The semiconductor industry forms the backbone of modern technology, powering everything from smartphones and laptops to data centers and autonomous vehicles. At the heart of this $600+ billion global market stand two American giants: Qualcomm and Intel. While both companies have shaped the evolution of computing, they’ve pursued distinctly different strategies and market segments.

This comprehensive analysis examines Qualcomm and Intel across ten critical dimensions to determine their relative strengths, market positioning, and future outlook. Whether you’re an industry analyst, investor, or technology strategist, understanding how these semiconductor powerhouses compare provides valuable insights into the industry’s direction and competitive landscape.

Company Background and Market Legacy

Founded in 1985, Qualcomm emerged from a small group of engineers led by Irwin Jacobs with a focus on wireless communication technologies. The company pioneered CDMA technology, which became fundamental to mobile networks worldwide. Qualcomm’s early strategic decision to focus on intellectual property and chip design rather than manufacturing established its fabless business model that continues today.

Intel, established in 1968 by Robert Noyce and Gordon Moore, helped create Silicon Valley’s technology ecosystem. The company revolutionized computing with the world’s first commercial microprocessor in 1971. Intel’s “Intel Inside” campaign in the 1990s transformed a component manufacturer into a household brand. Its integrated design-and-manufacturing approach and x86 architecture dominance defined personal computing for decades.

While Qualcomm built its empire on mobile connectivity and smartphone processors, Intel established itself as the foundation of desktop computing, servers, and data centers. These different evolutionary paths reflect each company’s core competencies and strategic vision, setting the stage for their current market positions.

Core Focus and Specialization Areas

Qualcomm’s Domain

Qualcomm has established unrivaled leadership in mobile system-on-chip (SoC) processors and cellular modems. Its Snapdragon platform powers most premium Android smartphones, combining CPU, GPU, AI processing, and connectivity in integrated packages. The company’s 5G modem technology maintains significant market share even in competitors’ devices, including previous iPhone generations.

Beyond smartphones, Qualcomm has strategically expanded into automotive computing platforms, extended reality (XR) processors, and Internet of Things (IoT) solutions. Its Snapdragon Digital Chassis for connected vehicles and Snapdragon Ride platform for autonomous driving represent major growth initiatives beyond its traditional mobile focus.

Intel’s Territory

Intel’s core strength remains in x86 CPU architecture that dominates personal computing and data center markets. Its Core and Xeon processor families serve as industry standards for desktops, laptops, and servers. The company’s integrated graphics solutions, while historically less powerful than dedicated GPUs, ship in massive volumes within its processor packages.

Intel has invested heavily in diversification, developing discrete graphics cards (Arc series), programmable gate arrays (through its Altera acquisition), and specialized AI accelerators. Its recent foundry services initiative aims to compete with TSMC and Samsung in contract manufacturing, leveraging Intel’s extensive fabrication expertise and facilities.

Strengths and Weaknesses

Qualcomm Strengths

- Dominant position in mobile SoCs with 40%+ market share

- Fabless model reduces capital expenditure and provides manufacturing flexibility

- Strong 5G patent portfolio generating consistent licensing revenue

- Diversification into automotive and IoT markets showing promising growth

- Lower exposure to PC market decline compared to Intel

Qualcomm Weaknesses

- Heavy dependence on smartphone market which is approaching saturation

- Reliance on third-party manufacturers (primarily TSMC) for production

- Ongoing legal challenges to licensing model in multiple jurisdictions

- Limited presence in data center and AI infrastructure markets

- Vulnerability to major customers developing in-house alternatives (e.g., Apple)

Intel Strengths

- Integrated design-manufacture model provides supply chain control

- Dominant position in PC and server CPU markets (70%+ share)

- Extensive manufacturing infrastructure with U.S. and global facilities

- Strong enterprise relationships and ecosystem integration

- Significant government support through CHIPS Act funding

Intel Weaknesses

- Manufacturing process delays have eroded technological leadership

- High capital expenditure requirements for fabrication facilities

- Limited success in mobile and low-power computing segments

- Increasing competition from AMD in core CPU markets

- Slower adaptation to AI acceleration compared to NVIDIA

Innovation and Technological Advancement

Process Technology Race

Intel historically led semiconductor manufacturing with its tick-tock model of process and architecture advancements. However, delays in its 10nm and 7nm transitions allowed competitors to catch up. Intel now manufactures on its Intel 4 process (roughly equivalent to TSMC’s 5nm), while Qualcomm leverages TSMC’s 4nm and 3nm processes for its latest Snapdragon chips.

