In the rapidly evolving world of digital payments, PayPal and Stripe stand as two dominant forces, each with distinct approaches to making online transactions seamless. PayPal, established in 1998, pioneered consumer-friendly digital payments, while Stripe, founded in 2010, revolutionized developer-first payment infrastructure. This comprehensive analysis compares these payment processing giants across ten essential categories to determine which platform truly makes digital payments easier for businesses and consumers in 2024.

1. Company Background and Vision

PayPal: The Pioneer

Founded in 1998 as Confinity, PayPal emerged during the early days of e-commerce with a mission to enable secure online payments. After merging with Elon Musk’s X.com in 2000 and being acquired by eBay in 2002 (later spinning off in 2015), PayPal established itself as the first widely adopted digital payment solution. Its vision centered on democratizing financial services for consumers and merchants alike.

Key milestones include:

- 2000: Reached 1 million user accounts

- 2006: Launched PayPal Mobile

- 2013: Acquired Braintree (including Venmo)

- 2018: Completed acquisition of iZettle for in-store payments

- 2021: Introduced cryptocurrency trading

- 2023: Launched PYUSD stablecoin

Stripe: The Developer’s Choice

Founded in 2010 by Irish brothers Patrick and John Collison, Stripe emerged with a developer-first approach to payments. Frustrated by the complexity of implementing online payment systems, they created an API-driven platform that prioritized simplicity for developers. Stripe’s vision focuses on increasing the GDP of the internet by building economic infrastructure for online businesses.

Key milestones include:

- 2011: Received backing from Y Combinator and Peter Thiel

- 2016: Launched Stripe Atlas for business formation

- 2018: Introduced Stripe Terminal for in-person payments

- 2020: Secured $600M funding at $36B valuation

- 2021: Valued at $95B, making it Silicon Valley’s most valuable private company

- 2023: Processed over $1 trillion in transactions

2. Core Focus and Payment Services

While both companies facilitate online payments, their core offerings and approaches differ significantly, reflecting their distinct origins and philosophies.

| Service Category | PayPal | Stripe |

| Online Checkout | PayPal Checkout with One Touch, Express Checkout, guest payments | Stripe Checkout, Elements, Payment Links |

| Peer-to-Peer Transfers | PayPal transfers, Venmo integration | Stripe Connect for marketplace payments |

| Merchant Solutions | PayPal Commerce Platform, Zettle POS | Stripe Terminal, Billing, Invoicing |

| API Infrastructure | RESTful APIs, less developer-centric | Comprehensive APIs, SDKs, extensive documentation |

| Subscription Management | Basic recurring billing | Advanced subscription tools with flexible billing cycles |

| In-Person Payments | Zettle card readers, QR code payments | Stripe Terminal, mobile tap-to-pay |

PayPal’s Consumer-First Approach

PayPal’s core strength lies in its consumer recognition and ease of use. With its ubiquitous “PayPal Checkout” button, the platform offers a frictionless payment experience that consumers trust. PayPal’s acquisition of Venmo and iZettle (now Zettle) has expanded its offerings to include peer-to-peer payments and in-person transactions, creating a comprehensive ecosystem for both online and offline commerce.

Stripe’s Developer-Centric Platform

Stripe focuses on providing flexible, programmable payment infrastructure that developers can customize to their exact specifications. Its extensive API documentation, SDKs, and developer tools allow businesses to create tailored payment experiences. Stripe’s modular approach enables companies to integrate only the components they need, from basic payment processing to complex subscription management and marketplace solutions.

Find Your Ideal Payment Solution

Need consumer recognition and simplicity? PayPal might be your best choice. Require developer flexibility and customization? Consider Stripe.

