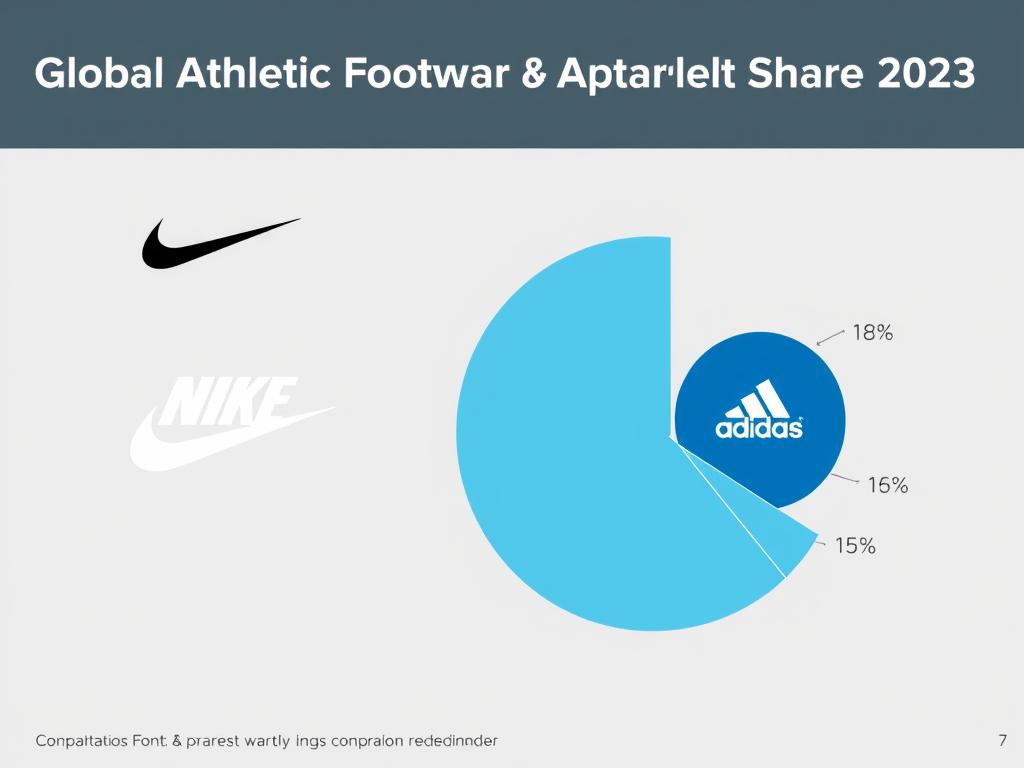

In today’s hyperconnected world, athletic brands have transcended their functional origins to become powerful cultural symbols that shape and reflect youth identity. Nike and Puma stand as titans in this space, each wielding distinct approaches to capturing the hearts, minds, and wallets of young consumers worldwide. This analysis delves into how these two global powerhouses navigate the complex intersection of sport, fashion, music, and social consciousness that defines contemporary youth culture.

As young consumers increasingly make purchasing decisions based on values and identity rather than mere utility, understanding how these brands position themselves within youth culture becomes crucial for market analysts, cultural commentators, and brand strategists. This comparative analysis examines ten key dimensions of Nike and Puma’s relationship with youth culture, offering data-driven insights into which brand more effectively resonates with today’s young consumers.

Nike and Puma compete for influence in shaping youth identity across global markets

