What if paying upfront for a home isn’t always the best financial move? Many assume cash purchases guarantee savings, but financing with a mortgage could offer hidden advantages. Market conditions, interest rates, and personal liquidity needs play crucial roles in this decision.

Current economic shifts make this debate more relevant than ever. Rising inflation and fluctuating rates impact both short-term affordability and long-term wealth-building. Choosing between upfront cash or installment plans requires careful evaluation.

This article breaks down key factors like tax benefits, opportunity costs, and financial flexibility. Whether you prioritize immediate ownership or strategic leverage, understanding these nuances helps you make an informed choice.

Key Takeaways

- Market conditions influence whether cash or financing works better.

- Mortgages offer tax deductions and liquidity benefits.

- Interest rates affect long-term costs and savings.

- Upfront cash eliminates debt but ties up capital.

- Flexibility matters—installments allow diversified investments.

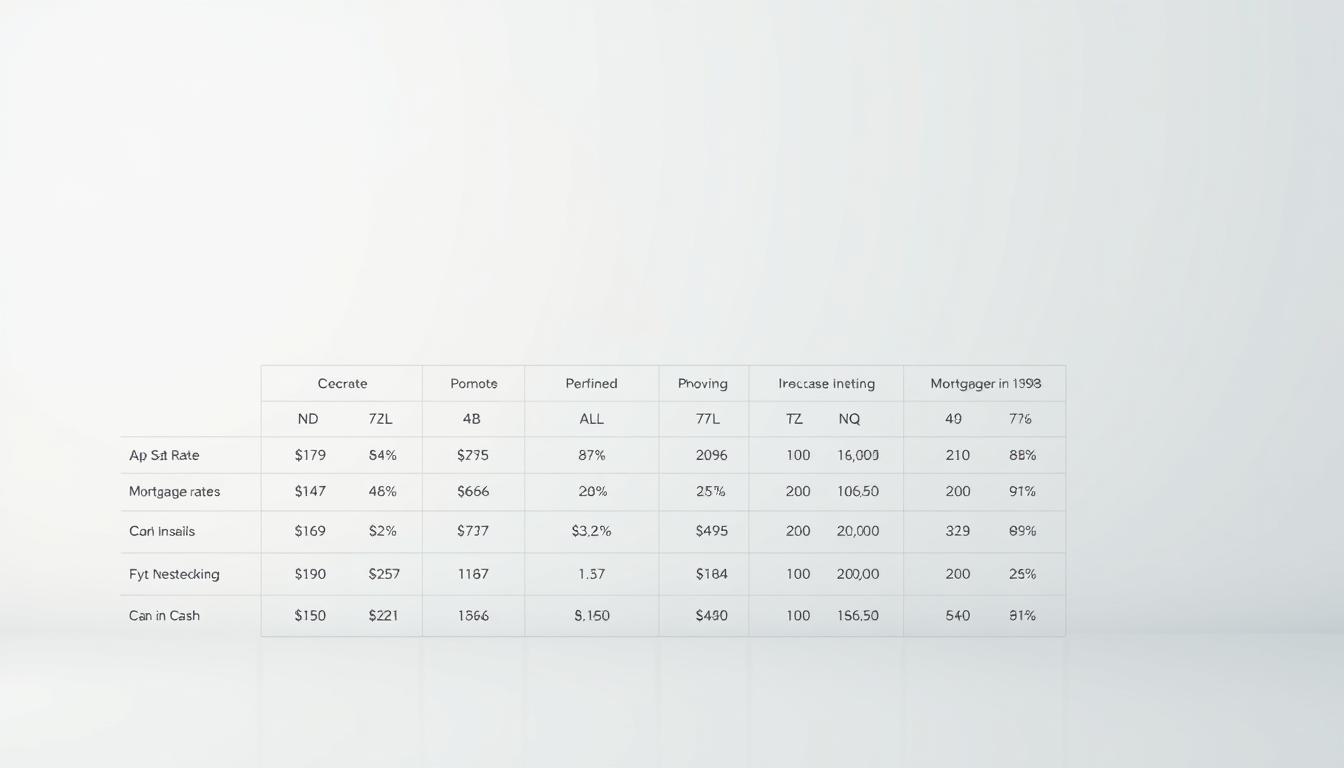

Cash vs. Installments: Key Differences at a Glance

Owning a home outright sounds appealing, but financing could unlock hidden financial benefits. The choice between paying upfront or opting for a mortgage impacts your equity, liquidity, and investment potential. While cash buyers enjoy immediate ownership and avoid interest payments, they may miss out on leveraging their capital for other investments.

