Congratulations on landing your first job! This is an exciting milestone that comes with new responsibilities, like managing your money. As you start earning a steady paycheck, it’s crucial to establish good financial habits that will help you thrive in your career.

The decisions you make about savings in these early years can have a tremendous impact on your long-term financial goals and freedom. By starting to save immediately, you’ll harness the power of time and set yourself up for greater financial confidence and security in the future.

Key Takeaways

- Establish healthy money habits that benefit you throughout your career.

- Make informed decisions about savings to secure your long-term financial freedom.

- Harness the power of time to grow your savings.

- Create a solid financial foundation right from your first paycheck.

- Balance immediate financial needs with long-term savings goals.

Understanding Your New Financial Landscape

As you start your new job, understanding your financial landscape is crucial for making informed decisions about your money. This involves analyzing your first paycheck, setting financial priorities, and creating a plan for your financial future.

Analyzing Your First Paycheck

Your first paycheck is more than just your initial earnings; it’s the foundation of your financial future. Take time to examine your gross pay versus net pay, identifying all deductions, including taxes, healthcare premiums, and any retirement contributions. This analysis will help you understand your actual take-home income and create realistic expectations about your spending power and saving capacity.

By understanding the components of your paycheck, you can begin to make intentional decisions about your money. Setting up direct deposit is a convenient and secure way to receive your regular income, eliminating the hassle of physically depositing checks and making it easier to automate your savings from day one.

Setting Financial Priorities as a New Professional

As a new professional, establishing clear financial priorities is essential. You’ll need to balance immediate needs, such as housing, transportation, and food, with long-term goals like emergency savings, retirement, and debt reduction. Creating a hierarchy of financial priorities helps you make intentional decisions about where your money goes, ensuring that your spending and saving align with what matters most to you.

Consider adopting a values-based approach to your finances, and remember that your financial priorities may shift as your career progresses. Establishing good habits now creates a flexible foundation for future adjustments, helping you stay on track with your financial goals.

Creating a Sustainable Budget Framework

A well-structured budget serves as the foundation for your financial journey, enabling you to track your money and make informed decisions. By understanding where your income comes from and where it goes each month, you can make adjustments to achieve your financial goal.

Tracking Income and Essential Expenses

Begin by meticulously tracking all income sources and categorizing your essential expenses like housing, utilities, transportation, groceries, and minimum debt payments to establish your financial baseline. This step is crucial in understanding your financial situation and making informed decisions.

Implementing the 50/30/20 Budgeting Method

The 50/30/20 budgeting method offers a simple yet effective framework: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment beyond minimums. This balanced approach prevents the common extremes of either overly restrictive budgets that fail due to burnout or overly loose budgets that don’t advance your financial goal.

Digital Tools to Simplify Budgeting

Leverage digital tools and apps like Mint, YNAB (You Need A Budget), or PocketGuard to automate expenses tracking, categorize spending, and provide visual representations of your financial habits. These digital solutions can send alerts when you’re approaching budget limits, identify spending patterns you might miss manually, and sync with multiple accounts to give you a comprehensive financial overview.

By implementing these strategies, you can create a sustainable budget framework that helps you manage your money effectively and achieve your financial goal over time.

Establishing an Emergency Fund

Building an emergency fund is a crucial step towards achieving financial stability after getting your first job. This fund acts as a financial safety net, protecting you from unexpected expenses and life events that could otherwise derail your financial progress or force you into debt.

Why Emergency Savings Come First

Prioritizing emergency savings before other financial goals creates a foundation of security that allows you to make better long-term financial decisions without fear of being blindsided by unexpected costs. Without an emergency fund, you risk relying on high-interest credit cards or loans during crises, which can create a cycle of debt that’s difficult to escape on an entry-level salary.

Setting Your Emergency Fund Target

Your emergency fund target should ideally cover 3-6 months of essential living expenses, including housing, utilities, food, transportation, and minimum debt payments. To determine your target, calculate your monthly essential expenses and multiply by your target number of months. This becomes your financial security benchmark.

Strategies to Build Your Fund Quickly

To accelerate your emergency fund growth, consider automating transfers to a dedicated savings account, allocating any windfalls (such as tax refunds or bonuses), and temporarily reducing discretionary spending. It’s also beneficial to keep your emergency fund in a separate, easily accessible savings account that’s not connected to your everyday checking account.

