In the mid-2000s, a perfect storm of risky lending and relaxed oversight reshaped the financial landscape. Banks and lenders handed out mortgages to borrowers with shaky credit scores, betting on ever-rising home prices. When those prices stalled, the dominoes began to fall.

Subprime loans—high-interest mortgages for high-risk borrowers—became the catalyst for disaster. Financial institutions bundled these loans into complex securities, masking their true risk. Investors worldwide snapped them up, unaware of the ticking time bomb.

The collapse didn’t stay contained. Major banks like Lehman Brothers crumbled under bad debt, triggering panic across markets. Stock values plunged, retirement accounts evaporated, and unemployment spiked. What started as a housing slump in America became a global financial catastrophe.

This article breaks down how loose regulations and speculative lending created a chain reaction. It explores why the united states housing market’s crash spread so quickly to Europe, Asia, and beyond. Historical data reveals how interconnected modern economies truly are.

Key Takeaways

- Subprime mortgages and risky investments fueled the crisis

- Complex financial products obscured mounting risks

- Major bank failures accelerated worldwide economic decline

- U.S. housing market collapse impacted international trade and jobs

- Regulatory gaps allowed unsustainable practices to thrive

Overview of the Housing Bubble and Global Market Impact

Post-9/11 monetary policies created fertile ground for risky mortgage lending practices. Between 2001 and 2004, the Federal Reserve slashed interest rates to historic lows, aiming to stimulate economic recovery. This cheap money environment encouraged banks to approve mortgages for borrowers with weak credit profiles.

As a result, many individuals who previously could not qualify for loans were suddenly able to purchase homes, leading to a surge in demand. This increased demand, coupled with speculative investments in real estate, caused home prices to rise dramatically, further enticing lenders to issue more loans. However, this rapid expansion of credit was not matched by adequate regulatory oversight, allowing predatory lending practices to flourish unchecked.

Roots of the Meltdown

Three factors accelerated the crisis:

- Home prices surged 124% between 1997 and 2006

- Subprime mortgages jumped from 8% to 20% of total loans

- Financial institutions repackaged risky debt as AAA-rated securities

By 2007, early warning signs emerged. BNP Paribas froze three investment funds tied to U.S. mortgages, citing “complete evaporation of liquidity.” Months later, Bear Stearns liquidated two hedge funds overloaded with toxic assets.

Cross-Border Contagion

The table below shows how domestic issues spread internationally:

| U.S. Event | Global Impact | Timeline |

|---|---|---|

| Subprime defaults peak | European banks lose $90B | Q2 2007 |

| Bear Stearns collapse | Asian stock markets drop 7% | March 2008 |

| Lehman Brothers bankruptcy | Credit markets freeze worldwide | September 2008 |

Interconnected financial markets amplified losses. German state banks held $300B in U.S. mortgage securities. Chinese exports plummeted 26% as Western consumers stopped spending. The crisis revealed how tightly global commerce relied on American housing stability.

Economic Environment: Low Rates and Excessive Borrowing

Cheap money became the lifeblood of America’s real estate frenzy after 2001. The Federal Reserve cut benchmark rates to 1% – the lowest since 1958 – creating a borrowing bonanza that encouraged consumers and investors alike to take on more debt than ever before. This unprecedented access to cheap credit fueled a speculative environment where many believed that housing prices would continue to rise indefinitely.

This artificial affordability pushed median home prices up 55% between 2002 and 2006, making homeownership seem more attainable to a broader segment of the population, while simultaneously inflating the market beyond sustainable levels.

Lenders abandoned traditional standards as federal regulators looked the other way. No-documentation loans and adjustable-rate mortgages exploded, with 40% of 2006 home purchases involving no down payment. Banks treated housing like a sure bet, approving loans for 100% of a property’s inflated value.

Three critical factors merged:

- Interest rates remained below 3% for five straight years

- Mortgage approvals for subprime borrowers tripled between 2000-2006

- Home equity extraction reached $750 billion annually by 2005

This cocktail of easy credit and lax oversight created systemic risk. Borrowers with $30k incomes qualified for $500k mortgages through “teaser rate” schemes. When rates eventually rose, millions faced payments doubling overnight.

The stage was set for disaster. Financial institutions kept repackaging shaky loans as safe investments, while regulators failed to curb obvious excesses. This economic tinderbox needed only a spark to ignite the financial crisis that would reshape global markets.

