What if the key to financial stability lies in something you’ve overlooked for years? For centuries, people have turned to precious metals during turbulent times. Pre-owned jewelry, coins, and bullion carry both cultural weight and practical value—but does that make them a wise choice today?

This tangible asset has served as a hedge against inflation for generations, especially during market crashes like 2008 when prices surged over 25%. Its appeal isn’t just historical: modern investors still rely on it to balance portfolios when currencies fluctuate. Yet buying secondhand pieces requires sharp awareness of purity, resale markets, and storage risks.

We’ll explore how cultural perceptions drive demand—from heirloom coins to digital gold ETFs—and whether physical ownership outweighs newer alternatives. You’ll discover how market trends shift during economic dips and why experts often recommend allocating 5-10% of assets to precious metals.

Key Takeaways

- Pre-owned gold offers historical value but requires careful evaluation of authenticity

- Physical assets like coins often outperform paper investments during inflation spikes

- Market instability increases demand for tangible stores of wealth

- Storage costs and resale challenges impact overall returns

- Digital gold products provide alternatives without physical handling

Discovering the World of Used Gold Investments

Few assets whisper stories of empires and everyday families alike. This enduring metal transcends borders, surviving wars and recessions while retaining its glow. Let’s unpack why generations have trusted its tangible value—and why you might consider it today.

Understanding the Appeal of Pre-Owned Gold

Liquidity defines this market. When currencies wobble during market volatility, people rush toward investing gold and physical assets. A 2021 World Gold Council report showed 20% spikes in jewelry resales during COVID-19 lockdowns as households tapped into savings. Families in India still trade heirloom necklaces during weddings—not just for tradition, but as instant liquidity and a smart investment in their portfolio.

Modern investors value how coins bars bypass digital risks. Unlike stocks, you hold wealth in your hands. “Physical metal becomes a psychological anchor when screens flash red,” notes financial historian Lila Torres. This tactile security explains why price gold often climbs when confidence in institutions falters.

Historical and Cultural Perspectives on Gold

Ancient Lydia minted the first coins around 600 BCE, creating portable wealth. Centuries later, Spanish conquistadors reshaped economies through plundered Aztec treasures. Fast-forward to 2008: as banks collapsed, demand for bullion surged 47% in six months.

Today’s hedge inflation strategies still lean on this legacy. Central banks stockpile bullion, while tech startups offer fractional digital ownership. Yet the allure remains rooted in reality—a gold bangle sold in Mumbai’s Zaveri Bazaar holds the same intrinsic value as one traded on Wall Street.