Brand Heritage and Market Position

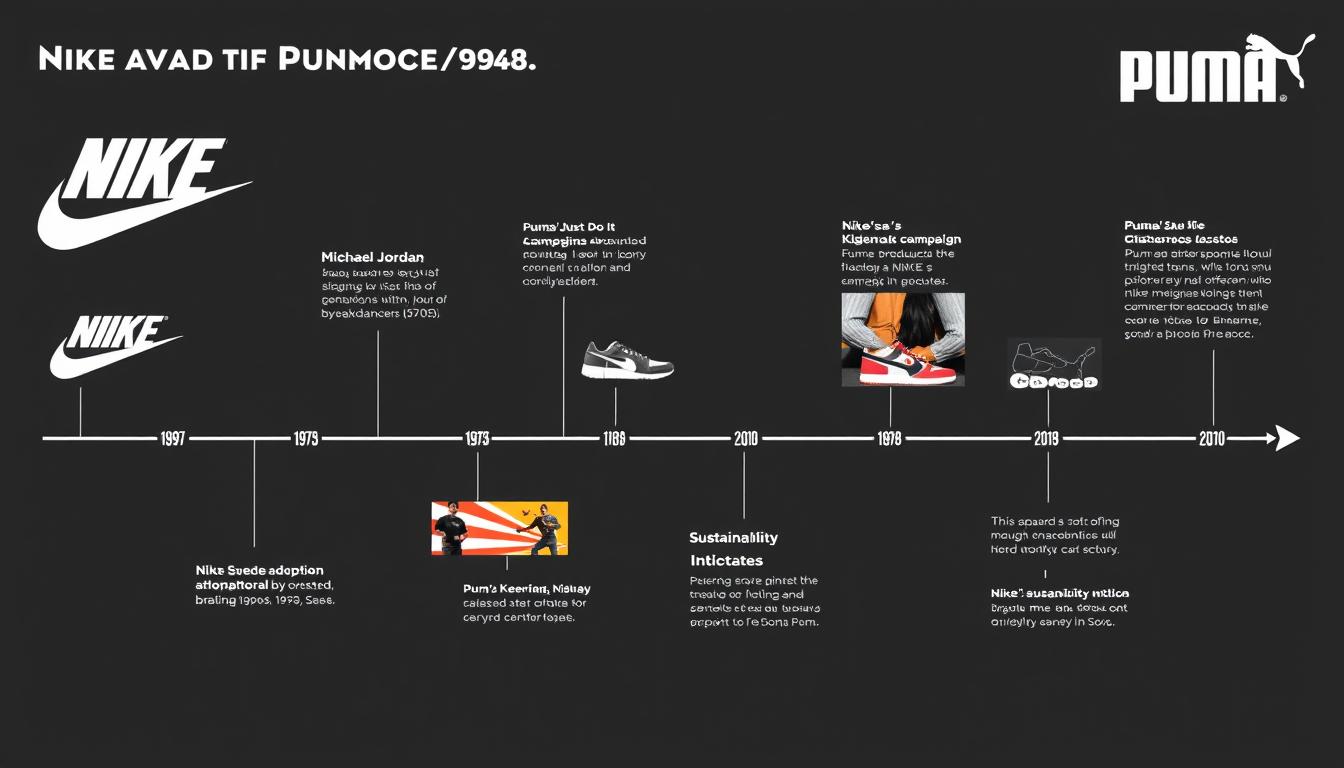

Nike’s journey began in 1964 as Blue Ribbon Sports, founded by University of Oregon track coach Bill Bowerman and his former student Phil Knight. Their mission was simple yet revolutionary: create better running shoes for athletes. By 1971, they had rebranded as Nike—named after the Greek goddess of victory—and introduced their iconic “swoosh” logo. Nike’s heritage is deeply rooted in American athletic performance and innovation, with early marketing focusing on elite athletes and competitive spirit.

Puma, conversely, emerged from a family feud in post-war Germany. Founded in 1948 when Rudolf Dassler split from his brother Adolf (who went on to found Adidas), Puma initially focused on soccer footwear. The brand’s European origins gave it a distinct aesthetic sensibility that would later translate well to fashion-forward youth markets. Puma’s leaping cat logo became synonymous with a blend of athletic performance and European style.

Nike’s Youth Culture Evolution

Nike’s relationship with youth culture crystallized in the 1980s with the signing of Michael Jordan and the subsequent launch of Air Jordans in 1985. This partnership revolutionized athletic endorsements and created the sneakerhead subculture that continues to drive youth consumption patterns today. Nike further cemented its cultural relevance through strategic partnerships with hip-hop artists and street artists, effectively bridging athletic performance with urban authenticity.

The brand’s “Just Do It” campaign, launched in 1988, transcended sports marketing to become a cultural rallying cry for youth self-determination. This slogan’s emphasis on individual achievement and breaking barriers resonated deeply with young consumers seeking identity through consumption. Nike has maintained this cultural positioning through controversial but culturally relevant campaigns, most notably with Colin Kaepernick in 2018, which explicitly aligned the brand with youth-driven social justice movements.

Puma’s Youth Culture Evolution

Puma’s path to youth cultural relevance took a different trajectory. While initially focused on soccer, the brand found unexpected cultural cache in the 1970s when its Suede sneaker was adopted by breakdancers and early hip-hop pioneers. This organic adoption gave Puma street credibility that would later become invaluable as youth culture and athletic wear became increasingly intertwined.