The Build-Up: Loose Lending Practices and Subprime Mortgages

Banks abandoned caution as demand for mortgages surged. The housing market was booming, with prices rising rapidly, leading lenders to relax their standards significantly. Lenders approved loans without verifying incomes or assets, using “stated income” applications that allowed borrowers to declare their earnings without any proof. This practice was particularly prevalent among subprime borrowers, who were often at greater risk of default. Adjustable-rate products with low introductory payments became standard, hiding long-term risks that would eventually catch up with borrowers.

Many individuals, lured by the prospect of homeownership, signed up for these loans without fully understanding the implications, unaware that their payments would balloon after the initial period ended. This reckless lending environment contributed to a false sense of security, both for lenders and borrowers, as everyone believed that rising home values would mitigate any potential risks.

Financial institutions transformed risky loans into seemingly safe investments through securitization. Here’s how it worked:

- Mortgage originators sold bundles of loans to investment banks

- Banks sliced these into tranches with varying risk levels

- Rating agencies stamped 80% of subprime securities as AAA-grade

| Year | Subprime Loans Issued | Percentage Securitized |

|---|---|---|

| 2001 | $160 billion | 46% |

| 2006 | $600 billion | 81% |

This conveyor belt incentivized reckless approvals. Loan officers earned commissions for pushing adjustable-rate mortgages, while financial institutions profited from packaging fees. When interest rates rose in 2006, borrowers faced payment shocks they couldn’t absorb.

The financial system became overloaded with hidden risks. By 2007, 13% of all U.S. mortgages were subprime – triple 2001 levels. These shaky foundations would soon destabilize global markets, proving that complexity couldn’t eliminate fundamental economic realities.