How to Start Saving After Getting Your First Job: Smart Retirement Planning

Beginning your career is the perfect time to lay the groundwork for a secure retirement. The earlier you start saving, the more time your money has to grow. It’s never too early to think about your retirement savings.

Understanding Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans, such as 401(k)s, offer a convenient way to save for retirement through automatic payroll deductions. These plans provide tax advantages that can help your savings grow more efficiently. It’s crucial to understand your company’s retirement plan options, including contribution limits, vesting schedules, and available investment choices.

Maximizing Employer Matching Contributions

One of the most significant benefits of employer-sponsored retirement plans is the company match. Contributing enough to maximize this match is essentially claiming free money for your retirement. If your employer offers a 6% match, for example, try to contribute at least 6% of your salary to your retirement account to take full advantage of this benefit.

Alternative Retirement Savings Vehicles

If your employer doesn’t offer a retirement plan, or if you want to supplement your employer-sponsored plan, consider alternative retirement savings options like Roth IRAs. These accounts offer tax-free growth potential and more investment flexibility. Diversifying your retirement savings across different account types can provide tax diversification and more withdrawal options in retirement.

| Retirement Savings Option | Key Benefits | Contribution Limits |

|---|---|---|

| 401(k) | Tax advantages, employer matching | $19,500 (2022 limit) |

| Roth IRA | Tax-free growth, flexibility | $6,000 (2022 limit) |

Starting with a manageable contribution amount and gradually increasing it with each raise or promotion can help you build a substantial retirement fund without sacrificing your lifestyle. Consistency is key when it comes to retirement savings.

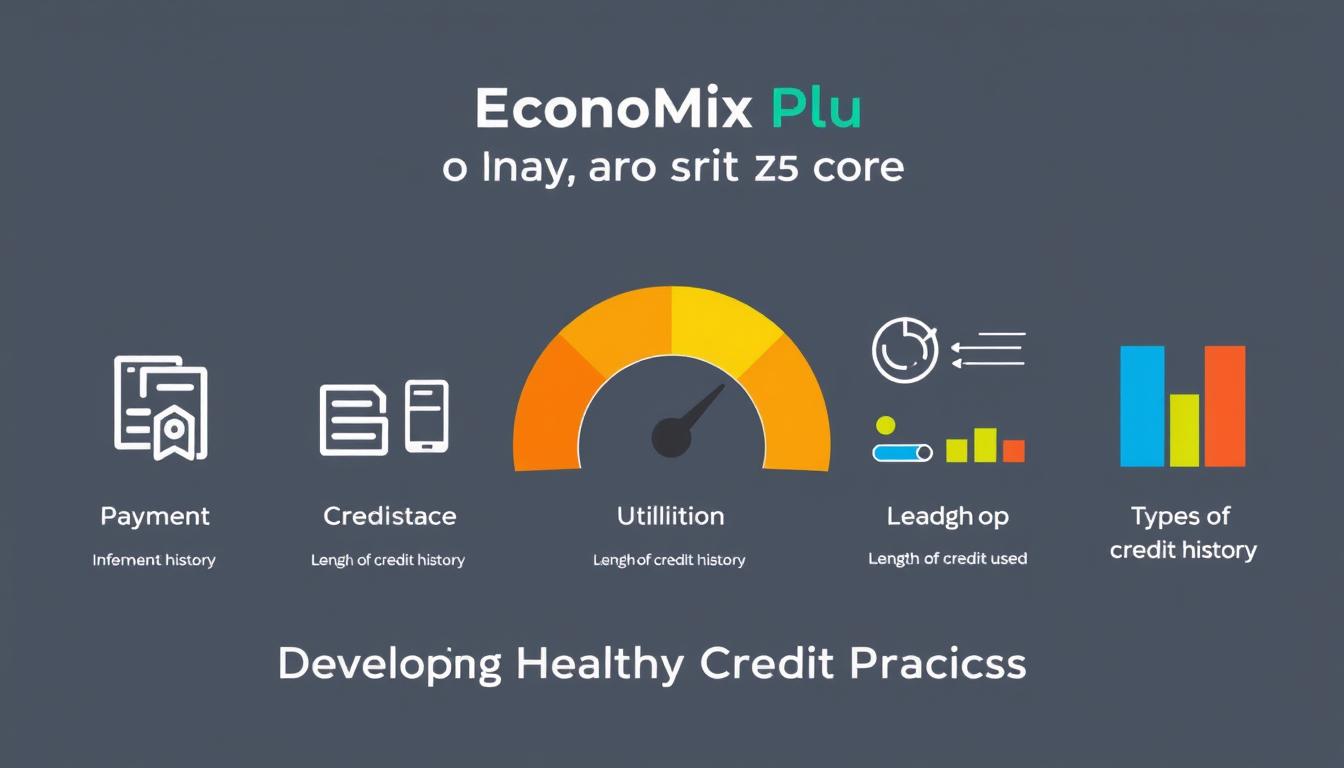

Developing Healthy Credit Practices

Your financial future is significantly influenced by your credit habits, making it essential to develop healthy credit practices early on. As you navigate your financial landscape, understanding the role of credit and how to manage it effectively is crucial.