Qualcomm’s fabless approach allows it to adopt cutting-edge manufacturing nodes more quickly, while Intel’s integrated model provides greater control but has recently faced technological challenges. Intel’s IDM 2.0 strategy aims to regain process leadership by 2025 through massive investments in new fabrication facilities and technologies.

AI and Specialized Computing

Both companies have prioritized artificial intelligence acceleration in their latest designs. Qualcomm’s AI Engine in Snapdragon processors delivers up to 45 TOPS (trillion operations per second) of AI performance in mobile form factors. Intel’s recent Meteor Lake processors incorporate dedicated NPU (Neural Processing Unit) cores, while its Gaudi AI accelerators target data center workloads.

Qualcomm has demonstrated leadership in heterogeneous computing, effectively combining CPU, GPU, DSP, and AI cores in power-efficient packages. Intel’s disaggregated chip design approach with Foveros packaging technology represents a major architectural shift, allowing more specialized silicon combinations.

Patent Portfolios and R&D Focus

Qualcomm maintains one of the industry’s strongest patent portfolios in wireless communications, with over 140,000 patents and patent applications covering 5G, Wi-Fi, and other connectivity technologies. Intel’s patent strength lies in computing architecture, memory subsystems, and manufacturing processes, with approximately 90,000 patents worldwide.

Qualcomm’s R&D focuses heavily on mobile SoC integration, power efficiency, and wireless standards development. Intel’s research priorities include advanced packaging technologies, new transistor designs, and memory-centric computing architectures. Both companies have established university research partnerships and maintain corporate venture capital arms to access external innovation.

Sustainability and Supply Chain Responsibility

Qualcomm’s Approach

As a fabless manufacturer, Qualcomm’s direct environmental footprint is smaller than Intel’s, but the company has still established ambitious sustainability goals. Qualcomm aims to reduce absolute Scope 1 and 2 greenhouse gas emissions by 30% by 2025 (from a 2014 baseline) and achieve carbon neutrality for global operations by 2040.

Qualcomm’s 2023 Corporate Responsibility Report highlights its focus on sustainable product design, with energy efficiency improvements of up to 30% in each new generation of mobile processors. The company has implemented a comprehensive supplier code of conduct covering environmental standards, labor practices, and ethical sourcing of materials.

Intel’s Initiatives

Intel’s manufacturing-intensive business model creates greater environmental challenges but also opportunities for direct impact. The company has committed to 100% renewable electricity across global operations by 2030 and zero waste to landfill. Intel’s water conservation programs have saved over 44 billion gallons since 1998.

Intel’s RISE strategy (Responsible, Inclusive, Sustainable, Enabling) guides its approach to corporate responsibility. The company has invested over $200 million in water conservation projects and achieved a 38% reduction in greenhouse gas emissions on a per-unit basis since 2010. Intel was among the first semiconductor companies to commit to eliminating perfluorinated compounds from its manufacturing processes.

Supply Chain Transparency

Both companies have implemented rigorous conflict minerals programs to ensure responsible sourcing. Qualcomm and Intel are founding members of the Responsible Minerals Initiative and require suppliers to source 3TG minerals (tin, tungsten, tantalum, and gold) from smelters validated as conflict-free. Intel has achieved 100% conflict-free status for its microprocessors since 2014.

Water usage remains a critical sustainability challenge for the semiconductor industry. Intel’s fabrication facilities use approximately 9 billion gallons of water annually, with about 80% either returned to local watersheds or reused. Qualcomm, through its manufacturing partners, indirectly impacts water resources but has less direct control over manufacturing processes.

