmental Initiatives

As global consumers demand eco-friendly products, Bangladesh’s textile sector is reinventing its production models. Rising sea levels and extreme weather patterns forced manufacturers to address climate change risks. Over 150 factories now hold LEED certifications—the highest concentration of green textile facilities worldwide.

Green Factory Innovations

Pioneering facilities blend solar power with rainwater harvesting systems. A Dhaka-based plant reduced water use by 40% through advanced recycling technology. Key advancements include:

- Zero-liquid discharge systems in 63% of large factories

- Biodegradable packaging for 28% of shipments

- Energy-efficient machinery cutting carbon emissions by 35%

The Circular Fashion Partnership channels 18,000 tons of textile waste annually into new products. Over 220 manufacturers achieved Global Organic Textile Standard certification since 2020. “Sustainability isn’t optional anymore—it’s survival,” states a factory owner participating in the UN’s Climate Action Accelerator.

Climate change pressures accelerated renewable energy adoption. Solar panels now power 12% of production lines, with plans to triple capacity by 2025. These efforts strengthen export competitiveness as brands like H&M prioritize ethical suppliers. By aligning with global environmental standards, the industry positions itself for long-term development in eco-conscious markets.

Labor Force Evolution and Gender Empowerment

Behind every stitch in the textile sector lies a workforce revolution reshaping social dynamics. Over three decades, the industry transitioned from informal labor pools to structured employment systems, creating a more stable and regulated environment for workers. This transformation has not only improved job security but also enhanced the overall working conditions, fostering a sense of dignity and respect among laborers.

Women now constitute 61% of the 4.2 million-strong workforce, up from 34% in 1990, reflecting a significant shift towards gender equality in a sector traditionally dominated by men. This increase in female participation has empowered many women, granting them greater financial independence and opportunities for career advancement, which in turn benefits their families and communities.

Worker Welfare Developments

Digital payroll systems replaced cash payments in 89% of factories by 2023, reducing wage disputes by 72%. Safety protocols expanded beyond physical infrastructure to include mental health resources. Key advancements include:

- Free medical clinics in 1,200+ production units

- Monthly safety drills for 92% of workers

- Grievance hotlines resolving 85% of complaints within 48 hours

| Indicator | 2015 | 2023 |

|---|---|---|

| Average Monthly Wage | $95 | $169 |

| Maternity Leave Coverage | 34% | 82% |

| Training Participation | 28% | 67% |

Empowerment and Skill Enhancement

Vocational centers trained 480,000 workers in advanced stitching techniques since 2018. A leading firm reported 41% higher productivity among upskilled teams. Female supervisors now manage 33% of production lines, compared to 9% in 2010.

Financial literacy programs reached 620,000 women, enabling 28% to start small businesses. “These initiatives create ripple effects beyond factory walls,” notes a Dhaka-based labor economist. Enhanced skills and leadership opportunities continue driving workforce development across rural and urban areas.

Innovative Practices and Global Partnerships

What fuels continuous growth in a crowded global market? Bangladeshi manufacturers answer through groundbreaking collaborations and operational reinvention. Progressive firms now blend digital tools with international expertise to maintain competitive edges.

Leading exporters adopted AI-powered inventory systems that predict fabric demand with 94% accuracy. One company reduced production waste by 38% using 3D virtual sampling. These advancements emerged from partnerships with tech giants like Microsoft and SAP, who provide customized solutions for textile operations.

Strategic alliances with global brands yielded measurable improvements:

| Partnership | Innovation | Outcome |

|---|---|---|

| H&M + Local Producer | Blockchain traceability | 27% faster compliance checks |

| Walmart + Export Group | Automated quality control | Defects reduced by 41% |

| Adidas + Factory Consortium | Recycled material integration | 19% lower carbon footprint |

A 2023 McKinsey analysis revealed that 73% of manufacturers using collaborative management systems shortened lead times by 15 days. “Shared knowledge accelerates capability building,” notes a Dhaka-based production head overseeing five international joint ventures.

Global retailers now co-develop training programs with local partners. Over 120 factories implemented Germany-inspired apprenticeship models, boosting worker productivity by 33%. These symbiotic relationships help exporters meet evolving quality standards while securing long-term contracts.

