Can a country owe more than its entire economy produces? For one major economy, this isn’t hypothetical. Over decades, its national debt has ballooned to over 260% of GDP—far exceeding typical thresholds. Recent spikes in bond yields above 3% and trillion-yen budget gaps now fuel global alarm.

The International Monetary Fund warns of unsustainable fiscal trends. Governments face mounting pressure as borrowing costs rise, straining budgets already stretched by aging populations and stagnant growth. Yet this article focuses strictly on macroeconomic indicators, avoiding discussions of bonds or savings products.

Key metrics tell a urgent story. Debt-to-GDP ratios hit historic highs, while interest payments consume larger shares of public spending. Currency exchange risks and yield volatility add layers of complexity. How did this situation develop—and what comes next?

Key Takeaways

- National debt exceeds 260% of GDP, dwarfing most global benchmarks.

- Bond yields recently crossed 3%, raising borrowing costs.

- The International Monetary Fund highlights long-term fiscal risks.

- Trillion-yen deficits reflect persistent budget shortfalls.

- Analysis focuses on economic data, not investment advice.

Introduction to Japan’s Fiscal Challenges

How does a nation accumulate obligations surpassing twice its economic output? Decades of expansionary government policy and external shocks created a perfect storm. Structural factors like aging demographics collided with cyclical pressures—global recessions, natural disasters, and pandemic-era spending.

In particular, the prolonged period of low interest rates aimed at stimulating growth led to increased borrowing, while an aging population resulted in rising healthcare and pension costs that strained public finances. Moreover, significant events such as the 2008 financial crisis and subsequent economic downturns forced the government to implement massive fiscal stimulus measures, further exacerbating the debt situation. The cumulative effect of these elements has not only heightened the fiscal burden but also raised questions about sustainability and future economic stability.

Economic Context and Historical Trends

Since the 1990s, fiscal stimulus packages became routine responses to economic stagnation. The ministry of finance approved over ¥150 trillion in supplementary budgets between 2000-2020. This pattern accelerated debt growth even as GDP plateaued. By 2023, obligations exceeded 260% of GDP—a threshold most economies avoid.

Background of Rising National Debt

Three forces dominate:

- Persistent budget deficits averaging 6% of GDP since 2008

- Interest payments consuming 25% of tax revenue by 2022

- Market skepticism as 10-year government bond yields tripled since 2016

Investors now demand higher interest rates for long-term securities, reflecting doubts about repayment capacity. “When debt becomes this pervasive,” notes one analyst, “it reshapes every fiscal decision.” Current strategies focus on balancing growth incentives with stability—a tightrope walk with global implications.

Japan’s Debt Crisis and Its Struggles

When fiscal obligations grow beyond control, what measures can stabilize an economy? Decades of aggressive stimulus packages and reactive government policy have created a complex web of challenges. These policies, aimed at stimulating demand and supporting growth, have often led to unintended consequences, such as increasing reliance on debt financing. Supplementary budgets totaling ¥450 trillion since 2000 fueled public spending but failed to spark sustained growth.

Instead, they have contributed to a cycle of increasing debt levels without achieving the desired economic revitalization, leading to a precarious fiscal environment where the government struggles to balance immediate needs with long-term sustainability.

The cabinet office now faces dual pressures: managing record-high obligations while addressing shrinking tax revenues. Interest payments alone consumed 24% of fiscal revenue in 2023—up from 15% a decade earlier. This squeeze limits options for new infrastructure or social programs.