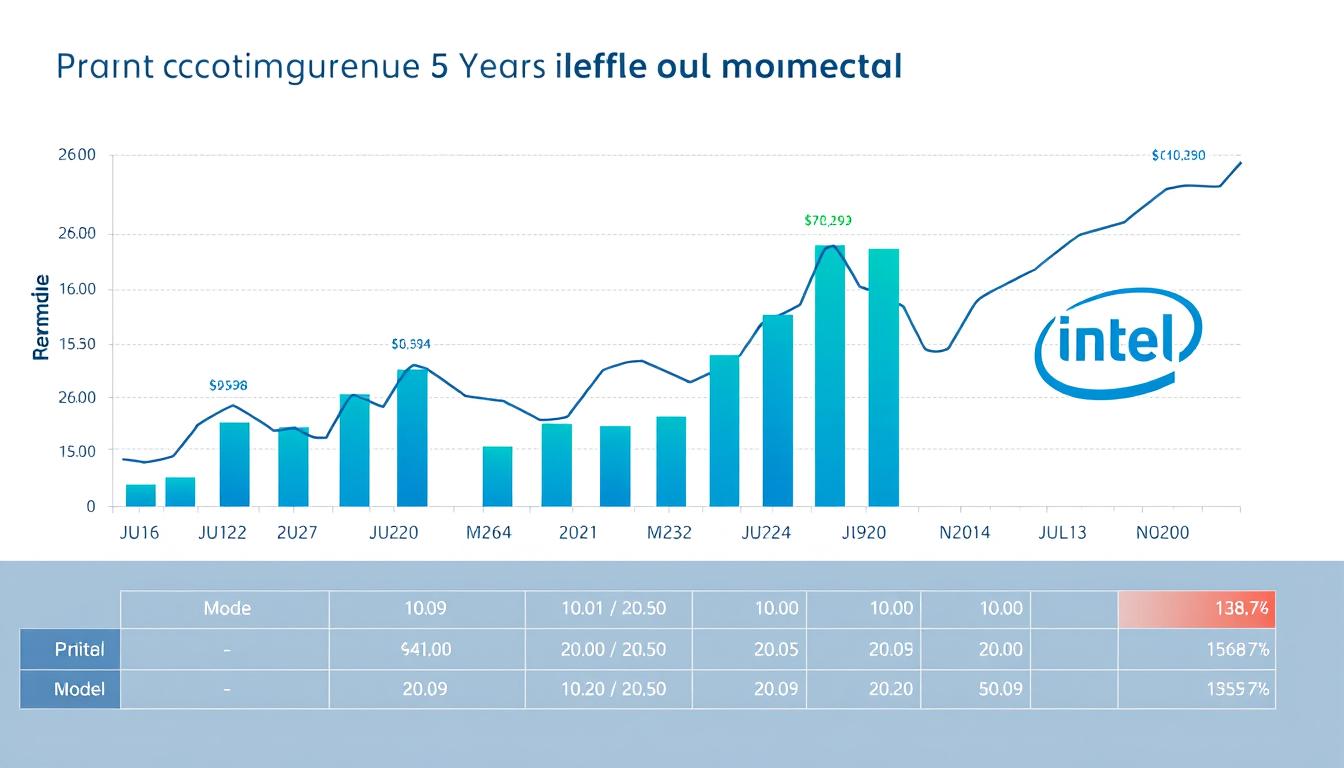

Financial Performance and R&D Investment

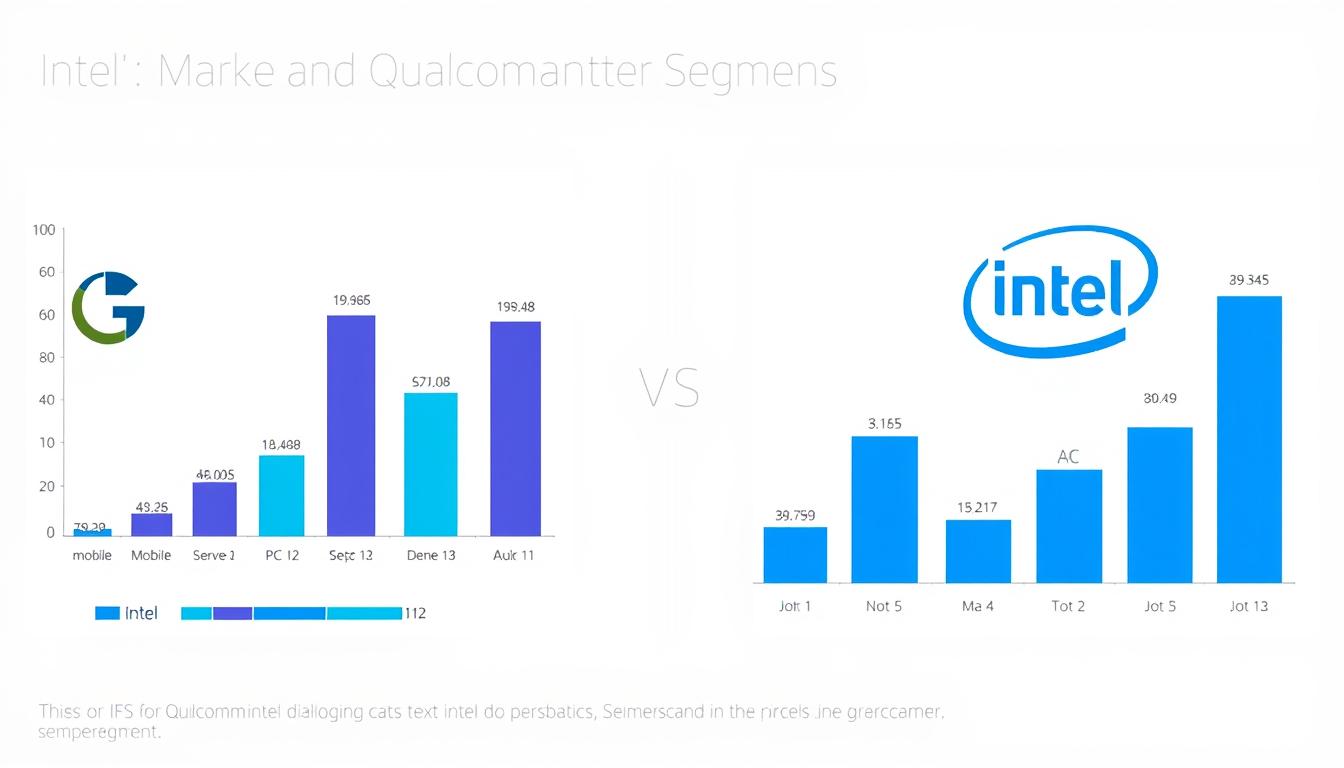

| Financial Metric (FY 2023) | Qualcomm | Intel |

| Revenue | $35.8 billion | $54.2 billion |

| Net Income | $8.9 billion | $1.7 billion |

| Operating Margin | 32.4% | 3.9% |

| R&D Expenditure | $7.2 billion (20.1% of revenue) | $17.5 billion (32.3% of revenue) |

| Capital Expenditure | $0.9 billion | $25.3 billion |

| Cash and Investments | $12.5 billion | $28.7 billion |

| Long-term Debt | $15.4 billion | $48.5 billion |

The financial profiles of Qualcomm and Intel reflect their different business models and market positions. Qualcomm’s fabless model generates higher profit margins but lower absolute revenue compared to Intel’s integrated manufacturing approach. Intel’s massive capital expenditures—primarily for fabrication facilities—dwarf Qualcomm’s, highlighting the financial implications of their different strategies.

Both companies invest heavily in research and development, though Intel’s absolute R&D spending is more than twice Qualcomm’s. This reflects Intel’s broader product portfolio and the substantial costs associated with advancing semiconductor manufacturing processes. Qualcomm’s R&D focuses more narrowly on mobile SoCs and wireless technologies.

Revenue diversification remains a strategic priority for both companies. Qualcomm has reduced its reliance on Apple’s business following their legal disputes, while expanding into automotive and IoT segments. Intel is investing heavily in its foundry services business to compete with TSMC and Samsung in contract manufacturing, potentially opening new revenue streams beyond its traditional processor sales.

Subscribe to Our Semiconductor Industry Newsletter

Stay informed with quarterly analysis of semiconductor market trends, financial performance updates, and strategic moves by major industry players. Our expert analysts provide insights you won’t find elsewhere.

Brand Reputation and Industry Influence

Developer Ecosystems

Intel has cultivated one of technology’s most extensive developer ecosystems through decades of investment in software tools, libraries, and optimization frameworks. Its oneAPI initiative aims to unify programming across CPUs, GPUs, and accelerators. The Intel Developer Forum (now Intel Innovation) has historically served as a key industry event for announcing new technologies and standards.

Qualcomm’s developer ecosystem centers around its Snapdragon platform, with particular strength in mobile and embedded applications. The company’s Snapdragon Developer Kit and Neural Processing SDK provide tools for optimizing applications for its heterogeneous computing architecture. Qualcomm’s influence is particularly strong in Android device optimization and mobile AI development.

Strategic Partnerships

Intel maintains deep relationships with PC manufacturers, cloud service providers, and enterprise customers. Its partnerships with Microsoft for Windows optimization and major cloud providers for data center processors represent significant competitive advantages. Intel Capital, the company’s venture arm, has invested over $12.9 billion in more than 1,500 companies since 1991.