On the other hand, those who choose a mortgage can retain more liquidity, allowing them to invest in other opportunities that may yield higher returns. Understanding these trade-offs is crucial, as the decision affects not only your current financial situation but also your long-term wealth-building strategy.

Upfront Costs and Immediate Equity

Paying with cash requires the full amount at closing. For a $500,000 property, that’s $500,000 gone in one transaction. With a loan, you’d pay just 15–20% ($75,000–$100,000) upfront.

Cash buyers gain 100% equity immediately. Mortgage holders build equity slowly as they pay down the principal. Over time, appreciation adds value to both strategies.

Long-Term Financial Commitments

Installment plans stretch payments over decades. A 30-year mortgage on a $1M home could cost $1M+ in interest payments alone. Cash avoids these costs but ties up capital.

“Leveraging debt lets investors control more assets with less cash—a key wealth-building tactic.”

| Factor | Cash Purchase | Mortgage |

|---|---|---|

| Upfront Cost | 100% of home value | 15–20% down payment |

| Equity | Immediate 100% | Gradual buildup |

| Fees | None | 1% loan origination fee |

| Flexibility | Low (capital locked) | High (invest elsewhere) |

Example: With $500,000, you could buy one house outright or four properties at $125,000 each (20% down). The latter diversifies risk and income streams.

Advantages of Paying Cash for Real Estate

Eliminating financing hurdles gives cash buyers unique advantages. You skip loan approvals, interest costs, and lengthy processes, which can often be a source of stress and uncertainty in real estate transactions. This approach simplifies transactions and strengthens your negotiating position, allowing you to act quickly and decisively.

Cash buyers can often close deals more efficiently, which is particularly appealing to sellers who may be looking for a swift resolution. Additionally, without the need for financing, you avoid the risk of potential appraisal issues that could delay or derail a sale. Overall, the ease and speed of cash transactions can make you a more attractive buyer in a competitive market.

No Interest Payments or Loan Fees

Paying cash means avoiding decades of interest. On a $400,000 home at 7%, you’d save $1,148 monthly—$413,280 over 30 years. Loan origination fees (1–3% of the loan) vanish too.

“Cash offers close 30% faster, with 72-hour turnarounds versus 45-day mortgage approvals.”

Faster Closings and Stronger Negotiation Power

Sellers favor cash for its reliability. In Seattle’s 2021 market, all-cash bids secured 5% discounts. Competitive markets see cash offers accepted 3x more often.

- Speed: No bank appraisals or underwriting delays.

- Savings: Immediate rental income without mortgage overhead.

- Example: A $400,000 purchase appreciating to $500,000 yields $100,000 tax-free profit.

Cash transforms you into a low-risk buyer. It’s a powerful tool in high-demand areas where speed and certainty win deals.

Drawbacks of an All-Cash Purchase

Cash purchases may seem secure but come with hidden costs. While you avoid interest payments, tying up capital in a house reduces financial agility significantly. This means that the funds you invest in a property are not readily available for other potential investments that could yield higher returns. For instance, if those funds were instead placed in a diversified portfolio of stocks or bonds, they could generate substantial income over time.

Market downturns and missed investment opportunities can outweigh the benefits. When the real estate market experiences fluctuations, cash buyers may find themselves unable to quickly access their funds or pivot to other lucrative opportunities, leading to financial strain during critical moments.