Three critical factors define the current situation:

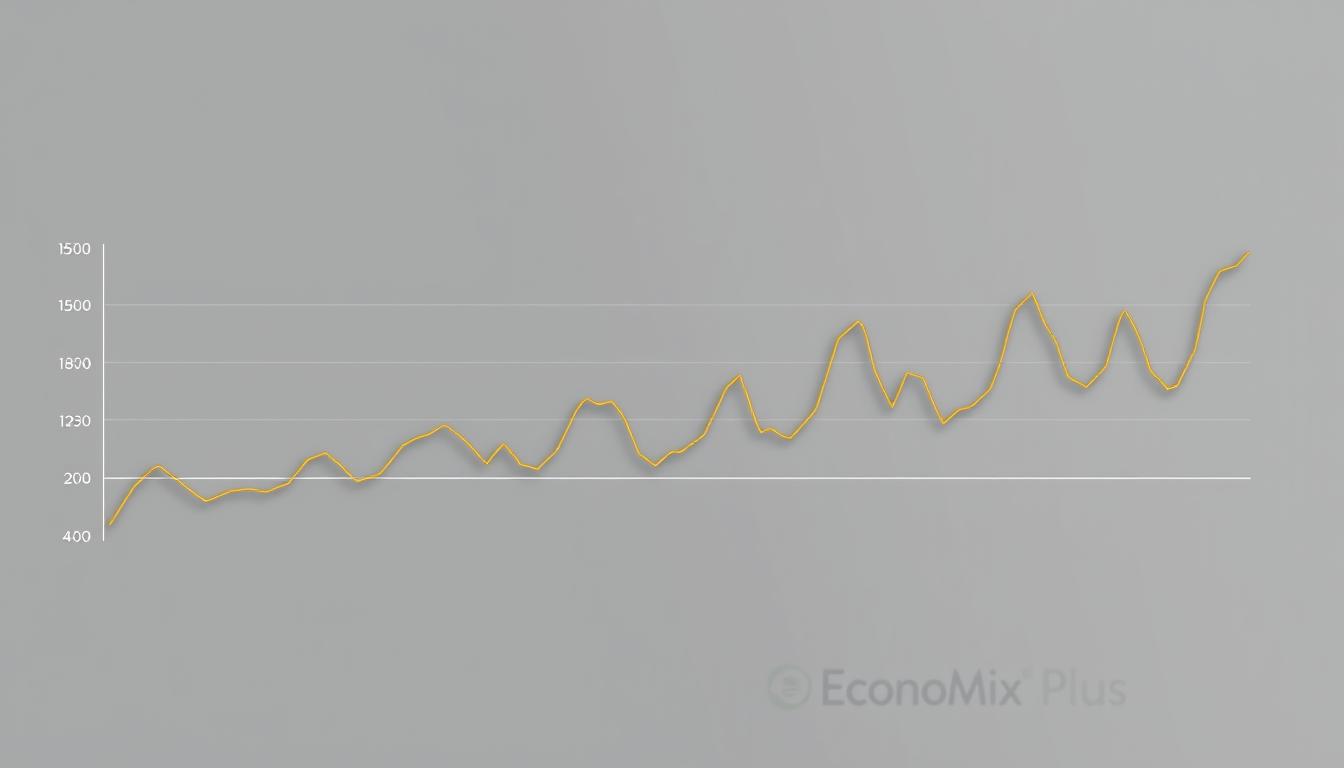

- Debt-to-GDP ratio tripled since 1990

- Annual deficits averaging 5.8% of economic output since 2010

- Bank of Japan’s monetary policy keeping rates near zero until 2022

| Year | Debt/GDP | Annual Deficit (¥T) | 10-Year Yield |

|---|---|---|---|

| 2000 | 135% | 32 | 1.7% |

| 2010 | 194% | 47 | 1.2% |

| 2020 | 240% | 68 | 0.6% |

| 2023 | 263% | 72 | 3.1% |

Recent yield spikes signal shifting market confidence. While the international monetary community urges structural reforms, balancing immediate needs with long-term sustainability remains contentious. Subsequent sections will explore how demographic shifts and global headwinds compound these fiscal tightropes.

Key Drivers Behind Japan’s Escalating National Debt

What forces push a nation’s financial obligations to unprecedented heights? Domestic instability and global turbulence have created a feedback loop that exacerbates economic challenges. Factors such as declining birth rates and an aging population have strained social services, leading to increased spending. Additionally, global economic fluctuations, including trade tensions and supply chain disruptions, further complicate the fiscal landscape.

Decades of reactive policies amplified vulnerabilities, turning temporary fixes into structural burdens that are difficult to unwind. These short-term measures often fail to address underlying issues, resulting in a cycle of dependency on government intervention.