The fusion of domestic ingenuity and international resources positions Bangladesh’s textile sector for sustained global relevance. As supply chains grow more complex, such partnerships become vital lifelines for maintaining market share and operational efficiency.

Critical Analysis: How Garment Exports Transformed Bangladesh’s Economy

Bangladesh’s textile-driven progress reveals a complex interplay of advancement and unresolved issues. While export revenues climbed 227% since 2000, wage growth lagged at 78% over the same period. This disparity highlights systemic imbalances in wealth distribution despite sectoral expansion.

Three achievements define the industry’s growth:

- Poverty reduction from 48% to 18% in 30 years

- Creation of 12 million indirect jobs through supply chains

- Global market share increase from 2.9% to 7.9% since 2005

Yet persistent challenges threaten sustained progress. Productivity rates remain 34% below Vietnam’s benchmark, while energy costs exceed regional averages by 22%. A 2023 World Bank analysis notes infrastructure gaps cost exporters $6.7 billion annually in missed orders.

Government policies show mixed effectiveness:

| Policy | Success Metric | Shortcoming |

|---|---|---|

| Export subsidies | 15% annual shipment growth | Limited SME access |

| Safety accords | 87% factory compliance | Slow wage reforms |

| Skill programs | 650,000 workers trained | Urban-rural disparity |

Forecasts underestimated the sector’s resilience during COVID-19, with actual 2021 exports exceeding projections by 19%. However, overreliance on cotton-based products leaves the industry vulnerable as synthetic fabrics gain 58% of global demand.

Strategic responses should prioritize:

- Automation investments to bridge productivity gaps

- Diversification into technical textiles

- Strengthened supplier financing mechanisms

This balanced assessment underscores both the transformative power and unfinished agenda of Bangladesh’s apparel-led development model.

Infrastructure and Modernization Driving Export Growth

Modern infrastructure forms the backbone of competitive trade networks. Bangladesh’s $3.6 billion Padma Bridge and ongoing Matarbari Deep Sea Port construction demonstrate strategic modernization. These projects address historical bottlenecks, enabling smoother movement of goods from factories to global markets.

The 6.15-kilometer Padma Bridge slashed Dhaka-to-Mongla Port travel time from 13 hours to 6 since its 2022 opening. This critical link supports 84% of textile shipments passing through southwestern corridors. Simultaneously, the Matarbari port project—set for 2026 completion—will handle 8,000-container vessels, tripling current capacity.

Improvements in Transport and Logistics

Three infrastructure upgrades are reshaping supply chains:

- Automated customs systems reduced cargo clearance from 11 days to 72 hours

- Dedicated freight corridors cut factory-to-port transit costs by 40%

- Digital tracking improved shipment reliability to 93% in 2023

Logistics modernization directly impacts export timelines. A Chittagong-based exporter reported 22% faster order fulfillment after route optimizations. Rail upgrades now connect 12 industrial zones to seaports, handling 1.2 million TEUs annually—double 2018 volumes.

| Project | Investment | Impact |

|---|---|---|

| Padma Bridge | $3.6B | 2.4% GDP growth boost |

| Matarbari Port | $4.5B | 300% capacity increase |

| Dhaka-Ctg Highway | $600M | 50% accident reduction |

These advancements position the country to capture $52 billion in apparel exports by 2025. As one logistics manager noted: “Efficient infrastructure lets us compete with Vietnam’s turnaround speeds.” Ongoing investments in smart warehouses and cold storage further strengthen market responsiveness.

Sector Resilience Amid Global Challenges

Global supply chain shocks tested the textile industry’s ability to withstand unprecedented pressures. When COVID-19 halted international commerce in 2020, Bangladesh’s manufacturers faced canceled orders worth $3.18 billion within two months, significantly impacting the economy and employment levels.

Over 72% of factories operated at half capacity, struggling to manage overhead costs, with 1.2 million workers temporarily laid off. This sudden downturn not only affected production rates but also led to a ripple effect in the supply chain, causing delays in raw material procurement and further exacerbating the financial strain on businesses. Many factories found themselves unable to fulfill existing contracts, leading to a loss of trust among international buyers.