Reduced Liquidity and Opportunity Cost

A $500,000 cash purchase locks funds that could earn 7% annually elsewhere—$35,000 yearly. During the 2008 crisis, all-cash buyers faced 40% losses with no flexibility to pivot.

- Illiquid assets: Selling a property takes months, complicating emergency fund access.

- Single-asset risk: Florida’s hurricane market crash left cash owners unable to sell.

- Tax impact: No mortgage interest deduction raises taxable income.

Limited Diversification of Assets

Concentrating money in one property ignores broader investment strategies. Compare $1M in a home versus $1M split across stocks, bonds, and rentals for balanced returns.

| Strategy | Potential Annual Return | Risk Level |

|---|---|---|

| Single-property cash | 3–5% appreciation | High (local market) |

| Diversified portfolio | 7–9% (S&P 500) | Moderate |

| Mortgage + investments | 5–7% (property + stocks) | Balanced |

“Diversification is protection against ignorance. It makes little sense if you know what you’re doing.” —Warren Buffett

Is Buying Real Estate in Installments Smarter for You?

Financing your next property could unlock financial opportunities you haven’t considered. While cash offers security, strategic debt leverages market conditions to grow wealth. By utilizing financing options, you can maintain a cash reserve for unforeseen expenses while simultaneously investing in additional properties.

This approach not only diversifies your portfolio but also allows you to take advantage of favorable market trends without depleting your liquid assets. Moreover, with the right financing strategy, you can amplify your investment potential, as borrowing at low-interest rates can lead to higher returns compared to investing solely in cash.

Leveraging Low Mortgage Rates

In 2021, mortgage rates hit 3.5%—below the S&P 500’s average 7% returns. Locking sub-4% loans created negative carry opportunities: borrowing cheap to earn higher yields elsewhere.

“A $300,000 mortgage at 3.5% costs $10,500 yearly. Invested in REITs averaging 8%, that same money generates $24,000—netting $13,500 profit.”

Flexibility to Invest Elsewhere

Taking mortgage debt preserves liquidity. Instead of tying up $500,000 in one property, you could:

- Buy four homes with 20% down, diversifying rental income.

- Fund securities-backed credit lines for emergency access.

- Allocate savings to stocks or bonds for balanced returns.

Hybrid strategies also work. A 50% cash downpayment reduces interest costs while keeping tax-advantaged debt. Analyze your goals—sometimes, debt is the smarter tool.

Risks of Buying Property with a Mortgage

Financing a house offers flexibility, but it also comes with financial risks that can significantly impact your financial health. Market shifts, such as fluctuations in property values or changes in demand, can leave homeowners vulnerable to negative equity, where they owe more on their mortgage than their property is worth.

Additionally, changing loan terms, whether due to refinancing or adjustments in interest rates, can lead to unexpected financial burdens. Understanding these challenges helps you prepare and make smarter decisions, ensuring that you are not caught off guard by sudden increases in payments or shifts in the market that could jeopardize your investment.

Interest Rate Fluctuations

Adjustable-rate mortgages (ARMs) expose borrowers to payment shocks. A 5/1 ARM might start with a $2,500 monthly payment, but rate adjustments could push it to $3,500. The 2023 hikes increased payments by 40% for some holders.

- Fixed vs. ARM: Fixed rates offer stability; ARMs risk sudden cost spikes.

- Refinance limits: Falling credit scores or equity may block better terms.

- Budget strain: Higher payments reduce disposable income for emergencies.

“Rate hikes turn affordable homes into financial burdens overnight. Locking fixed terms protects against volatility.”

Market Downturns and Negative Equity

Property value drops leave borrowers owing more than their house is worth. The 2008 crash left 30% of leveraged investors underwater. Recovery often takes 7+ years.

| Risk Factor | Impact | Solution |

|---|---|---|

| 20% price drop | Delayed equity growth | Longer hold period |

| Foreclosure | 7-year credit damage | Emergency savings |

| Non-recourse states | Lender claims other assets | Legal consultation |

Case study: Phoenix investors lost four properties in 2022 when values fell 18%. Diversification could have softened the blow.