Impact of Domestic Shocks and Stimulus Measures

The 1990s asset bubble collapse triggered a cycle of emergency spending. Over ¥150 trillion poured into stimulus packages between 2000-2020 to revive growth. Natural disasters like the 2011 earthquake demanded ¥25 trillion in reconstruction funds—paid through new government bonds.

These measures temporarily stabilized communities but deepened fiscal imbalances. By 2023, annual deficits reached 6.2% of GDP, forcing borrowing even for basic operations. “Each crisis reshuffles priorities,” observes a Tokyo-based economist, “but the bill always comes due.”

Influence of External Crises and Global Events

International upheavals compounded local challenges. The 2008 global financial crash slashed export revenues, while pandemic-era supply shocks required ¥78 trillion in relief spending. Rising interest rates worldwide pushed 10-year JG yields past 3%—triple 2020 levels.

Key pressure points include:

- Foreign investors holding 14% of government bonds by 2023

- Global inflation pushing import prices up 20% since 2021

- IMF warnings about debt sustainability thresholds

Market reactions reveal growing skepticism. Bond auctions now require higher yields to attract buyers, signaling doubts about repayment capacity. These intertwined forces—homegrown and imported—keep debt ratios climbing despite short-term fixes.

Role of Japanese Government Policy and Fiscal Stimulus

How do policymakers balance growth incentives with fiscal restraint? Since 2012, the Japanese government has deployed aggressive strategies to counter economic stagnation. Prime Minister Shinzo Abe’s “Abenomics” framework became a defining approach, combining monetary easing, fiscal expansion, and structural reforms. This multifaceted strategy aimed not only to stimulate demand but also to enhance the overall productivity of the economy. Key components included substantial increases in public spending, particularly in infrastructure projects, and initiatives designed to encourage private investment.

Additionally, Abenomics sought to combat deflationary pressures that had plagued the economy for years, thereby fostering a more conducive environment for growth and innovation. The government also focused on labor market reforms to improve workforce participation and productivity, recognizing that a dynamic labor force is essential for sustainable economic growth.

Abenomics and Monetary Easing Initiatives

The Bank of Japan’s monetary policy under Abenomics included negative interest rates and massive asset purchases. Over ¥20 trillion in stimulus boosted infrastructure and corporate subsidies. These measures temporarily lifted the GDP ratio but required issuing new bonds—deepening national debt.

Legislative and Budgetary Responses

Key legislative actions aimed to stabilize finances:

- Consumption tax hikes from 5% to 10% (2014-2019)

- ¥73 trillion pandemic relief package approved in 2020

- Social security spending rising to 34% of the budget by 2023

The International Monetary Fund notes these steps increased short-term stability but worsened long-term debt projections. With higher interest rates elevating borrowing costs, investor confidence now hinges on credible deficit reduction plans. Recent cabinet office reviews emphasize balancing welfare needs with fiscal discipline—a challenge magnified by aging demographics.

Demographic Pressures and Social Security Spending

A silent force reshapes fiscal stability: an aging population. Over 33% of citizens are now 60 or older, according to the cabinet office. This demographic shift not only drives social security costs to historic highs but also places immense pressure on the economy, as a growing proportion of the population relies on pensions and healthcare services. The increasing number of retirees means that fewer workers are contributing to the system, which in turn exacerbates the financial strain on social security programs. This scenario consumes resources needed for debt reduction, making it increasingly challenging for the government to balance its budget and meet fiscal targets.

Implications of an Aging Population

The ministry finance reports pension and healthcare spending jumped from 28% to 38% of the national budget since 2010. By 2040, these costs could surpass 45% as retirees outnumber workers. Every yen spent here reduces funds available for infrastructure or economic stimulus.