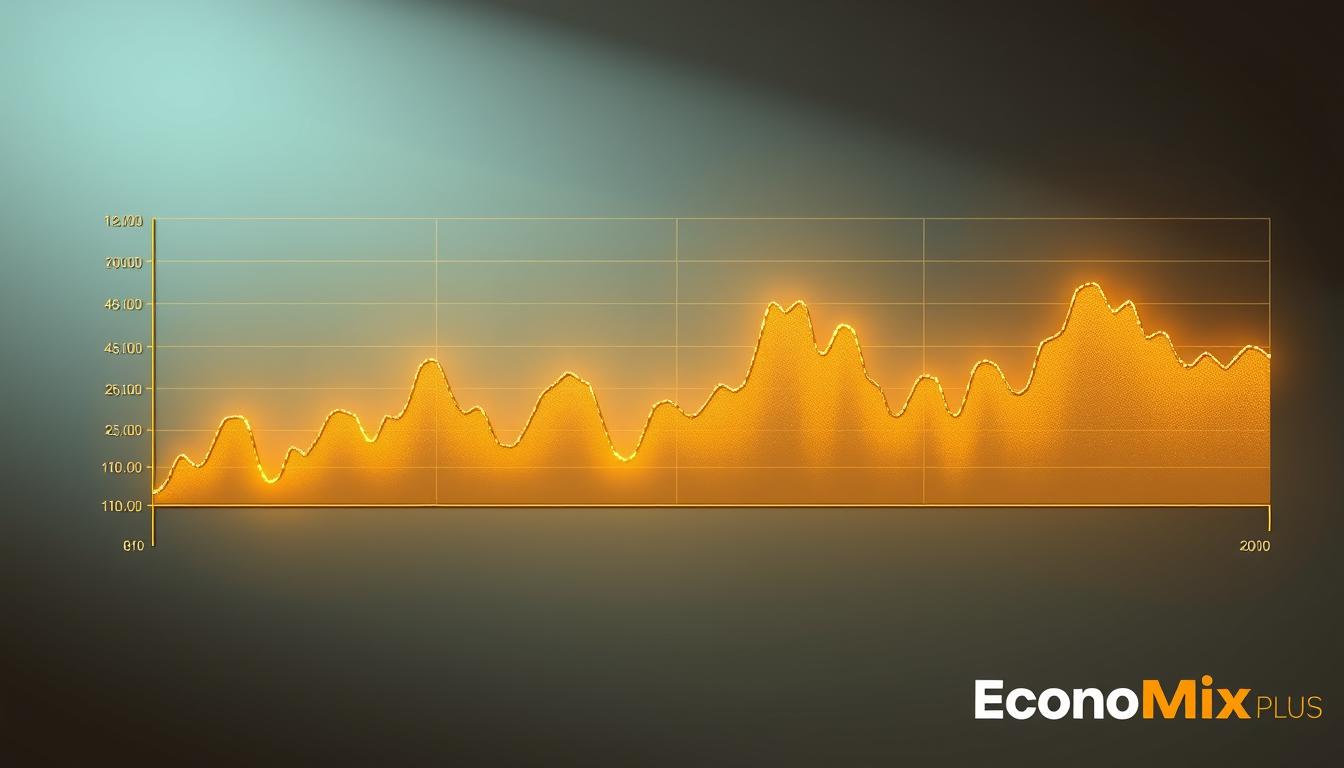

Market Dynamics and Price Trends in Gold

Why do investors flock to tangible assets when headlines scream uncertainty? The answer lies in patterns older than Wall Street. From pandemics to political standoffs, global events create ripples that reshape price trends for centuries-old stores of wealth.

Market Volatility and Its Impact on Prices

Stock market crashes often light a fire under metal valuations. During March 2020’s COVID-19 crash, the S&P 500 dropped 34%—while bullion gained 25% in six months. “Physical assets become lifeboats when paper wealth sinks,” observes economist Mark Finley.

Central banks amplified this trend in 2022-23. They bought 1,136 tons of bullion—a 55-year high—to hedge against currency risks. This institutional demand creates floor prices, even when retail interest wanes.

Factors Influencing Value Fluctuations

Four elements drive today’s market dynamics:

- Geopolitical tensions (e.g., Ukraine war boosted prices 8% in Q1 2022)

- Interest rate decisions (each Fed hike typically causes short-term dips)

- Dollar strength (a weak USD lifts metal valuations)

- Mining output (2023 supply shortages added 4% to premiums)

| Event | Price Impact | Timeframe |

|---|---|---|

| 2008 Financial Crisis | +24% | 12 months |

| Brexit Vote | +16% | 3 months |

| 2023 Banking Crisis | +11% | 6 weeks |

These shifts highlight why experts suggest limiting metal allocations to 10% of your portfolio. While past performance fascinates, future gains depend on timing exits as skillfully as entries.

Used Gold: A Smart Opportunity or a Risky Trap?

When markets tremble, tangible assets often become anchors. Secondhand coins and bars present unique advantages—but require careful navigation through hidden challenges. Let’s weigh the scales between potential gains and pitfalls.

Evaluating the Risk Factors in Pre-Owned Gold

Authenticity headaches top the list. A 2019 New York case saw buyers lose $28,000 on counterfeit Krugerrands. “Scratches or resizing can mask purity issues,” warns gemologist Rachel Nguyen. Storage costs add another layer—$150/year for secure vaults versus DIY home safes vulnerable to theft, which can be a concern for those looking to buy gold or invest gold as part of their portfolio. Understanding the price gold and the value of physical gold, such as gold bars, is crucial in this market.

Market demand swings create timing risks. During the 2021 crypto boom, resale premiums on pre-owned bars dropped 9% as investors chased digital assets. Yet those who held until 2023 saw values rebound 14% amid banking crises.

| Risk Factor | Potential Impact | Prevention Strategy |

|---|---|---|

| Counterfeit Items | Total Loss | Third-Party Certification |

| Storage Mishaps | 15-30% Value Drop | Insured Facilities |

| Market Timing | ±20% Fluctuation | Dollar-Cost Averaging |

Exploring the Potential Rewards of Buying Used Gold

Diversification shines here. Physical metal historically moves opposite stocks during recessions—a 2008 study showed 22% gains while equities crashed. Secondhand pieces often cost 18% less than new items, skipping retail markups.

Inflation protection remains compelling. When consumer prices jumped 9% in 2022, vintage coins outperformed bonds by 31%. “Scrap gold becomes liquid money during emergencies,” notes economist David Park. This flexibility avoids interest-based loans when cash runs tight.

