The battle between Starbucks and Dunkin’ has shaped the global coffee landscape for decades. These two giants have transformed how millions start their day, with distinctly different approaches to everything from store atmosphere to pricing strategy. This comprehensive analysis examines how these coffee powerhouses stack up against each other across multiple dimensions, revealing the strengths and weaknesses that define their ongoing competition for market dominance.

Company Overview and Business Model

Starbucks and Dunkin’ represent two fundamentally different approaches to the coffee business, with origins that help explain their divergent paths in the market.

Starbucks: Premium Experience

Founded in 1971 in Seattle’s Pike Place Market, Starbucks began as a single store selling coffee beans before transforming into the coffeehouse chain we know today. Under Howard Schultz’s leadership, Starbucks embraced the Italian coffee bar concept, focusing on creating a “third place” between home and work where customers could enjoy premium coffee in a comfortable environment.

Starbucks primarily operates through company-owned stores, with approximately 50% of locations being corporate-operated rather than franchised. This approach gives the company greater control over brand experience and quality standards across its locations.

Dunkin’: Speed and Convenience

Established in 1950 as “Open Kettle” before becoming “Dunkin’ Donuts” in 1950, Dunkin’ is 20 years older than its Seattle-based competitor. The company began with a focus on donuts and simple coffee before gradually expanding its beverage offerings to compete more directly with Starbucks in the early 2000s.

Unlike Starbucks, Dunkin’ operates almost entirely through a franchise model, with nearly all of its stores independently owned and operated. This approach has allowed for rapid expansion with lower corporate capital investment but creates more variability in the customer experience.

Core Focus and Menu Strategy

The menu strategies of these coffee giants reflect their broader business philosophies and target demographics.

- Premium, customizable espresso-based drinks

- Seasonal offerings (Pumpkin Spice Latte, etc.)

- Extensive non-coffee options (teas, refreshers)

- Limited but upscale food selection

- Higher price points reflecting premium positioning

- Emphasis on coffee origin and quality

Starbucks Menu Strategy

- Value-priced drip coffee and simple espresso drinks

- Extensive donut and breakfast sandwich options

- Faster service model for on-the-go customers

- More food variety at lower price points

- Simpler customization options

- Focus on consistency and familiarity

Dunkin’ Menu Strategy

Starbucks positions itself as a premium coffee experience, with baristas crafting customized beverages and an atmosphere that encourages lingering. Their menu innovations often create cultural phenomena, like the Pumpkin Spice Latte, which generates significant seasonal revenue and social media buzz.

Dunkin’, meanwhile, emphasizes speed, value, and accessibility. Their “America Runs on Dunkin'” slogan highlights their focus on providing quick, affordable coffee and food for busy customers. While their coffee menu has expanded to include more specialty drinks, they maintain lower price points and faster service as key differentiators.