Qualcomm’s strategic partnerships focus on mobile device manufacturers, automotive companies, and telecommunications providers. Its close collaboration with Android smartphone makers and recent partnership with Microsoft for Windows on ARM represent key relationship assets. Qualcomm Ventures has invested in over 150 companies across mobile, IoT, automotive, and AI sectors.

Brand Perception

Intel’s “Intel Inside” campaign created unprecedented brand awareness for a component manufacturer, making it one of few semiconductor companies recognized by mainstream consumers. However, recent manufacturing delays and increased competition have somewhat eroded its reputation for technological leadership. Intel ranked 42nd in Interbrand’s 2023 Best Global Brands list.

Qualcomm’s brand is less recognized by consumers but maintains strong reputation among industry professionals, particularly in wireless technology. The company’s Snapdragon brand has gained increasing visibility through co-branding with smartphone manufacturers. Qualcomm’s licensing disputes with Apple and regulatory bodies have periodically impacted its public perception.

Global Presence and Strategic Partnerships

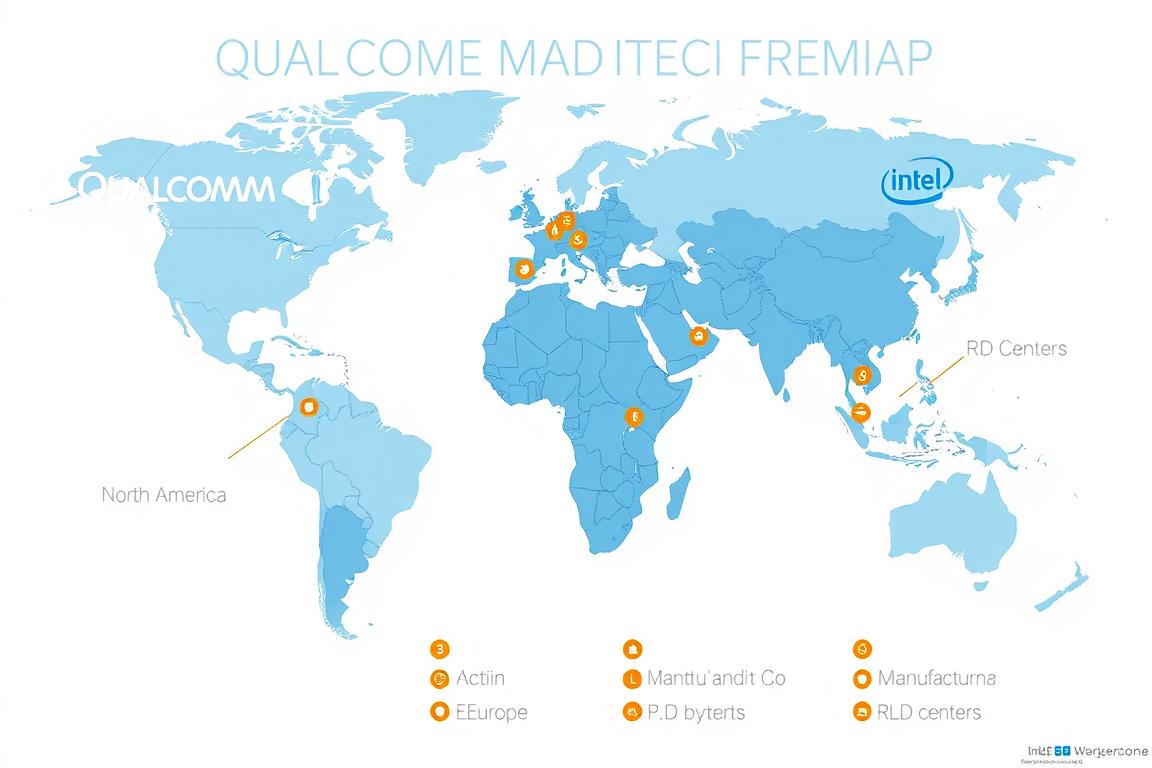

Qualcomm’s Global Footprint

Qualcomm maintains engineering and design centers across 30+ countries, with major facilities in the United States, India, Taiwan, South Korea, and China. While headquartered in San Diego, California, the company derives approximately 67% of its revenue from Asia, highlighting its dependence on manufacturing partners and customers in the region.

As a fabless company, Qualcomm relies primarily on TSMC and Samsung for chip production. This model provides manufacturing flexibility but creates potential supply chain vulnerabilities, as demonstrated during recent semiconductor shortages. Qualcomm has strengthened relationships with multiple foundries to reduce concentration risk.