The inability to meet delivery deadlines not only jeopardized future orders but also threatened long-term relationships with key partners. Additionally, the workforce, already facing economic uncertainty, dealt with increased anxiety over job security, leading to a decline in morale.

As a result, factories were not only battling operational challenges but also the need to maintain a motivated workforce amidst the turmoil. This complex scenario highlighted the interconnectedness of production capabilities and workforce stability, emphasizing the critical need for strategic interventions to mitigate such crises in the future.

Impact of the COVID-19 Pandemic

The crisis exposed vulnerabilities in traditional trade models. Export earnings dropped 18% year-over-year in Q2 2020—the sharpest decline in four decades. Major buyers like Gap and Primark suspended payments for completed orders, straining cash flows. Manufacturers responded by:

- Negotiating deferred payment plans with 63% of suppliers

- Shifting 28% of production to PPE and medical textiles

- Implementing biosecurity protocols across 89% of facilities

Adaptive Strategies for Future Stability

Proactive policy adjustments helped stabilize operations. The government introduced wage subsidies covering 60% of worker salaries for six months. Exporters diversified sourcing, reducing reliance on Chinese raw materials from 62% to 49% since 2021.

Key operational shifts emerged:

- Digital sampling reduced design approval times by 40%

- Blockchain tracking improved supply chain transparency for 33% of firms

- Shorter-term contracts replaced 45% of annual agreements

“Flexibility became our survival toolkit,” remarks a Dhaka-based factory owner who pivoted 30% of capacity to reusable fabrics. These measures enabled 92% recovery in export volumes by late 2022, outperforming regional competitors like Sri Lanka and Cambodia.

Diversification of Products and Market Strategies

Manufacturers face a critical pivot point as basic apparel markets reach saturation. Exporters now create 45% higher margins through technical fabrics and smart clothing compared to traditional cotton T-shirts. This shift reflects strategic responses to shrinking demand in oversupplied categories.

- Integrating recycled polyester into 28% of product lines

- Developing temperature-regulating fabrics for sportswear

- Launching limited-edition designer collaborations

Advanced production methods enable complex items like seamless activewear, which saw 300% export growth since 2020. Domestic raw material output for knitwear doubled in five years, cutting import reliance by 19%. A Dhaka factory manager notes: “Our resources now stretch beyond basic stitching—we engineer performance fabrics rivaling European suppliers.”

| Product Category | 2018 Share | 2023 Share |

|---|---|---|

| Basic Cottonwear | 67% | 48% |

| Technical Textiles | 9% | 22% |

| Premium Apparel | 24% | 30% |

Market data reveals 58% of companies now allocate R&D budgets to innovative materials. H&M’s 2023 partnership with a local producer for bio-based dyes exemplifies this trend. Such strategies help manufacturers maintain 6.2% annual growth despite global economic headwinds.

Digital design tools accelerate product testing cycles from 12 weeks to 18 days. This agility lets exporters like Epic Group capture emerging trends faster than Vietnamese competitors. With synthetic fabrics projected to dominate 60% of global demand by 2025, diversification remains vital for sustained competitiveness.

Conclusion

As Bangladesh approaches its 50th year of sovereignty, its apparel industry stands as proof of strategic reinvention. From stitching basic shirts in the 1970s to supplying global fashion giants, the sector now anchors 84% of export earnings while lifting millions from poverty.

Smart trade agreements and infrastructure upgrades fueled this progress. Investments in worker safety and automation helped manufacturers meet evolving demands. Over 4 million employees—mostly women—gained financial independence, creating ripple effects across rural communities.

Challenges remain. Wage gaps and supply chain bottlenecks require attention as competitors advance. Yet the industry’s pivot toward eco-friendly practices and technical textiles shows adaptability. Solar-powered factories and recycled materials now position the country as a sustainability leader.

The road ahead demands continued innovation. Diversifying markets beyond Europe and America while upgrading port capacities will maintain momentum. With 73% of firms adopting AI-driven systems, Bangladesh’s garment success story evolves—proving resilience through reinvention remains its greatest asset.