3. Strengths and Weaknesses

PayPal Strengths

- Widespread consumer recognition and trust

- Simple setup process for merchants

- Integrated consumer wallet functionality

- Available in 200+ countries

- Built-in buyer and seller protection

- Instant access to funds via PayPal balance

PayPal Weaknesses

- Higher transaction fees (3.49% + $0.49 for standard transactions)

- Limited customization options

- More complex fee structure with add-on costs

- Less robust developer tools

- Account stability issues (frozen funds)

- Customer service challenges

Stripe Strengths

- Extensive customization capabilities

- Developer-friendly APIs and documentation

- Transparent pricing (2.9% + $0.30 for standard transactions)

- Advanced fraud prevention with Stripe Radar

- Robust subscription and recurring billing tools

- Seamless integration with business software

Stripe Weaknesses

- Less consumer brand recognition

- Steeper learning curve for non-technical users

- Available in fewer countries (47 vs PayPal’s 200+)

- First-time deposits can take up to 14 days

- Limited virtual terminal functionality

- Requires more technical setup for advanced features

Usability Comparison

PayPal excels in user-friendliness, particularly for small businesses and those without technical resources. Its familiar interface and straightforward setup process make it accessible to merchants of all sizes. Stripe, while requiring more technical knowledge, offers unparalleled flexibility for businesses that need customized payment flows and advanced features.

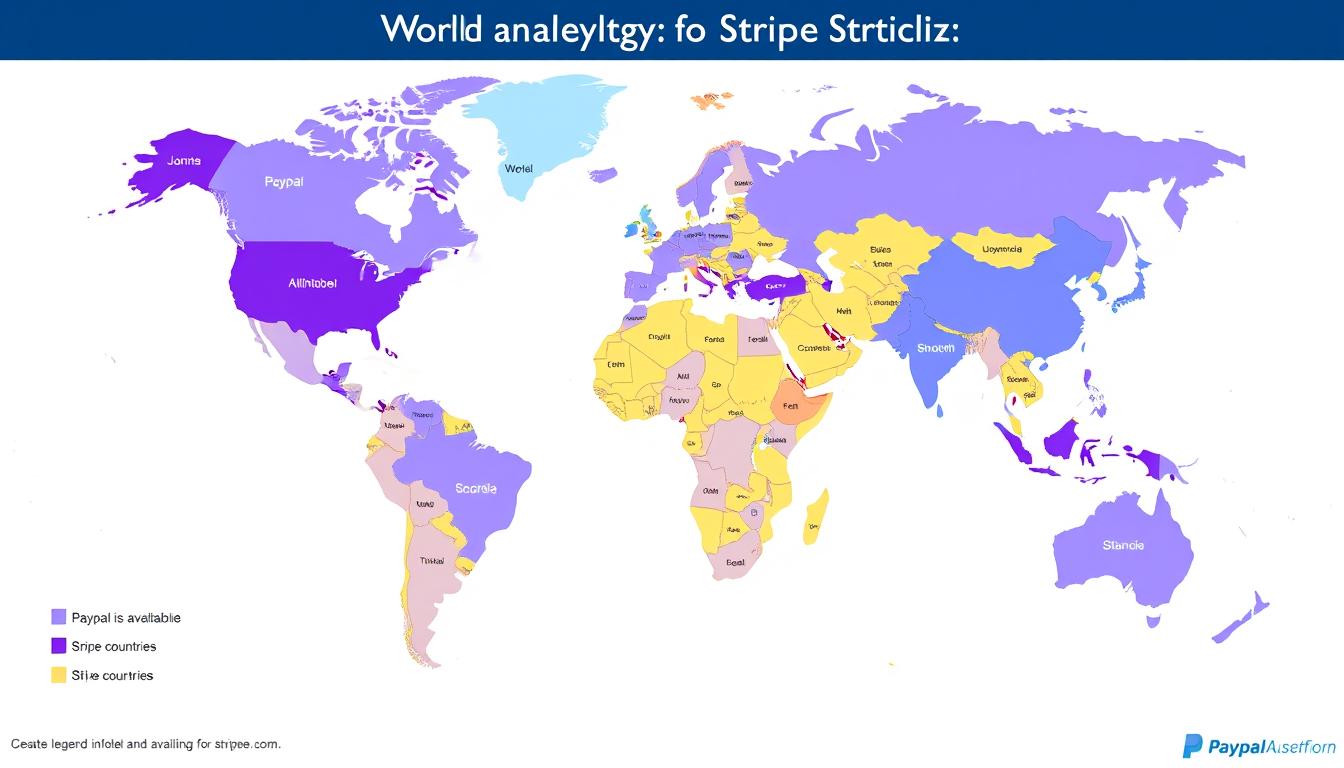

Global Adaptability

PayPal’s wider global reach makes it the better choice for businesses targeting international markets, especially in regions where Stripe hasn’t yet launched. However, Stripe offers superior multi-currency support and localization features in the countries where it operates, providing a more seamless experience for international customers.