Intel’s Manufacturing Network

Intel operates major manufacturing facilities in the United States, Ireland, Israel, and China, with significant expansion underway in Arizona, New Mexico, Ohio, and Germany. The company’s IDM 2.0 strategy includes over $100 billion in planned manufacturing investments, supported by government incentives through the CHIPS Act and similar programs in Europe.

Intel’s global research network includes major R&D centers in Oregon, California, India, and Israel. The company’s recent foundry initiatives aim to rebalance global semiconductor manufacturing, which is currently concentrated in East Asia. Intel’s domestic manufacturing capacity has become a strategic asset amid growing concerns about supply chain resilience.

Regional Market Dynamics

Both companies face complex geopolitical challenges, particularly regarding U.S.-China technology tensions. Qualcomm derives approximately 60% of its revenue from Chinese customers and manufacturing partners, creating significant exposure to trade restrictions. Intel’s exposure to China is lower at approximately 27% of revenue, though still substantial.

European expansion represents a strategic priority for both companies. Qualcomm has strengthened its automotive partnerships with European manufacturers, while Intel has committed to major manufacturing investments in Germany and Ireland. Both companies have positioned their European initiatives within the context of the European Chips Act and broader semiconductor sovereignty efforts.

Current Challenges and Future Outlook

Competitive Pressures

Both companies face intensifying competition across their core markets. Qualcomm contends with MediaTek’s growing share in mobile processors and increasing vertical integration by smartphone manufacturers developing in-house chips. Apple’s transition away from Qualcomm modems represents a significant revenue risk, though the timeline has been extended through 2026.

Intel faces resurgent competition from AMD in PC and server markets, with AMD gaining significant market share through its Ryzen and EPYC processors. NVIDIA’s dominance in AI acceleration and ARM’s growing presence in data centers present additional competitive challenges. Intel’s foundry services business must compete with established players like TSMC and Samsung.

Technological Inflection Points

The semiconductor industry is approaching several major technological transitions that will shape both companies’ futures. The potential end of Moore’s Law—the observation that transistor density doubles approximately every two years—requires new approaches to performance scaling. Advanced packaging technologies, chiplet architectures, and specialized accelerators represent key strategies for both companies.

Qualcomm’s expertise in heterogeneous computing and power efficiency positions it well for edge AI applications, while its expansion into Windows PCs with Snapdragon X Elite processors represents a direct challenge to Intel’s core market. Intel’s investments in quantum computing, neuromorphic chips, and advanced packaging aim to establish leadership in post-Moore’s Law computing paradigms.

Regulatory Environment

Both companies navigate complex regulatory landscapes across antitrust, export controls, and national security domains. Qualcomm has faced antitrust scrutiny regarding its licensing practices in multiple jurisdictions, though it has successfully defended its business model in recent years. Intel’s manufacturing expansion has benefited from government incentives but also brings increased political visibility.

Export controls and technology restrictions, particularly regarding China, create strategic challenges for both companies. Qualcomm’s greater revenue exposure to China represents a potential vulnerability, while Intel’s domestic manufacturing expansion aligns with U.S. policy priorities for semiconductor sovereignty.

Download Our Comprehensive Semiconductor Market Report

Get in-depth analysis of market trends, competitive dynamics, and future outlook for the global semiconductor industry. Our 50-page report includes detailed company profiles, technology roadmaps, and investment implications.

Conclusion: Different Leaders for Different Markets

The question of who dominates the semiconductor market between Qualcomm and Intel defies a simple answer. Each company maintains leadership in distinct segments while facing challenges in others. Qualcomm’s dominance in mobile connectivity and smartphone processors contrasts with Intel’s strength in PC and data center computing. Both companies are investing heavily to expand beyond their traditional domains into growth markets like automotive, IoT, and edge AI.

Qualcomm’s fabless model has provided manufacturing flexibility and higher profit margins, while Intel’s integrated approach offers supply chain control but requires massive capital investment. Recent manufacturing challenges have eroded some of Intel’s traditional advantages, though its IDM 2.0 strategy represents an ambitious attempt to regain process leadership.

Looking ahead, both companies face similar strategic imperatives: diversifying beyond their core markets, adapting to AI-centric computing paradigms, and navigating complex geopolitical constraints. Their success will depend on execution across process technology, architectural innovation, and ecosystem development. For industry observers, investors, and technology strategists, understanding the distinct strengths and challenges of these semiconductor giants provides valuable insight into the industry’s future direction.