Unlike Nike’s athlete-first approach, Puma more aggressively pursued fashion and music collaborations to establish cultural relevance. The brand’s watershed moment came in the early 2000s with collaborations with designers like Jil Sander and Alexander McQueen, positioning Puma at the intersection of athletic performance and high fashion. This strategy culminated in Rihanna’s FENTY PUMA line, which brought the brand firmly into youth cultural conversations around gender fluidity, inclusivity, and the blurring of athletic and fashion boundaries.

Key milestones in Nike and Puma’s youth culture evolution (1970s-Present)

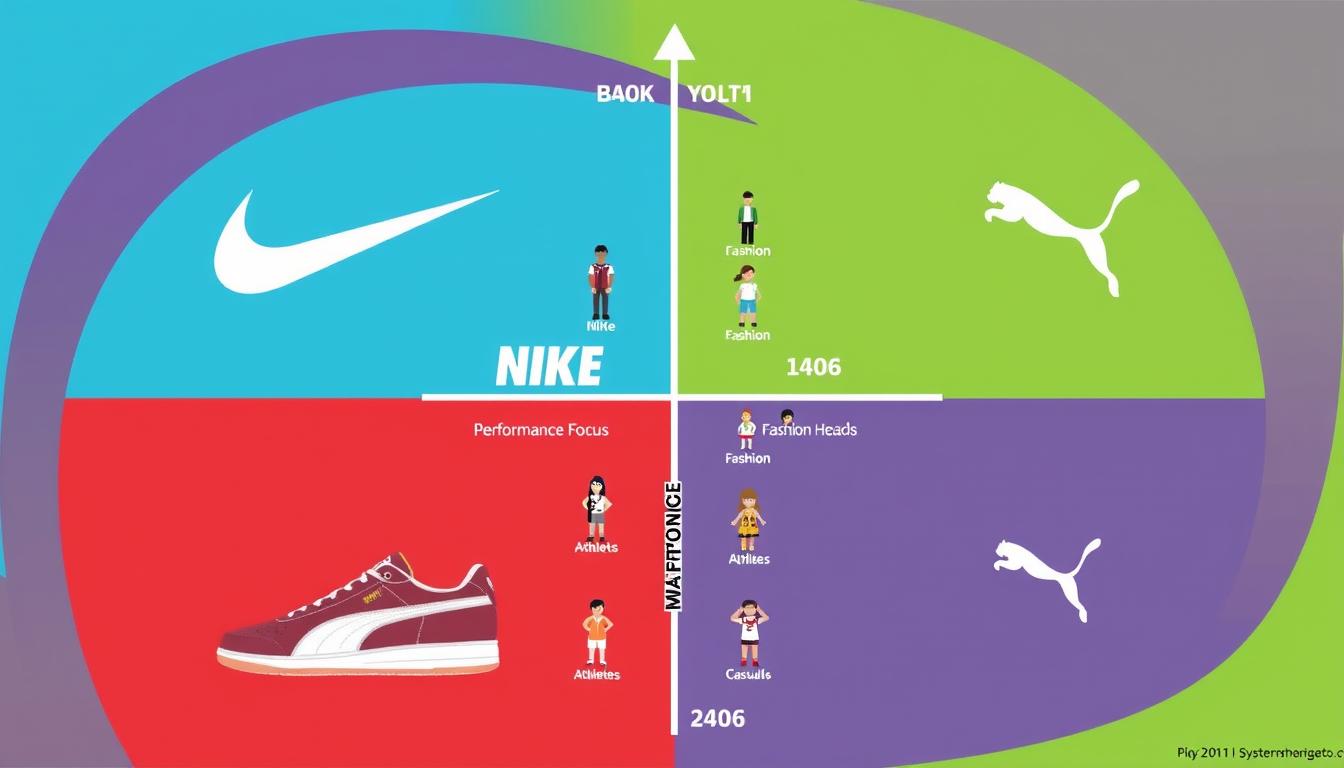

Core Product Lines and Target Audience

Both Nike and Puma have developed diverse product ecosystems that target different segments of youth culture, but their approaches reveal distinct strategies for connecting with young consumers.

Nike’s Product Strategy

Nike’s product architecture is built around performance categories (Running, Basketball, Training, Soccer) that are then extended into lifestyle offerings. This performance-first approach is evident in flagship products like Air Max (running heritage), Dunk SB (skateboarding), and Jordan Brand (basketball). Each product line maintains technical credibility while incorporating design elements that appeal to youth cultural sensibilities.

Nike’s target audience skews toward urban, digitally-native consumers who value both performance and cultural cachet. The brand particularly resonates with sneakerhead communities, streetwear enthusiasts, and young athletes who see sport as integral to their identity. Nike’s product drops and limited editions create artificial scarcity that drives youth engagement through “hype culture” and social media visibility.