Balancing these factors requires research. Start small—test sellers with gram-sized bars before larger investments. Pair physical holdings with digital alternatives to spread exposure.

Physical vs. Digital Gold Investments

Would you rather hold wealth in your hands or tap it through an app? This modern dilemma reshapes how investors approach precious metals like gold coins and gold bars. Physical assets and digital tokens each offer distinct paths through today’s unpredictable markets for those looking to invest gold and diversify their portfolio.

Benefits of Investing in Physical Gold

Coins passed down through generations carry stories alongside value. A 2023 Metals Focus study found 68% of buyers prefer tangible assets during economic uncertainty. Physical bars let you bypass digital theft risks—no hacker can steal a locked safe.

Storage challenges remain. Home safes cost $200-$800 upfront, while insured vaults charge annual fees. Yet this tactile security comforts many during volatility. “Holding metal connects people to centuries of financial history,” notes collector Amir Patel.

The Rise of Digital Gold Options

Platforms like Paytm and PhonePe now let you buy fractions of bullion instantly. Digital holdings eliminate storage headaches—your “gold” stays in secure reserves. During the 2022 crypto crash, these platforms saw 40% user growth as investors sought stable alternatives.

But screens can’t replicate the weight of a sovereign coin. Market dips sometimes freeze digital withdrawals, unlike physical sales. A 2024 Bloomberg report showed paper gold dropped 6% during a banking crisis while physical prices rose 9%.

| Factor | Physical | Digital |

|---|---|---|

| Access Speed | Days (shipping) | Minutes |

| Storage Cost | $50-$300/year | $0 |

| Liquidity During Crises | High | Variable |

Your timeline matters. Physical metal suits long-term strategies spanning years, while digital tokens work for quick trades. Mix both to balance risk and flexibility—experts suggest 70% physical, 30% digital for new investors.

Evaluating the Pros of Used Gold

Could your portfolio benefit from an asset that thrives when others falter? Physical bullion offers unique advantages for those seeking balance in unpredictable markets. Let’s explore how seasoned investors leverage its timeless appeal.

Diversification and Portfolio Value Enhancement

Adding bullion to your holdings acts like financial shock absorbers. During the 2008 recession, portfolios with 10% allocated to precious metals saw 18% smaller losses than stock-only strategies. “Tangible assets create counterweights to paper investments,” explains financial advisor Clara Mendes.

Secondhand coins and bars often cost 12-15% less than new items. This lets you acquire more ounces while maintaining liquidity. Consider pairing bullion with silver—its industrial uses provide additional stability during tech booms.

Hedging Against Market Volatility and Inflation

When consumer prices surged in 2022, physical bullion outperformed bonds by 31%. Its value typically rises as currencies weaken, making it a reliable store of wealth. Historical data shows:

| Year | Inflation Rate | Bullion Price Change |

|---|---|---|

| 1979 | 11.3% | +126% |

| 2008 | 5.1% | +24% |

| 2022 | 9.1% | +15% |

Storing physical metal serves dual purposes. It becomes both a symbolic reminder of wealth preservation and a practical safeguard. Unlike digital assets, you control access—no third-party approvals required during emergencies.

Silver plays a supporting role here. Its affordability lets people build positions gradually while benefiting from similar stability traits. Together, these metals form defensive barriers against economic storms.

Assessing the Cons and Risks of Used Gold

Every glittering asset casts shadows you need to see. While physical metal offers stability, its secondhand market demands careful navigation through hidden pitfalls.

Uncertainty Amid Shifting Market Conditions

Prices swing like pendulums during crises. A 2020 London case saw investors lose 19% on bars purchased weeks before a mining surplus crashed values. Geopolitical shifts and interest rate changes create unpredictable valuation gaps.

Your purchase timing becomes critical. When the Fed raised rates in 2022, bullion dipped 8% within three months. Yet those who held until 2023 regained 14% as banking fears resurfaced.

Storage, Purity Concerns, and Authenticity Issues

Authenticity checks separate savvy buyers from victims. Over 12% of resold coins fail purity tests, according to 2023 Gemological Institute data. Scratched surfaces or alloy mixes often hide beneath polished finishes.

Storage presents dual challenges. Home safes risk theft, while professional vaults cost $200+/year. A single dented bar could lose 30% value if its proper form gets compromised.

| Risk Factor | Frequency | Solution |

|---|---|---|

| Counterfeit Items | 1 in 8 pieces | XRF Testing |

| Environmental Damage | 23% of home-stored items | Climate-Controlled Storage |

| Resale Premium Loss | Up to 18% | Third-Party Certification |

While perceived benefits attract many, the physical form requires constant vigilance. One collector’s “rare” 24k coin became worthless when tests revealed tungsten plating.