Three critical trends emerge:

- Workforce shrinkage: 12 million fewer taxpayers projected by 2040

- Healthcare inflation: Annual costs up 5.2% since 2015

- Pension deficits: ¥4.5 trillion gap expected by 2030

| Year | Social Security (% of Budget) | Health Costs (¥T) | Pension Outlays (¥T) |

|---|---|---|---|

| 2010 | 28% | 34 | 52 |

| 2020 | 33% | 43 | 58 |

| 2023 | 38% | 49 | 64 |

Stagnant GDP growth amplifies these pressures. With fewer workers contributing taxes, the government borrows more to cover obligations—a cycle deepening the debt-to-GDP ratio. Analysts warn demographic realities could soon outweigh monetary policy’s impact on fiscal health.

Historical Overview of Government Spending Patterns

Fiscal policy shifts over decades reveal a pattern of crisis-driven spending. Since the 1990s, supplementary budgets became primary tools for economic stabilization, reflecting the government’s reactive approach to economic downturns and financial crises. These budgets were designed not only to address immediate fiscal needs but also to stimulate growth and restore public confidence. Over ¥300 trillion in emergency funds were approved between 1995–2023, reshaping public finance dynamics and highlighting the increasing reliance on debt financing to manage economic challenges. This trend underscores the government’s commitment to maintaining essential services and supporting the economy during turbulent times, yet it also raises concerns about long-term fiscal sustainability and the burden of debt on future generations.

Supplementary Budgets and Fiscal Expansion

Post-crisis interventions dominated budget planning. The 2008 global recession triggered a ¥12 trillion package, followed by ¥47 trillion for pandemic recovery in 2020. Each event expanded the debt-to-GDP ratio, which climbed from 135% in 2000 to 263% by 2023.

| Period | Event | Spending (¥T) | GDP Impact |

|---|---|---|---|

| 1995–2000 | Banking Crisis | 65 | +18% Debt/GDP |

| 2009–2012 | Global Recession | 78 | +29% Debt/GDP |

| 2020–2022 | Pandemic Relief | 98 | +23% Debt/GDP |

Stimulus Packages and Their Long-Term Impact

Large-scale initiatives initially boosted growth but strained future budgets. The 2013 Abenomics stimulus added ¥20.2 trillion, yet GDP growth averaged just 0.8% annually afterward. “Short-term gains often mask structural costs,” notes an International Monetary Fund report analyzing fiscal sustainability.

Social security demands compounded these pressures. Pension and healthcare outflows doubled since 2000, consuming 38% of the 2023 budget. This left fewer resources for debt reduction, creating a cycle explored in structural reforms and fiscal adjustments.