Puma’s Product Strategy

Puma’s product strategy more explicitly bridges athletic and fashion worlds. While maintaining performance categories like Running (Nitro foam technology) and Soccer (Future and Ultra lines), Puma has more aggressively positioned its Lifestyle category as the brand’s center of gravity. Signature products like the Suede, RS-X, and Cali have minimal performance pretensions and instead focus on aesthetic appeal and cultural relevance.

Puma targets fashion-forward youth who prioritize style versatility and cultural fluency over pure athletic performance. The brand particularly appeals to young consumers interested in music, art, and fashion who see athletic wear as an extension of their broader style vocabulary rather than a statement about athletic identity. Puma’s collaborations with fashion designers and musicians attract consumers who might find Nike’s performance focus less relevant to their lifestyle.

Flagship products from Nike and Puma that have gained significant traction in youth culture

| Brand | Primary Youth Segments | Key Product Lines | Cultural Associations |

| Nike | Urban Sneakerheads, Athletes, Streetwear Enthusiasts | Jordan Brand, Nike SB, Air Max, Tech Fleece | Basketball, Skateboarding, Hip-hop, Streetwear |

| Puma | Fashion-Forward Youth, Music Enthusiasts, Creative Communities | Suede, RS-X, Cali, Fenty Collection | Music, Fashion, Street Dance, European Aesthetics |

Strengths and Weaknesses

Nike Strengths

- Unmatched technical innovation creating authentic performance credibility

- Powerful athlete endorsement portfolio spanning multiple sports and generations

- Mastery of artificial scarcity and “drop culture” driving youth engagement

- Strong digital ecosystem including SNKRS app and Nike Training Club

- Cultural relevance reinforced through controversial but authentic social stances

Nike Weaknesses

- Premium pricing creating accessibility barriers for some youth segments

- Persistent labor practice controversies undermining ethical positioning

- Size and corporate structure limiting agility in responding to youth trends

- Overreliance on basketball heritage in a shifting youth sports landscape

- Challenges in authentically connecting with female youth consumers

Puma Strengths

- Strong fashion credibility through designer collaborations and runway presence

- More accessible price points for budget-conscious youth consumers

- Agility in responding to emerging cultural trends and subcultures

- Stronger appeal to female youth consumers through inclusive design

- European heritage providing distinct aesthetic differentiation

Puma Weaknesses

- Limited technical innovation perception compared to competitors

- Smaller athlete endorsement portfolio with fewer transcendent stars

- Less developed digital ecosystem and community platforms

- Inconsistent brand messaging across global markets

- Challenges in maintaining relevance in performance-focused categories

Comparative positioning of Nike and Puma across performance and fashion dimensions

Innovation and Technology

Technological innovation serves as both functional advancement and cultural signifier for youth consumers, with Nike and Puma taking divergent approaches to innovation narratives.

Nike’s Innovation Approach

Nike has built its youth cultural relevance partly on a foundation of visible, marketable technological innovation. The Air cushioning platform, introduced in 1979 and made visible in the Air Max 1 (1987), created a visual language of innovation that continues to influence youth perceptions. Subsequent technologies like Flyknit, React foam, and ZoomX have maintained this tradition of visible innovation that young consumers can identify and discuss as part of their cultural capital.

Beyond product technology, Nike has pioneered digital innovation that shapes youth engagement with the brand. The SNKRS app has transformed limited product releases into cultural events, creating a digital community around product drops. Nike Training Club and Nike Run Club apps extend the brand relationship beyond product purchase into lifestyle integration, collecting valuable data while building brand loyalty.

Puma’s Innovation Approach

Puma’s innovation strategy has focused less on proprietary visible technology and more on aesthetic innovation and cultural relevance. While the brand has introduced performance technologies like NITRO foam and FUZIONFIT+ adaptive fit systems, these innovations are marketed with less technical emphasis than Nike’s equivalents. Instead, Puma has innovated through unexpected collaborations and design approaches that challenge category conventions.

The brand’s most significant recent innovation has been in sustainability technology, with the development of RE:SUEDE (biodegradable version of its classic sneaker) and experimentation with circular production models. This focus aligns with youth concerns about environmental impact while differentiating from Nike’s performance-focused innovation narrative. Puma’s Black Station Web3 platform represents the brand’s exploration of digital innovation through NFTs and virtual products.