5. Innovation and Technology Integration

Both payment processors continue to push the boundaries of financial technology, though their innovation focuses differ based on their core strengths.

AI and Fraud Prevention

PayPal’s Approach

PayPal leverages AI-based risk management systems that analyze transaction patterns across its vast network. Its fraud detection capabilities benefit from the massive dataset of consumer behavior accumulated over decades. Recent innovations include:

- Advanced risk modeling using machine learning

- Behavioral biometrics for authentication

- Smart Payment Buttons that adapt to user preferences

- Personalized checkout experiences based on user history

Stripe’s Approach

Stripe Radar represents the company’s flagship fraud prevention system, using machine learning to identify and block fraudulent transactions. Stripe’s approach emphasizes customization, allowing businesses to:

- Set risk thresholds based on business tolerance

- Create custom rules for transaction approval

- Implement 3D Secure authentication selectively

- Access detailed fraud analytics and reporting

Cryptocurrency and Alternative Payments

PayPal’s Crypto Initiatives

PayPal has embraced cryptocurrency more directly, allowing users to:

- Buy, hold, and sell cryptocurrencies within PayPal

- Pay merchants using crypto holdings

- Access the PYUSD stablecoin launched in 2023

Stripe’s Crypto Approach

Stripe takes a more infrastructure-focused approach to crypto, offering:

- Fiat-to-crypto on-ramp APIs

- Support for crypto businesses through Stripe Connect

- Integration with blockchain payment networks

- KYC/AML compliance tools for crypto transactions

Real-Time Payments and Financial Tools

Both companies have developed solutions to accelerate payment settlement and provide additional financial services:

| Innovation Area | PayPal Offering | Stripe Offering |

| Instant Transfers | Instant Transfer to bank (1.75% fee) | Instant Payouts (1.5% fee) |

| Business Financing | PayPal Working Capital, PayPal Business Loan | Stripe Capital, revenue-based financing |

| Banking Services | PayPal Balance, debit card, bill pay | Stripe Treasury, embedded banking APIs |

| Tax Management | Basic sales tax calculation | Stripe Tax, automated tax compliance |

Innovation Leadership Assessment

While both companies demonstrate strong commitment to innovation, Stripe generally leads in developer-focused technologies and infrastructure flexibility, while PayPal excels in consumer-facing innovations and mainstream cryptocurrency adoption. Businesses prioritizing cutting-edge payment infrastructure typically favor Stripe, while those seeking established consumer technologies often prefer PayPal.

6. Security and Compliance

Both payment processors maintain rigorous security standards, though their approaches and emphases differ slightly.

Security Infrastructure

PayPal Security Features

- End-to-end encryption for all transactions

- Fraud monitoring systems with machine learning

- Seller and buyer protection policies

- Two-factor authentication

- Email confirmation for unusual activity

- Secure data centers with physical safeguards

Stripe Security Features

- Client-side tokenization via Stripe.js

- Stripe Radar for fraud detection and prevention

- Machine learning risk scoring for transactions

- Team-based permission controls

- Automatic TLS certificate management

- Dedicated security team and bug bounty program

Compliance Standards

Both PayPal and Stripe maintain compliance with key industry standards and regulations:

| Compliance Standard | PayPal | Stripe |

| PCI DSS | Level 1 Service Provider | Level 1 Service Provider |

| GDPR | Compliant | Compliant |

| SOC 1 Type 2 | Certified | Certified |

| SOC 2 Type 2 | Certified | Certified |

| ISO 27001 | Certified | Certified |

| CCPA | Compliant | Compliant |

Key Security Differences

The primary distinction in security approaches lies in implementation rather than overall protection level:

PayPal’s security advantage: By handling the entire payment flow, PayPal removes the burden of security from merchants entirely. Businesses never touch sensitive payment data, which simplifies PCI compliance.