Market Dynamics: Impact of Bond Yields and Investor Sentiment

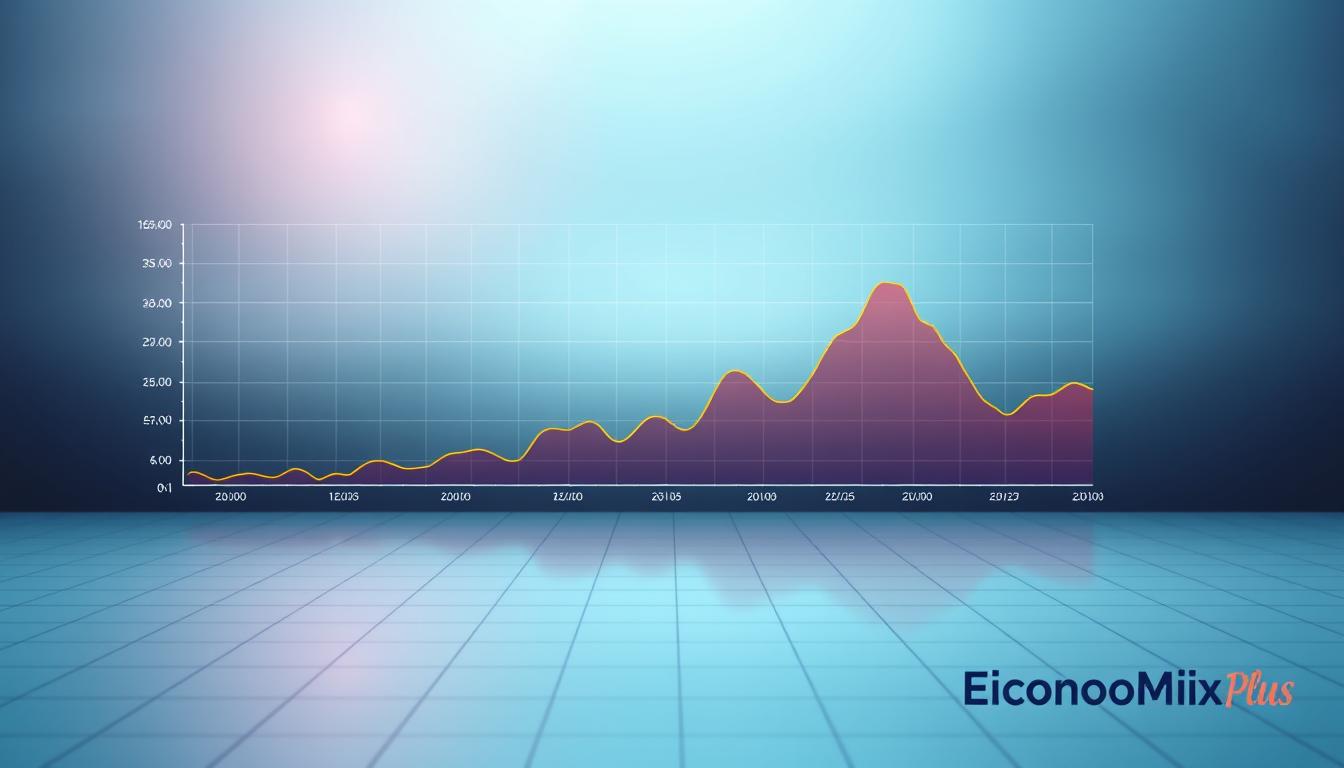

Market fluctuations often reveal deeper economic stresses. For years, government bond yields remained stable despite rising debt levels. This changed in 2023 when 10-year JGBs surpassed 3%—their highest since 2014. Analysts now view these shifts as vital indicators of fiscal health. This increase in yields suggests that investors are becoming increasingly wary of Japan’s long-term economic stability, reflecting concerns over the sustainability of its high debt levels.

The rise in bond yields can lead to higher borrowing costs for the government, which may further strain public finances and limit the ability to fund essential services and infrastructure projects. Moreover, as interest rates rise globally, the competitive landscape for investment shifts, prompting domestic and foreign investors to reassess their strategies and risk tolerance. The dynamics of investor sentiment are critical in this context, as they can significantly influence market behavior and economic outcomes.

Trends in Japanese Government Bond Yields

Yield movements tell a story of growing skepticism. From 2020 to 2023, 10-year rates tripled as interest rates climbed globally. The ministry finance reports borrowing costs now consume 28% of tax revenue—up from 19% in 2018.

| Year | 10-Year Yield | Debt Servicing Costs (¥T) |

|---|---|---|

| 2018 | 0.8% | 9.1 |

| 2020 | 0.6% | 11.3 |

| 2022 | 2.4% | 15.7 |

| 2023 | 3.1% | 18.2 |

Higher yields reflect doubts about long-term debt sustainability. Domestic banks still hold 60% of JGBs, but foreign ownership dropped to 12% in 2023—down from 16% pre-pandemic.

Shifts in Domestic versus Overseas Investor Behavior

Investor priorities have diverged sharply. Overseas funds now demand shorter maturities, while pension institutions extend holdings to 20+ years. “Foreign buyers now demand higher premiums for risk,” notes a fixed-income strategist at Morgan Stanley.

Key contrasts emerge:

- Domestic buyers prioritize stability over returns

- Global funds focus on yield spreads versus U.S. Treasuries

- Hedge funds increasingly short JGBs during policy shifts

Despite volatility, the market shows resilience. Secondary trading volumes rose 22% since 2021, suggesting liquidity remains strong. Yet with interest rates still climbing, these dynamics could reshape fiscal strategies nationwide.