Key technological innovations from Nike and Puma that resonate with youth consumers

The divergent innovation approaches reflect different understandings of youth cultural priorities. Nike’s emphasis on performance technology appeals to youth segments that value technical mastery and athletic identity. Puma’s focus on aesthetic and sustainability innovation connects with youth segments more concerned with cultural fluency and environmental values. Both approaches have proven effective with their respective target audiences, though Nike’s innovation narrative has historically generated more cultural conversation among young consumers.

Sustainability and Social Responsibility

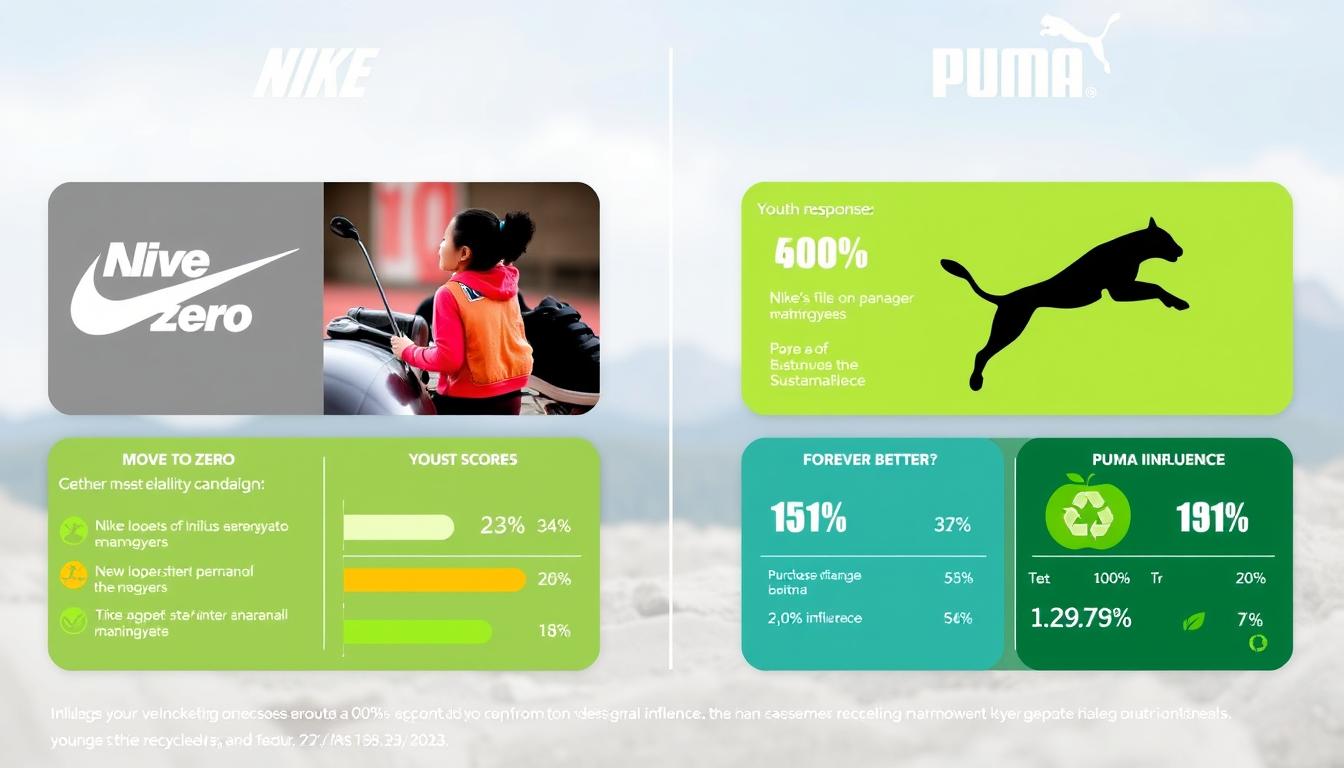

As environmental and social consciousness becomes increasingly central to youth identity, both Nike and Puma have developed comprehensive sustainability initiatives that speak to these concerns while reflecting their distinct brand positions.

Comparative analysis of Nike and Puma’s sustainability initiatives and youth response

Nike’s sustainability platform, Move to Zero, aims for zero carbon emissions and zero waste, with specific targets including 100% renewable energy in owned facilities by 2025 and 30% reduction in supply chain carbon emissions by 2030. The program emphasizes material innovation through initiatives like Nike Grind (recycled shoe components) and Space Hippie (shoes made from factory scraps). Nike’s social responsibility efforts have focused on racial justice and gender equity, most visibly through the controversial but culturally significant Colin Kaepernick campaign.