Stripe’s security advantage: Stripe’s client-side tokenization approach keeps sensitive card data from ever touching merchant servers while still allowing for highly customized checkout experiences. This provides both security and flexibility.

For businesses handling sensitive customer data or operating in highly regulated industries, both processors offer robust security features. Stripe’s approach may appeal more to businesses requiring granular control over security parameters, while PayPal’s turnkey solution simplifies compliance for smaller merchants.

7. Financial Performance and Scalability

The financial structures and performance metrics of PayPal and Stripe reflect their different business models and market positions.

Revenue and Growth

PayPal (Public Company)

As a publicly traded company, PayPal’s financial performance is transparent:

- 2023 Revenue: $29.8 billion

- Q3 2023 Revenue: $7.4 billion

- Total Payment Volume (2023): $1.36 trillion

- Year-over-Year Revenue Growth: 8%

- Active Accounts: 435 million

Stripe (Private Company)

As a private company, Stripe discloses limited financial information:

- Estimated 2023 Revenue: $14-16 billion (analyst estimates)

- Processed Volume (2023): Over $1 trillion

- Latest Valuation: $50 billion (July 2023, down from $95B peak)

- Estimated Year-over-Year Growth: 25-30%

- Reported Profitability: Achieved profitability on an EBITDA basis

Scalability Factors

| Scalability Factor | PayPal | Stripe |

| Transaction Volume Capacity | Excellent – Handles peak holiday volumes | Excellent – Powers major platforms like Shopify |

| Enterprise Readiness | Good – Custom solutions available but less flexible | Excellent – Modular architecture designed for scale |

| International Expansion | Excellent – Already in 200+ markets | Good – Rapid expansion but in fewer markets (47) |

| Fee Structure at Scale | Volume discounts available at $3,000/month | Custom pricing for high-volume businesses |

| Technical Debt | Higher – Older infrastructure with more legacy systems | Lower – Modern architecture built for flexibility |

Long-Term Scalability Assessment

Both payment processors demonstrate strong capabilities for handling growing transaction volumes, though they excel in different aspects of scalability:

PayPal’s Scalability Strengths

- Established global presence and regulatory relationships

- Proven ability to handle massive transaction volumes

- Strong consumer network effects

- Diversified revenue streams beyond core payment processing

Stripe’s Scalability Strengths

- Modern, API-first architecture designed for flexibility

- Superior developer experience facilitating technical integration

- Modular product suite allowing selective implementation

- Strong focus on automation and operational efficiency

Scalability Recommendation

For rapidly growing businesses with complex payment needs, Stripe’s modern infrastructure and developer-friendly approach typically provides better long-term scalability. For businesses prioritizing global reach and consumer recognition, PayPal’s established presence in more markets offers advantages. Many large enterprises ultimately implement both solutions to maximize benefits.

8. Brand Trust and Developer Ecosystem

The strength of a payment processor extends beyond its technical capabilities to include brand perception and developer support.

Brand Recognition and Trust

PayPal’s Brand Position

With over 25 years in the market, PayPal has established exceptional consumer recognition:

- 98% brand recognition among US online shoppers

- Trusted by 435 million active accounts worldwide

- 54% of consumers more likely to complete purchase when PayPal is available

- Strong association with buyer and seller protection

Stripe’s Brand Position

Stripe has built a strong reputation primarily among businesses and developers:

- Recognized as the developer’s preferred payment platform

- Associated with innovation and technical excellence

- Strong reputation among startups and tech companies

- Less consumer-facing brand recognition

Developer Ecosystem

| Developer Resource | PayPal | Stripe |

| Documentation Quality | Good – Comprehensive but sometimes fragmented | Excellent – Industry-leading clarity and examples |

| API Design | Good – RESTful but with some legacy inconsistencies | Excellent – Consistent, intuitive, well-structured |

| SDK Availability | Good – Major languages supported | Excellent – Comprehensive libraries for all major platforms |

| Testing Tools | Sandbox environment | Test mode, mock data, CLI testing tools |

| Community Support | Forums, Stack Overflow presence | Active Discord, GitHub, Stack Overflow presence |