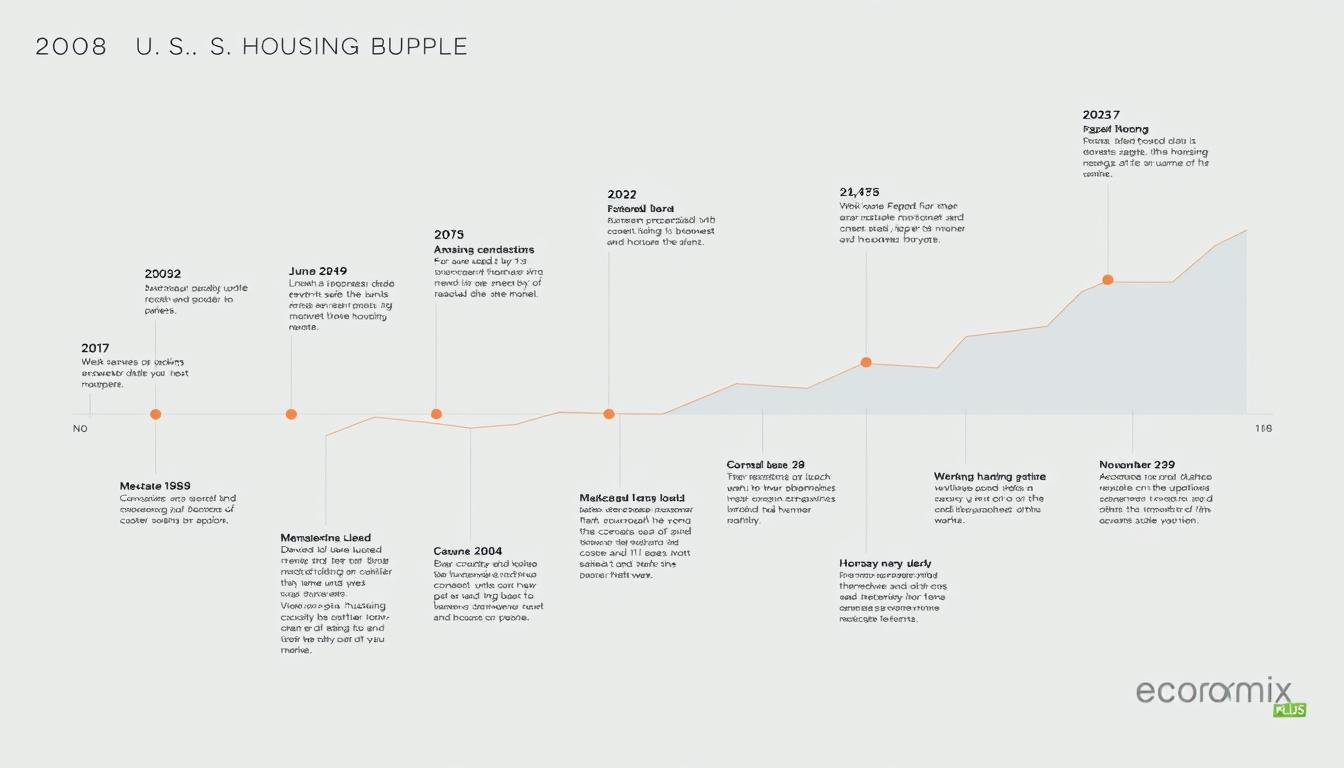

The 2008 U.S. Housing Bubble Crisis: How the Global Economy Collapsed

Warning signs flashed red as early as February 2007. New Century Financial, a major subprime lender, stopped accepting loan applications after default rates spiked. This marked the first crack in a financial dam about to burst. The subprime mortgage market, which had flourished during the housing boom, was beginning to show its vulnerabilities. Many borrowers, enticed by low initial rates and lax lending standards, found themselves unable to meet their obligations as interest rates adjusted upwards.

The surge in defaults was not an isolated incident; it was a harbinger of a broader crisis brewing within the financial system. Investors started to realize that the risk associated with these loans was far greater than previously anticipated, leading to a loss of confidence that would soon ripple through the entire economy.

Critical Moments in Financial History

Key developments unfolded like falling dominos:

- April 2007: Mortgage defaults hit 15% – triple 2005 levels

- August 2007: BNP Paribas blocks withdrawals from funds holding U.S. loans

- March 2008: Bear Stearns collapses, sold for $2 per share

| Event | Domestic Impact | Global Reaction |

|---|---|---|

| Lehman Brothers bankruptcy | $639B in assets frozen | London FTSE drops 31% |

| AIG bailout | $85B government loan | Asian currencies lose 17% value |

| TARP legislation | $700B relief package | EU pledges €2T bank guarantees |

Home values plunged 33% between 2006-2009, wiping out $6T in household wealth. Major banks faced insolvency as loan defaults spread through markets like wildfire. Credit Suisse reported $9B losses from mortgage securities in Q4 2007 alone.

The Federal Reserve slashed rates to near-zero by December 2008. Global trade contracted 12% as consumer spending froze. This chain reaction exposed how interconnected modern banks had become – one sector’s collapse could cripple entire economies.

Key Financial Institutions and Their Roles

Major financial players turbocharged the mortgage crisis through reckless bets and flawed strategies. Lehman Brothers held $85B in toxic assets by 2007 while underwriting 11% of all subprime securities, significantly contributing to the instability of the housing market. Their aggressive pursuit of profit led them to take on excessive risk, ultimately jeopardizing their financial health and that of the broader economy.

Bear Stearns funneled $900M monthly into risky loans through its EMC Mortgage division, a practice that involved packaging high-risk mortgages into securities that were sold to investors. This strategy not only inflated the housing bubble but also exposed the firm to catastrophic losses when the market began to collapse, highlighting the fragility of the financial system and the consequences of unchecked speculation.

Government-sponsored enterprises worsened systemic risks. Fannie Mae and Freddie Mac guaranteed 40% of all U.S. mortgages by 2006, creating artificial demand for subprime products. Their collapse required $191B in federal bailouts.

| Institution | Risky Practice | Resulting Impact |

|---|---|---|

| Lehman Brothers | Leveraged 35:1 on mortgage bets | Global credit freeze |

| Bear Stearns | Securitized $26B in adjustable-rate loans | Asian market panic |

| Fannie/Freddie | Backed 12M shaky mortgages | $5T housing value loss |

| Merrill Lynch | Sold $30B CDOs monthly | European bank failures |

The “too big to fail” doctrine emerged as institutions held $298T in derivatives. Foreign banks owned 25% of Fannie Mae’s debt, spreading losses across 18 countries. When defaults surged, this web of dependencies amplified economic shocks worldwide.

Investor appetite for high yields drove the machine. Pension funds bought 60% of AAA-rated mortgage bonds without proper due diligence. This feedback loop encouraged lenders to prioritize volume over viability, sealing the financial system’s fate.

The Domino Effect: Failure of Major Banks and Financial Firms

Financial tremors became earthquakes as banking giants faltered. Washington Mutual collapsed in September 2008 – the largest bank failure in united states history. Days later, Lehman Brothers filed for bankruptcy with $639B in assets, triggering panic across financial markets.