Puma’s sustainability program, Forever Better, has set more aggressive targets in some areas, including carbon neutrality in owned operations by 2025 and 90% reduction in supply chain emissions by 2030. The brand has pioneered environmental profit and loss accounting, valuing its environmental impact at €455 million in 2020. Puma’s RE:GENERATE program for circular products and biodegradable experimentation has particularly resonated with environmentally conscious youth. The brand’s social initiatives have emphasized gender equality through women’s sports support and the She Moves Us platform.

| Sustainability Dimension | Nike Approach | Puma Approach | Youth Response |

| Carbon Reduction | 30% supply chain reduction by 2030 | 90% supply chain reduction by 2030 | Puma perceived as more ambitious |

| Material Innovation | Nike Grind, Flyleather, recycled polyester | RE:SUEDE biodegradable materials, recycled polyester | Nike seen as more innovative |

| Circular Economy | Nike Refurbished program, limited recycling | RE:GENERATE circular products, compostable experiments | Puma perceived as more committed |

| Social Justice | Black Community Commitment, Kaepernick campaign | Reform platform, #REFORM social justice initiative | Nike seen as more authentic |

| Transparency | Impact reports, limited factory disclosure | Environmental P&L accounting, factory disclosure | Puma perceived as more transparent |

Youth response to these initiatives reveals important distinctions. According to 2023 Morning Consult data, 64% of Gen Z consumers are aware of Nike’s sustainability efforts compared to 51% for Puma, reflecting Nike’s superior communication reach. However, Puma’s initiatives are perceived as more authentic by those aware of them, with 58% of Gen Z respondents viewing Puma’s sustainability claims as “very credible” compared to 43% for Nike. This authenticity gap likely stems from Nike’s larger scale and more publicized labor controversies, which create skepticism among socially conscious youth consumers.

Financial Performance and Growth Trajectory

Financial performance provides concrete metrics for assessing how effectively Nike and Puma are connecting with youth consumers through their distinct strategies.

Revenue growth and youth market penetration for Nike and Puma (2018-2023)

Nike reported $51.2 billion in revenue for fiscal year 2023, representing 10% growth year-over-year. The company’s direct-to-consumer strategy has been particularly successful with youth consumers, with Nike Digital growing 14% to represent 26% of total brand revenue. Jordan Brand continues to outperform the broader Nike portfolio, growing 29% to reach $6.6 billion in revenue, demonstrating the enduring appeal of this sub-brand with youth consumers. North America remains Nike’s largest market at $20.5 billion, though Greater China has shown the fastest growth at 16%.

Puma reported €8.5 billion ($9.1 billion) in revenue for fiscal year 2023, representing 6.6% growth year-over-year. While significantly smaller than Nike, Puma has achieved more consistent growth in youth-dominated categories, with Sportstyle (lifestyle products) growing 9.2% to represent 43% of total revenue. Puma’s regional performance shows particular strength in Europe (€3.2 billion) and emerging markets in Asia (€1.9 billion), where its fashion-forward positioning resonates with youth consumers. The brand’s direct-to-consumer channels grew 11.8%, reflecting successful youth engagement strategies.

| Financial Metric | Nike (FY 2023) | Puma (FY 2023) | Youth Market Implications |

| Total Revenue | $51.2 billion | $9.1 billion | Nike’s scale enables broader youth cultural impact |

| Year-over-Year Growth | 10% | 6.6% | Nike showing stronger recent youth connection |

| Digital Revenue Growth | 14% | 11.8% | Both brands effectively engaging digital-native youth |

| Lifestyle Category Revenue | $18.7 billion (37%) | $3.9 billion (43%) | Puma more dependent on youth fashion trends |

| R&D Investment | $1.1 billion (2.1%) | $156 million (1.7%) | Nike’s innovation advantage with tech-focused youth |

Growth strategies reveal different approaches to youth market development. Nike has invested heavily in its direct-to-consumer ecosystem, with particular emphasis on the SNKRS app as a community platform for youth engagement. The company has also pursued strategic acquisitions of digital platforms that provide data on youth consumer behavior. Puma has focused on strategic collaborations with youth cultural figures and more aggressive pricing to gain market share, accepting lower margins (9.4% operating margin vs. Nike’s 13.5%) to build youth consumer loyalty.

Brand Image and Public Perception

How youth consumers perceive Nike and Puma reveals the effectiveness of their respective strategies in connecting with youth identity formation processes.