Strengths and Weaknesses

Starbucks Strengths

- Strong global brand recognition

- “Third place” atmosphere encouraging longer visits

- Successful digital ecosystem and loyalty program

- Premium pricing supporting higher margins

- Innovation in seasonal and limited-time offerings

- Strong presence in high-traffic urban locations

Starbucks Weaknesses

- Higher prices limiting accessibility

- Inconsistent experience in some international markets

- Slower service model in rush periods

- Recent labor relations challenges and unionization efforts

- Market saturation in core regions

- Vulnerability to premium coffee competition

Dunkin’ Strengths

- Value pricing accessible to broader market

- Strong breakfast food offerings

- Efficient service model for commuters

- Successful franchise system driving expansion

- Strong regional loyalty, especially in Northeast US

- Simplified operations model

Dunkin’ Weaknesses

- Less distinctive brand experience

- Limited international presence compared to Starbucks

- Less control over franchise operations

- Lower average ticket value

- Less developed “third place” atmosphere

- Stronger competition in breakfast category

Innovation and Technology

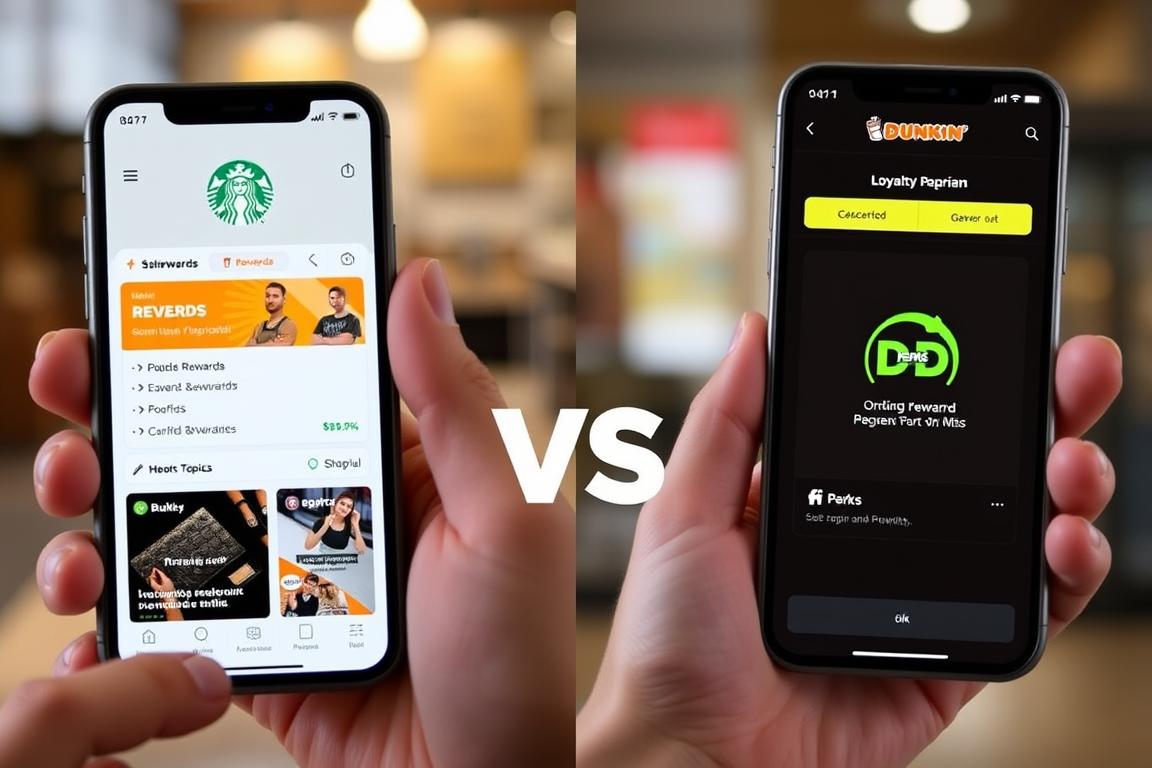

Digital innovation has become a critical battleground in the coffee wars, with both companies investing heavily in technology to enhance customer experience and operational efficiency.

Starbucks Digital Ecosystem

Starbucks has established itself as a leader in retail mobile technology, with its app regularly ranking among the most popular payment apps in the US. Key innovations include:

- Mobile Order & Pay allowing customers to skip lines

- Starbucks Rewards program with 30+ million active members

- Personalized offers based on purchase history

- Starbucks Odyssey Web3 initiative integrating NFTs with loyalty

- AI-powered inventory management and staffing optimization

Dunkin’ Digital Initiatives

Dunkin’ has worked to close the technology gap, developing its own digital capabilities:

- DD Perks loyalty program with 16+ million members

- On-the-Go mobile ordering

- Drive-thru recognition technology for loyalty members

- Delivery partnerships with DoorDash and Grubhub

- Digital menu boards optimizing for time of day

Starbucks maintains a significant lead in digital engagement, with its app accounting for approximately 25% of US company-operated transactions. The company’s early investment in mobile technology has created a competitive advantage that Dunkin’ continues to chase, though both companies recognize digital channels as essential to future growth.

Sustainability and Corporate Responsibility

As consumer awareness of environmental and social issues grows, both coffee chains have developed sustainability initiatives, though with different approaches and levels of commitment.

Starbucks Sustainability Commitments

Starbucks has positioned itself as a sustainability leader with ambitious goals:

- Carbon neutral green coffee by 2030

- 50% reduction in water usage in coffee production by 2030

- 100% ethically sourced coffee through C.A.F.E. Practices

- Elimination of single-use plastics

- Plant-based menu expansion

- $100 million investment in community development funds

Dunkin’ Sustainability Initiatives

Dunkin’ has focused its sustainability efforts on packaging and operational improvements:

- Transition to paper cups from polystyrene foam

- Sustainable packaging goals for 2025

- DD Green Achievement program for energy-efficient stores

- Rainforest Alliance certified espresso beans

- Reduction of artificial ingredients in products

- The Dunkin’ Joy in Childhood Foundation

Starbucks has generally taken a more comprehensive and ambitious approach to sustainability, making it a core part of its brand identity. Dunkin’ has made progress but has been more focused on specific operational improvements rather than transformative industry leadership. Both companies face ongoing scrutiny from environmentally conscious consumers regarding their progress toward stated goals.