Why Credit Matters for Your Financial Future

Building credit helps you establish a solid financial foundation. A good credit history makes it easier to qualify for larger purchases and life events, such as loans, renting an apartment, getting a mortgage, and obtaining new credit cards, as it demonstrates your reliability as a borrower. Your credit history and score will influence nearly every aspect of your financial life.

Strategic Credit Building for Young Professionals

For young professionals, establishing credit might seem challenging without existing credit history, but there are strategic approaches to building your credit profile from scratch. You can start with a secured credit card or become an authorized user on a parent’s well-established account to begin building your credit history responsibly. Focus on the five key factors that influence your credit score: payment history (35%), credit utilization (30%), length of credit history (15%), credit mix (10%), and new credit (10%).

Monitoring and Improving Your Credit Score

Regularly monitoring your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) is essential to catch errors or fraudulent activity early. You’re entitled to free annual reports through AnnualCreditReport.com. Use credit monitoring services or apps that provide regular updates on your credit score and alert you to significant changes without negatively impacting your score.

| Credit Score Factor | Importance | Tips for Improvement |

|---|---|---|

| Payment History | 35% | Make timely payments on all bills and debts. |

| Credit Utilization | 30% | Keep credit card balances below 30% of your limit. |

| Length of Credit History | 15% | Maintain your oldest accounts to show a longer credit history. |

Creating a Debt Management Strategy

Creating a comprehensive debt management plan is essential for young professionals to achieve long-term financial stability. As you navigate your new financial landscape after landing your first job, tackling debt strategically can make a significant difference in your financial health.

Prioritizing High-Interest Debt

When managing multiple debts, it’s crucial to prioritize those with high-interest rates. The debt avalanche method is a popular strategy that involves paying minimum payments on all debts while directing extra funds toward the debt with the highest interest rate first. This approach can save you money in the long run by reducing the amount of interest you pay over time. For more information on creating a DIY debt repayment program, you can visit Money Management.

Student Loan Repayment Approaches

For many young professionals, student loans represent a significant portion of their debt. Exploring repayment options such as income-driven plans, refinancing opportunities, and potential loan forgiveness programs can help make your monthly payments more manageable. It’s essential to create a realistic repayment timeline that balances aggressive debt reduction with other financial priorities, such as building an emergency fund and contributing to retirement accounts. Regular saving can also help you build a secure financial future, as explained on Economix Plus.

Avoiding New Debt Traps

While paying off existing debt is crucial, it’s equally important to avoid taking on new debt. Be cautious of common debt traps that target young professionals, such as lifestyle inflation, buy-now-pay-later schemes, and excessive credit card usage. Implementing preventative measures like waiting 24-48 hours before making non-essential purchases and using cash for discretionary spending can help you stay on track. By being mindful of your spending habits and maintaining a well-structured budget, you can make significant progress in your debt reduction journey.

Conclusion: Building Lasting Financial Habits

The financial habits you develop early in your career can significantly impact your long-term financial health. As you’ve learned, starting to save after getting your first job is a crucial step towards financial stability. It’s not just about saving; it’s about creating a comprehensive financial plan that includes budgeting, building an emergency fund, planning for retirement, and managing debt.

To achieve financial wellness, it’s essential to start with small, achievable goals and gradually build upon them. Automating your savings and retirement contributions can help ensure consistency. Regularly reviewing and adjusting your financial plan as your income and expenses change is also vital.

By implementing these strategies, you’re not only building wealth but also financial confidence and security that will benefit you throughout your life. Remember, financial wellness is about creating a life where money supports your values and goals. Take control of your finances now to secure a prosperous future.

Key Takeaways:

- Establish good saving habits early in your career.

- Create a comprehensive financial plan.

- Automate your savings and retirement contributions.

- Regularly review and adjust your financial plan.