Social media presence and youth perception metrics for Nike and Puma

Nike maintains a dominant position in youth brand perception surveys, with 42% of Gen Z consumers naming it their favorite athletic brand according to YPulse’s 2023 data. The brand’s social media presence reflects this dominance, with approximately 300 million followers across platforms (143 million on Instagram, 8.7 million on Twitter, 35 million on TikTok). Nike’s brand associations among youth include “innovative” (cited by 67% of respondents), “authentic” (62%), and “cool” (58%), though also “expensive” (71%) and “corporate” (48%).

Puma ranks fifth in youth brand preference surveys at 8%, behind Nike, Adidas, Jordan Brand, and Under Armour. The brand’s social media presence is significantly smaller at approximately 50 million followers across platforms (23 million on Instagram, 4.1 million on Twitter, 5.3 million on TikTok). However, Puma shows stronger engagement rates, particularly on TikTok where its content averages 2.3% engagement compared to Nike’s 1.7%. Puma’s brand associations among youth include “stylish” (cited by 73% of respondents), “accessible” (65%), and “diverse” (59%).

Nike’s Cultural Positioning

Nike’s brand image among youth is built on a foundation of athletic authenticity extended into cultural relevance. The brand is perceived as aspirational but attainable, with products that signal both athletic competence and cultural awareness. Nike’s controversial but culturally relevant campaigns, particularly around social justice issues, have strengthened its perception as a brand that understands youth values despite its corporate scale.

Influencer strategy has centered on transcendent athletic figures (LeBron James, Serena Williams) supplemented by strategic cultural partnerships (Travis Scott, Virgil Abloh). These partnerships create cultural moments that extend beyond product to shape broader conversations in youth culture. Nike’s streetwear credibility remains strong, with 68% of surveyed youth considering Nike products relevant to streetwear culture.

Puma’s Cultural Positioning

Puma’s brand image among youth emphasizes cultural fluency and accessibility over athletic dominance. The brand is perceived as more inclusive and approachable, with products that prioritize style versatility and cultural references. Puma’s less controversial but more consistent messaging around diversity and sustainability has built credibility with values-driven youth consumers.

Influencer strategy has focused on cultural figures with strong youth appeal (Rihanna, J. Cole, Dua Lipa) rather than primarily athletes. These partnerships emphasize authentic cultural integration rather than mere endorsement. Puma’s streetwear credibility has grown significantly, with 54% of surveyed youth now considering Puma relevant to streetwear culture, up from 37% in 2018.

The perception gap between these brands reveals different approaches to youth cultural capital. Nike has built a position of cultural authority, where its products confer status through association with athletic excellence and cultural relevance. Puma has cultivated a position of cultural fluency, where its products signal awareness of current trends and values without the performance expectations of Nike. Both approaches have proven effective with different youth segments, though Nike’s cultural authority remains more broadly recognized.

Global Footprint and Cultural Adaptation

The ability to adapt global brand positioning to local youth cultural contexts represents a critical success factor for both Nike and Puma.

Regional adaptation strategies employed by Nike and Puma across global youth markets

Nike has developed sophisticated localization strategies that maintain global brand consistency while adapting to regional youth cultural contexts. In China, the brand has embraced digital-first engagement through WeChat mini-programs and partnerships with local influencers like Olympic sprinter Su Bingtian. The Nike By You customization platform has been adapted to incorporate local cultural references that resonate with Chinese youth. In European markets, Nike has emphasized soccer heritage and streetwear crossover through city-specific collections like the London On Air campaign.

Puma’s smaller scale has paradoxically enabled more nimble cultural adaptation in some markets. The brand has achieved particular success in India through cricket partnerships and Bollywood collaborations that connect with local youth cultural touchpoints. In Japan, Puma has embraced the intersection of streetwear and anime culture through collaborations with properties like Dragon Ball Z. The brand’s European heritage has been leveraged effectively in North American markets to position Puma as a more sophisticated alternative to domestic brands.

| Region | Nike Cultural Adaptation | Puma Cultural Adaptation | Youth Response |

| East Asia | Lunar New Year collections, digital-first engagement | K-pop partnerships, anime collaborations | Puma gaining share with fashion-forward youth |

| South Asia | Cricket sponsorships, Air Max India collection | Bollywood partnerships, accessible pricing | Puma leading with broader accessibility |

| Middle East | Nike Pro Hijab, modest activewear | Middle East-exclusive designs, local athletes | Nike perceived as more culturally sensitive |

| Africa | Nigeria football collections, Made in Kenya | African national team sponsorships, local production | Mixed preference based on country |

| Latin America | Soccer dominance, regional athlete stories | Reggaeton partnerships, accessible pricing | Nike aspirational, Puma more accessible |

Both brands have recognized the importance of authentic cultural integration rather than superficial localization. Nike’s “Nothing Beats a Londoner” campaign demonstrated deep understanding of local youth culture through hyperlocal references and authentic casting. Similarly, Puma’s “She Moves Us” platform has been adapted to feature local female cultural figures in different markets rather than imposing global ambassadors. This authentic localization has become increasingly important as youth consumers become more sensitive to cultural appropriation versus appreciation.