Financial Performance

The financial results of these coffee giants reflect their different business models and market positioning.

| Financial Metric (2023) | Starbucks | Dunkin’ |

| Annual Revenue | $36 billion | $1.4 billion |

| Operating Margin | 14.2% | Not publicly disclosed (part of Inspire Brands) |

| Average Ticket | $7.50 | $5.00 |

| Same-Store Sales Growth | 5% | Not publicly disclosed (part of Inspire Brands) |

| Revenue per Store (avg) | $945,000 | $650,000 |

Starbucks’ financial performance reflects its premium positioning, with significantly higher revenue and average ticket prices than Dunkin’. The company’s company-owned store model also allows it to capture more revenue directly, while Dunkin’s franchise model generates revenue primarily through royalties and fees from franchisees.

Since Dunkin’ was acquired by Inspire Brands (a private company that also owns Arby’s, Buffalo Wild Wings, and other restaurant chains) in 2020, detailed financial information has become less transparent. However, industry analysts estimate that Dunkin’ generates approximately $1.4 billion in annual revenue for its parent company, significantly less than Starbucks’ $36 billion.

Brand Perception and Customer Loyalty

The way consumers perceive these brands reflects their different market positioning and target demographics.

Starbucks has successfully positioned itself as an aspirational brand, with customers willing to pay premium prices for what they perceive as a higher-quality product and experience. The company’s “third place” concept has created strong emotional connections with customers who view Starbucks as more than just a coffee shop.

Dunkin’ enjoys strong regional loyalty, particularly in the Northeast US where it originated, with customers appreciating its unpretentious, straightforward approach. The brand’s “America Runs on Dunkin'” slogan effectively communicates its positioning as the everyday, accessible coffee choice for working people.

“Starbucks sells an experience; Dunkin’ sells coffee. This fundamental difference in approach defines how customers relate to each brand and explains much of their respective success in different market segments.”

Operational Strategy and Supply Chain

The operational approaches of these coffee giants reflect their different business philosophies and target markets.

Starbucks Operations

Starbucks employs a more vertically integrated approach:

- Direct relationships with coffee farmers

- Company-owned roasting facilities

- Mix of company-owned and licensed stores

- Higher staff-to-customer ratio

- More complex in-store operations

- Emphasis on barista training and expertise

Dunkin’ Operations

Dunkin’ focuses on operational simplicity and efficiency:

- Centralized supply chain for franchisees

- Standardized equipment and processes

- Almost entirely franchise-operated

- Streamlined staff requirements

- Simplified beverage preparation

- Focus on speed and consistency

Starbucks’ operational model supports its premium positioning but results in higher costs and complexity. The company invests heavily in training its “partners” (employees) and maintaining quality standards across locations. This approach has created challenges during labor shortages and unionization efforts.

Dunkin’s simplified operational model allows for faster service and lower costs, supporting its value positioning. The franchise model also enables rapid expansion with less corporate capital investment, though it creates more variability in customer experience across locations.

Challenges and Future Outlook

Both coffee giants face significant challenges as they navigate changing consumer preferences, economic pressures, and competitive threats.

Starbucks Challenges

Key issues facing Starbucks include:

- Market saturation in core regions

- Labor relations and unionization efforts

- Competition from specialty coffee shops

- Maintaining growth in mature markets

- Balancing digital innovation with in-store experience

- Meeting ambitious sustainability commitments

Dunkin’ Challenges

Dunkin’ must address:

- Limited international presence and growth

- Increasing competition in breakfast category

- Catching up in digital innovation

- Maintaining value positioning amid inflation

- Evolving beyond regional strongholds

- Balancing menu expansion with operational simplicity

Growth Opportunities

Despite these challenges, both companies have identified promising avenues for future growth:

Asia Expansion

Starbucks continues aggressive expansion in China despite recent challenges, while Dunkin’ has opportunities to grow its limited Asian footprint, particularly in markets like India and Southeast Asia.

Ready-to-Drink Market

Both companies are expanding their presence in grocery and convenience channels with bottled and canned beverages, a market growing at 6% annually and expected to reach $45 billion globally by 2027.

Digital Innovation

Continued investment in mobile ordering, delivery partnerships, and loyalty programs represents a significant growth opportunity, particularly as consumer habits increasingly favor convenience and personalization.

Conclusion: Who Wins the Global Coffee War?

The Starbucks vs Dunkin’ battle represents a classic case of companies succeeding with fundamentally different business models targeting different market segments. Starbucks clearly dominates in terms of global presence, revenue, and premium positioning, while Dunkin’ maintains strong regional loyalty and excels in the value-oriented, convenience-focused segment.

Rather than declaring a single winner, it’s more accurate to recognize that each company has carved out its own successful niche in the coffee market. Starbucks wins on global scale, premium positioning, and digital innovation, while Dunkin’ succeeds through operational efficiency, value pricing, and strong regional presence.

As consumer preferences continue to evolve and new competitors emerge, both companies will need to adapt their strategies while staying true to their core brand identities. The coffee war is far from over, and the next decade will likely bring new battlegrounds in sustainability, digital engagement, and international markets.