For deeper insights, compare cash versus mortgage strategies to align with your risk tolerance.

Financial Factors to Consider

Your decision between cash and financing goes beyond upfront costs. Tax benefits, long-term investment returns, and liquidity all play critical roles. Understanding these factors helps maximize your financial advantage.

Tax Implications of Mortgages

Mortgage holders often benefit from tax deductions unavailable to cash buyers. The mortgage interest deduction allows itemizing payments, potentially saving thousands annually.

For example, a $750,000 loan at 4% interest generates $30,000 in deductible interest. At a 37% tax rate, that’s an $11,100 yearly savings. Compare this to the standard $30,000 deduction for married couples to determine which works better.

- 1031 exchanges: Installment buyers defer capital gains when reinvesting in similar properties

- Depreciation benefits: Rental property owners deduct property value over 27.5 years

- State variations: Some states cap deductions or offer additional homeowner credits

“Smart investors treat mortgage debt as a tool—the IRS subsidizes your borrowing costs through tax breaks.”

Comparing Investment Returns

Your money could work harder elsewhere. A 4% mortgage cost looks attractive when stocks historically return 7%. This spread creates wealth-building opportunities.

| Strategy | 15-Year Growth | Notes |

|---|---|---|

| $500k in home equity | $900k (4% appreciation) | Illiquid, single asset |

| $100k down + $400k in S&P 500 | $1.1M (7% returns) | Balanced risk |

| Hybrid approach | $950k+ | 50% equity, 50% investments |

Consider your risk tolerance. As financial experts note, diversified portfolios often outperform single-property investments over time.

Run an opportunity cost calculator. Would that $200,000 down payment earn more in index funds? Could rental income cover mortgage payments while building equity? These questions shape smarter decisions.

How Market Conditions Influence Your Decision

Local housing market conditions should dictate your payment strategy. What works in Austin’s competitive scene fails in Detroit’s buyer-friendly zones. For instance, in a bustling market like Austin, where demand often outstrips supply, buyers may need to act quickly and consider all-cash offers to secure properties before they are snatched up by others.

Conversely, in Detroit, where there may be an abundance of homes available, buyers can afford to take their time, negotiate better terms, and utilize financing options that might not be as appealing in a hot market. Recognizing these differences helps you leverage cash or financing when it matters most.

When Sellers Hold the Upper Hand

Cash dominates in tight markets. In 2023, 68% of bidding wars went to all-cash offers—especially in tech hubs like San Diego. Sellers favor these deals for their speed and certainty.

- Discount potential: Miami cash buyers saved 15% during last year’s inventory glut

- Closing speed: 72-hour transactions beat 45-day mortgage approvals

- 2024 hotspots: Target cash offers in Austin, Seattle, and Raleigh

Financing Wins in Buyer’s Markets

When inventory piles up, loans gain traction. The 2009 crash saw FHA loans with 3.5% down payments dominate Cleveland and Detroit. Today’s slow markets offer similar perks:

“Rate buydowns can temporarily reduce payments by 2%—a game-changer for budget-conscious buyers.”

| Strategy | Best For | Example |

|---|---|---|

| REO financing | Bank-owned properties | 5% lower price + repair credits |

| ARM loans | Short-term holders | 3.1% intro rate vs 6.5% fixed |

| Seller concessions | New constructions | $10k closing cost credits |

The Fed’s projected 2024 rate cuts may shift this balance. If rates drop below 5%, financing could outperform cash even in seller’s markets. Track Treasury yields for early signals.

Conclusion

Choosing between cash and a mortgage depends on your financial goals. Liquidity matters if you value access to funds, while leverage helps grow wealth in rising markets.

Assess your risk tolerance. Conservative investors may prefer owning outright, but strategic debt can boost returns. Hybrid approaches—like larger down payments—offer balance.

Current market conditions and interest rates play key roles. For personalized advice, consult a CFP® professional. Use online calculators to compare scenarios and find your best path.

Ultimately, flexibility is crucial. Whether you prioritize stability or growth, align your strategy with long-term objectives.