Making an informed choice means weighing these realities. Arm yourself with reliable information—know that 67% of buyers regret skipping purity verification. Your due diligence determines whether bullion becomes an anchor or an albatross.

Comparing Used Gold with Other Investment Options

Investors often debate the merits of traditional versus modern investments—where does physical bullion fit in? Unlike stocks that live on screens or real estate tied to locations, this tangible metal carries inherent security that outlasts market cycles. Let’s examine how it stacks up against popular alternatives.

Contrasting with Stocks, Real Estate, and Other Assets

Stocks often deliver higher returns during bull markets—the S&P 500 gained 26% in 2021 compared to bullion’s 4% rise. But when recession fears hit in 2022, the index dropped 19% while physical metal climbed 12%. This inverse relationship makes it a stabilizing force in your account.

Real estate requires hefty upfront costs and ongoing maintenance. Selling property can take months, whereas reputable dealers often buy pre-owned coins within days. During the 2023 banking crisis, homeowners faced 14% price drops while gold bars saw 9% demand spikes.

| Asset | Liquidity | Volatility | Security |

|---|---|---|---|

| Stocks | High | Extreme | Digital risks |

| Real Estate | Low | Moderate | Physical risks |

| Gold | Moderate | Low | Inherent value |

Why do experts call this a gold good investment? Its 5,000-year track record as a crisis hedge contrasts sharply with cryptocurrencies’ 80% crashes. While tech stocks might triple in a year, they can vanish overnight—unlike a 1-ounce coin that retains baseline demand.

Balancing your portfolio means recognizing each asset’s role. For those exploring gold’s role in modern portfolios, its ability to preserve wealth during turbulence remains unmatched. Stocks grow wealth; physical metal protects it—making this gold good investment a timeless counterweight.

Practical Tips for Buying and Storing Used Gold

Navigating the secondhand market requires equal parts knowledge and caution. Whether you’re new to precious metals or expanding existing holdings, these strategies help protect your assets while maximizing value.

Ensuring Purity and Authenticity

Start with simple verification methods. Use a magnet—real physical gold won’t stick. Check for hallmarks like “24K” or “999” indicating purity levels. Acid testing kits ($15-$30) provide quick results for coins and bars.

Reputable dealers should offer third-party certifications. Look for:

- NGC or PCGS grading for coins

- XRF scanner reports from jewelers

- Original assay cards for bullion

| Tool | Cost | Accuracy |

|---|---|---|

| Digital Tester | $80 | 98% |

| Acid Kit | $25 | 89% |

| Professional Appraisal | $150+ | 100% |

Secure Storage Solutions

Home safes work for small holdings under $5,000. For larger amounts, consider:

- Bank safe deposit boxes ($50-$200/year)

- Specialized vaults with climate control ($300+/year)

- Allocated storage through bullion dealers

Long-Term Strategy Considerations

Review market cycles every six months. When the stock market dips below 200-day averages, precious metals often gain traction. Balance your portfolio by comparing performance across stocks real estate and tangible assets.

Successful investors who people invest gold recommend:

- Reallocating 2-5% annually based on inflation rates

- Holding for minimum 3-5 year periods

- Using dollar-cost averaging during price dips

Your approach should evolve with economic shifts. Pair physical gold holdings with digital trackers to monitor spot prices effortlessly. Remember—knowledge transforms risk into calculated opportunity.

Conclusion

Balancing risks and rewards requires clarity in today’s complex markets. Physical assets like gold bars offer historical stability, while gold ETFs provide modern flexibility without storage hassles. Market shifts during crises show these options often outperform paper assets when gold prices climb.

Diversification remains key. Pre-owned pieces can hedge against inflation, but demand careful verification. Digital alternatives like mutual funds simplify entry points—though they lack the tactile security of vault-stored metal.

Every choice carries trade-offs. Physical holdings require authentication checks, while digital platforms depend on market liquidity. Your strategy should match timelines: long-term collectors often mix both approaches.

This analysis focuses on tangible assets, excluding traditional savings tools. Whether through ETFs, bars, or funds, success hinges on research. Track gold prices trends, compare fees, and verify seller reputations.

View this good investment through a multi-year lens. Avoid impulsive moves during short-term spikes. With informed planning, these timeless assets can anchor portfolios through economic storms.