Key Partnerships

Both companies have established strategic partnerships that extend their reach and capabilities:

PayPal’s Key Partnerships

- Major e-commerce platforms (Shopify, WooCommerce, Magento)

- Financial institutions (Synchrony Bank for PayPal Credit)

- Point-of-sale providers (integration with multiple POS systems)

- Cryptocurrency exchanges (for crypto transactions)

Stripe’s Key Partnerships

- Major cloud providers (AWS, Google Cloud)

- E-commerce platforms (Shopify as primary payment processor)

- Accounting software (QuickBooks, Xero)

- Banking partners (Goldman Sachs, Evolve Bank for Stripe Treasury)

“Stripe has set a new standard for what developers expect from payments APIs, while PayPal continues to dominate consumer trust in online payments. The choice often comes down to whether you prioritize developer experience or consumer recognition.”

9. Global Expansion and Localization

The ability to process payments globally and adapt to local markets is increasingly critical for businesses with international ambitions.

Market Availability

PayPal’s Global Reach

PayPal operates in over 200 countries and regions, making it one of the most widely available payment processors globally. This extensive reach provides significant advantages for businesses targeting emerging markets or diverse geographic regions.

Stripe’s Global Reach

Stripe is available in 47 countries across North America, Europe, Asia Pacific, and Latin America. While more limited in total market count, Stripe has focused on comprehensive support in the markets it serves, often with more localized features.

Currency Support

| Currency Feature | PayPal | Stripe |

| Supported Currencies | 25 currencies for holding balances | 135+ currencies for processing |

| Multi-Currency Accounts | Available in select markets | Available through Stripe Connect |

| Currency Conversion | 3-4% above base exchange rate | 1% fee for automatic conversions |

| Local Currency Display | Available with PayPal Checkout | Dynamic currency conversion available |

Local Payment Methods

Supporting region-specific payment methods is crucial for maximizing conversion rates in international markets:

PayPal’s Local Payment Support

- Integrated with major regional methods like iDEAL (Netherlands)

- Support for Boleto Bancário in Brazil

- Integration with SEPA Direct Debit in Europe

- Limited support for Asian payment methods

Stripe’s Local Payment Support

- Extensive support for European methods (iDEAL, Bancontact, etc.)

- Integration with popular Asian methods (Alipay, WeChat Pay)

- Support for OXXO in Mexico, Konbini in Japan

- SEPA, BACS, and ACH direct debits

Localization Strategies

Beyond basic currency and payment method support, both processors employ various strategies to adapt to local markets:

PayPal Localization

- Translated user interfaces in multiple languages

- Local customer support in major markets

- Region-specific risk management systems

- Compliance with local financial regulations

Stripe Localization

- Adaptive acceptance rates based on regional patterns

- Local acquiring in key markets to improve authorization rates

- Region-specific fraud prevention rules

- Automatic tax calculation and compliance

Global Expansion Recommendation

For businesses targeting a wide range of international markets, especially emerging economies, PayPal’s broader geographic coverage provides significant advantages. For businesses focusing on major developed markets and requiring support for diverse local payment methods, Stripe often offers more comprehensive localization features despite its more limited country availability.

10. Challenges and Future Trajectory

Both payment processors face evolving challenges and opportunities in the rapidly changing fintech landscape.