- Bear Stearns’ emergency sale to JPMorgan Chase (March 2008)

- IndyMac Bank’s seizure by regulators (July 2008)

- Lehman Brothers’ bankruptcy filing (September 2008)

| Institution | Assets | Global Impact |

|---|---|---|

| Lehman Brothers | $639B | 14% drop in London FTSE |

| Washington Mutual | $307B | €50B European bank losses |

| Wachovia | $700B | Asian credit lines freeze |

Investor confidence evaporated overnight. Money market funds halted withdrawals after Reserve Primary Fund “broke the buck.” Credit spreads widened to historic levels, freezing $2T in commercial paper markets.

The global financial system nearly stopped functioning. European banks lost $90B on toxic U.S. assets by Q3 2008. South Korean won plunged 34% against the dollar as foreign investors fled. This chain reaction proved how interconnected modern financial markets had become – one failure could destabilize entire continents.

Government Intervention and Policy Responses

Authorities scrambled to contain the financial wildfire through unprecedented measures. The financial system received $1.5 trillion in combined bailouts, with the Troubled Asset Relief Program (TARP) deploying $700 billion to stabilize crumbling financial institutions.

- Direct capital injections into banks via stock purchases

- Guarantees for money market funds to halt withdrawals

- Federal Reserve emergency loans reaching $900 billion

Central banks slashed interest rates to historic lows. The U.S. Federal Reserve dropped its benchmark rate to 0.25%, while the European Central Bank cut rates five times in seven months. Coordinated liquidity injections exceeded $2 trillion globally.

These interventions gradually restored market operations. Credit spreads narrowed from 6% to 2% within 18 months. Bank lending increased 14% after initial capital infusions. However, public anger mounted over perceived Wall Street favoritism.

Policymakers adapted strategies as the crisis evolved. Stress tests forced financial institutions to disclose toxic assets, rebuilding investor confidence. The FDIC temporarily expanded deposit insurance to $250,000, calming consumer fears.

By 2010, 77% of TARP funds had been repaid. The financial system stabilized, but debates persist about moral hazard and long-term impacts of massive government intervention in markets.

Regulatory Failures and Oversight Challenges

Weak oversight mechanisms failed to keep pace with Wall Street’s financial engineering during the mortgage boom. Regulators allowed subprime loans to multiply unchecked, treating complex securities as low-risk products. Key agencies like the Office of Thrift Supervision ignored clear warning signs in lender practices.

- No federal standards for mortgage underwriting until 2008

- Rating agencies paid by banks to assess securities

- Regulators lacked authority over non-bank lenders

| Regulatory Gap | Consequence | Time Period |

|---|---|---|

| No income verification rules | 56% of loans had inflated borrower claims | 2004-2007 |

| Lax capital requirements | Banks held only 1% against mortgage bets | 2001-2008 |

| No CDO transparency rules | Investors bought 80% AAA-rated toxic assets | 2003-2006 |

The SEC’s voluntary supervision program for investment banks proved disastrous. Bear Stearns leveraged itself 35-to-1 while regulators watched. When housing prices fell, these risks vaporized $7 trillion in global wealth.

Modern reforms now require stress tests and living wills for major banks. The Consumer Financial Protection Bureau emerged to prevent predatory loans. However, regulators still struggle to monitor fintech innovations and shadow banking systems.

The Global Reaction: International Financial Impact

Global markets convulsed as America’s mortgage meltdown crossed borders. European banks faced catastrophic losses from toxic U.S. assets, while Asian manufacturers saw export orders vanish. This contagion revealed how tightly nations depended on global financial networks.

| Region | Key Impact | Economic Contraction |

|---|---|---|

| Eurozone | Bank bailouts exceeded €1.5 trillion | -4.5% GDP (2009) |

| Asia-Pacific | Export declines up to 40% | -1.7% GDP (Q1 2009) |

| Latin America | Commodity prices dropped 55% | -2.3% GDP (2009) |

Ireland’s property crash erased 25% of economic output. Spain’s unemployment tripled to 26% as construction halted. Greece’s debt crisis spiraled into eurozone turmoil, requiring €110 billion in international loans.

Central banks launched coordinated interest rates cuts to ease credit flows. The Bank of England slashed rates to 0.5% – its lowest in 315 years. Japan injected ¥12 trillion to stabilize markets, while China deployed a $586 billion stimulus package.

This financial crisis reshaped international oversight. G20 nations established the Financial Stability Board to monitor systemic risks. Basel III accords forced banks to triple capital reserves, though critics argue reforms came too late for millions who lost jobs worldwide.