Global Financial Implications and Policy Challenges

Could fiscal instability in one nation ripple through the world economy? The international monetary fund identifies systemic risks as debt levels approach critical thresholds. With obligations exceeding 260% of GDP, this situation challenges global financial frameworks and policy coordination.

Assessing Cross-Border Contagion Risks

IMF reports warn that prolonged fiscal strain could trigger capital flight from Asian markets. Foreign investors hold 14% of the nation’s bonds—a vulnerability if yields spike further. “Sovereign debt markets are interconnected,” states a recent industry analysis, noting spillover effects on U.S. Treasury demand.

Fiscal Benchmarks Among Major Economies

Comparative data reveals stark contrasts:

| Country | Debt/GDP | 10-Year Yield | Policy Response |

|---|---|---|---|

| United States | 123% | 4.3% | Rate hikes + spending caps |

| Germany | 69% | 2.6% | Balanced budgets |

| France | 112% | 3.1% | Pension reforms |

| Case Study | 263% | 3.1% | Yield curve control |

While the U.S. combats inflation with higher interest rates, the Japanese government maintains ultra-loose monetary policy. This divergence complicates global efforts to stabilize currency markets. World Bank projections suggest such imbalances could reduce world economic growth by 0.4% annually through 2030.

Structural reforms remain contentious. Unlike European nations implementing austerity measures, policymakers here prioritize short-term stability over debt reduction—a strategy drawing mixed reviews from international observers.

Inflation, Interest Rates, and Fiscal Sustainability

Balancing price stability with fiscal health grows increasingly complex as borrowing costs climb. Recent surges in government bond yields—reaching 3.1% for 10-year securities—signal mounting pressure on budgets already strained by inflation. The ministry of finance reports debt servicing now consumes 28% of annual revenue, up from 19% five years ago.

Risks of Rising Yields Amid Fiscal Strain

Higher yields amplify repayment challenges. For every 1% increase in interest rates, annual debt costs rise by ¥3.2 trillion. This creates a vicious cycle:

- Borrowing costs divert funds from public services

- Currency depreciation pressures intensify

- Investor confidence erodes, raising refinancing risks

Global comparisons highlight vulnerabilities. While U.S. 10-year Treasuries yield 4.3%, the narrower spread with government bonds reduces their appeal to foreign buyers—ownership dropped 4% since 2020.

Policy Responses to Mitigate Financial Risks

Regulators employ three strategies to stabilize markets:

- Yield curve control to cap long-term rates

- Strategic bond purchases by central banks

- Coordination with the International Monetary Fund on deficit targets

Recent reviews show these measures delayed—but didn’t eliminate—structural reforms. As one analyst notes, “Monetary tools can’t substitute for sustainable fiscal discipline.” With inflation persisting at 3.2%, policymakers face narrowing options to reconcile growth incentives with stability.

GDP, Debt Ratios, and Economic Growth Projections

When debt outpaces economic output, what pathways remain for sustainable growth? The government faces a critical balancing act: stimulating expansion while managing obligations exceeding 260% of GDP. Recent International Monetary Fund projections suggest this ratio could reach 275% by 2030 if current trends persist.

High debt levels create a double-edged sword. While enabling short-term stimulus, they divert resources from productivity-boosting investments. Data shows each 10% rise in the GDP ratio correlates with 0.3% slower annual growth over five years—a pattern observed since 2008.

Interplay Between Debt Levels and Economic Growth

Three mechanisms drive this dynamic:

- Interest payments consuming 28% of fiscal revenue by 2025 (Cabinet Office estimates)

- Reduced private sector credit access as government borrowing dominates markets

- Currency volatility discouraging foreign direct investment

The International Monetary Fund warns that debt above 250% of GDP typically triggers monetary policy paralysis. Yet unconventional measures like yield curve control have temporarily stabilized interest rates.

“Structural reforms must accompany financial engineering,”

states their 2023 fiscal monitor report.

Future scenarios hinge on growth revival. If productivity rises 1.5% annually, the debt ratio could stabilize by 2040. Stagnation below 0.5% growth, however, risks a spiral where borrowing costs outpace economic expansion. Current levels demand urgent action—not just accounting adjustments, but fundamental shifts in fiscal strategy.