Current Challenges

PayPal’s Key Challenges

- Increasing competition from neobanks and fintech startups

- Technical debt from legacy systems

- Balancing consumer and merchant needs

- Account stability issues (frozen funds complaints)

- Maintaining growth as market matures

Stripe’s Key Challenges

- Limited geographic coverage compared to competitors

- Building consumer brand recognition

- Balancing simplicity and advanced features

- Managing valuation expectations (down from $95B peak)

- Potential IPO pressures and public market scrutiny

Competitive Landscape

Beyond competing with each other, both companies face pressure from various directions:

| Competitor Type | Examples | Threat Level |

| Traditional Payment Processors | Square/Block, Adyen, Worldpay | High – Direct competition with similar offerings |

| Tech Giants | Apple Pay, Google Pay, Amazon Pay | Medium-High – Leveraging massive user bases |

| Banking-as-a-Service Platforms | Plaid, Marqeta, Galileo | Medium – Enabling new competitors |

| Cryptocurrency Platforms | Coinbase, BitPay | Low-Medium – Growing but still niche |

| Regional Payment Methods | Alipay, WeChat Pay, PIX | High in specific regions |

Regulatory Changes

Both payment processors must navigate an increasingly complex regulatory environment:

- Open Banking Initiatives: PSD2 in Europe and similar regulations globally are changing how payment services interact with banking infrastructure.

- Data Protection: Evolving privacy regulations like GDPR and CCPA impact how payment data can be stored and utilized.

- Cryptocurrency Regulation: Emerging frameworks for digital assets affect how payment processors can integrate with blockchain technologies.

- Anti-Money Laundering: Increasingly stringent AML requirements add compliance burdens and operational complexity.

Future Trajectory

PayPal’s Strategic Direction

PayPal’s future strategy appears focused on:

- Expanding its super-app vision with more financial services

- Deeper integration of cryptocurrency capabilities

- Enhancing in-store payment solutions

- Leveraging AI for personalized financial experiences

- Expanding buy-now-pay-later offerings globally

Stripe’s Strategic Direction

Stripe’s future trajectory seems oriented toward:

- Continued geographic expansion

- Deeper banking and financial service integrations

- Enhanced tools for global commerce

- Climate initiatives and sustainability features

- Potential public market debut

“The future of payments isn’t just about moving money—it’s about creating integrated financial ecosystems that serve businesses and consumers across their entire financial journey. Both PayPal and Stripe are positioning themselves as central players in this broader financial infrastructure.”

Conclusion: Which Makes Digital Payments Easier?

After examining PayPal and Stripe across ten essential categories, it’s clear that both offer powerful solutions for digital payments, but with different strengths that make them suitable for different business needs.

PayPal Excels For:

- Small businesses seeking simple setup and brand recognition

- Companies targeting global markets, especially emerging economies

- Merchants valuing consumer trust and familiarity

- Businesses needing integrated consumer wallet functionality

- Organizations requiring immediate access to funds

Stripe Excels For:

- Tech-forward companies requiring customization

- Businesses with developer resources

- Subscription-based services and recurring billing models

- Marketplaces and platforms managing complex payment flows

- Companies prioritizing modern infrastructure and scalability

The question of which platform makes digital payments “easier” ultimately depends on your specific business context. PayPal makes payments easier for merchants seeking simplicity and consumer recognition, while Stripe makes payments easier for businesses requiring technical flexibility and customization.

Many successful businesses ultimately implement both solutions: PayPal to capture its loyal user base and Stripe for its superior developer experience and customization capabilities. This hybrid approach allows companies to leverage the strengths of each platform while mitigating their respective limitations.

As the digital payment landscape continues to evolve, both PayPal and Stripe are likely to remain dominant forces, continually adapting their offerings to address emerging challenges and opportunities in global commerce.

Ready to Implement Your Payment Solution?

Based on your business needs, get started with the payment processor that best aligns with your priorities.

Frequently Asked Questions

Is PayPal or Stripe better for small businesses?

For small businesses with limited technical resources, PayPal typically offers an easier setup process and broader consumer recognition. However, if your small business has specific customization needs or plans to scale quickly, Stripe’s flexibility may provide long-term advantages despite a steeper initial learning curve.

Which has lower fees, PayPal or Stripe?

Stripe generally offers lower standard transaction fees (2.9% +

Frequently Asked Questions

Is PayPal or Stripe better for small businesses?