Challenges and Future Prospects

Both Nike and Puma face significant challenges in maintaining and strengthening their connections with youth culture in an increasingly fragmented and values-driven marketplace.

Emerging challenges and opportunities for Nike and Puma in evolving youth markets (2023-2030)

Nike’s primary challenges include maintaining authenticity at scale, addressing persistent labor controversies that undermine ethical positioning, and defending against the fragmentation of youth culture that threatens mass-market approaches. The brand also faces increasing competition from direct-to-consumer brands like On and Hoka that appeal to specific youth niches with focused value propositions. Nike’s future strategy appears focused on deepening its digital ecosystem to create more personalized youth engagement while leveraging its scale for sustainability innovation that smaller competitors cannot match.

Puma confronts challenges in building technical credibility to complement its fashion positioning, developing more distinctive innovation narratives, and maintaining growth momentum against larger competitors with superior resources. The brand also struggles with inconsistent global execution that can dilute its cultural relevance in specific markets. Puma’s future strategy emphasizes sustainability leadership through ambitious targets and circular models, continued fashion integration through strategic collaborations, and selective performance category focus where it can credibly compete.

Emerging Youth Culture Trends

Several emerging trends will shape how these brands connect with youth culture moving forward. The rise of Gen Alpha (born after 2010) as consumers introduces a generation with even greater digital nativity and values orientation than Gen Z. Early research suggests this generation places even higher priority on sustainability, inclusivity, and brand purpose than their predecessors. The continued blurring of performance and lifestyle boundaries creates both opportunities and challenges for brand positioning, as does the growing importance of digital spaces for identity formation.

The metaverse and Web3 technologies represent both opportunity and risk for youth cultural relevance. Nike has made early investments in this space through RTFKT acquisition and Nikeland on Roblox, while Puma has experimented with Black Station NFT platform. However, youth skepticism toward corporate involvement in these spaces creates authenticity challenges that both brands must navigate carefully.

Strategic Outlook

Nike appears positioned to maintain its youth cultural dominance through superior resources, established cultural capital, and sophisticated digital ecosystem. The brand’s ability to connect performance credibility with cultural relevance creates a powerful value proposition that smaller competitors struggle to match. However, Nike’s size and corporate structure may limit its agility in responding to rapidly evolving youth cultural trends.

Puma’s more focused approach and fashion credibility position it well for continued growth in specific youth segments, particularly those prioritizing style versatility and cultural fluency over athletic performance. The brand’s sustainability leadership and more accessible pricing create opportunities to connect with values-driven youth consumers. However, Puma’s smaller scale limits its ability to shape broader cultural conversations in the way Nike consistently achieves.

The competition between these brands ultimately reflects different theories about youth cultural capital formation. Nike believes in the enduring power of athletic achievement as cultural currency, extended through strategic cultural partnerships. Puma bets on the growing importance of cultural fluency and values alignment over performance credentials. Both approaches have proven viable, suggesting that youth culture has room for multiple authentic expressions of identity through brand affiliation.

Conclusion

The comparative analysis of Nike and Puma reveals two distinct but effective approaches to connecting with youth culture and identity. Nike maintains dominant market position through a performance-first approach extended into cultural relevance, supported by unmatched resources and sophisticated digital ecosystem. The brand’s cultural authority stems from authentic athletic heritage amplified through strategic cultural partnerships and controversial but relevant social positioning.

Puma has carved out a growing position through fashion integration, cultural fluency, and values alignment, particularly around sustainability and inclusivity. The brand’s more accessible positioning and agile cultural adaptation have enabled it to connect with youth segments that prioritize style versatility and social values over athletic performance. While smaller in scale, Puma’s focused approach has yielded consistent growth in key youth-dominated categories.

Currently, Nike more effectively reflects youth culture at scale through its unmatched cultural reach and ability to shape broader conversations. However, Puma more authentically connects with specific youth segments through its fashion credibility and values alignment. As youth culture continues to fragment and values orientation intensifies, both brands must evolve their approaches to maintain relevance with increasingly discerning young consumers seeking authentic expressions of identity through brand affiliation.