Government Reforms and Future Fiscal Adjustments

What policy shifts could stabilize a debt-laden economy? Authorities face mounting pressure to balance fiscal consolidation with growth incentives. Recent reforms target structural weaknesses through tax adjustments and spending reviews, aiming to curb obligations exceeding 260% of GDP.

Strategies for Debt Consolidation

The Japanese government prioritizes three measures:

- Gradual consumption tax hikes to 15% by 2030

- Expenditure cuts targeting redundant subsidies

- Privatization of state-owned assets worth ¥7 trillion annually

These steps aim to reduce primary deficits by 3% of GDP within five years. The International Monetary Fund projects these reforms could lower debt ratios to 235% by 2040—if implemented fully.

Long-Term Fiscal Projection Scenarios

Market volatility complicates forecasts. Under current interest rates, debt servicing costs could consume 35% of revenue by 2035. Two scenarios dominate analysis:

| Scenario | 2030 Debt/GDP | Annual Growth |

|---|---|---|

| Baseline | 245% | 0.8% |

| Stress Case | 275% | 0.3% |

“Higher interest rates globally will test fiscal resilience,” notes a 2023 monetary fund report. Demographic pressures and global financial shocks remain wild cards, potentially derailing even aggressive consolidation plans.

Assessing External Shocks and Fiscal Risks

How do unexpected events reshape a nation’s financial trajectory? Natural disasters and global crises have repeatedly destabilized fiscal planning, forcing governments to redirect funds toward recovery. The 2011 earthquake alone required ¥25 trillion in emergency spending—equivalent to 5% of that year’s GDP. Similarly, the 1997 Asian financial crisis slashed export revenues by 14%, worsening the debt-to-GDP ratio.

Impact of Natural Disasters and Global Crises

Catastrophic events create immediate budgetary strain. Reconstruction costs from the 2011 disaster consumed 23% of annual tax revenue, delaying deficit reduction goals. Global shocks like the 2008 recession amplified challenges:

| Event | Fiscal Impact (¥T) | Debt/GDP Change |

|---|---|---|

| 2011 Earthquake | 25 | +8% |

| Asian Financial Crisis | 12 | +11% |

| COVID-19 Pandemic | 78 | +23% |

Exchange rate volatility compounds these pressures. A 10% yen depreciation increases government debt servicing costs by ¥4.8 trillion annually, per International Monetary Fund estimates.

Uncertainties in Fiscal and Monetary Policies

External shocks disrupt long-term planning. The global financial system’s interconnectedness means local crises often require international coordination. “Unforeseen events force policymakers into reactive modes,” states a 2023 IMF report, noting that 65% of fiscal adjustments since 2000 followed external triggers.

Three persistent risks stand out:

- Social security demands rising during recovery phases

- Diverging interest rates complicating debt refinancing

- Currency fluctuations eroding budget projections

With the country’s situation uniquely exposed to earthquakes and trade disruptions, fiscal buffers remain critical. As years of accumulated obligations intersect with new shocks, balancing stability and adaptability becomes paramount.

Conclusion

Mounting fiscal pressures underscore a critical juncture for economic stability. With government bond yields tripling since 2020 and obligations exceeding 260% of GDP, the nation faces compounding challenges. Rising interest rates amplify repayment costs, consuming over a quarter of annual revenue while limiting funds for public services.

Decades of stimulus-driven policy and external shocks created this unsustainable trajectory. The monetary fund warns that without reforms, debt ratios could reach 275% by 2030. Global comparisons reveal stark contrasts—few economies operate with such elevated gdp ratios amid aging populations and stagnant growth.

Three priorities emerge:

- Structural adjustments to curb primary deficits

- Balanced strategies addressing international monetary concerns

- Credible plans to stabilize government borrowing costs

As world economic stability hinges on coordinated action, this fiscal crossroads demands urgent attention. Metrics like yield volatility and debt servicing thresholds signal systemic risks. While short-term measures provide temporary relief, lasting solutions require reimagining fiscal frameworks for a shifting global landscape.