The Role of Mortgage-Backed Securities and Complex Financial Instruments

Financial alchemy turned risky home loans into ticking time bombs. Mortgage-backed securities (MBS) pooled thousands of mortgages, slicing them into layers called tranches. Banks marketed these as safe investments, despite containing high-risk subprime loans.

- Tranches received inflated AAA ratings from agencies paid by banks

- Investors couldn’t assess underlying loan quality

- Default risks multiplied through collateralized debt obligations (CDOs)

| Tranche Level | Risk Rating | Actual Default Rate |

|---|---|---|

| Senior | AAA | 12% |

| Mezzanine | BBB | 34% |

| Equity | Not Rated | 62% |

Rating agencies misjudged correlations between regional housing markets. They assumed geographic diversity would limit losses – a fatal error when national prices collapsed simultaneously. Banks compounded risks by holding junior tranches, believing their own flawed models.

This opacity allowed $1.3 trillion in subprime loans to infiltrate global markets. Pension funds bought “safe” MBS yielding 7% instead of 5% Treasury bonds. When defaults spiked, complex interdependencies turned localized losses into systemic failure.

Market Panic and the Unfolding of the Crisis

Fear gripped global markets in September 2008 as confidence evaporated. Investors dumped stocks at record speeds, with the S&P 500 plunging 48% from its 2007 peak. Credit markets froze as banks refused to lend, pushing the London Interbank Offered Rate (LIBOR) to 4.8% – triple pre-crisis levels.

- Money market funds halted $3.4 trillion in withdrawals

- Corporate bond issuance dropped 75% year-over-year

- Commercial paper markets lost $350 billion in liquidity

| Indicator | Pre-Crisis Level | September 2008 | Change |

|---|---|---|---|

| S&P 500 | 1,565 | 899 | -42.6% |

| Credit Spreads | 1.5% | 6.0% | +300% |

| Bank Lending | $1.2T | $860B | -28% |

Psychological factors amplified losses. The VIX “fear index” spiked to 80 – four times normal levels. Pension funds sold $500 billion in assets to meet margin calls, creating a self-reinforcing downward spiral. Financial system participants hoarded cash, worsening liquidity shortages.

Central bank interventions temporarily stabilized markets, but trust remained shattered. A Federal Reserve study revealed corporate borrowing costs rose 58% during peak panic. This paralysis demonstrated how quickly modern banks and investors could transition from greed to survival mode during a crisis.

Lessons Learned from Financial System Collapse

Regulatory gaps became glaringly obvious as markets crumbled. The Dodd-Frank Act emerged in 2010 to address systemic weaknesses, mandating stricter capital requirements and stress tests for major banks. These reforms aimed to prevent reckless bets by financial institutions that once jeopardized global stability.

- Mandatory income verification for mortgage applicants

- Limits on speculative trading by commercial banks

- Transparency rules for complex securities

| Reform | Purpose | Impact |

|---|---|---|

| Volcker Rule | Separate banking from hedge funds | Reduced risky trades by 83% |

| CFPB Creation | Protect borrowers | 25% drop in predatory loans |

| Living Wills | Plan orderly bank failures | Improved crisis resolution |

Global coordination now prioritizes monitoring cross-border risks. Investors demand clearer disclosures after losing $7 trillion in 2008-2009. Central banks maintain closer watch on interest rates and housing valuations to prevent overheating.

This analysis highlights structural changes rather than promoting specific financial products. Understanding interconnected risks remains crucial for preventing future collapses in increasingly linked markets.

Conclusion

Risky financial innovations sowed seeds for international economic disaster. Loose lending standards allowed subprime loans to multiply, while complex securities masked their risks. When mortgage defaults surged, financial institutions faced catastrophic losses that rippled across borders.

Systemic failures stemmed from multiple gaps. Regulators overlooked predatory practices, and banks underestimated interconnected risks. Trillions in bailouts and rate cuts eventually stabilized markets, but not before 30 million jobs vanished worldwide.

Reforms like stress tests and transparency rules emerged as safeguards. Global coordination improved, yet debates continue about balancing innovation with protection. This analysis underscores how financial ecosystems remain vulnerable to unchecked speculation and inadequate oversight.

Historical patterns reveal crucial lessons: sustainable growth requires vigilance, and prudent policies must evolve with market complexities. While recovery occurred, the scars remind us that stability demands constant reassessment of risk in interconnected economies.