For small businesses with limited technical resources, PayPal typically offers an easier setup process and broader consumer recognition. However, if your small business has specific customization needs or plans to scale quickly, Stripe’s flexibility may provide long-term advantages despite a steeper initial learning curve.

Which has lower fees, PayPal or Stripe?

Stripe generally offers lower standard transaction fees (2.9% + $0.30) compared to PayPal (3.49% + $0.49) for online transactions. However, fee structures vary by transaction type, volume, and country. Stripe’s pricing is more transparent, while PayPal has a more complex fee structure with various add-on costs for specific services.

Can I use both PayPal and Stripe on my website?

Yes, many businesses implement both payment processors to maximize customer payment options. This approach allows you to capture PayPal’s loyal user base while leveraging Stripe’s customization capabilities. Most e-commerce platforms and content management systems support multiple payment gateways simultaneously.

Which payment processor offers better international support?

PayPal operates in over 200 countries compared to Stripe’s 47 countries, giving it broader global reach. However, Stripe supports more currencies (135+ vs. PayPal’s 25) and often provides better localization features in the markets where it operates. The best choice depends on your specific target markets.

Is Stripe or PayPal more secure?

Both PayPal and Stripe maintain high security standards with PCI DSS Level 1 compliance and robust encryption. PayPal’s approach removes merchants entirely from handling sensitive data, while Stripe’s client-side tokenization ensures card data never touches merchant servers. Both approaches are highly secure, with the difference being primarily in implementation rather than protection level.

.30) compared to PayPal (3.49% +

Frequently Asked Questions

Is PayPal or Stripe better for small businesses?

For small businesses with limited technical resources, PayPal typically offers an easier setup process and broader consumer recognition. However, if your small business has specific customization needs or plans to scale quickly, Stripe’s flexibility may provide long-term advantages despite a steeper initial learning curve.

Which has lower fees, PayPal or Stripe?

Stripe generally offers lower standard transaction fees (2.9% + $0.30) compared to PayPal (3.49% + $0.49) for online transactions. However, fee structures vary by transaction type, volume, and country. Stripe’s pricing is more transparent, while PayPal has a more complex fee structure with various add-on costs for specific services.

Can I use both PayPal and Stripe on my website?

Yes, many businesses implement both payment processors to maximize customer payment options. This approach allows you to capture PayPal’s loyal user base while leveraging Stripe’s customization capabilities. Most e-commerce platforms and content management systems support multiple payment gateways simultaneously.

Which payment processor offers better international support?

PayPal operates in over 200 countries compared to Stripe’s 47 countries, giving it broader global reach. However, Stripe supports more currencies (135+ vs. PayPal’s 25) and often provides better localization features in the markets where it operates. The best choice depends on your specific target markets.

Is Stripe or PayPal more secure?

Both PayPal and Stripe maintain high security standards with PCI DSS Level 1 compliance and robust encryption. PayPal’s approach removes merchants entirely from handling sensitive data, while Stripe’s client-side tokenization ensures card data never touches merchant servers. Both approaches are highly secure, with the difference being primarily in implementation rather than protection level.

.49) for online transactions. However, fee structures vary by transaction type, volume, and country. Stripe’s pricing is more transparent, while PayPal has a more complex fee structure with various add-on costs for specific services.

Can I use both PayPal and Stripe on my website?

Yes, many businesses implement both payment processors to maximize customer payment options. This approach allows you to capture PayPal’s loyal user base while leveraging Stripe’s customization capabilities. Most e-commerce platforms and content management systems support multiple payment gateways simultaneously.

Which payment processor offers better international support?

PayPal operates in over 200 countries compared to Stripe’s 47 countries, giving it broader global reach. However, Stripe supports more currencies (135+ vs. PayPal’s 25) and often provides better localization features in the markets where it operates. The best choice depends on your specific target markets.

Is Stripe or PayPal more secure?

Both PayPal and Stripe maintain high security standards with PCI DSS Level 1 compliance and robust encryption. PayPal’s approach removes merchants entirely from handling sensitive data, while Stripe’s client-side tokenization ensures card data never touches merchant servers. Both approaches are highly secure, with the difference being primarily in implementation rather than protection level.